RISING UNEMPLOYMENT: US jobs report points to renewed global crisis

The disastrous jobs report released Friday by the US Labor Department is further evidence of a deepening global crisis that threatens to unravel into a full-blown financial collapse.

The American economy added only 69,000 jobs in May, far below expectations about half the amount needed to keep up with population growth. The official unemployment rate rose from 8.1 to 8.2 percent.

The report revised downwards the number of jobs created in March and April, bringing the latter down from 115,000 to 77,000. While, on average, the US economy created 226,000 jobs per month in the first quarter, it averaged just 73,000 in April and May.

It was the worst payroll figure since May of last year, and the first time the unemployment rate increased since June. The report follows similarly gloomy economic data from both Europe and Asia, and comes amid an intensification of the euro crisis, now centered on the solvency of the Spanish banking system.

On Friday, Eurostat, the European Union’s statistics office, said that unemployment in the Eurozone reached 11 percent for the first time in records going back to 1995. At the same time, China’s purchasing managers’ index fell to 50.4 in May, down dramatically from 53.3 in April.

Adding to the gloom, Brazil announced that its economy barely expanded in the first quarter, growing only 0.2 percent, significantly less than expected.

The slew of bad economic news sent markets down in Europe and the US by between 2 and 3 percent. The US Dow Jones Industrial Average fell by 2.2 percent, wiping out all the gains the index had made since the start of the year.

There was also a flight of capital to “safe” assets, pushing down yields on US and German government bonds. The price of two-year German bonds once again fell below zero, meaning that investors were paying the German government to take their money.

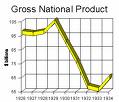

The details of the US jobs figures expose a society in deep crisis. The number of long-term unemployed people in the US reached 5.4 million, the highest since February and 300,000 more than in April. The average duration of unemployment grew to 39.7 weeks. Long-term unemployment has declined only slightly over the past year, and remains at levels far in excess of anything seen since the 1930s.

The continued growth in the number of long-term unemployed comes as states prepare to cut another 70,000 people off of extended unemployment benefits this month. This would bring the total number of people who have lost extended benefits due to legislation signed by President Barack Obama earlier this year to nearly half a million.

The US healthcare sector added 33,000 jobs in May, transportation added 36,000, and manufacturing added 12,000. But these gains were partially offset by the fall in the construction sector, which shed 28,000 positions.

Government jobs likewise fell by 13,000, including 2,900 in the US Postal Service, which is planning to cut tens of thousands of additional jobs. A total of 7,000 jobs were eliminated from state and local education, coming on top of hundreds of thousands already eliminated over the past several years.

The jobs report followed other gloomy US economic figures. The Commerce Department said Thursday that the US economy grew at a rate of 1.9 percent in the first quarter, down from its earlier estimate of 2.2 percent.

On Wednesday, the Confidence Board said that consumer confidence fell in May to its lowest level in four months. The number of Americans who expect worse employment prospects in the next six months hit its highest level since November.

The sharp deterioration in the US was spurred on by the intensification of the Euro crisis. Last week the Spanish government announced plans to inject a further €19 billion into Bankia, the country’s fourth largest bank.

On Thursday, Spain’s central bank published data showing that about €97 billion euros had been pulled out of the country in the first three months of the year, amounting to about a tenth of the country’s total economic output.

Spain’s economy is forecast by the OECD to contract by 1.6 percent this year and Italy by 1.7 percent. The borrowing costs of both countries—Spain at 6.6 percent and Italy 6 percent—are approaching the levels at which Greece, Ireland and Portugal sought bailouts.

Obama responded to the day’s disastrous economic news by calling on Congress to pass his so-called economic “to-do list,” a collection of corporate handouts, deregulation and other measures that will do nothing to address the jobs crisis. (see, “Obama’s jobs program: A laundry list of corporate handouts”)

The only portion of the program that is not a corporate handout or tax cut is predictably trivial. Obama is calling for 20,000 military veterans to work on an environmental conservation program over five years and provide an “online training program” in “the fundamentals of small business ownership” for 10,000 veterans.

In fact, for the American ruling class, represented by both big business parties, mass unemployment is part of a strategy of boosting profits by permanently reducing wages and benefits for workers.

Four years since the start of the economic downturn, it is becoming increasingly clear that a new period of intensified crisis is gripping the global economy, which the ruling class can only answer with war, repression, and an unceasing attack on the social position of working people.