Video: Blackrock, State Street and Vanguard Have the Ability of “Buying Up” Entire Countries

Patrick Bet-David Deconstructs BlackRock's Influence and ESG Ratings

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

As outlined by Patrick Bet-David in this incisive interview:

“The largest shareholder of 88% of the companies on S&P 500 is either State Street, Vanguard or BlackRock.

And you can see their influence in defense contracts.“

Three Portfolio Financial Giants are in a position to take control of the real economy of entire countries.

Watch Patrick Bet-David in conversation with Joe Rogan in the video below.

This world economic tyranny is:

“led by a group of super-wealthy oligarch, multi-billionaires … These oligarchs are accompanied by some super-giant financial institutions, like BlackRock, Vanguard, State Street, Fidelity and more which control an estimated 25 trillion dollars-equivalent in assets, giving them a leverage power of well-over a 100 trillion dollars, as compared to the world’s GDP of some 90 trillion dollars. In other words, they can manipulate, control and pressure every government on Mother Earth to do their bidding. (Peter Koenig)

“BlackRock, headed by Larry Fink, has thousands of companies from all sectors in its portfolio. The capital it manages has grown in the last ten years from 3,500 to 9,500 billion dollars (more than 5 times the GDP of Italy) and is increasing further.

In this way, BlackRock, Vanguard and State Street have a decision-making voice in the boards of directors of the major multinationals and banks, including central banks.

The “Big Three” also control Standard & Poor Global, the rating agency that monitors the world’s economies, failing or promoting them” (Manlio Dinucci)

The Privatization of Ukraine by BlackRock

“In recent developments. BlackRock together with JPMorgan “have come to the rescue of Ukraine”. Their objective is to “buy out” an entire country.

The stated objective is “to attract billions of dollars in private investment to assist rebuilding projects in a war-torn country”. (FT, June 19, 2023)

The Kiev Neo-Nazi regime is a partner in this endeavour. War is Good for Business. The greater the destruction, the greater the stranglehold of Ukraine by “private investors”:

The Privatization of Ukraine was launched in November 2022 in liaison with BlackRock’s consulting company McKinsey, a public relations firm which has largely been responsible for co-opting corrupt politicians and officials Worldwide not to mention scientists and intellectuals on behalf of powerful financial interests.

BlackRock and Ukraine’s Ministry of Economy signed a Memorandum of Understanding in November 2023.

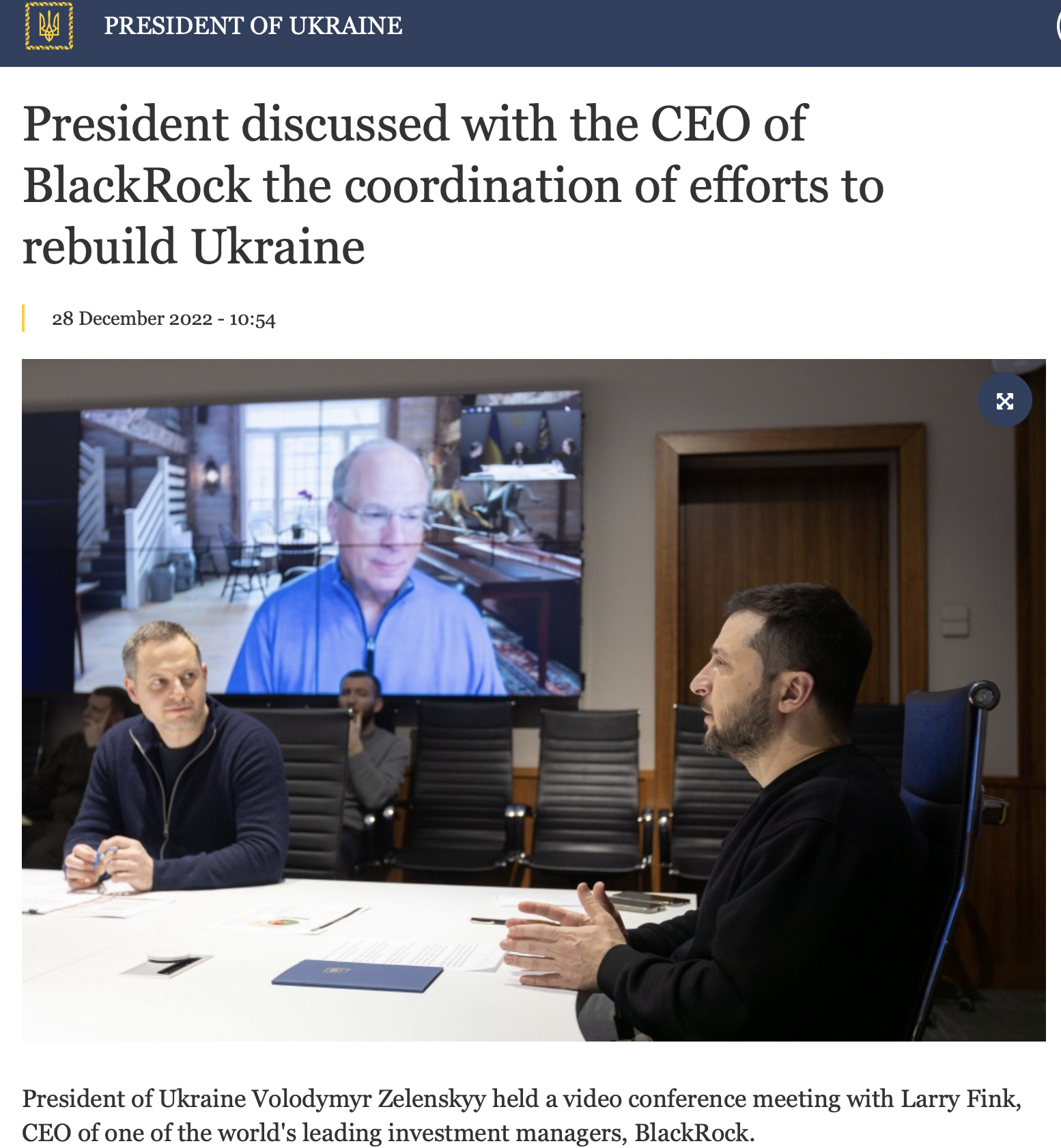

In late December 2022, president Zelensky and BlackRock’s CEO Larry Fink agreed on a so-called “investment strategy”. (Michel Chossudovsky)

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Featured image is a screenshot from the video