Spiraling Gasoline Prices are Impoverishing Americans

Together with draconian austerity measures, home foreclosures, layoffs and the phasing out of social programs, the dramatic hike in gasoline prices constitutes yet another economic mechanism which contributes to the impoverishment of millions of people across the land.

Gasoline prices have skyrocketed overnight in California, with prices at the pump exceeding $5 a gallon.

Across America, the increase in gasoline prices has contributed to compressing purchasing power. It has a devastating impact on suburban families. It compresses the levels of household consumption. It contributes to lowering the standard of living.

The hike in gasoline prices constitutes a mechanism whereby money income is routinely appropriated and transferred from households and consumers into the coffers of oil companies and financial institutions. The price hikes result in windfall corporate profits, while contributing to expanding levels of household debt.

The hikes in fuel and gasoline prices across the US (and Worldwide) also contribute to precipitating small and medium sized businesses into bankruptcy.

Crude Oil and Commodity Prices

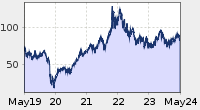

This rise in gas prices is the result of a deliberate manipulation in the oil and energy markets. The speculative onslaught has pushed the price of crude oil to more than 100 dollars a barrel.

This movement in the price of crude oil on the New York mercantile exchange bears no relationship to the costs of producing oil.

The spiraling price of crude oil is not the result of a shortage of oil. It is estimated that the cost of a barrel of oil in the Middle East does not exceed 15 dollars. The costs of a barrel of oil extracted from the tar sands of Alberta, Canada, is of the order of $30 a barrel.

With low production costs and abysmally high prices of crude oil, the oil market is a source of significant corporate enrichment.

The price of crude oil is hovering around $100 a barrel. This market price is largely the result of speculative trade in index funds, futures and options on major commodity markets including the London ICE, the New York and Chicago mercantile exchanges. It is also the consequence of the total absence of government regulation pertaining to the energy market as well as the retail price of gasoline.

Brent Crude oil prices are now in excess of 100 dollars a barrel. (see below)

|

|

||||||||||||||||||||||||||||||||||||

According to the Business Insider, the price of West Texas Intermediate crude oil (see above), which “has been used as the principal price benchmark” at which producers sell to refiners, is no longer relevant. WTI hinges upon oil futures contracts on the New York mercantile exchange. Instead, Brent prices — which is sourced to prices received by refiners in Europe’s North Sea — has become the new standard.” (Business Insider)

Impacts on Local Economy

Fuel enters into the production of virtually all areas of manufacturing, agriculture and the services economy. The hikes in fuel and gasoline prices across the US (and Worldwide) contribute to precipitating small and medium sized businesses into bankruptcy.

The increased cost of gasoline at the retail level is leading to the demise of local level economies, increased industrial concentration and a massive centralization of economic power in the hands of a small number of global corporations. In turn, the hikes in gasoline prices backlash on the urban transit system, schools and hospitals, the trucking industry, intercontinental shipping, airline transportation, tourism, recreation and most public services.