Whither The Economy?

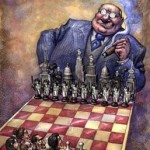

The great problem with corporate capitalism is that publicly owned companies have short time horizons. Unlike a privately owned business, the top executives of a publicly owned corporation generally come to their positions late in life. Consequently, they have a few years in which to make their fortune.

As a consequence of the short-sightedness of reformers and Congress, the annual salaries of top executives were capped at $1 million. Amounts in excess are not deductible for the company as an expense. The exception is “performance-related” pay, which has no limit. The result is that the major part of executive pay comes in the form of performance bonuses. Performance means a rise in the price of the company’s shares.

Performance bonuses can be honestly obtained by good management or mere luck that results in a rise in the company’s profits. However, there are a number of ways in which performance bonuses can be less legitimately obtained, almost all of which result in short-term gains to executives and shareholders and long-term damage to the corporation and economy.

Replacing American workers with foreign workers is one way. The collapse of communism in Russia and China and the collapse of socialism in India resulted in the under-utilized Indian and Chinese labor forces becoming available to American corporations. Pushed by “shareholder advocates,” Wall Street, and large retailers, US manufacturing corporations began closing their manufacturing plants in the US and producing offshore the goods, and later the services, that they market to Americans.

Replacing American workers with foreign workers is one way. The collapse of communism in Russia and China and the collapse of socialism in India resulted in the under-utilized Indian and Chinese labor forces becoming available to American corporations. Pushed by “shareholder advocates,” Wall Street, and large retailers, US manufacturing corporations began closing their manufacturing plants in the US and producing offshore the goods, and later the services, that they market to Americans.

From the standpoint of the short-term interests of executives and shareholders, this decision made sense. But to transform manufacturing companies into marketing companies, as happened for example to Apple Computer, which apparently does not own a single factory, was a strategic mistake for the long-term. By offshoring the production of their products, US corporations transferred technology, physical plant, and business knowhow to China. American corporations are now dependent on China, a country that the idiots in Washington are endeavoring to turn into an enemy.

Further downside comes from the fact that research, development, and innovation are connected to the manufacturing process, because it is difficult for these important functions to be successful in a sterile atmosphere removed from the production process. As time goes by, US companies are transformed from manufacturing enterprises into sales organizations and lose connection to the work process, and these functions relocate abroad with the manufacturing jobs.

Offshoring manufacturing jobs left Americans with fewer high-value-added well-paid jobs, and the US middle class downsized. Ladders of upward mobility were taken down. Income and wealth distributions worsened. In effect, the One Percent got richer by giving away US incomes and GDP to China. Economists who shilled for the offshoring corporations promised new and better jobs to take the place of the lost manufacturing jobs, but as I have pointed out for years, there is no sign of these promised jobs in the payroll jobs releases or ten-year jobs projections.

Jobs offshoring began with manufacturing, but the rise of the high speed Internet made it possible to move offshore tradable professional skills, such as software engineering, Information Technology, various forms of engineering, architecture, accounting, and even the medical reading of MRIs and CT-Scans. The jobs and careers of university graduates were sent abroad and denied to Americans. Many of the jobs that remained in the US were given to foreign workers brought in on H1-B and L-1 work visas based on the obviously false claim that there was a shortage of talent in the US.

The gains in executive bonuses and shareholder capital gains were achieved by destroying the economic prospects of millions of Americans and by reducing the growth potential of the US economy. In the long-run this means the demise of the US as a world power. As I forecast in 2004, “the US will be a Third World country in 20 years.”

As jobs offshoring ran its course and had fewer remaining gains to offer the One Percent, short-term greed turned to new ways of wrecking both corporations and the US economy in behalf of executive and shareholder gains. Executives of utility companies, for example, forewent maintenance and upgrades and used the money instead to buy back their own shares. If you have ever wondered why you can’t get faster Internet in your area or why your electricity is constantly interrupted, this is probably the cause.

Executives also use the company’s profits to repurchase shares, and when they lack profits executives arrange bank loans to the companies in order to buy back shares. Executive “performance pay” goes up, but the corporations are left more heavily indebted and thus more vulnerable to recession and foreign competition. In recent years, buybacks and dividends have used up most of corporate profits, leaving the corporations bereft of updates and reserves.

Publicly owned capitalism’s short-term time horizon is also apparent with regard to nature’s resources and the environment. Ecological economists, such as Herman Daly, have established the fact that environmental destruction is the consequence of corporations moving many of the waste costs associated with their activities off their profit and loss statements and onto the environment. As other ways of artificially raising corporate profits and share prices become exhausted, expect corporations to push harder against pollution control measures. As the environment declines in its ability to produce new resources and to absorb wastes or pollution—for example the large growing dead areas in the Gulf of Mexico—the planet’s ability to sustain life withers.

Publicly owned capitalism’s short-term time horizon is also apparent with regard to nature’s resources and the environment. Ecological economists, such as Herman Daly, have established the fact that environmental destruction is the consequence of corporations moving many of the waste costs associated with their activities off their profit and loss statements and onto the environment. As other ways of artificially raising corporate profits and share prices become exhausted, expect corporations to push harder against pollution control measures. As the environment declines in its ability to produce new resources and to absorb wastes or pollution—for example the large growing dead areas in the Gulf of Mexico—the planet’s ability to sustain life withers.

President Richard Nixon established the Environmental Protection Agency in order to reduce the external or social costs that corporations impose on the environment. However, the polluting industries were not slow in taking over or capturing the agency, as University of Chicago economist George Stigler predicted.

A basis of economic theory is the absurd assumption that man-made capital is a perfect substitute for nature’s capital. This means that if the environment is used up and ruined, not to worry. Innovation and technology will substitute for nature. This absurd foundation of economic theory is why there are so few ecological economists. Economics teaches not to worry about the environment.

To sum up, the One Percent have enriched themselves at the expense of the economy’s potential and everyone else.

Where does the economy stand at the present time, a question on many of your minds? I am not a seer. Nevertheless, various things are obvious. In the US consumer demand is constrained by high debt and the absence of growth in real median family income. Evidence of the constrained US consumer shows up in lackluster real retail sales and in year-over-year declines in factory orders. On September 2, Zero Hedge reported that factory orders had fallen for 9 consecutive months.

As I point out, the monthly payroll jobs announcements are always overblown and consist largely of lowly-paid, part-time, domestic service employment. The 5.3% unemployment rate is phony, because it does not count any discouraged workers, and there are millions of them. Indeed, the absence of jobs is the reason the labor force participation rate has continually declined, a contradiction to the alleged recovery. On September 1, the Economic Cycle Research Institute reported that the US government’s data on employment/population ratios by education shows that the employment/population ratio for those with high school and college diplomas is lower now than when the alleged economic recovery began in June 2009. The only job gains have been for those without a high school diploma, the cheapest labor available in the US. Clearly, these are not jobs that will produce any rebound in consumer demand. And clearly education is not the answer.

The main economic releases from Washington—the ones that make the headline news: the unemployment rate, payroll jobs, GDP, and the consumer price index—are worthless. The unemployment rate does not include millions of unemployed, the CPI is rigged to undercount inflation, and as inflation is undercounted, real GDP is over-reported. Indeed, in my opinion and that of economic-statistician John Williams of shadowstats.com, nominal GDP deflated with a correct measure of inflation shows essentially no growth during the alleged recovery. What the government and financial media call economic growth is essentially price rises or inflation.

What is happening to America is that all of the surplus in the system accumulated over decades of success is being used up. Americans have had no interest income from their savings since the Federal Reserve decided to print trillions of dollars with which to purchase the troubled financial assets of a small handful of mega-banks. In other words, the Federal Reserve decided that, contrary to the propaganda about serving the public interest, the Fed exists to serve a few oversized banks, not the American people or their economy. As an institution, the Federal Reserve is so corrupt that it should be shut down.

The elderly avoid the stock market, because a decline can be long-lasting and eat up a large chunk of one’s savings. The same can happen from long-term bonds. Therefore, older people prefer shorter term interest instruments. The Federal Reserve’s zero interest rate policy means that older people are using up their savings, at the expense of their peace of mind and their heirs, in order to prevent a collapse in their standard of living. The elderly are also drawing down their savings in support of unemployed children and grandchildren. Unable to find jobs that will support the formation of a household or even an individual existence, many young college educated Americans are living with parents or grandparents, something I have not previously seen in my lifetime.

All the while the corrupt financial media pump us full of good economic news.

Many readers want to know if the stock market decline is over. It remains to be seen. In my opinion two opposite forces are at work. Based on earnings and the economy’s prospects, stocks are overvalued. However, the appearance of a successful economy is important to Washington’s power, and this brings in the Plunge Protection Team, a US Treasury/Federal Reserve team that intervenes to support the market. Wall Street managed to get the team created in 1988, and in the recent troubled days there are signs of it in operation. For example, suddenly during a time of market decline strong purchasing appeared, arresting the decline. Normally, optimistic purchasers who interpret declines as buying opportunities wait until the decline is over. They do not buy into the middle of a decline.

Today most stock purchases are made by money managers, such as mutual funds and pension funds. Individuals do not account for much of the market. Money managers are judged by their performance relative to their peers. As long as they move up or down with their peers, they are safe. Once the professionals see that government is supporting the market, they support it. This behavior is bolstered by greed. Participants want the market to go up, not down. Therefore, even if money managers understand that stocks are a bubble, they will support the bubble as long as they think the Plunge Protection Team is holding up the market. The unanswered question in the minds of money managers is whether the Treasury and Fed are committed to maintaining an overvalued market or whether they are just holding it up long enough for their well-connected friends to get out. Only time will tell.

My book, The Failure of Laissez Faire Capitalism and Economic Dissolution of the West, will introduce you to the damage done by jobs offshoring and to the mistaken assumption of economists that the environment puts no constraints on economic growth.

The other part of the story comes from Michael Hudson, who explains the financialization of the economy and the transformation of the financial sector, which once financed the production of real goods and services, into a money-sucking leach that sucks all life out of the economy into its own profits. I recently posted a link to Pam Martens’ review of his book, Killing The Host.

If you can absorb my book, Michael Hudson’s book, and one of Herman Daly’s books, you will have a much firmer grasp on economics than economists have. Go to it.