Trump’s $1.5 Billion Uranium Stockpile: A Solution in Search of a Problem

In late 1973, an OPEC oil embargo shocked the global oil market. Virtually overnight, prices around the world ballooned from around $4 per barrel to more than $10 per barrel, with costs in the United States even higher. The US economy was left reeling, and so in 1975 Congress passed the Energy Policy and Conservation Act establishing a strategic petroleum reserve, hoping to ensure that foreign oil suppliers could never hold the US economy hostage again.

For 2021, the Trump administration has asked Congress for $1.5 billion over the next 10 years to establish a similar energy stockpile, but for uranium rather than petroleum. The administration wants to fill the stockpile with US-mined uranium to help prop up domestic uranium production. At various points, such as during the First Gulf War in 1991 and again during the Arab Spring uprisings two decades later, the petroleum reserve has proven useful. But it’s highly unlikely that a uranium stockpile would ever do the same.

Low risk. The Trump administration claims that a uranium stockpile is vital for US energy security. But there’s almost zero risk that the United States will ever face a uranium shortage, for a few reasons.

First, for nearly four decades leading up to the mid 1980s, and again over the last few years, uranium supply far exceeded demand. That means there’s never been a supply shortage. Victor Gilinsky, who served on the US Nuclear Regulatory Commission under presidents Ford, Carter, and Reagan, told the Bulletin that, as far as he knows, “no nuclear plant, anywhere, not just in the United States, has ever failed to operate for lack of fuel.”

Second, the major US suppliers are hardly foes of the United States. As Dawn Stover wrote in the Bulletin last year, “Uranium fuel for nuclear reactors is readily available from friendly countries such as Canada and Australia, and is more affordable than the lower-grade, harder-to-access uranium mined in the United States.” Combined imports from Canada and Australia alone satisfied more than 40 percent of the US nuclear industry’s needs in 2018. (US mines supplied about 10 percent.)

Further guaranteeing the supply of uranium, the International Atomic Energy Agency recently established a low enriched uranium fuel bank, which accepted its first deposit in October. Based in Kazakhstan, the stockpile will help insure against supply disruptions for all member states. Though it’s reserves are modest, they’re slated to grow over time.

Such facts have not been reassuring to everyone, though. Ever since Russia’s state-owned nuclear energy company, Rosatom, acquired a company called Uranium One and gained ownership of a mine in the United States, politicians and conspiracy theorists have been voicing fears about Russia controlling the uranium supply. Early in February 2020, just before the Trump administration released its 2021 budget request, the US Senator from Wyoming John Barrasso released a statement asserting that, “For years, Russia has manipulated the uranium market to unfairly undermine American uranium production.”

Such fears have been roundly dismissed by experts. Estimates made in 2015 that Rosatom’s purchase of Uranium One would give Russia control of one-fifth of uranium capacity in the United States were both misleading and overblown; in 2018, the company produced just 23 tons of uranium, or 4 percent of the total produced in the United States that year. Globally, Russia accounted for just 5 percent of uranium production in 2018.

If there were a shock to the supply of uranium, not much would change. Energy costs would increase only slightly, since the reactor fuel represents a tiny fraction of the overall cost of nuclear energy. As Steve Fetter and Erich Schneider wrote for the Bulletin in 2015:

A doubling of the price of uranium would in fact add less than $4 per megawatt-hour to the cost of nuclear electricity.… For comparison, the average retail price of electricity in the United States (and most countries with nuclear reactors) is more than $100 per megawatt-hour. Therefore, even if a sustained, moderate increase in the price of uranium did occur, it would not significantly affect the economics of nuclear power relative to other technologies, and it would have little or no impact on the price of electricity paid by consumers.

Plus, the uranium market is like all commodity markets. If the supply ever becomes limited, the price will go up. That will prompt production at existing mines to quickly increase and new producers to enter the market, stabilizing the price. The same thing happened in the oil and gas industry, Fetter and Schneider point out, where high prices and technological innovation opened the door for the United States to become the number one oil and gas producer in the world.

Amber Reimondo, the energy program director at Grand Canyon Trust, told the Bulletin in an email that even if the United States did ever want to establish a uranium stockpile, domestic mining is not the place to get it. “US uranium ore quality is far below that of uranium found elsewhere in the world…. That means that no matter what, it’s always going to require more resources, energy, and money to produce a pound of US uranium compared to a pound of uranium from another mine with higher quality ore,” she wrote.

For most of the uranium in the United States, extraction would not be profitable unless the market price were more than $80 per kilogram. For the last three years, the spot price for uranium price has hovered between $45 and $55 per kilogram. This economic reality explains why the US nuclear industry imports more than 90 percent of the uranium it needs, and why US mines are simply not competitive.

A win for foreign companies. Although the Trump administration framed the proposal as a matter of national security, none of the companies that would stand to benefit from increased mining in the United States are even American.

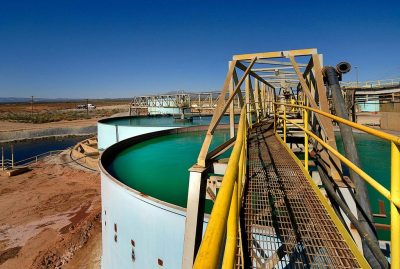

Energy Fuels Inc., which has been lobbying hard for federal government help, is based in Toronto. Within days following the Trump administration’s release of its 2021 budget request, the company had announced a stock sale and had updated its investor pitch. The presentation paints a rosy outlook for a company that recently laid off one-third of its 79 employees at US mines and recorded a net loss of $25 million for 2018.

Perhaps the only company that stands to gain more from a federal government bailout than Energy Fuels is Cameco, the world’s biggest uranium mining company, which is based in Saskatchewan. Cameco has two uranium mines in the United States, but both have curtailed production since 2016.

Though smaller than the other two, Ur-Energy, registered in Ottawa, is also poised to benefit from a bailout. In 2019, the company produced a modest 225 metric tons of uranium at its Lost Creek site in Wyoming. But because it already has an up-and-running operation, it would be a step ahead of other companies that would have to build infrastructure and obtain the requisite licensing.

Aside from predominantly helping foreign-owned firms, the Trump administration’s proposal, if it were enacted, would likely only have a small and temporary effect. The request calls for $150 million of funding per year over the next 10 years. At current market prices, the US government would be able to purchase at most 2,700 metric tons of uranium per year. But paying market prices would not amount to any real relief, so it would need to pay more—perhaps $80 per kilogram—at which rate it could purchase about 1,900 metric tons per year. (Mark Chalmers, the CEO of Energy Fuels, said in a December 2019 interview that “the magic number for sustainability”—the rate at which his business could really get going again—would be $65 per pound, or $143 per kilogram.) So a best-case scenario might put US mines back at the production levels of 2013 and 2014, but well below what would be needed to sustain the industry, and far off the US production peak of almost 20,000 metric tons in 1980.

And even that wouldn’t last. Reimondo said, “If it works, it will only last as long as the taxpayer dollars flow toward that purpose.” After that, the industry would be subjected once again to the pressures of the market, which over the long term does not seem favorable for US mining operations.

Some have suggested that the Trump administration’s proposal is dead on arrival in Congress. However, Republicans in Congress have already been calling for other measures to help spur uranium mining. Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists, told Reuters that he wouldn’t be surprised if the proposal gains support at least in the Senate.

If Congress does fund a uranium stockpile, experts are unequivocal that it won’t save the mining industry, let alone strengthen US energy security. “The best argument for establishing a stockpile is to provide a federal subsidy to the miners in a red state to help re-elect President Trump. If that doesn’t appeal to you, it’s a terrible idea,” said Gilinsky. In 2016, Trump carried a 46-point margin over Hillary Clinton in Wyoming and an 18-point margin in Utah. Evidently it wasn’t enough.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

John Krzyzaniak is an associate editor at the Bulletin of the Atomic Scientists. Before joining the Bulletin, he was an associate editor at the journal Ethics & International Affairs, based at the Carnegie Council. His main areas of interest include arms control and non-proliferation on one hand, and politics and culture in the Persian-speaking world on the other. He holds a master’s degree in international affairs from the Georgia Institute of Technology.

Featured image: The White Mesa uranium mill, the only conventional uranium mill in the United States that is still operating, is owned by Energy Fuels, a Toronto-based company. (Photo credit: Wikimedia Commons)