The Subservient Role of Governments. How Economics Changed to Work against Us

There is no question that this is a time when corporations have taken over the basic process of governing.

Do you wonder;

• Why is there so much national debt?

• Where has the middle class gone?

• Why do my kids have less opportunity than I did?

If so, this book by Gordon Bryant Brown is for you!

• 97% of money is created by the banks, not by governments.

• The Federal Reserve is a private bank controlled by private banks.

• Adam Smith did not say an invisible hand guides the markets.

• Government debt was static until the mid-1970’s and has soared since.

• Milton Friedman and Alan Greenspan both admitted to fundamental economic errors.

• About 1/3 of an average persons’ spending is goes to banks as interest.

• Corporations are using treaties to overrule nations and democracy.

• The TARP bank bailouts were the biggest theft in history.

The text below is an excerpt from Gordon Bryant Brown‘s recently released book entitled An Insider’s Memory, How Economics Changed to Work against Us

***

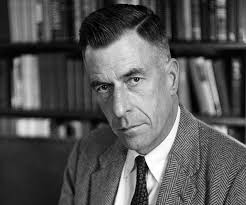

When elected world leaders meet to discuss trade, patents, banking, and other items from the corporate agenda, and important social issues like peace, security, survival, the environment and culture are ignored, it’s because corporations have overridden the role of government. That is the subject of this chapter, and it begins with thoughts from my favorite economist John Kenneth Galbraith. As decades passed, hi s writing ability never left him, but he became more forgiving. Perhaps it was his comfortable, tenured life as a Harvard professor, or perhaps it was just time that made him mellow. He published his last book,

s writing ability never left him, but he became more forgiving. Perhaps it was his comfortable, tenured life as a Harvard professor, or perhaps it was just time that made him mellow. He published his last book,

The Economics of Innocent Fraud, in 2004, when he was 96. The Economist newspaper proclaimed,

“Galbraith returns to the battle lines”.

He returned, to the extent he was aware how the economy was changing, however, he didn’t, as he once did, point a finger.

To purchase Bryant Brown’s book click book cover (left )

To purchase Bryant Brown’s book click book cover (left )

Corporate fraud today is commonplace and Galbraith had warned us, decades ago, to be wary. The older and gentler Galbraith called apparent corporate fraud “innocent”! With what we have learned about Wall Street, he was too kind. Financial corruption has been self-serving, planned, devious and vicious.

Galbraith noted the way the term ‘capitalism’ had been replaced with the more innocuous-sounding ‘market system’, was fraudulent, weakening the image that capitalists/the wealthy, controlled the market. He claimed it was fraud to rely on the gross national product as a measure of progress, since it failed to account for education, literature and many other important parts of life. He believed it was fraud to retain the myth that shareholders controlled corporations when corporate bureaucracies had long since taken control. The justifications for huge corporate salaries he saw as fraud because no one is worth the money corporate leaders were paying themselves. And it was fraud the way the Federal Reserve pretended to manage the economy through interest rates. It’s easy to see that much of the fraud he mentions was, and remains, too self-serving to be innocent.

He died in 2006 at age 97. Fortunately, he had a son who picked up where his dad left off.

James K. Galbraith (1952)

American capitalism is neither benign competition, nor class struggle, nor an inclusive middle-class utopia. Instead, predation has become the dominant feature — a system wherein the rich have come to feast on decaying systems built for the middle class.[1]

James Galbraith is John Kenneth and Catherine’s youngest son, an economist at the University of Texas. The quote above is from his 2008 book, The Predator State. Like his father, he chooses his titles well. His father’s book, The New Industrial State, summarized in the title how industry was changing economics to put corporate needs ahead of the people’s. James warns in his title that it’s government, “the State”, that’s become a predator we need to fear. He explains that the state is now the servant of corporations. As a consequence, the corporate controlled state has become, “… a system wherein the rich have come to feast on decaying systems built for the middle class”. 69

One feature of capitalism, he explains, is how periods of economic stability create instability! The logic is simple. In good times, banks and others feel confident and lend (or borrow) money. As good times continue they take on projects of steadily increasing risk. With every increase in risk, the collapse gets closer. Instability is an inescapable component of uncontrolled free markets.

James got a bachelor’s degree at Harvard and then went to Yale for both a masters and Ph.D. in economics. In the mid-1970’s, he chose to then go to Cambridge in England, as his father had done, to do a year of postgrad work. After that, again as his father had done, he spent several years working in government as Executive Director of Congress’ Joint Economic Committee. One of his tasks was to prepare hearings on monetary policy. From there he went to teach at the University of Texas where he remains.

In 1979 the Federal Reserve tried to manage the economy with short-term monetary targets and the result was, as James called it, “a cascading disaster”, with interest rates soaring to 20%, and 11% unemployment, recession and many industries closures. The Fed policy also threw much of the Developing World into crisis, and Mexico faced default. (I recall not being able to afford a mortgage at the time. As those high rates spread to Canada as well, so did the recession!) That period is referred to as the Monetarist Recession of 1981-82 and illustrates how much the subject of economics matters. It also illustrated how much bad economics matters, and how wrong people can be.

In March, 2008 James Galbraith was invited to give the Milton Friedman Distinguished Lecture at Marietta College in Ohio. He began by stating he was there to, “… bury Friedman, not to praise him”[2], and this he proceeded to do. His lecture focused on the collapse of Monetarism, which occurred in August, 1982 when the Fed dumped the Friedman policy of monetary targeting.

It took twenty-two years for Friedman to admit that he had been wrong. Twenty years too late, in an apology as vague as Greenspan’s had been, Friedman explained, “… the use of the quantity of money as a target has not been a success. I’m not sure I would, as of today, push it as hard as I once did”. The word ‘sorry’ didn’t come up.

Monetarism may be dead, but it is not buried. When news of small changes in the bank lending rate are reported, it implies that it’s important: that’s a Monetarist assumption. We hear much about ‘staying the course’ and ‘being disciplined’ in the fight against inflation, although inflation has not been an issue for decades. There have been hundreds of anguished reports about the ‘struggling manufacturing sector’, but almost no reports explaining why this sector is struggling.

James Galbraith writes about the relationship between economic instability and the decline of the working class. The decline of the working class is the direct result of actions such as moving jobs offshore, which serve to concentrate wealth at the top. James Galbraith points out it doesn’t have to be that way. Countries such as Sweden have freedom and prosperity, combined with greater equality and more economic stability.

Instead, in America, the state became increasingly pitted against the people, with cutbacks in social services, pensions, job security and union rights. One of the first campaigns against the people was Nixon’s “War On Drugs”, in 1971. That was an attack on people that produced multiple effects. It disproportionately targeted blacks, resulting in the loss of their (usually Democratic) right to vote. It also led to an explosive growth of prisons, and expanded the role of the police. When the ‘war’ was declared there were about 400,000 people in American jails, which was about 100 per 100,000 people. The chart below shows the effect.

Forty years later, in 2011, there were 2.2 million people in jail, or 743 per 100,000 of population: five times the world average of about 150 per 100,000. Not only were there more prisoners per capita, people were kept in jail longer than in any other nation on earth. In the U.S. there are now more prisoners than farmers! About 10 percent of those prisoners are housed in institutions run for profit. These for-profit institutions have no incentive to rehabilitate — worse, they have incentive not to rehabilitate — keeping prisoners longer maximizes revenue. To insure and expand their profits the Corrections Corporation of America spends about $1 million dollars a year on lobbying Congress.

James Galbraith’s more recent book, The End of Normal,[3] is not an optimistic book. He writes that so many of the essential assumptions of economics have been altered that the system has no direction: nothing is normal. Changes have occurred to protect corporate-finance capitalism and military capitalism, while the people have become unprotected. His ideas are being ignored in America, while, at the same time, he has been asked for advice from abroad: the government of Greece asked for ways to recover from a near decade of bad policies which stole hope from the young and pensions from the old. (I’ll talk more about Greece in the next chapter.)

He anticipates, at best, slower growth, and recognizes that the ending of the American Era, which is underway both financially and militarily, should lead to less military spending and more social spending.

Bryant Brown is a business turn-around specialist with an interest in the bigger subject of economics.

He has also been a community organizer, worked for both multinationals and small co-ops, travelled much of the world and brings that experience together into a readable analysis of the economic world today.

Bryant Brown has been supportive of the Global Research Project from the very outset.

Notes:

[1] James Galbraith http://www.motherjones.com/politics/2006/05/predator-state

[2] http://utip.gov.utexas.edu/papers/CollapseofMonetarismdelivered.pdf

[3] The End of Normal; The Great Crisis and the Future of Growth, 2014