U.S. Debt: Visualizing the $31.4 Trillion Owed in 2023

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

First published on April 27, 2023

***

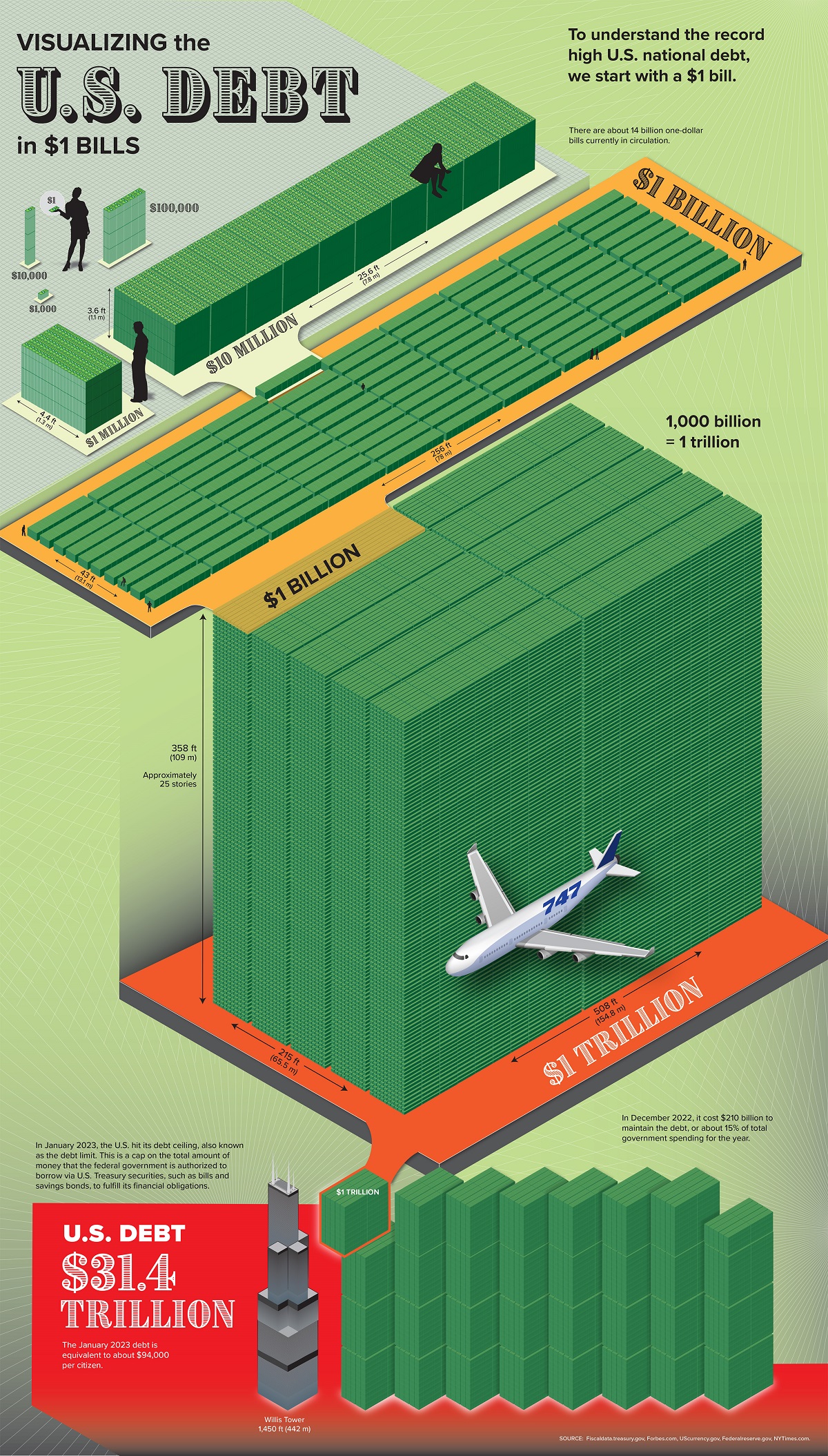

Can you picture what $31.4 trillion looks like?

The enormity of U.S. government debt is hard for the average person to wrap their head around. For instance, compared to the median U.S. mortgage, the current level of federal debt is 230 million times larger.

In this graphic, Julie Peasley shows how many one-dollar bills it would take to stack up to the total U.S. debt of $31.4 trillion.

How Did U.S. Debt Get So High?

U.S. national debt is how much money the federal government owes to creditors. When the government spends more than it earns, it has a budget deficit and must issue debt in the form of Treasury securities.

The U.S. has run a deficit for the last 20 years, substantially increasing the national debt. In fact, according to the Department of the Treasury, the current debt is $31.4 trillion.

Stacked up in one-dollar bills, the U.S. debt would be equivalent to almost eight of Chicago’s 110-story Willis Tower.

Click here to read the fiscal data.

The last time the government had a surplus was in 2001, when debt rose only 2% due to interest costs. Since then, the largest jumps in U.S. debt have been during the Global Financial Crisis—which saw three straight years of double-digit growth rates—and in 2020 due to trillions of dollars of COVID-19 stimulus.

U.S. federal debt rises during recessions because government revenue, primarily composed of taxes, decreases. At the same time, the government increases spending to help stimulate an economic recovery.

And in today’s case, the U.S. is facing additional financial issues. As the country’s senior population grows and people live longer, this puts pressure on programs that serve older Americans such as Social Security. Healthcare is becoming more expensive and is the second-fastest growing part of the U.S. budget.

The Pros and Cons of Debt

U.S. debt helps fund critical programs for Americans, including retirement and disability benefits, healthcare, economic security, and national defense.

As one example of the impact of these programs, income security nearly halved the percent of the population living below the poverty line in 2019 from 22.8% to 12.2%.

Of course, U.S. debt also comes with challenges. A chief concern is the ability to pay the interest costs on U.S. debt, especially as interest rates rise.

Before rate hikes began, interest costs amounted to 6% of the U.S. budget in the 2021 fiscal year. Fast forward to December 2022, and interest costs amounted to 15% of total government spending since the start of the fiscal year in October.

Addressing the Problem

In January 2023, the U.S. hit its debt ceiling, also known as its borrowing limit. While some countries tie their debt to GDP, the U.S. sets an exact limit in dollar terms.

The government would run out of money to pay its debts this summer if the ceiling is not raised, though policymakers have historically agreed to debt ceiling increases in the past to avoid a default. In 2011, the U.S. narrowly avoided default due to a last-minute debt ceiling negotiation and the country’s credit rating was downgraded as a result.

Tackling U.S. debt is simple in theory: raise taxes or the debt limit, reduce spending, or a combination of all three. However, it’s much more difficult in practice. Which taxes should be raised? Which programs should be cut? What happens the next time the debt limit is reached?

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.