Recession Engineered by the Creditors: Seven Years of Demanding the Impossible in Greece

In a recent presentation of his book, Laid Low, which examines the International Monetary Fund’s role in the eurozone crisis, author and journalist Paul Blustein disclosed a memo dated May 4, 2010, from the IMF’s then head of research Olivier Blanchard, to Poul Thomsen, who headed the Greek mission at the time.

In his missive, Blanchard warned that the cumulative fiscal adjustment of 16 percentage points being demanded of Greece in such a short period of time and with such a high level of frontloading had never been achieved before.

.@PaulBlustein: in 2010,@ojblanchard1 warned austerity cld go awry,even if done to plan. DSK broached debt restructuring: Trichet said "no!" pic.twitter.com/1cFFPsKszf

— Trineesh Biswas (@TrineeshB) January 31, 2017

According to Blanchard, not only was the task unprecedented, but Greece was being asked to achieve the impossible in unfavourable external circumstances, when everyone was barely recovering from the 2008 global financial crisis and without any other policy levers (low interest rates or exchange rate adjustment).

Blanchard foresaw what became a reality only about a year later: Even with “perfect policy implementation” the programme will be thrown off track rather quickly and the recession will be deeper and longer than expected, he warned.

Blanchard’s scepticism and warnings were ignored. Instead, political limitations took hold of the decision-making process and domestic-focussed calculations pushed Greece into trying to achieve the impossible.

This week, the former IMF chief economist admitted on Twitter that although he was not the one that leaked the memo he was not unhappy that the truth has been revealed because “it is seven years and still there is no clear/realistic plan” for Greece.

I did not leak, but am not too unhappy that it did leak :). 7 years already, and still no clear/realistic plan. https://t.co/8mCzO3TYvL

— Olivier Blanchard (@ojblanchard1) February 14, 2017

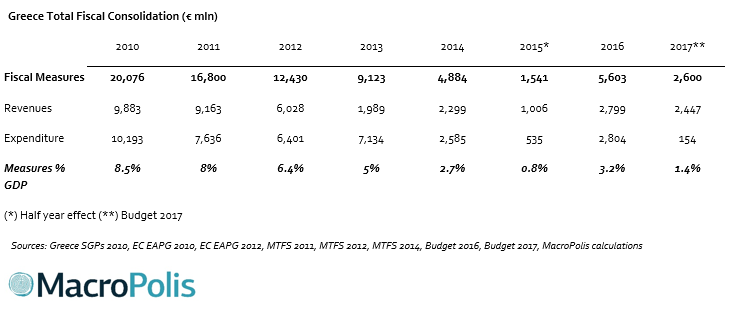

Athens is currently under pressure to adopt another 2 percent of GDP in new fiscal measures, which relate to the tax-free threshold and pension spending. Since 2010, Greece has adopted revenue-raising measures and spending cuts that are equivalent to more than a third of its economy and more than double what Blanchard had described as unprecedented almost seven years ago.

The Greek economy has been burdened with 35.6 billion euros in all sorts of taxes on income, consumption, duties, stamps, corporate taxation and increases in social security contributions. When totting all this up, it is remarkable that the economy still manages to function.

During the same period, the state has also found savings of 37.4 billion euros from cutting salaries, pensions, benefits and operational expenses. Discretionary spending is now so lean that even the IMF argues that in certain areas it needs to increase if Greece is to meet the minimum requirements in the provision of public services.

When this misery started, Greece had to correct a primary deficit of 24 billion euros. But the painful fiscal adjustment Greeks have had to endure had turned out to be three times as much.

The IMF’s Thomsen, now the director of its European Department, recently argued that Greece doesn’t need any more austerity but brave policy implementation. Somehow, though, the discussion has ended up being about finding another 3.5 billion euros in taxes and cuts to pension spending. Bravery is nowhere to be seen.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

Featured image is from Panayotis Tzamaros/Fosphotos