Russia’s Economy Recovers While Dozens of US Banks Face Collapse

All Global Research articles can be read in 51 languages by activating the Translate This Article button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

Although Western media were boasting about Sberbank’s 78% plunge in profit in 2022 due to US-led sanctions, with CEO German Gref acknowledging a “most difficult year”, it appears that the US economic system is the one actually on the brink as four banks have already collapsed, with dozens more expected to follow.

CNN described the Russian bank’s drop in profit as a “collapse” in its headline, but then had to admit in the article that “Sberbank’s resilience in the face of sanctions helped Russia’s banking sector recover from a loss-making first half in 2022.”

This is in line with Gref’s belief that this year’s profits should be close to the record 1.25 trillion rubles ($16.5 billion) earned in the “pre-crisis year.” “Our business model passed another strength test,” he added.

It is recalled that Russian Presidential spokesperson Dmitry Peskov said on March 14 that there is “practically” no risk of Russia facing a fallout from the SVB collapse, adding that: “Our banking system has certain connections with some segments of the international financial system, but it is mostly under illegal restrictions.”

Despite alarmist headlines from US media and experts, Peskov was proven correct as no Russian bank has collapsed despite Western sanctions. Meanwhile, the full repercussions of SVB’s downfall are yet to be felt, with former Lehman Brothers executive Lawrence McDonald believing that up to another 50 American banks could collapse if structural problems are not fixed.

“So Lehman failed and then it forced this too-big-to-fail system, and then, now this interest rate shock to the regional banks is moving hundreds of billions of dollars out of regional banks into the big banks… So you could have another 50 bank failures… unless they fix the structural problem,” said McDonald on March 22.

“There’s going to be further damage. They have to cut rates and then they have to have a deposit guarantee, a larger one, that’s what they’re going to come up with… That’s a bailout. That’s basically the federal government taking on bank deposit risk,” he added.

By being cut-off from the Western banking system, Russia is effectively protected from the series of bank collapses that are expected to follow. Russia faced a credit crunch due to the fallout from the US subprime mortgage crisis in 2008, which ultimately led to the Global Financial Crisis, a demonstration of how it too was exposed to weaknesses in the US economy.

Although Russia was cut-off from SWIFT only two-days after the special military operation began, in addition to many other Western restrictions, including a $60 per barrel oil price cap, President Vladimir Putin boasted about the resilience of the Russian economy.

The IMF reported that Russia’s economy contracted by 2.2% in 2022 and will start growing again in 2023, expanding by 0.3%, and then 2.1% in 2024. This is impressive when considering that fellow European countries, which are not sanctioned, will be struggling immensely. The UK is expected to contract by 0.6% and Germany will have a growth of only 0.1%.

At the same time, the OECD forecasts that US economic growth would slow from 1.5% this year to 0.9% next year. This is due to higher interest rates slowing down demand. Bloomberg on March 21, citing sources, reported that the US Treasury Department is studying the possibility of guaranteeing all bank deposits in the event of a recession in the banking sector.

The current banking crises has forced economists, including from the esteemed JPMorgan Chase, to make new recession forecasts after any hopes of recovery were snuffed away.

“The Fed is facing a difficult task on Wednesday, but it is likely already past the point of no return,” JPMorgan strategists wrote in a note to clients on March 22. “A soft landing now looks unlikely, with the airplane in a tailspin (lack of market confidence) and engines about to turn off (bank lending).”

Goldman Sachs also echoed JPMorgan and said in mid-March that the banking crisis could deliver a severe blow to economic growth.

For his part, former Treasury Secretary Larry Summers has warned multiple times, including as recently as March 9 but even from before the banking crisis, that the economy could be heading for a “Wile E. Coyote moment,” referencing a Looney Tunes character who was always blissfully unaware that he was about to hit the ground after running off the edge of a cliff.

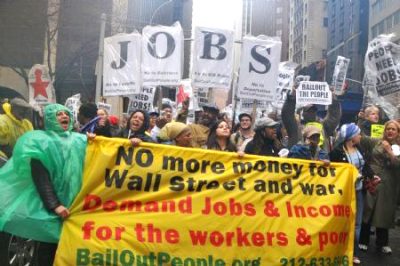

However, the expected collapse of many banks in the US and the impending economic crisis has not deterred the determination of the Biden administration to fanatically arm, fund and train the Ukrainian military and regime. With millions of Americans on the verge of dropping out of the Middle Class, Washington continues to send tens of billions of dollars to Ukraine, and all the while Western sanctions are now beginning to have a minimum effect on the Russian economy, thus effectively rendering them nearly useless.

*

Note to readers: Please click the share buttons above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Ahmed Adel is a Cairo-based geopolitics and political economy researcher.

Featured image is from InfoBrics