Towards A 2016 Banking Crisis in Europe: Hard Landing in a New Reality

The beginning of 2016 is marked by the announcements of a “cataclysm”, expected to happen this year on the stock markets. What is different now compared to 2008 is that, this time, it is not some contrarian analysts who say so (the way LEAP did in its early publication of GEAB in February 2006) and who launch these alerts. It is the high ranking institutions which shout out loud: BIS, Fed (through Richard Fisher’s voice of the Dallas Federal Bank), the IMF, and some very important banks: Société Générale, RBS and UBS. These actors have thus joined the other analysts, like us, who denounce the creation of this financial bubble even more inflated than the previous one, and a Western economic recovery which is not even real.

Yet, as soon as the heart of the system broadcasts this anticipation, it is infinitely more likely not to happen than when marginal players say it. Remember, the paradox of a successful anticipation relies in the fact that it should not happen, since a collectively anticipated problem is a solved problem. Still, are the alerts launched by the heart of the system real anticipations, or more like simple descriptions of factual situations? In the same way, repeating after us, Richard Fisher, president of the Federal Bank of Dallas says: “We are out of ammunition.”

According to our team, the panic which seems to worry the major operators of the “western system” is too late to support a smooth transition, but their avowed awareness still allows anticipation of radical changes within the crisis management strategies made by an “establishment” which will tighten its ranks.

Unfortunately, the lack of imagination of this “establishment” particularly allows the introduction of protectionist measures. The tendency of hardening is to combine with another trend, which we have often spoken about in the first half of 2015: unlike 2008, the creation of a new system is an operation advanced enough to allow us to anticipate that instead of an outright collapse into nothingness, the 2016 crisis will primarily correspond to a “hard-landing” in a new reality to which big players of the old reality will try willy nilly to adapt. This adaptation attempt will nevertheless require them to take some tactical retreat.

Timeline of a Financial Crisis

January 13th, the indicators show a widening deflationary storm, like a barometer: the GSCI Commodity Index : 284.7 (the lowest value since 2004); the Baltic Dry Index : 402 (the lowest value since 1985, creation date of the index!);

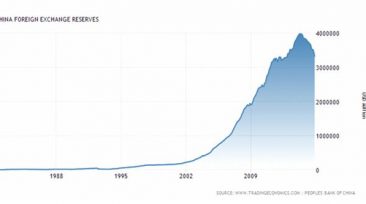

the Chinese central bank has been emptying its dollar foreign exchange reserves since June 2014 to a continuous rhythm of 37 billion dollars a month, which is quicker than it initially filled it; the Saudi central bank is in the same situation; the central banks of Brazil, Japan and Russia, the BoE or the ECB see their reserves decrease, even if the rhythm is slower. The most important states holding dollar debts are selling dollars simultaneously.

Monthly evolution of foreign exchange reserves in China, 1980-2015; source: tradingeconomics

Is the financial crisis coming from China?

This is the analysis encountered in all mainstream media. First of all, let’s compare the index of the Chinese stock market and the evolution of the Dow-Jones, over a period of two years…

Read the rest of this article here

Notes:

Source : The Telegraph, 11/01/2016

Source : The Telegraph, 25/06/2015

Source : Business Insider, 06/01/2016

Source : Global Research, 31/12/2015

Source : The Guardian, 12/01/2016

Source : The Telegraph, 11/01/2016

Source : Conscience Sociale, 19/11/2012

Source : Bloomberg, 14/01/2016