The next major move in the stock market will be DOWN

Last vestiges of a rally similar to what we saw in 1931

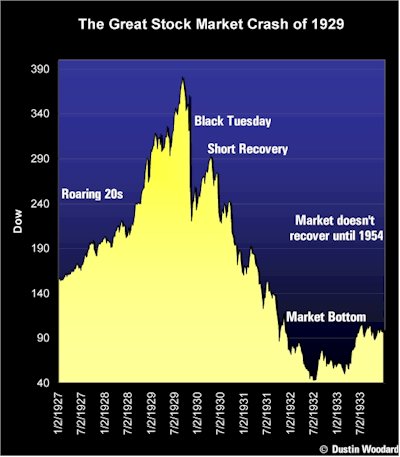

The next major move in the stock market will be down. We are seeing the last vestiges of a rally similar to what we saw in 1931. The rally we expected at 6600 up to 8500 will end as soon as all the financial institutions that need to sell what stock is necessary to bolster their balance sheets. Our guess is the rally has been aided in a big way by short covering and the participation of the US government. Those who believe the SEC has stopped naked short selling are sadly mistaken. Markets weaken during the summer as volume dries up during the vacation season. In addition, second quarter earnings will be very disappointing, especially in the financial segment. Unemployment continues to worsen and capacity utilization is at its lowest level in years. Banks continue to cut credit lines and not lend nearly as much as they did before. Citigroup’s earnings should turn down again. They won’t have another $2.7 billion gain or another $400 million mark-to-market fictitious gain. Absent those gains they would have lost $2.8 billion.

The credit crisis certainly isn’t over after 23 months. The credit markets are still very tight and the residential and commercial real estate markets are still in a state of collapse. In the midst of this ongoing fiasco the Fed is monetizing $2.2 trillion in treasuries, Agencies and CDOs, collateralized debt obligation, otherwise known as toxic junk. Our fiscal deficit for this year ended 9/30/09 will be between $2 and $2.5 trillion, followed by more than $2 trillion in 2010.

Times are tough, everywhere and export nations are determined to keep their products cheaply devaluing their currencies.

When all is said and done the Fed will have to remove hundreds of billions in toxic assets from lender balance sheets, get consumers to spend and allow banks to lend again. Ben Bernanke at the Fed would really like to see a lower dollar, to get consumers to spend. But if that happens interest rates will move higher hurting real estate sales. As Ben dreams, unemployment increases adding more downward pressure on home prices, causing lower prices and reducing equity. Congress is pushing to have returned TARP money back to the Treasury and the PPIP program looks like a nonevent, because it could cause insolvencies. Public funds would be used to protect bondholders of mismanaged companies. Ben and Tiny Tim want to reopen securitization markets that caused the problem in the first place. They have to be insane. They want to bring back leverage that caused this monstrous problem we have.

The TALF, Term Asset-backed Securities Loan Facility, makes non-recourse loans, willing to buy AAA bonds backed by consumer and small-business loans, in a market that is frozen. Then for private investors there is a guarantee because the loan recipients cannot pay the loans back. This would cost taxpayers hundreds of billions more dollars.

The public is de-leveraging, which means less consumption, less profits and more savings. The bear market is far from reversible. The rally is over. Dow 6600 will be retested. The basis and support for growth no longer exists. Credit markets are still semi-frozen and the financial system is no better off now than it was 23 months ago.

The big foreign lenders have brought a new global dynamic into the game. Rising yields are a signal that the unusual dollar rally that should never have been, is over. The safety of the dollar is no longer sacrosanct. In fact, it is being in some quarters perceived that the dollar is no longer safe and it has to vie with gold as the safe haven go to asset. Fiscal deficits are projected this year to be $2 to $2.5 trillion and well over $1 trillion annually for years to come.

Commodity prices have surged over the past several months as the dollar has weakened, which reflects anticipated future inflation as well as rotation. We have seen this reflected in precious metal prices as well. The leeway the Fed experienced some months ago via deleveraging has past making it much more difficult to employ quantitative easing, monetization. The job of pegging long-term as well as short-term interest rates will be difficult and very injurious to the value of the dollar, as more and more money and credit are made up out of thin air. Trillions of dollars of MBS, ABS and CDO being purchased by the Fed incurring long-term losses can’t be tolerated indefinitely.

Sadly as the Fed and the Treasury go so does most of the nations of the world. In that case most all currencies depreciate against gold. Yes, the Fed can drive rates down, but for how long? Especially as the economy fails to perform and taxes rise as do borrowing costs. Import costs are already rising as well. Foreign lenders, with each passing day, become more skeptical of monetization, the damage it will do to the dollar and the Fed’s ultimate ability to retire dollars from the financial system. Dollar selling will feed on itself under those circumstances pushing the dollar lower versus other currencies and gold. It is now only a question of when will the system break? We do not know that, but we do know it will break and the only safe haven to preserve wealth is in gold and silver.

Higher interest rates have to have caused great consternation in the banking community concerning their IRS and CDS swaps. This is an unregulated market so no one except the players know what is going on inside. For a number of years these contracts have caused interest rates to be abnormally low. If these swaps were to blow up interest rates could and probably would move substantially higher.

The big loser in all of this will be the dollar as more and more dollar owners become fearful and sell dollars. If you look at a USDX chart you will see what we mean. A total breakdown as the dollar struggles to begin momentum and break out over 81 again. It is not going to happen. The question is how long will it take to get to 71.18? We can list all the reasons for pressure on the dollar, but you already know them.

The Fed is monetizing about $2.3 trillion in Treasuries, Agencies and CDOs. We said week’s ago that these monetizations would be followed by an additional $2 trillion if not by the end of this year, by March 2010. The Fed has no other choice. This is going to go on indefinitely until the dollar reaches 40 on the USDX and at that point no one will want to buy dollar denominated securities or to even borrow dollars. That is when we’ll have our next Bretton Woods type conference where all currencies will devalue and default and gold and silver will reach great heights. We saw all this coming when we warned you earlier in the year that you had until June to refinance debt. We hope you did so. We are now entering a new stage in real estate. Price pressure is going to press a further downward bias that will last a minimum of 3-1/2 years. How long we will be on the bottom no one knows.

This is why you do not want to own US Treasuries or US corporate or municipal bonds. A better currency is the Canadian dollar if you must have money in Treasuries. All your funds should really be in gold and silver related assets.

Interest rates have now become a dummy’s game driven by derivatives. They are going to explode. It is only a question of when. All the major banks, holding 75% of US deposits are insolvent, and they will collapse when the derivative bomb explodes. In addition there are lots of other losses on the way as well. The ability of the Fed and the Treasury in the misuse of “The Working Group on Financial Markets” will come to an end. Much of what they have been up too will be exposed by an audit of the Fed, which we believe is on the way. As a result legislation will follow that and will bring an end to the criminally misused executive order number 1263, which Bill Keene and Sue Herrera tell us on CNBC doesn’t exist. It will be discovered that the swaps market has little or no collateral and as a result Goldman Sachs, Citigroup, JP Morgan Chase and Bank of America will meet their demise. The biggest positions reside with JP Morgan, thus they should be first to bite the dust. The losses are going to be in the trillions. The loss of capitalization when the bomb explodes will engulf the entire world financial system.

The Ron Paul strategy in HR 1207, now with 225 co-sponsors, the Federal Reserve Transparency Act of 2009, and the companion Bill in the Senate S604, The Federal Reserve Sunshine Act, sponsored by Bernard Sanders (I-VT) will uncover what the Fed and its owners – the major banks – have been up too; particularly in rigging markets.

It looks like HR 1207 will be passed in the House. Now train your guns on the Senate. Hit every Senator with: Dear Senator, Please co-sponsor S604, the Federal Reserve Sunshine Act of 2009, and make it become law. Sincerely, etc. Short and sweet and to the point. No comments or opinions.

The Fed is in a box and cannot get out. We have to make sure they do not get out by investigation, exposure and destruction. The Fed is the core, the nexus of the Illuminati. Few in the media or in business will tell the truth because they are either in on it or they are terrified to talk about it for fear of being destroyed. This is the kind of world we live in. you can still do your part by contacting the Senators. We want them buried in emails. This is our chance to finally win without bloodshed.

President Obama has begun selling his healthcare program. He presents it as a reduced cost, guaranteed choice, quality plan for all. The reality is government programs will result in higher costs, no choices and inferior care. The legislative vehicle for this health care deception is planned to be in the budget reconciliation bill, which requires only 51 Senate votes for passage instead of the 60 needed to authorize new programs.

The Kennedy Plan promises that all Americans will have health care, employers will have to contribute to the costs. A government program will subsidize premiums for people up to 500% of the poverty level, that is $110,000 for a family of 4, and private insurers will have to pay out a specified percentage of their premium revenues in benefits. There is no provision for funding the program, so it looks like perpetual deficit spending to cover the costs.

Healthy people will be forced to pay more for their insurance in order to subsidize those not as healthy, those who have ruined their bodies and minds and the old.

Fines will be imposed if you do not provide health care for employees. That means the employers will not insure employees and pay the cheaper fine, or just go out of business.

That means 100 million people happy with their programs will have to take an inferior government plan. Then, of course, is the bureaucracy, which dictate treatment and who will live and who will die.

Part of the proposal includes a proposal to tax these health benefits with current employer-based health insurance.

We are promised cost savings by putting all Americans’ health records on a uniform computer system, which will be eventually mandatory for all countries. These totalitarian controls will be forced on all doctors and terminate all medical privacy.

Healthcare will be rationed letting bureaucrats decide who gets treated and how and who will be allowed to die. Seventy percent of medical lifetime costs occur in the last year of life. We already experienced this with a doctor and I asked him which side of his head he’d like his brains blown out of.

Part of the legislation would provide healthcare for illegal aliens, which 80% of American voters are opposed too.

It would be far more constructive to begin to fix the problems in Medicare and Social Security then try to create an expensive new system.

On the other side of the spectrum are those who want a single-payer-approach like those used in Europe. Congress has said they won’t even consider it, this in spite of the fact that any other plan will leave the big insurance companies in charge and keep hurting patients. Someone should tell these poor ignorant souls that both parties are promoting corporatist fascism.

The real deep-seated problem is that the health insurance companies and related industries are major campaign contributors to members of Congress on both sides of the aisle. Senator Grassley is a good example. Since 2005, he has collected $1.3 million in donations from industries related to the health insurance debate.

In a different perspective on healthcare the US will spend 15.4% of GDP both state and private. With that it gets 2.6 doctors per 1,000 people; 3.3 hospital beds and its people live to 78.2 years.

The question is how do we cut down medical costs? There has been some pressure to do so, but costs go relentlessly higher. Senators and congressmen receive hundreds of millions of dollars from the industry to continue their gravy train. Then there are the investors, bureaucrats and preexisting conditions.

Mr. Obama doesn’t have the answers and neither does the industry.

How can anyone not expect interest rates to rise? Mandated programs such as Medicaid, Medicare, Social Security and the FDIC and the Pension Benefit Guarantee Corp., and a host of others have us over $100 trillion the short-term.

We have been in a crisis financially and economically for 23 months. We were in recession from February 2007 to February 2009, and we have been in depression since this past February. The budget deficit for the fiscal year ended 9/30/09 should be about 15% of GDP the largest deficit since WW II or five times last year’s deficit. The Treasury and the Fed have created money and credit of some $14.8 trillion and next year we project over $20 trillion – this as our government acquires large stakes in banks, brokerage houses, insurance companies, health-care, mortgage companies and auto and truck manufacturers.

As a result of this dreadful profligacy last month in May we began the beginnings of inflation resumption that will soon become hyperinflation. Interest rates will continue to rise as will gold, silver and commodities and bonds, stocks and the dollar will decline against other currencies and gold and silver. Business will be forced to pass on price increases or go out of business. Currency in circulation, which nominally is 10%, is now 50% of the monetary base and bank reserves have risen by 20-fold. Banks have this huge position as a reserve against their liabilities. This allows banks to float or extend the day they’ll have to write off their losses.

Banks are able to expend their loan making abilities, but they have not done so as yet. As this loan constriction continues the expansion of money and credit is running at about 18% annualized. This will in time result in higher interest, which are underway and higher inflation, which we’ve begun as well. By way of example, M1 is near 15% the highest level in 50 years.

We are looking at a monetary policy far more inflationary than in the late 1970s, we know we were there. That wasn’t a pretty picture and neither will this be. We saw inflation at 13.5% and the prime rate at 21.5%. We saw gold rise from $35.00 to $850.00. This time it could cross $6,000.

We’d like to see the Fed purge the system, something they should have done six years ago. We hear talk of contraction, but that is not going to work even if the FED wanted to do it, which they don’t. They contract and the whole house of cards collapses. Some talk of raising reserve requirements, but if the FED does that the system will implode due to the continuing deflationary drag. Real estate is still a long way from the bottom and it will experience trouble for years to come. The bottom won’t be hit until 2012 or 2014. The demand for liquidity by the Fed and the Treasury is so great that just over the coming year it will be close to $5 trillion. There you have it and it is not a pretty picture.

Quite frankly, we have a once in 100-year opportunity to destroy the Federal Reserve. The House should pass Ron Paul’s HR 1207, so we have to now make sure S 604 is passed in the Senate. After the investigations begin it’s terminate the Fed.

The Fed has done as it pleases for 96 years looting the American public. They are almost totally secret and when a federal judge demanded the Fed to disclose where funds went, why, and how they were used, they told the judge to drop dead – it was a state secret. There is so little transparency congress just had to subpoena the Fed over the Bank of America affair, where our Treasury Secretary Paulson and Fed Chairman Bernanke told Mr. Lewis, BoA Chairman and CEO that if he didn’t take over Merrill they’d destroy him and his board. These people are criminals and should be treated as such. Let’s begin the charges and let’s pass HR 1207 and S 604 and follow that with terminating the Fed and return our monetary policy where the founding fathers directed it – to the US treasury. The Fed is fighting a battle behind the scenes against new accounting rules that would make banks move more assets onto their books. The issue is toxic assets. The banks instead of lending 8 to 10 dollars for every dollar on deposit lent 40 to 60, made bad decisions and lost. These banks, some of whom own part of the Fed are insolvent. That is why the Fed does not want rule changes. They cannot deal with the toxic waste that runs into the trillions of dollars. The Fed has been buying this worthless waste in anticipation of the American taxpayer paying for it. The Fed cannot stand transparency because they are criminals and don’t want the public to know what they are up too. The mortgage market is frozen and may never be unfrozen. That is why the Fd is trying to clear the banks books. We find it of interest that the Fed won’t tell us what they are paying for this garbage. Yes, what did they pay and what are they worth? Who has gotten bailed out by the Fed shareholders? Americans have a right to know.

Foreigners, or at least some of them, are dumping dollars in a big way because they see what is going on. That isn’t going to end anytime soon. The further the dollar falls the more heat the Fed will get from foreign investors. If they do not clear bank balance sheets, fund and monetize the Treasury and increase money and credit on a continual massive basis, the economy will collapse as well as the financial system. The Fed will not be forced to slow down monetary creation because they have no other choice to gain time. Yes, and lest we forget, zero interest rates. Japan has had them for 16 years and they have never come out of depression. Removing money and credit from the system is just wishful thinking. All we can tell you is the dollar has seen its highs and it won’t be too long until the bubble bursts. Before this is over there will be many criminal indictments of Illuminist and the entire world economy will be zombieized. This depression will last at least ten years and probably twenty years unless the elitists fund both sides and have another war. Then it could be another dark ages. The same kind of fascism existed in the 1930s under FDR but no one understood what the elitists really were up too and that was world fascist government, but again they couldn’t make it work. What did work and we live with that legacy today and it is preeminence of industrial America, Wall Street and banking.

Our Treasury Secretary Mr. Geithner tells us the $700 billion from TARP that is and will be returned will go back to the General Fund, but the treasury will continue to use those funds on a permanent basis in any way Treasury sees fit. That means a slush fund for perpetuality. Needless to say, we need legislation to change this. The reason 10 of our biggest banks, that hold 75% of deposits, want to go back to paying their executives hundreds of millions of dollars a year. The next step is to concentrate regulatory power over the financial system with the Fed and restart massive derivative creation and securitization, so the banks can return to profitability in a big way, and these CEO’s can get ever richer, as the economy goes deeper into the abyss. This is why we have fought for Ron Paul’s HR 1207, the Federal Reserve Transparency Act of 2009. Once the Congress and the people see what the Fed has been up too, they will want to get rid of it. Once gone we have to end the revolving door between Wall Street and banking and government. As we slip deeper into depression congress will then consider tariffs on goods and services to bring our jobs and companies back home.

It is also time to press for the companion Bill in the Senate S 604 sponsored by Bernard Sanders (I-VT). It is now in the Senate Committee on Banking, Housing and Urban Affairs. Deluge every Senator on this issue and haul in the co-sponsors as you did in the House.

The US Treasury has to be stopped from subsidizing the major banks that own the Fed under TARP. The taxpayers are supplying the capital and are guaranteeing all of these bank’s derivatives and other bad debt. It is no wonder they want the Fed to oversee things. These are the people who own the Fed. You will see more shotgun weddings, like you saw in the Bank of America-Merrill Lynch rescue, or the Countrywide-Bank of America caper. Both rescued firms were virtually worthless, but BoA was forced to buy them both out.

Economist Paul Krugman sees the current economic situation in comparison with Japan’s last 18 years. He sees the risk of long-term stagnation as really high and these past two years as being worse than those Japan endured. As we have predicted he says a second stimulus package will be needed late next year.

Banks over the past year have accumulated $949.6 billion, up from $96.5 billion in April 2008. We guess those funds will be used to purchase the shortfall in what the Treasury needs due to falling reserves. We have said that we believe all the toxic garbage being purchased by the Fed is providing further funds to buy treasuries in daisy chain fashion. We also expect some falling off of domestic Treasury and Agency buying of $2 trillion as the stock market declines and bond yields attempt to be capped at 4% to 4-1/4%. Another thought is that the Fed and Treasury have created negative events to shift to positions, which allow them to better control markets. The manipulation, which we cannot see, is unbelievable. That is why we need a Fed audit and real oversight, not just a wink and a nod.

Internet advertising in the United States dropped 5 percent in the first quarter, marking the marketing medium’s first downturn since 2002 when the Web was still recovering from the dot-com bust.

The data released Friday by the Interactive Advertising Bureau and PricewaterhouseCoopers LLP provided another reminder of the widespread pain wrought by the longest U.S. recession since World War II.

But the Internet’s financial backbone isn’t sagging as badly as that of more established media like newspapers and broadcasters, where far more severe advertising losses have triggered massive layoffs, bankruptcy filings and doubts about whether their businesses will ever be the same again.

By contrast, the setback for ad-driven Web sites and services is considered temporary.

`”We’re confident that growth will resume as the U.S. economic climate improves,” said Randall Rothenberg, the Interactive Advertising Bureau’s chief executive.

Advertising revenue has been drying up as more companies clamp down on their marketing budgets to save money during tough times. The drought has gotten worse during the past year as traditionally big spenders like banks, automobile makers and dealers, department stores and real estate developers have been grappling with major crises that have forced some of them to merge with rivals or simply close their doors.

Even before the Internet recorded the first-quarter decline in ad revenue, sales have been slowing down after years of rapid growth.

U.S. advertisers spent $5.48 billion on search, display, video and other Internet ads during the first three months of the year, a decline from $5.77 billion during the same quarter last year.

It was the first year-over-year decrease since the fourth quarter of 2002, when Internet advertising fell 4 percent.

Mahmoud Ahmadinejad won Iran’s presidential election with 62.6 percent of the vote, the country’s Interior Minister Sadegh Mahsouli said in comments broadcast on state television.

Textron Inc.’s Cessna unit will cut 1,300 more jobs as the planemaker revises its production forecast amid continued order cancellations.

The reductions are in addition to the 6,900 previously announced, Karen Gordon Quintal, a company spokeswoman, said in an e-mail. With today’s cuts, Textron will eliminate 9,600 jobs companywide, including the 8,200 at Cessna, she said.

A legal loophole lets bill collectors seize Social Security and veterans’ benefits, even though federal law is supposed to protect the payments from most creditors.

That loophole is direct deposit.

Creditors have been seizing payments by getting court orders to freeze and garnish bank accounts that receive the benefits through direct deposit and it’s happening more often as more people opt to have their benefits deposited straight into their bank accounts.

For their part, banks say they’re often confronted with court orders to garnish accounts that include deposits from multiple sources.

They often respond by freezing the account until the bank customer and the creditor resolve the issue.

Lawmakers from both parties have been pressing the Treasury Department for years to close the loophole.

The Obama administration is promising action but has offered no timetable for developing new rules.

Confidence faltered in June among U.S. home builders, left uneasy by a rise in mortgage rates.

A market sentiment index published monthly by the National Association of Home Builders dipped this month. The gauge reflects builder confidence in sales of new, single-family houses.

The drop in the NAHB’s housing market index reported Monday, to 15 from 16 in May, followed two months of increases that had nurtured hopes of a bottom to the housing crisis. Signs have surfaced this spring indicating the worst of the recession is past.

But mortgage rates have climbed in recent weeks, pushed by rising government bond yields. Investors are concerned about inflation because of increased spending in Washington meant to pull the economy out of recession. Freddie Mac (FRE) data showed the average on a 30-year mortgage loan was 5.59% last week – 73 basis points higher than the average four weeks earlier of 4.86%, an advance that could hurt demand for houses.

Net long term securities transactions have been $11.2 billions in April, down from from revised $ 55.4 billion in March, according to figures by the US Treasury Department. Net foreign purchases of US securities have totalled $34.3billion in April, from which $18.3 billion were purchased by private foreign investors, and $16.0 billion by foreign official institutions. US residents sold a net $23.0 billion worth of long term foreign securities. USD/JPY has the most sensitive pair, in regards to TIC data, and the Dollar has broken below the intra-day support level ar 98.00/10, and rejection from 98.55 has extended to 97.94 intra-day low minutes after TIC data was released.

Economic conditions for NY manufacturers have worsened in May, as the NY Fed manufacturing Index dropped to a reading of -9.41 from -4.55 in April. The Dollar has remained little moved by manufacturing figures. New orders Index remained in the negative side; -8.15 in May from -9.01 in April, while the index of employment improved slightly, although at very low levels; -21.84 from -23.86.

Extended Stay Hotels, the operator of mid-priced hotels acquired at the peak of the commercial real estate market for $8 billion, filed for bankruptcy protection as the recession cut corporate and leisure travel.

The Spartanburg, South Carolina-based chain, with more than 680 properties in 44 states, collapsed two years after Lightstone Group LLC purchased the company with $7.4 billion in financing. The company said it had $7.1 billion in assets and $7.6 billion in debts at the end of last year, according to papers filed today in U.S. Bankruptcy Court in New York.

The latest act in the drama of the American International Group opens Monday when the ailing insurance giant takes its former chief executive to court, accusing him of plundering a trust that it says was set up to pay top performers.

A.I.G. contends Maurice R. Greenberg, 84, who ran the company for decades, unlawfully took $4.3 billion in stock in 2005, the year he was forced out as chief executive.

Mr. Greenberg and his lawyers say that those A.I.G. shares — owned by Starr International, a privately held company, of which he is chairman — were not held in a trust at all. As Starr’s chairman, they say, Mr. Greenberg had the authority to sell the shares and invest the proceeds in new offshore insurance businesses and in a new charitable arm.

The government bailout of A.I.G. occurred after the main events in the case, which revolve around the intricacies of trust and securities law. But the trial may delve into the broader questions of who is responsible for A.I.G’s near collapse and whether, as chief executive of A.I.G., Mr. Greenberg was more preoccupied with financial maneuvers than with fostering sound risk management. For his part, he has accused the government of destroying a company that he nurtured.

U.S. credit card defaults rose to record highs in May, with a steep deterioration of Bank of America Corp’s lending portfolio, in another sign that consumers remain under severe stress.

Delinquency rates — an indicator of future credit losses — fell across the industry, but analysts said the decline was due to a seasonal trend, as consumers used tax refunds to pay back debts, and they expect delinquencies to go up again in coming months.

“I find it hard to believe that it is really a trend. You need to see stabilization in unemployment before you see anything else,” said Chris Brendler, an analyst at Stifel Nicolaus. “It is too early to see some kind of improvement.”

Bank of America Corp — the largest U.S. bank — said its default rate, those loans the company does not expect to be paid back, soared to 12.50 percent in May from 10.47 percent in April.

In addition, American Express Co, which accounts for nearly a quarter of credit and charge card sales volume in the United States, said its default rate rose to 10.4 percent from 9.90, according to a regulatory filing based on the performance of credit card loans that were securitized.

The credit card company also holds a large exposure in California and Florida, two of the states most affected by the housing crisis and unemployment.

Citigroup — the largest issuer of MasterCard branded credit cards — reported credit card chargeoffs rose to 10.50 percent in May from 10.21 percent in April.

“Chargeoffs went up to record highs,” said Walter Todd, a portfolio manager at Greenwood Capital Associates, referring to the entire U.S. credit industry.

Credit card losses usually follow the trend of unemployment, which rose in May to a 26-year high of 9.4 percent and is expected to peak over 10 percent by the end of 2009.

If credit card losses across the industry surpass 10 percent this year, as analysts and bank executives expect, loan losses could top $70 billion.

“Until lenders show stabilization then trend-bucking improvement over a several-month period, we remain bearish on credit card lenders — and the U.S. consumer,” said John Williams, an analyst at Macquarie Research.

“We continue to believe that macro challenges and credit quality concerns will pressure U.S. card issuers over the next 12 months,” he added.

However, some smaller credit card companies such as Capital One Financial Corp and Discover Financial Services reported defaults rates grew less than expected.

Capital One said its credit card default rate rose to 9.41 percent from 8.56 percent, while Discover said its charge-off rate increased to 8.91 percent from 8.26 percent.

JPMorgan Chase & Co — the second-largest U.S. bank and the biggest issuer of Visa-branded credit cards — said its default rate rose to 8.36 percent in May from 8.07 percent in April, but it still holds the best performance among the largest credit card companies.

The stock market’s main fear gauge moved past a key level on Monday, indicating possible troubles ahead for the market.

And one options player with deep pockets is making a big bet that volatility will increase sharply, making this a tumultuous summer.

The Chicago Board Options Exchange Volatility Index, or VIX, moved past 30, a mark it hasn’t closed above since June 4. A VIX (Chicago: VIX) reading of better than 30 generally indicates high volatility that usually accompanies stock market drops.

Following suit, stocks lost more than 1 percent.

The joint moves in the VIX and stocks come just a few days after a big investor bet on the VIX caused tremors in the options market.

One trader on Thursday bought 20,000 July VIX calls at the 45 strike and sold 55 strike calls for an overall premium of 42.5 cents in a trade that cost about $850,000 to execute. The net impact is that the VIX would have to beat the 45.42 level by the July expiration for the investor to make money. The VIX hasn’t been past 40 since April 21.

“The last few weeks we’ve come under 30 and we’ve been under 30 as investors became more sanguine in their approach,” said Andrew Wilkinson, senior strategist at Interactive Brokers. “This was a standout trade that went against the grain.”

While there would be no direct correlation between such a huge trade and the actual VIX movement, the bet could be indicative of a shifting mood.

VIX options premiums have been generally drifting higher, with trading last week on July calls for a 35 in the index exceeded open interest. Implied volatility on the index also has risen sharply, also suggesting higher moves in the index and tougher sledding for stocks.

The inverse relationship between the stock market and the VIX was in full effect Monday as stocks fell on a stronger dollar and news that

New York manufacturing activity had slowed more than expected in June.

At 69.7, the Index is now down two points from a week ago and down six points from one month ago.

Nationally, 26% of adults believe the economy is getting better, while 52% disagree and say it is getting worse. Democrats are much more optimistic than Republicans. Thirty-five percent (35%) of Democrats think the economy is getting better, while only 16% of Republicans feel the same way. Meanwhile, 45% of Democrats say the economy is getting worse and 62% of Republicans say the same thing. Nationally, only 9% of adults rate the economy as good or excellent, while 57% disagree and say the economy is poor.

There’s $3.6 trillion, the amount of leveraged loans made since 2000. But right now, the leveraged loan market is fixated on one number: $430 billion, the amount in leveraged loans due to mature between 2012 and 2014. Despite the big numbers of the past, this might be simply too big.

To get a fix on how much work remains to be done, consider the substantial amount of short-term debt coming due at financial companies in the next year or two. As you absorb these figures, keep in mind that many of the entities that bought this debt when it was issued aren’t around now — they’ve either left the market or are gone, casualties of the crisis.

As a result, they’re not around to step up and buy the debt again. So issuers can’t roll it over. They’ll be forced to buy back the debt, at a time when they’re already wallowing in other forms of troublesome debt and short on liquidity.

Barclays Capital has analyzed financial company debt among United States institutions coming due over the next decade. During the rest of the year, for example, roughly $172 billion in debt will mature; in 2010, an additional $245 billion comes due. That amounts to about $25 billion a month in debt rolling into a market with a shortage of buyers willing to invest in it…

Of the $172 billion coming due by year-end, Barclays says, $123 billion was floating-rate debt. And of the $245 billion maturing next year, some $141 billion pays a variable rate.

This much is evident: it is too soon to celebrate the end of the banking crisis. Less debt is the answer, but shrinking balance sheets is hard.

Dozens of US cities may have entire neighbourhoods bulldozed as part of drastic “shrink to survive” proposals being considered by the Obama administration to tackle economic decline. The government is looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature. Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

Shocker: Number of Americans who say U.S. should support Israel drops from 71% to 44% in one year.

U.S. and Mexican officials took another step Monday in their ongoing effort to crack down on border violence, signing an agreement to boost security by inspecting southbound vehicles for weapons and drug money.

At the same time, the agreement, signed by U.S. and Mexican officials, will make it easier for tourists and workers to pass through customs when returning to either country.

“People traveling south across the border will see more license-plate scanners and more canine teams in place,” Homeland Security Secretary Janet Napolitano said at a news conference.

But she said U.S. officials don’t want to create traffic jams and will make the process as efficient as possible.

Signed by Napolitano and Agustin Carstens, Mexico’s minister of finance and public credit, the agreement declares the two nations’ intent to build on efforts to work together to combat drug smuggling and border violence. It also calls for the U.S. to help Mexico train more customs officers. Mexico is poised to add about 1,500 officers.

To encourage cross-border tourism, Mexico and the U.S. are working on a customs form that would be recognized by both nations so tourists and businesses engaged in trade don’t have to fill out two separate forms.

This is back up the border big time. Guns are not going from the US to Mexico; they come over the border from the South. This is just another effort to harass Americans. It will cut border traffic into Mexico by at least 30%. Another stupid idea. The problem is going the other way and they all know it.

It’s hard to know whether President Obama’s health care “reform” is naive, hypocritical or simply dishonest. Probably all three. The president keeps saying it’s imperative to control runaway health spending. He’s right. The trouble is that what’s being promoted as health care “reform” almost certainly won’t suppress spending and, quite probably, will do the opposite.

Health spending, which was 5 percent of the economy (gross domestic product, GDP) in 1960 and is reckoned at almost 18 percent today, would grow to 34 percent of GDP by 2040 — a third of the economy.

Medicare and Medicaid, the government insurance programs for the elderly and poor, would increase from 6 percent of GDP now to 15 percent in 2040 — roughly equal to three-quarters of present federal spending.

Employer-paid insurance premiums for family coverage, which grew 85 percent in inflation-adjusted terms from 1996 to $11,941 in 2006, would increase to $25,200 by 2025 and $45,000 in 2040 (all figures in “constant 2008 dollars”). The huge costs would force employers to reduce take-home pay.

The question of whether and how to limit the Fed’s power turns in part on what may replace it. Republicans want to limit the government’s ability to bail out any institution, but Democrats are pushing for the creation of a regulatory council designed to oversee systemically important institutions.

Some said the creation of a systemic risk council and giving the government power to seize and resolve systemically important institutions would lessen the need for the Fed to have emergency powers.

Housing starts jumped 17.2% in May from April to a 532,000 annual rate, the Commerce Department said Tuesday, more than twice the gain economists in a Dow Jones Newswires survey had expected.

Building permits, a leading indicator, rose as well. And single-family starts – which economists tend to focus on for a less-volatile reading on housing trends – rose 7.5% from April, their third-straight rise.

The good news on housing was offset by another grim report on the state of U.S. manufacturing. Industrial production tumbled 1.1% in May from April, the Federal Reserve said. Capacity utilization fell to 68.3%, well below its long-run average, an indication that there’s still a great deal of disinflationary slack in the economy.

The producer price index for finished goods advanced 0.2% in May from April, much less than the 0.6% rise that economists had expected. The PPI was down 5% from one year ago, the biggest decline since August 1949.

National chain store sales fell 4.5% in the first two weeks of June versus the previous month, according to Redbook Research’s latest indicator of national retail sales released Tuesday.

The fall in the index was compared to a targeted 4.1% drop.

The Johnson Redbook Index also showed seasonally adjusted sales in the period were down 4.6% compared with May 2008, versus a targeted 4.2% fall.

Redbook said that on an unadjusted basis, sales in the week ended Saturday were down 4.8% from the same week in 2008 after a 4.4% fall the prior week.

The International Council of Shopping Centers and Goldman Sachs Retail Chain Store Sales Index fell 0.6% in the week ended Saturday from its level a week before on a seasonally adjusted, comparable-store basis.

On a year-on-year basis, retailers saw sales fall 1.5% in the latest week.

The Obama administration has turned back pleas for emergency aid from one of the biggest remaining threats to the economy — the state of California.

Top state officials have gone hat in hand to the administration, armed with dire warnings of a fast-approaching “fiscal meltdown” caused by a budget shortfall. Concern has grown inside the White House in recent weeks as California’s fiscal condition has worsened, leading to high-level administration meetings. But federal officials are worried that a bailout of California would set off a cascade of demands from other states.

With an economy larger than Canada’s or Brazil’s, the state is too big to fail, California officials urge.

“This matters for the U.S., not just for California,” said U.S. Rep. Zoe Lofgren, who chairs the state’s Democratic congressional delegation. “I can’t speak for the president, but when you’ve got the 8th biggest economy in the world sitting as one of your 50 states, it’s hard to see how the country recovers if that state does not.”

The administration is worried that California will enact massive cuts to close its deficit, estimated at $24 billion for the fiscal year that begins July 1, aggravating the state’s recession and further dragging down the national economy.

The House is considering imposing a $37 billion tax on drugmakers by denying deductions for advertising of prescription drugs, Ways and Means Committee Chairman Charles Rangel said.

“One thing that’s not off the table is you can pick up $37 billion knocking out the deduction for advertising” for prescription drugs, said Rangel, a New York Democrat. Lawmakers are seeking ways to help pay for a health-care overhaul.

Rangel identified the proposal as one of a series of revenue-raising measures House lawmakers may include in broader health-care overhaul legislation later this month. Members of his tax-writing committee are meeting daily this week to discuss ways to pay for the legislation.

Rangel said he and other lawmakers believe it is “wrong” to let drug companies deduct their advertising costs for prescription drugs.

“The whole thing is messy, but you can raise $37 billion,” Rangel said. “Which means you’re taxing somebody $37 billion, and they don’t like that.”

Yesterday, the Congressional Budget Office said a separate health-care plan proposed by Senator Edward Kennedy of Massachusetts would cost about $1 trillion over the next decade and would provide coverage to about 16 million more people. The estimate was based on a preliminary analysis that focused only on major provisions, the CBO said.

Rangel said last week a health-care overhaul being drafted by House Democrats would include $600 billion in tax increases and $400 billion in cuts to Medicare and Medicaid.

News Corp.’s MySpace social-networking unit fired almost 30 percent of its staff to save money in response to falling ad sales and gains by rival Facebook Inc.

The cuts lower US staffing at Los Angeles-based MySpace to 1,000, according to a statement yesterday. The announcement suggests the company eliminated about 400 jobs. Dani Dudeck, a MySpace spokeswoman, declined to comment.

Mortgage applications in the U.S. fell last week to the lowest level since November as a jump in borrowing costs discouraged refinancing and threatened to deepen the housing slump.

The Mortgage Bankers Association’s index of applications to purchase a home or refinance a loan dropped 16 percent to 514.4 in the week ended June 12, from 611 the prior week. The group’s refinancing gauge declined 23 percent, while the purchase index fell 3.5 percent.

Homeowners and prospective buyers are also being thwarted by signs that the housing market isn’t improving. U.S. home prices may fall another 14 percent before reaching a bottom as an increase in unemployment offsets lower prices, Deutsche Bank AG said in a report this week.

The biggest price declines are likely to occur in the New York and Orange County, California, metropolitan areas, Deutsche Bank said.

Rates are rising as President Barack Obama and Federal Reserve Chairman Ben S. Bernanke are trying to spur a housing recovery. Obama has pledged to spend $275 billion to help keep as many as 9 million Americans in their homes and stem the rise of foreclosures. His measures also include a tax break of as much as $8,000 for first-time homebuyers that wouldn’t require repayment.

The Fed said in March it would purchase as much as $1.25 trillion in securities from mortgage-buyers Fannie Mae and Freddie Mac to help drive borrowing costs lower.

The mortgage bankers’ refinancing gauge decreased to 1,998.1 from 2,605.7 the previous week, today’s report showed. The purchase index dropped for the first time in a month, falling to 261.2 last week from 270.7.

The share of applicants seeking to refinance loans fell to 54.1 percent of total applications last week from 59.4 percent.

The average rate on a 30-year fixed-rate loan fell to 5.50 percent, the first decrease in a month, from 5.57 percent the prior week, when it reached its highest level since November.

Still, at the current rate, monthly borrowing costs for each $100,000 of a loan would be $567.79, or about $72 less than the same week a year earlier, when the rate was 6.62 percent.

The average rate on a 15-year fixed mortgage fell to 4.99 percent from 5.10 percent the prior week. The rate on a one-year adjustable mortgage decreased to 6.54 percent from 6.75 percent last week.

Hartford Financial Services Group Inc. and Lincoln National Corp. debt investors are exiting the “fear trade” that turned credit-default swaps upside down before the life insurers secured U.S. bailouts.

Concern has abated that Lincoln, Hartford, MetLife Inc. and Prudential Financial Inc. may suddenly fail to make debt payments, according to prices for swaps used to insure against company defaults. As recently as April, a year of protection cost as much as 10 percentage points more than five-year contracts, a condition known as an inverted curve that signals uncertainty about a company’s ability to survive.

Now, the costs are about equal, after the panic subsided as stocks and credit markets recovered and the insurers replenished funds that had been eroded by the recession. Treasury’s offer last month to inject capital into six insurers, which was accepted by Lincoln and Hartford, also bolstered confidence in the industry.

“We’ve seen that fear trade unwind,” said David Havens, a managing director at Hexagon Securities LLC in New York. “To a large extent, the insolvency or severe downgrade worries over the life insurance sector have been taken off the table. It was probably overdone to begin with.”

Hedges against default jumped in October as investors — concerned about the failure of Lehman Brothers Holdings Inc. and near-collapse of insurer American International Group Inc. — began to withhold debt and equity financing. The housing slump lowered the value of holdings backing policies, while the stock market slide increased the cost of guaranteeing minimum returns on clients’ equity-linked retirement accounts.

Last month’s unadjusted yoy figures show permits fell 50% and housing starts 54%.

Those of you who question whether hyperinflation is on the way, we say we are in a subtle, quiet time when monetized inflation is being sown. When it hits it will be too late to protect yourself and gold and silver will be long gone to higher prices.

The powers behind government will force the government to choose between inflation and default. The choice, of course, is inflation and then hyperinflation. That will be followed by a deflationary depression. Wait until the 10-year note rates jump over 4% and head for 5%. The Fed won’t be able to stop them, the dollar will fall and inflation will rage.

The market Demand Index for trucks fell to 3.52 from 3.87 the previous week, as the trucking market again weakened. Load availability dropped by 4%. New England was the weakest. Load searching rose 10% and truck availability rose 8%. Truck searching fell 9%. Fuel prices rose from $2.35 to $2.50 a gallon. Inbound rates fell 1% to $1.47 from $1.49 and outbound rates fell 1% to $1.43 from $1.45.

In an industry that calls customers “Dead Beats” – because they pay off their bill every month in full, there is going to be difficult times ahead.

Credit Card issuers have been confronted in unprecedented numbers by troubled customers and have been forced to settle delinquent accounts for substantially less then owed. The Fed reports that 6.5% of credit card debt is at least 30 days late.

After six months of being delinquent the value of the debt on the bank’s books has to be reduced to zero. As a result of unemployment lenders can expect to collect 5 cents on the dollar.

Increased housing starts are ridiculous. They only add to the existing overwhelming inventory.

Capacity utilization fell to a record low of 68.3%. Only 10% of our industry is left due to free trade, globalization and outsourcing.

It is absolutely insane that the BLS would want us to believe that prices fell 1.6% in May, as food commodities soared. The lies get more unbelievable.

The Obama administration last night detailed a series of proposals that would involve the government much more deeply in the private markets, from helping to steer consumers into affordable mortgage loans to imposing new limits on the largest financial companies, in a sweeping effort to prevent the kinds of risk- taking that sparked the economic crisis.

It would vastly increase the powers of the Federal Reserve in an effort to create stronger and more consistent oversight of the largest companies and most important markets.

It also would create a new agency to protect consumers of mortgages, credit cards and other financial products.

Treasury’s latest TARP transaction report shows Countrywide (now nestled inside

Bank of America) just got another $3.3 billion in gov’t incentive payments to modify distressed mortgages — many of which Countrywide originated while it was on its own. Countrywide is among nine mortgage servicers which got additional TARP payments. The other “adjustment” payments were small fractions of Countrywide’s.

For the first time in 11 months China’s holdings of US Treasury bonds fell – to $763.5 billion in April, US government data showed. The figure, down from March’s $767.9 billion, was the lowest since June 2008.

They do not include US Treasury bond holding in Hong Kong Special Administrative Region, which climbed to $80.9 billion in April from $78.9 billion the previous month.

The decline in the China holding “seems to stem from net selling of Treasury bills,” said Chirag Mirani of Barclays Capital Research. On the whole, foreigners decreased holdings of Treasury bills by $44.5 billion in April, the data showed.

Two Japanese men are detained in Italy after allegedly attempting to take $134 billion worth of U.S. bonds over the border into Switzerland. Details are maddeningly sketchy, so naturally the global rumor mill is kicking into high.

Are these would-be smugglers agents of Kim Jong Il stashing North Korea’s cash in a Swiss vault? Bagmen for Nigerian Internet scammers? Was the money meant for terrorists looking to buy nuclear warheads? Is Japan dumping its dollars secretly? Are the bonds real or counterfeit?

The implications of the securities being legitimate would be bigger than investors may realize. At a minimum, it would suggest that the U.S. risks losing control over its monetary supply on a massive scale.

The trillions of dollars of debt the U.S. will issue in the next couple of years needs buyers. Attracting them will require making sure that existing ones aren’t losing faith in the U.S.’s ability to control the dollar.

The dollar is, for better or worse, the core of our world economy and it’s best to keep it stable. News that’s more fitting for international spy novels than the financial pages won’t help that effort. It is incumbent upon the U.S. Treasury to get to the bottom of this tale and keep markets informed.

On his blog, the Market Ticker, Karl Denninger wonders if the Treasury “has been surreptitiously issuing bonds to, say, Japan, as a means of financing deficits that someone didn’t want reported over the last, oh, say 10 or 20 years.”

1. 40% of all workers in L. A. County (L. A. County has 10.2 million people) are working for cash and not paying taxes. This is because they are predominantly illegal immigrants working without a green card.

2. 95% of warrants for murder in Los Angeles are for illegal aliens.

3. 75% of people on the most wanted list in Los Angeles are illegal aliens.

4. Over 2/3 of all births in Los Angeles County are to illegal alien Mexicans on Medi-Cal, whose births were paid for by taxpayers.

5. Nearly 35% of all inmates in California detention centers are Mexican nationals here illegally

6. Over 300,000 illegal aliens in Los Angeles County are living in garages.

7. The FBI reports half of all gang members in Los Angeles are most likely illegal aliens from south of the border.

8. Nearly 60% of all occupants of HUD properties are illegal.

9. 21 radio stations in L. A. are Spanish speaking.

10. In L. A. County 5.1 million people speak English, 3.9 million speak Spanish.

(There are 10.2 million people in L. A. County )

(All 10 of the above are from the Los Angeles Times)

Less than 2% of illegal aliens are picking our crops, but 29% are on welfare. Nearly 90% of the United States ‘ annual population growth (and nearly 100% of California , Florida , and New York ) results from legal and illegal immigrants and offspring. 29% of inmates in federal prisons are illegal aliens.

We are a bunch of fools for letting this continue!

For more details read www.Theinternationalforecaster.com