China-US Relations: From Trade War to Hot War?

According to the Trump regime, a US-China trade deal is on the horizon. If a trade deal is reached then no doubt global stock markets will surge even further into over inflated bubble territory. Bloomberg estimates a trade deal could add 10% to global equities.

If a trade deal is struck then the mainstream media and Trump can gleefully tell us that all is well with the world: stock markets are booming so don’t worry yourself about a thing. Hyperbole aside will a trade deal lead to a thaw in US-China relations? Can it help resolve the economic and geostrategic tensions that exist between both nations?

President Obama’s much vaunted ‘pivot’’ to Asia in 2011 was a belated recognition by the American Empire that it faced a new superpower in the making that threatened its economic and geo-political dominance of the Asia-Pacific region. During Obama’s presidency the Asia pivot was primarily military in nature although we shouldn’t forget his ill-fated Trans Pacific Partnership that was designed to contains China’s economic expansion throughout the region.

The election of the populist Trump, a billionaire businessman, on a ticket of ‘Make America Great Again’ tapped into a public mood that was angry at the de-industrialisation of America and the way Wall Street has been fleecing ‘Main street’. Trump’s election reflected a recognition by the American ruling class of the need for action against a backdrop of an escalating rivalry in advanced technology between the US and China, competition for raw materials/markets and increasing geo-political tensions.

Dean Cheng of The Heritage Foundation has argued that the leadership of the misnamed Chinese Communist Party (CCP), sees their country as being in a period of peaceful competition with the U.S.. The CCP leadership sees China as in a period of “strategic opportunity’’ that will allow it to focus upon the non-military aspects of “comprehensive national power.’’ In other words this is a period where there is an historic opportunity to not only catch up with the more economically developed nations of the West but to go on to become a world leader in advanced manufacturing and technology. Thereby, raising living standards for its 1.4 billion population whose passive acceptance of the one party state is of paramount concern to President Xi and the billionaire oligarchs whose interests he represents.

The Chinese Communist Party leadership have been looking to the future in terms of decades when it comes to the country’s economic, scientific and military development. At the CCP congress in 2017 President Xi stated that by mid century the objective was of becoming a “global leader in terms of comprehensive national power and international influence.”

Made In China 2025 Initiative

The ‘Made In China 2025’ initiative that was launched in 2015 represented a turning point in the escalation of the economic and military rivalry between China and the US. The Chinese ruling class see the initiative as an attempt to comprehensively upgrade their entire economy from advanced manufacturing tech to traditional industries and the service sector.

Scott Kennedy from the Centre For Strategic & International Studies has observed that:

“The goal is to comprehensively upgrade Chinese industry, making it more efficient and integrated so that it can occupy the highest parts of global production chains. The plan identifies the goal of raising domestic content of core components and materials to 40% by 2020 and 70% by 2025.’’

In his testimony to a congressional committee on 25 September 2018 Dean Cheng emphasised the comprehensive nature of the Made In China 2025 initiative:

“China’s “Made in 2025” program, where the Chinese hope to be able to become largely autonomous in key manufacturing areas by 2025, should therefore be seen as part of the larger effort to promote Chinese science and technology, not only in terms of innovation and R&D, but sustaining China’s industry by localizing the entire technology development, commercialization, and production process.’’

The Made In China 2025 initiative is seen as a serious threat by the United States to both its advanced technology sector and its attempts at full spectrum military dominance of the planet on behalf of corporate capital.

According to the U.S. Congress the next generation IT. that China wants to become dominant in includes: 5G networks, A.I., blockchain, cloud computing, quantum computing and semi conductors. The fear of Chinese dominance in these hi-tech sectors is portrayed as a grave economic and national security threat to the United States that must be stopped.

Hi-tech economic rivalry

The fear and alarm at China’s emergence as a competitor to the U.S. in high-tech industries is not unfounded. Chinese supercomputers are some of the fastest in the world. China is now the largest producer of supercomputers in the world. In 2017 202 of the 500 fastest supercomputers were Chinese compared to 143 for the U.S. A Chinese lunar probe is scheduled to make a landing on the far side of the moon while the world’s largest radio telescope is based in China.

Alex Barrera, Chief Editor at the Adelph Report has observed:

“The US and Europe are lagging behind in technological adoption. Robotics, AI-based systems, automated education, Quantum computing or smart mobility are all happening in China, not in the US.’’

The emerging gap in terms of investment, research and adoption of AI and Deep Learning is staggering. This has led to the US Congress holding a series of hearings into the economic threat posed by China to the United States. On 26 September 2018 the U.S. House of Representatives held a hearing titled: “Countering China-Ensuring America remains the world leader in Advanced Technologies and Innovation.’’ The chairman of the hearing, Rep. Hurd, stated in his opening remarks that China wanted to “replace us’’ as the world leader in advanced technology and was guilty of intellectual property theft that was costing the US economy between $225 and $600 billion annually.

The arrest of Huawei CFO Meng Wanzhou on 1 December 2018 by Canadian authorities, at the request of the U.S. government, has brought into the public spotlight this rapidly escalating technology rivalry between China and the U.S..

It is also evidence of increasing U.S. frustration at China’s emergence as high-tech powerhouse that may well eclipse the U.S. in the next 20 years.

In 2018 Huawei became the number one smart phone maker in China, eclipsing Apple to become the second biggest maker globally. In 2017 its revenue was greater than Chinese corporate giants such as Alibaba, Tencent and Baidu combined. Over half of this revenue came from sales abroad in Europe and Asia. This revenue growth has increased far faster in recent years than U.S. rivals such as Cisco. In 2012 both had similar revenues but by 2017 Huawei’s revenues far surpassed those of Cisco: $92 billion for Huawei compared to $50 billion for Cisco. Blake Schmidt of Bloomberg has observed that Huawei’s revenue growth, “strikes fear among some policy makers in the West.’’

The military-industrial complex in the U.S. is pushing Trump to ban Huawei from supplying wireless carriers as they upgrade to 5G. American allies such as Australia, New Zealand and Japan are planning to limit use of Huawei gear in their countries.

It will be interesting to see how the “impending’’ trade deal manages the issues of intellectual property rights, access to software and patents for the advanced tech sector.

Challenges facing China’s leadership

President Trump’s imposition of trade tariffs on Chinese imports reflects another front in this escalating trade war between the two superpowers. U.S. trade tariffs have undoubtedly hurt the slowing Chinese economy that is facing a number of major challenges not least of which is maintaining annual GDP growth above 6% to ensure social stability.

The Chinese ruling class is still haunted by the memory of the Tiananmen Square uprising that threatened its very existence. Hence, its economic programme is motivated by the key priority of avoiding social unrest in a country with a well educated population that has high expectations raised by its economic revolution over the last 40 years. Professor Marshall Meyer of Wharton Management has noted that the current government of President Xi, “is not totally secure. This is the first government post-1949 that has not had the mantle of Mao or Deng, and it is struggling a bit for legitimacy.’’

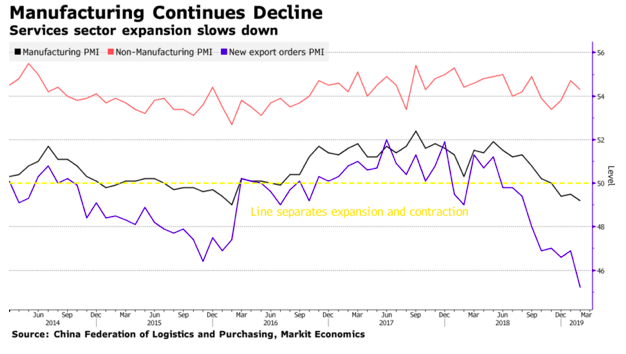

Hence, the continuing slowdown in manufacturing is of great concern to the CCP leadership. China has made concessions to the U.S., such as resuming soya bean purchases last December, and is no doubt keen to get the $250 billion of U.S. trade tariffs lifted in the hope of boosting its slowing economy.

U.S.-China co-dependency

On the one hand both nations are mutually dependent upon one another yet they are both in competition with each other on the economic, technological, diplomatic and military fronts. The question is whether their state of mutual dependency is strong enough to stave off any further deterioration in their relationship that raises the prospect of a military conflict.

The United States is dependent upon China in a number of key areas that range from the cheap consumer goods that Chinese and American manufacturing based in China can sell to American consumers. Besides this, is the vitally important role of America’s key foreign creditors such as China, that holds over a $1trillion in U.S. treasury bonds. Foreign creditors help enable the U.S. government to run its public debt to over $22 trillion that helps pay for its huge war machine.

China’s economic problems

Conversely, Chinese manufacturing industry is dependent upon the continuing ability of heavily indebtedU.S. consumers to continue purchasing its products. China’s leaders are also mindful that in key technology areas its industry is heavily dependent upon foreign sources. Major Chinese companies such as ZTE and Huawei and key state enterprises like Petro China are still heavily dependent upon Western technology in certain key areas.

More importantly, China’s leaders are acutely aware that they have to tread carefully in managing its huge debt problems, particularly in the sphere of corporate debt running at 145% of GDP. According to the IMF 15% of bank loans to the corporate sector (Over $1.3 trillion) are “at risk’’ meaning their earnings cannot cover their interest expense. Hence, why the Chinese government is so keen to try and stimulate its slowing economy to help resolve this escalating debt crisis. The One Belt One Road project and the Made In China 2025 projects, that are seen as major threats by the American Empire, are integral parts of trying to boost economic growth.

The U.S. and China will probably come to a trade deal that will resolve some of their short term issues. However, longer term trends suggest any trade deal is unlikely to resolve the economic, technological and military rivalry between the two nations.

U.S. economic problems

Despite the much trumpeted boom in its economy the United States faces a number of structural economic problems that threaten to undermine its superpower status to the advantage of rivals such as China. The economic problems facing the U.S. also illustrate the profound short termism of American capitalism which threaten to intensify the great power rivalry with China.

In 1945 the U.S. was both the chief creditor and the workshop of the world. It was able to dictate the terms of world trade through the Bretton Woods agreement of 1944 to its advantage. The U.S. dollar became the world’s reserve currency which together with fixed exchange rates between all other currencies and the dollar allowed the U.S. to dominate the global economy in a totally unprecedented way.

Fast forward to 2019 the United States has allowed a major portion of its manufacturing industry to be sent offshore to China and other low wage economies. Corporate giants such as Apple produce their iPhones in China and ship them to the U.S. The United States faces increasing attempts by more and more countries, with China leading the way, to bypass the dollars dominance of global trade by deals that allow the purchase of goods and services in their own domestic currency. From the world’s creditor the United States has become a nation drowning in unpayable debts from the $22 trillion in government public debt to the record $13.4 trillion of household debt.

Source: U.S. Federal Reserve

Since the 9/11 attacks the U.S. has thrown off the so called Vietnam syndrome. It has used its military power to engage in naked gun boat diplomacy fighting one regime change war after another in an attempt to reassert its political, economic and strategic dominance over the Middle East.

Instead of investing in its education system, creaking infrastructure, and unbalanced economy the U.S. ruling class, dominated as it is by the demands of finance capital, has degenerated into myopic short termism allowing the pursuit of massive profits by Wall Street and the bloated financial industry at the expense of the rest of society. This had led to huge wealth inequalities in America that threaten the long term stability of its society. The U.S. Federal Reserve, probably the most powerful central bank on the planet, has dedicated itself to propping up financial markets creating a gigantic wealth transfer unprecedented in history.

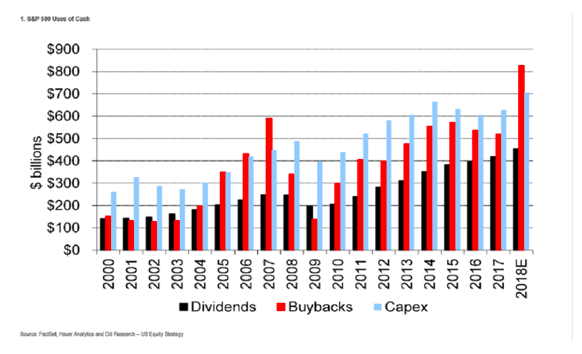

The Fed’s low interest rate policy along with money printing through it s Q.E. programme has fuelled an orgy of parasitic debt based activity since the 2008 financial crisis. This had led to a merger and acquisition mania (worth over $400 billion in 2018) and stock buybacks worth over $800 billion in 2018 surpassing capex for the first time since 2008.

Despite the stock market correction in the last quarter of 2018 the Fed’s policies, particularly its recent statements that further rate rises and the unwinding of its $4 trillion balance sheet are on hold, have fuelled a speculative frenzy that has boosted U.S. financial markets into making huge gains this year.

It would appear that the financial elite in America have completely lost their heads. Instead of punishing such short termism investors are rewarding companies that put M&A and stock buyback activity ahead of R&D and long term capital investment. The American media and corporate politicians have the temerity to complain about China’ s rapid economic development and have fallen fall back upon sabre rattling threats and imposing tariffs upon Chinese imports.

China catching up with the U.S.

No amount of American trade tariffs or gunboat diplomacy in the South China Sea will prevent China from investing massively in research and development to stimulate innovation in its economy that will threaten American hegemony over the global economy. It is estimated that this yearChina will surpass the U.S. in the amount of money devoted to research and development. China’s R&D spending has increased by an average of 18% a year since 2004 compared to 4% a year for the U.S. which devotes ever greater resources to its bloated military.

America’s military budget for the next fiscal year will be $989 billion which is 4 times larger that of China’s which stands at $228 billion. America’s military budget is larger than the defence budgets of the next 9 countries combined!

Let’s take two examples to illustrate how China’s long term economic strategy is surpassing the U.S. in critical areas. The telecommunications sector is a critical industry for any modern industrial economy. Over the last 3 years China has outspent the U.S. by approximately $24 billion on investments in telecommunications infrastructure. It is planning to spend an additional $400 billion over the next 5 years to win the race to be the first to deploy 5G wireless technology. China has already deployed 350,000 cell sites for 5G whereas the U.S. has only deployed 30,000.

In the key sector of education China is rapidly catching up to the U.S. According to the National Science Foundation China now awards nearly as many doctorates in science and engineering as America. Meanwhile, China produces 22% of the world’s Science and Engineering undergraduates compared to 10% for the U.S. In 2017 American scientists published 409,000 science, medical and technology papers in premier international journals compared to 426,000 for China.

Dr.John Schrock, in an article for University World News, noted in December 2018 that American science is in decline as China’s science leaps forward. Schrock noted that China’s :

“long-term policy and investment in education and people has paid off in accelerating advancements in science.… The US has failed to move ahead in many areas of science, from particle accelerators to astronomy to organismic biology.’’

Geo-political rivalry will intensify

The much touted trade deal, if it comes off, may help to relieve tensions between China and the U.S. on a temporary short term basis. However, no matter how comprehensive the deal it will not resolve the fundamental economic problems between the two nations that are leading to rising geo-political and military tensions.

Despite its own serious problems with a gigantic debt pile China has committed itself to a massive long term investment in its economic development. All the trends suggest that by mid century or even sooner China will have eclipsed the U.S. to become a global leader in advanced technologies that will greatly enhance its economy.

This undermining of American hegemony over the global economy obviously has serious geo-political consequences as the U.S. will not allow this to happen without a struggle. It remains to be seen whether this intensified rivalry remains contained to the economic sphere or whether it may escalate to military warfare. The next global recession, that comes closer every day, will undoubtedly exacerbate U.S.-China relations and may well push military and geo-political tensions to breaking point. After all, warfare and foreign policy are merely a continuation of domestic politics and economics by other means.

*

Note to readers: please click the share buttons above. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

Leon Tressell is a UK based historian whose research focuses upon geo-politics and economics.