There was a $51 billion aggregate pledge at the FOCAC 2024 summit in Beijing for the period 2025-27, but of that, nearly 60% will be in the form of loans. FOCAC’s essential objective is to maintain the position that China has a positive role, no matter its firms’ fingerprints when it comes to Africa’s ongoing deindustrialisation, debt crises, resource looting, despotism and political instability (partly based on popular unrest such as has risen in Kenya and Nigeria in recent months). There is no ‘debt trap’ set in Beijing for Africa, of course, since Chinese state banks as well as commercial banks have a credit market share of less than 20% of total Sub-Saharan African loans and a far greater share than any other country of investments and trade. And in the G20’s (failed) Debt Service Suspension Initiative run by the Bretton Woods Institutions, Chinese creditors reportedly accounted for 30% of debt claims but contributed 63% of debt service suspensions.

Part of the problem associated with these capital flows is that the renminbi is essentially a hard currency – in terms of its value – even if Beijing retains capital controls, leaving it relatively non-convertible. The renminbi’s rise against the dollar from the early 2000s – when it was nominally pegged at 8.27/$1 – to 2014 when it hit 6/$1, ended with the waning of China’s locally-directed industrialisation and infrastructure boom, so it retreated to well over 7/$. The dollar was weak in the period 2020-21 due to Federal Reserve Quantitative Easing policies flooding the world with liquidity. But with the Fed raising interest rates starting in early 2022, the dollar’s value strengthened. And in spite of persistent trade surpluses with nearly the entire world, China’s authorities – while allowing some zig-zagging – generally promoted a weaker renminbi, to the point it exceeded 7 to $1 for most of 2023-24. That in turn fueled accusations of currency manipulation (undervaluation) and in turn the new tariffs on Chinese exports discussed below.

.

.

All of these trends, in turn, are confirmation that instead of a broad de-dollarisation agenda and promotion of intra-BRICS+ economic connectivities, there are simply too many ways that the worst tendencies of international capitalism compel Chinese firms to become super-exploitative. There is enormous evidence of this process in Southern Africa, as discussed in the pages below, even if these problems were never flagged – much less contemplated in the depth deserved – in myriad FOCAC commentaries.

China Attacked by Imperialism

By way of background, a ‘New Cold War’ began in the mid-2010s (Pilger 2016), as Western economic and technological interests generate geopolitical and military pressure, largely as a backlash to Chinese industrialisation, exports, finance and direct investments now spanning the globe. Predictably, U.S. leaders have been driving the process since Barack Obama’s mid-2010s ‘pivot’ of Pentagon resources to East Asia, to Donald Trump’s extreme protectionism from 2017-21, and to Joe Biden’s continuation of both processes from 2021.

In 2024, Biden’s foreign minister Anthony Blinken railed against Beijing’s material support to Russia in the wake of Western sanctions imposed in 2022 due to the Ukraine invasion. By mid-2024, the Taiwan Strait and South China Sea – especially ocean territory claimed by the Philippines (following disputes with Vietnam a decade earlier) – witnessed worsening skirmishes and indeed the danger of full-fledged war, adding to East China Sea conflicts over Exclusive Economic Zone control with Japan and South Korea, and Himalayan Mountain border disputes with India and Bhutan, and the China-Pakistan Economic Corridor through contested Kashmir.

But well before the recent upsurge of tensions, dating to the early 1990s rise of China’s export economy and, from the early 2010s, Beijing’s Belt & Road Initiative (BRI), also have generated notable geopolitical, economic and even occasional military conflict. At the BRI’s most distant site, Southern Africa (a terrain often not even recognised in quasi-official BRI mapping which typically provides BRI economic arrows going as far south as Kenya), there are revealing problems with Chinese investment, finance and trade.

These relations are mainly of an underdevelopmental and super-exploitative character, and because in turn they stem from Chinese capitalist crisis conditions, interrogating the BRI as a ‘spatial fix’ for ‘overaccumulated capital’ – i.e. displacing excess capacity in key industries through international geographical expansion, a process identified as early as 1913 by Rosa Luxemburg’s Accumulation of Capital – helps explain some of the most extreme manifestations of global uneven development.

To be sure, Chinese economic involvement in the newly-decolonising Southern Africa economy was once, in the latter half of the 20th century after the 1949 Communist revolution, characterised mainly by South-South mutual aid, including support to liberation movements, especially Zimbabwe’s during the 1970s. These were reflected in Zhou Enlai’s ‘Eight Principles for Collaboration,’ developed during a 1963-64 trip to Egypt, Algeria, Morocco, Tunisia, Ghana, Mali, Guinea, Sudan, Ethiopia and Somalia. [1]

But in the first decades of the 21st century, as Chinese business leaders’ motivations shifted from Third World solidarity to cut-throat capitalism following bursts of domestic productive overcapacity, and as no Africans with the stature and principles of those first-generation liberation leaders emerged, the BRI offered new opportunities for business, against the public interest and environmental sustainability.

Hence by the 2020s it is fair to conclude that the impacts of Chinese investment, trade and finance on Southern African society and natural environment are mainly negative: severe local social disputes, extreme cases of corruption, so-called ‘Odious Debt’ (that ideally should not be repaid), deindustrialisation and infrastructural bias towards a neo-colonial mode of underdevelopment.

These adverse impacts can be seen in at least 18 controversial Chinese investment and financing sites across the region – most of which were initiated under the rule of Xi Jinping since 2012 (Map 1). Although tri-annual Forum on China-Africa Cooperation (FOCAC) meetings allowed positive public relations emerge from Beijing’s raised expectations, these were negated by many subsequent disappointments.

Map 1: Southern Africa’s 18 sites of major conflicts with Chinese investments and financing

.

.

Although lessons from the broader region are touched upon below, the focus in this review is on a half-dozen South African cases which, alongside trade-related deindustrialisation, exemplify adverse economic relations. What Archbishop Desmond Tutu termed the country’s ‘Rainbow Nation’ potential as a multi-racial democracy, starting in 1994, reflected the majority black population’s ‘non-racial’ approach to reconciliation, following five centuries of local and international-solidarity struggles against successive manifestations of white power and Western capital. [2] By the early 20th century, an extreme form of socio-economic-ecological super-exploitation accompanied South Africa’s insertion into global capitalism.

This was documented by Luxemburg as the “metabolism between capitalist economy and those pre-capitalist methods of production without which it cannot go on and which, in this light, it corrodes and assimilates” (Luxemburg 2003, 327). In this context, British imperialists had, during the early 1900s, imported semi-colonised Chinese workers to Johannesburg because local labour had not yet mastered the deep mining techniques required to extract gold (Yap and Man 1996, Accone 2004). For those who remained in Johannesburg, a vibrant China Town prospered in the central area, before it moved to an eastern suburb in the early 1990s.

From 1948-94, the prevailing racial capitalism – i.e. business drawing on both oppressed workers and mineral depletion to achieve the world’s highest super-profits – entailed the imposition of apartheid laws by white Afrikaner ruling elites in Pretoria allied with local and global white English-speaking capital, which appreciated the inexpensive labour and electricity along with generous mineral-depletion permission (Saul and Bond 2014). During the 1970s – as a United Nations ‘One-China’ policy came into effect and Henry Kissinger helped Richard Nixon reach out to Mao’s Beijing – the apartheid regime was firmly supported by Taiwan. That entailed not only stronger trade but a three-way collaboration between Pretoria, Taipei and Tel Aviv, sharing uranium and nuclear technologies (Miller 1981).

In addition, during the 1980s when economic decentralisation occurred in an increasingly siege-economy South Africa, hundreds of Taiwanese factory owners took up the apartheid regime’s invitation to super-exploit Bantustan labour (Hart 2002). Ambassador HK Yang expressed their supposed common interests during late apartheid: “South Africa and my country are joined in the fight against communism. We are in favour of free enterprise, democracy and freedom” (Pickle and Woods 1989). But it was only in 1998 – after Taiwan did finally democratise due to organised labour’s pressure – that Nelson Mandela cut official diplomatic relations with Taipei so as to recognise only Beijing as South Africa’s Chinese partner.

Until the dawn of freedom in 1994, there was little to implicate the People’s Republic of China in the looting of South African mineral resources and in unequal exchange through super-exploited labour. However, a disruptive, deindustrialising expansion of trade with China began during the 1990s, followed by an era of major investments and financial ties which began in earnest when in 2010 Chinese officials invited South African President Jacob Zuma (who served from 2009-18) to join the BRICS bloc: Brazil, Russia, India, China, South Africa. [3]

Political power began to be wielded, e.g. when on three occasions from 2009-14, the Chinese Embassy in Pretoria prevented the Dalai Lama from receiving a visitor’s visa. After the third visa rejection, Ambassador Lin Songtian bragged, “We invest a lot of money in South Africa and we can’t allow him to come and spoil the good relations” (Mazibuko 2015).

Also in the sphere of political influence, in 2015 Zuma was reportedly pressured by Chinese financiers – who owned 20% of the largest Johannesburg bank – to rapidly recall a dubious choice of finance minister (Desmond van Rooyen) and to replace him with a man more trusted by local business (Pravin Gordhan) according to Business Day publisher Peter Bruce (2016), who along with most South African business elites, was extremely pleased at the intervention.

From early 2018, when Cyril Ramaphosa defeated Zuma in a palace coup and hosted that year’s BRICS summit in Johannesburg, relations became more complex, in part because of other geopolitical tensions then rising. [4] But in spite of subsequent interstate disturbances, BRI political economy continued to unfold along a longer, deeper trajectory worth exploring in South Africa.

The first manifestations are in aggregate terms: the way trade – followed by investment and finance – replicated and amplified neo-colonial patterns. The next provides context, insofar as waves of overaccumulated capital washed into South Africa and the region. This is witnessed in the five brief case studies in South Africa. The conclusion assesses BRI as a spatial fix to overaccumulation, but one that has reached certain limits and barriers that appear profoundly debilitating in the mid-2020s.

BRI Reaches South Africa

Since the 1990s, Chinese-South African trade has been controversial, largely due to the latter’s import of manufactured goods and export of raw materials, and the resulting adverse impact on labour-intensive industries, plus the unequal ecological exchange associated with extractivism.

Trade increased by an average of 16% annually between 1994-2002, and by 2022 South African exports to China were valued at $23.4 billion, comprised in the majority of just three minerals: gold ($8.85 billion), diamonds ($3.36 billion), and platinum ($1.83 billion), nearly all of which were dug from South African soil by multinational mining corporations with headquarters in London (hence, in racial terms, with largely white ownership).

The $23.5 billion in South African imports from China included these top three categories: broadcasting equipment ($1.78 billion), computers ($1.04 billion) and electric batteries ($777M). Such a neo-colonial arrangement was devastating to South African manufacturing, which in 1990 reached nearly a quarter of GDP. By 2022 that ratio had fallen to less than half that.

Moving to investment and finance, the role of China has attracted enormous criticism and social resistance. To illustrate, the South African government attempted to mimic Chinese Special Economic Zones, with low corporate taxes (at 15%, just over half the national rate), state subsidies (especially in financing) and deregulatory production conditions (Toussaint et al 2019).

These are especially obvious, first, at a prospective industrial zone near the Zimbabwe border – Musina-Makhado – and second, at one of the deepest Indian Ocean ports (Coega), which hosts two Chinese auto factories. Those projects provide examples of the negative features of Chinese productive investment, as do, third and fourth, major transport and energy infrastructure deals beset by corruption and neo-colonial trade relations affecting the KwaZulu-Natal coastal cities of Durban and Richards Bay, and fifth, the Mpumalanga coal region where electricity generation has recently gone awry in spite of prolific foreign financing, including from the China Development Bank.

As noted, there were 13 other high-profile controversies in seven other Southern African Development Community countries (Map 1). In these sites, not only are large debts owed to Chinese lenders – carrying a relatively high price tag (in contrast to concessional debt given by Germany and France), a distinctly negative feature – so too does direct Chinese investment in the extractive industries explicitly underdevelop this vulnerable region, the most unequal in the world. The reason for this is obvious: a global capitalist division of labour in which value chains continue to extract non-renewable resources and other raw materials from Africa without adequate compensation, or what is termed unequal ecological exchange (Bond and Basu 2021).

For as Barry Sautman and Yan Hairong (2022) – who are ordinarily very strong supporters of China’s role in Africa – admitted in 2022: “China is partly linked to the post-colonial capitalism in Africa that derives from the gross inequality and power asymmetry that was first created by colonialism. China as a trade driven industrial power is integrated into a world system… [and] thus impacts Africa through its semi-neo-liberalism. It partly replicates the developed states’ policies in Africa, of disadvantageous terms of trade, exploitation of natural resources, oppressive labor regimes and support for malign rulers.”

That ‘part replication’ can even become an amplification under adverse conditions that prevail in so many Southern African settings (Bond 2021). To illustrate, imports of Chinese consumer and capital goods destroyed capacity within many South African labour-intensive manufacturing sectors (clothing, textiles, footwear, appliances, electronics, etc), and what was once a large steel industry collapsed due to Chinese competition.

The rise of ‘China Mall’ discounted wholesale and retail outlets pleased South African consumers, but the sector’s menial workers were subject to extreme forms of both systemic and flippant racism by Chinese shop owners that reflected the workers’ precarity as very low-paid migrant labourers, often from Zimbabwe and Malawi. As ethnographer Mingwei Huang (2024, x) found, Johannesburg’s China Mall retailers “act within the global structural parameters of white supremacy, anti-Blackness, capitalism, and colonialism that they have not made but nevertheless inherited and further perpetuate,” partly in cultural relations and in exceptionally low wage levels (below the full reproduction cost of labour, hence super-exploitative) (Bond 2021).

Trade, finance and extractive industries are all notorious for predatory features, but even in the two main Special Economic Zone sites in South Africa where Chinese manufacturing production occurs or is envisaged, there have been profound problems: Coega and Musina-Makhado. The limits to the BRI spatial fix can be blamed, since overaccumulation of industrial capital is so severe at Chinese East Coast production facilities that even in areas where South Africa should develop its own manufacturing capacities, such as solar and wind infrastructure, batteries and electric vehicles, these are being consistently undercut by Chinese exports’ low prices.

China’s Persistent Overaccumulation of Capital

The fact that during their April 2024 trips to Beijing, U.S. Treasury Secretary Janet Yellen and Secretary of State Tony Blinken arrogantly, threateningly pointed out durable overcapacity in China’s electric vehicle (EV), solar panel and battery industries, and that Ursula van der Leyen did the same when Xi Jinping visited Paris in May 2024, does not negate the reality: the problem of Chinese export-oriented factory overproduction is the contemporary ground zero of global capitalist crisis formation, in the manner Marx predicted.

However, it is important to acknowledge at the outset, that two features are contested in 2024 debates among political economists (several of whom are openly pro-Beijing, politically): excess capacity as a problem in and of itself, and implications for what can be termed China’s sub-imperial behavior within global value chains especially associated with mineral extraction (Bond 2024b).

For Michael Roberts (2024), Yellen was speaking “nonsense,” because the “particularly pathetic” claims about overcapacity ignore the fact that “China has no problem selling its exports to the rest of world’s consumers and manufacturers, who are eager to buy.” Roberts attacks “the Western mainstream view that China is stuck in an old model of investment-led export manufacturing…”

Moreover, Roberts (2024) continues, China “cannot be considered even sub-imperialist, let alone imperialist” – a position echoing the Tricontinental Institute’s (2024) assertion that in the context of a ‘hyper-imperialism’ centred at the U.S. Pentagon, “Objectively, there is no such thing as sub-imperialism or non-Western imperialist powers (such concepts are subjective deceptions that cloud over the factual realities).”

This narrative negates a venerable political economy tradition introduced by Brazilian dependency theorist Ruy Mauro Marini (1972), followed by David Harvey (2003), Sam Moyo and Paris Yeros (2011) and Samir Amin (2019). As the latter remarked about the post-apartheid economy in his posthumous autobiography, “nothing has changed. South Africa’s sub-imperialist role has been reinforced, still dominated as it is by the Anglo-American mining monopolies” (Amin 2019, 178). In mid-2023, the assimilated layer of the BRICS+ economies and regimes were of even more profound importance within the global corporate power structure, global value chains and Western-dominated multilateral institutions (Bond 2024b).

And in 2024, with eight out of ten BRICS+ governments giving net-positive material support to Israel during the genocide of Palestinians (excepting only South Africa and Iran), with a normalisation processes being pursued by Saudi Arabia (in the wake of BRICS+ members Egypt and the UAE), and with Sergei Lavrov having remarked that the Netanyahu and Putin invasions of Gaza and Ukraine were ‘nearly identical’ insofar as they sought ‘de-Nazification,’ geopolitical arrangements simply do not justify optimism about BRICS+ opposing Western imperialism.

The April 2024 re-election of neoliberal economist Kristalina Georgieva as International Monetary Fund (IMF) Managing Director, with unanimous BRICS+ support, and the failure of the ‘de-dollarisation’ initiative to gain critical mass within the bloc’s finance ministries, central banks and banks, further illustrate the sub-imperial not anti-imperial location (Bond 2024b).

When it comes to whether Chinese Gross Domestic Product is slipping (hence requiring what Beijing has termed the ‘going out’ process), Renmin University economist John Ross (2024) insists, “the U.S. has launched a quite extraordinary propaganda campaign, including numerous straightforward factual falsifications, to attempt to conceal the real international economic facts,” which are that China’s growth will give it a 60% larger economy than the U.S. by 2035, “decisively overcoming the alleged ‘middle income trap’ and, as the 20th Party Congress stated, China reaching the level of a ‘medium-developed country’.”

But there are real problems these critiques of Washington’s conventional wisdom gloss over, and they have vital implications for the BRI – and then for South Africa and Africa which are recipients of overaccumulated Chinese capital. (Similar rosy predictions to Ross’ were made for Japan in the 1980s, before the massive financial crash of 1990 and the flatlining of GDP ever since.)

There are indeed indicators of a slow-down in Chinese capital accumulation, including falling profit rates in the new-tech industries, while shifts of excess capital are occurring to a dangerous degree, as banks rapidly redirect lending from real estate to production. And by using GDP as a central measure of prosperity, crucial factors are simply ignored, such as unpaid women’s work in social reproduction (which makes a profound long-distance contribution via Chinese migrant labour similar to apartheid’s Bantustan system), greenhouse gas emissions, local pollution and non-renewable resource depletion.

Ross, Roberts and Tricontinental Institute staff (led by Vijay Prashad) certainly produce extremely useful analysis. However, in addition to an uncritical use of GDP – which ignores feminist-economic and ecological-economic insights into super-exploitation even though they are of enormous importance for Chinese capital accumulation given the economy’s reliance upon the hukou system (for nearly 30% of labour supply) and extractivism – they believe China is largely socialist.

Hence none would acknowledge the theoretically-informed conclusion Ho-fung Hung (2015) arrived at by the mid-2010s: “Capital accumulation in China follows the same logic and suffers from the same contradictions of capitalist development in other parts of the world… [including] a typical overaccumulation crisis, epitomised by the ghost towns and shuttered factories across the country.” By 2015, the confirmed overcapacity levels had reached more than 30 percent in coal, non-ferrous metals, cement and chemicals (in each, China was at the time responsible for 45-60 percent of the world market) (Bond 2021). The subsequent need for overcapacity shrinkage was the central reason for the crash of raw materials prices in 2015.

Today, overproduction problems remain in heavy industrial sectors, especially steel, petrochemicals, cement and construction of major works (such as coal-fired power plants). As one illustration of rising productive capacity, higher capital intensity and hence greater efficiency was witnessed in Chinese industry’s 2022 utilisation of 285,000 robots, compared to less than 50,000 in each of the second-fifth most robot-populated industrial facilities: Japan, the U.S., South Korea and Germany (Statzon 2023).

To accommodate this new investment wave, Chinese bank credit lines that were once reserved for real estate developers – e.g. with year-on-year additions of more than $1 trillion at peak in 2019 – switched urgently to manufacturing, suddenly reaching $700 billion more in 2023 than in 2022. The resulting production prowess meant China’s trade surplus in manufactured goods rose from less than 0.3% of world GDP before 2000, to more than 1.5% of GDP by 2022.

But the higher-growth green economy did not mop up these prolific production surpluses. As the U.S. and European leaders complained, Chinese excess capacity had by late 2023 risen to exceptionally high levels in solar energy equipment, batteries and EVs. The components of solar photovoltaic production are profoundly imbalanced between supply and demand given China’s dominance in the four main components – modules (75%), cells (85%), wafers (97%) and polysilicon (79%) – at a time the country’s consumption comprises 36% of world demand (Statzon 2023).

Moreover, the location of the world’s lithium-battery plants is revealing: 77% are in China, followed by the U.S. (6%), Poland (6%), Germany (3%) and Hungary (3%), and nowhere else (in spite of Zimbabwe’s ambitions to have a battery industry, and its apparently futile attempt to prevent its raw lithium ore from being exported and processed in China).

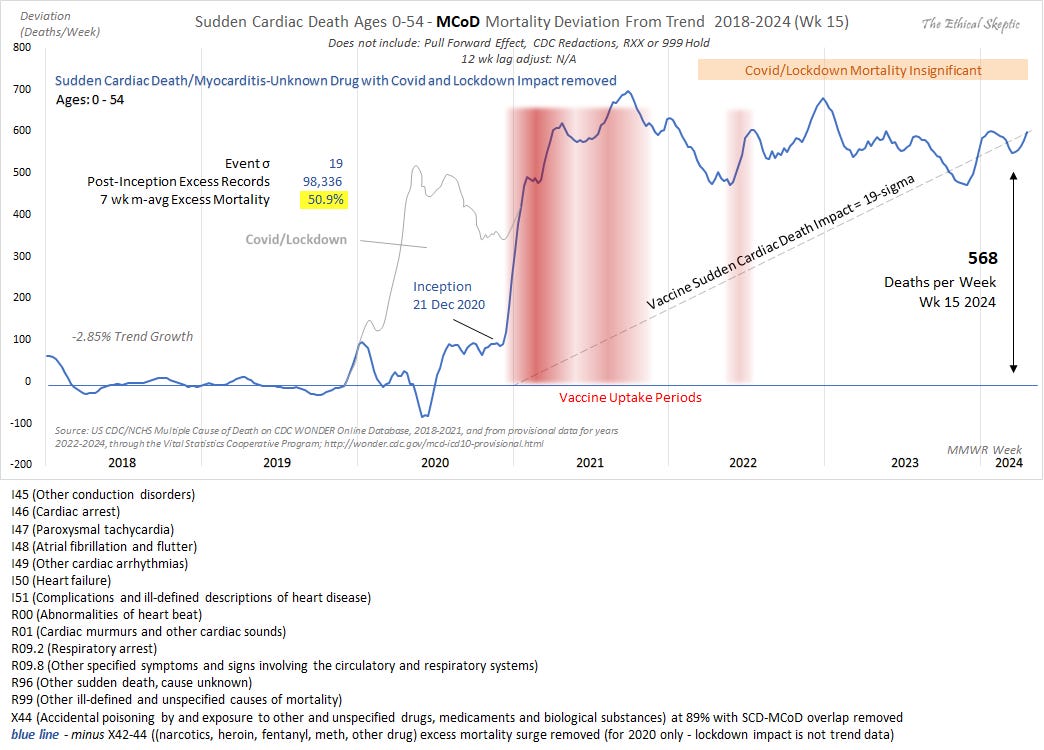

Figures 1-4: Solar PV demand, manufacturing capacity, 2021 Industrial robot installations, 2022 (1000s)

.

Source

.

Bank loans: manufacturing and real estate (y-o-y rise) Manufactured goods trade surpluses

.

.

This degree of capital overaccumulation in EVs, solar and batteries is ominous, because all these commodities should, in an ideal world, represent global public goods for which multilateral agencies would prevent any demand constraint as the world’s transition to renewable energy proceeds.

Indeed, solar, wind, non-invasive energy storage and electric transport should be provided gratis by the high-emitting countries – including not just the West but most BRICS+ countries – simply as a downpayment on their climate debt. And this should be done in a manner characterised by collectivised commoning, not using South Africa’s model of unreliable, chaotic Independent Power Producers.

Without this anti-capitalist approach, global capitalism will simply not achieve the needed emissions cuts for the world – especially vulnerable Asian and African countries – to survive the climate apocalypse that was hinted at in South Africa on 12 April 2022, when a Rain Bomb (350 millimeters) killed 500 Durban residents. But capitalism in the mid-2020s appears, as neoliberal U.S. politicians openly acknowledged, incapable of mopping up Chinese exports when sold at market prices, or even with enormous implicit subsidies from Bejiing (as Yellen and Blinken alleged, attempting to save Biden’s Inflation Reduction Act support for similar U.S. industries).

It appears inevitable that global effective demand for renewable energy and electric transport will continue to be severely constrained during a period, since early 2022, of rapidly rising interest rates, debt crises, financial chaos, productive-sector stagnation, durable price inflation in some sectors, and worrying levels of geopolitical volatility that affect the economy (e.g. grain and energy price hikes due to Russia’s invasion of Ukraine, or Red Sea shipping disruptions due to Yemenese solidarity with Palestine following Israel’s genocide, or another potential Israel-Iran military flare-up).

In spite of Ross’ (2024) celebration of still-rising GDP, the Chinese economy is badly exposed on many of these fronts. To illustrate, transnational corporations (TNCs) often watch the inventories of their subsidiaries and outsourcing partners most closely and with the most expansive global vision. Revealingly, FDI into China fell to $33 billion in 2023, which at 82% below 2022’s figures, is also the lowest level since 1993 (Bloomberg 2024).

Indeed by early 2024, the return of productive-sector overaccumulation in China was profound and reinforced the need for a viable international spatial fix, after the apparent exhaustion of China’s relatively powerful local spatial fix, which during the 2010s had taken the form of massively-expanded infrastructure and housing.

But by the early 2020s the BRI began experiencing problems in displacing overaccumulated Chinese capital, largely due to financial crises bubbling up in many Asian and African countries. Even after the dramatic 2021-22 recovery from Covid-19 lockdowns – which spurred a brief commodity price spike appreciated in South Africa and the rest of the continent – the contradictions were also being displaced along the BRI.

To be sure, several of the sovereign defaults and austerity programmes can be blamed upon limits to the temporal fix (credit creation) represented by the U.S. Federal Reserve’s excessively rapid interest rate increases in 2022-23 following the excessively loose Quantitative Easing practiced there and across the world in 2020-21 (even South Africa, briefly, in April 2020).

What did we learn from the prior episode of overaccumulation in 2010s’ China? There were some, like myself (Bond 2019), who believed Beijing could effectively manage such overaccumulation. This would occur through not only displacement, but by actively devalorising the overaccumulated capital through Beijing’s centralised control and planning power.

One example was Beijing’s order to shut down high-carbon industry and coal-fired power plants in Hebei Province earlier than they would have otherwise, in part to improve air quality. Another example of that power to mothball polluting industry was witnessed during the Beijing Winter Olympic Games in 2022.

Indeed from late 2015, Beijing’s “Supply-Side Structural Reforms” were meant to “guide the economy to a new normal,” using five five strategies: capacity reduction, housing inventory destocking, corporate deleveraging, reduction of corporate costs, and industrial upgrading with new infrastructure investment. The “three cuts, one reduction, and one improvement” strategy was, the World Bank observed, a welcome “departure from China’s traditional demand-side stimulus policies” (Chen et al 2018).

However, in 2019, I asked this question: “whether the other contradictions in the Chinese economy, especially rising debt and the on-and-off trade war with the United States (potentially spilling into other economies trying to resist devaluation), would turn a managed process into the kind of capitalist anarchy that causes overaccumulation in the first place” (Bond 2019, 147)? The latter seems to have occurred these past five years, with worse overaccumulation than ever.

Xia Zhang (2017, 321-22) was more realistic about Beijing’s propensity to avoid devaluation much earlier, instead explaining China’s capitalist externalisation of uneven development as a geographical “restructuring as the result of overaccumulation. Often jointly with various representatives of Chinese capital, the Chinese state is compelled to reconfigure Chinese capitalism on a much larger spatial dimension so as to sustain the capital accumulation and expansion. Hence it must engage in a ‘spatial fix’ on an unprecedented scale.”

Throughout capitalist history, the first of two main strategies to combat overaccumulation has typically been a spatial fix involving trade, FDI and labour migration (so as to lower wage rates). But a further dilemma for Beijing is the second strategy: rising cross-border finance.

Not only did Chinese banks overextend, but they did so in the context of an unpatriotic bourgeoisie. As Hung (2018) remarked, “the elite who control the state sector seek capital flight, encroach on the private sector and foreign companies, and intensify their fights with one another.”

Even the IMF recognised this by 2021, in its survey of economic sectors suffering low capacity utilisation, which revealed that overaccumulation was correlated to Chinese firms’ overseas Mergers & Acquisitions during the critical period of going out through overseas investment, during the mid-2010s. The IMF economists blamed Beijing’s gift of subsidies to firms, so they would “constantly expand capacities in sectors where their comparative advantage led to ever greater international market shares, which in turn reinforced such comparative advantages. However, as growth began slowing down in China, capacity utilisation started to decline, putting pressure on corporate profitability.”

Then in turn, “Chinese companies had to seek new markets to relocate capital and keep the pace of expansion, the latter an important consideration for the State-Owned Enterprises as they were often tasked to support governments at all levels to meet the growth targets” (Ding et al 2021, 19).

Progressive Chinese activists understand this too, including the “Hong Kong People’s Forum on BRICS and the BRI” (Lee 2017, 1), a group forced into exile four years later. Their BRICS counter-summit statement was critical of a BRI “whose main purpose is to export China’s surplus capital, and in this process seek the cooperation and ‘mutual benefit’ of big foreign TNCs and regimes which are often authoritarian. The price of these investments is often borne by the working people and the ecological balance.” And as a delegation of us from South Africa could testify at that Forum, we were seeing already by the mid-2010s how much Chinese displacement of overaccumulation relied upon accumulation by dispossession.

All of these insights are of enormous importance when it comes to the ways a genuine ‘public goods’ approach emerges from the global (and Chinese) overcapacity crisis in solar, wind, energy storage and EVs, so that instead of being treated as commodities, they become decommodified contributions by the wealthier countries, to planetary preservation.

Contradictions Reflected in South Africa’s Chinese-driven Special Economic Zones

To begin a survey of the BRI at the tip of Africa, along South Africa’s southern coastline, consider the Nelson Mandela Bay metropolitan area where the Coega Special Economic Zone was initiated in the early 2000s. Two Chinese car factories were built there during the 2010s – First Auto Works (FAW) and Beijing Auto Industrial Corporation (BAIC) – and attracted widespread criticism for labour conflicts, for drawing down large South African state subsidies (and electricity supply), for their capital-intensive semi-knockdown kit status (instead of the anticipated integrated factories), for failing to produce electric vehicles, and for an exceptionally slow start up (eight years in BAIC’s case).

At FAW, the metalworkers union went on strike in 2021. Workers were being “paid R39 ($2.90) per hour, while their counterparts at other truck assemblers earn R99 ($6.60) per hour,” according to the country’s leading trade union (Chirume 2021). In spite of promises to create 500 permanent jobs, there were only 190.

The much larger ($600 million) BAIC plant was co-financed in 2016 by the South African state’s Industrial Development Corporation (IDC). In mid-2018, for an audience that included Xi and Ramaphosa, the first few semi-knock down Sport Utility Vehicles were rolled off the BAIC assembly line just a day before the BRICS Summit was to start in Sandton.

The experience led Lin Songtian to exclaim, “I’ve been to many developing countries and industrial development zones and the Coega SEZ is by far the best of them all” (Toussaint et al 2019). However, it would be nearly six years after the Xi and Ramaphosa unveiling of the BAIC’s assembly line before the plant began producing its own cars, in March 2024.

Eric Toussaint et al (2019) offered other relevant critiques of various problems that arose, including “inadequate Small, Medium and Micro Enterprise involvement, budget shortfalls for the start-up phase, differential labour laws, and delays in production.”

Journalist Max Matavire (2019) noted the high share of imported inputs, and the extensive work stoppages and language barriers encountered in the early stages. Even a partially Chinese-owned newspaper admitted in 2019, “Serious doubts have been expressed in motor industry circles about the claims that the vehicle was manufactured in South Africa… The local media reported that the construction had been moving at a snail’s pace and all SMMEs had vacated the premises due to non-payment” (Cockayne 2019).

Another industrial production site near the Zimbabwe border received even greater fanfare in 2018, at the Beijing FOCAC session co-chaired that year by Xi and Ramaphosa: the Musina-Makhado Special Economic Zone (Mokone 2018, MMSEZ 2020). If eventually built, it may become the single largest industrial mega-project in Africa, with a $10-40 billion estimated investment.

However, like the BAIC plant, major delays are obvious, and perhaps fatal due to Xi’s curtailing of BRI coal-fired power in 2021. In 2017, the MMSEZ operating license was granted to entrepreneur Ning Yat Hoi’s Shenzhen Hoi Mor investment firm even though he was on the Interpol red list for corporate fraud in Zimbabwe (at the country’s largest gold mine, Freda) and Great Britain (Bond 2024a).

The MMSEZ’s main industrial ambitions are in an ecologically-sensitive zone in the close vicinity of Ramaphosa’s home village. But the $10 billion project requires not only piping in vast water supplies (unavailable on site) but also finding an energy source which, until September 2021, was meant to be a 4600 MegaWatt coal-fired power plant.

Xi’s speech to the United Nations General Assembly that month, in advance of the Glasgow UN climate summit, promised an end to such plants along Beijing’s Belt and Road Initiative, which soon compelled MMSEZ organisers to claim (dubiously) that the vast industrial facility could operate on local solar power supplies (Bond 2024a).

The challenge of supplying energy to the MMSEZ is, in the 2020s, formidable given not only overconsumption by electricity-guzzling smelters elsewhere in South Africa, but the desperate need to meet the power needs of labour-intensive industry, small businesses and households, especially where (patriarchy-determined) cooking chores based upon hot plates are necessarily being replaced by dirty coal, wood and paraffin.

And even without the thermal coal plant, Ning’s other proposed MMSEZ industrial emitters (at 34 megatonnes annually, 8% of South Africa’s projected 2030 total) and their extensive local pollution were irrational.

The irrationality is obvious for five reasons:

- first, when MMSEZ officials repeatedly deny the urgent need to decarbonise industry, or face the Carbon Adjustment Border Mechanism climate-sanctions that will begin in Europe in 2026 and the UK in 2027;

- second, Chinese-driven overproduction of most of the industrial metals proposed are already resulting in global gluts;

- third, evidence of South Africa’s global uncompetitiveness is seen in ongoing closures of other local steel mills (especially Indian-owned Arecelor-Mittal and Russian-owned Evraz Highveld);

- fourth, by the 2020s, the national economy’s annual steel output had halved from its 2005 peak of 8 million tonnes; and

- fifth, instead of replacing imports with MMSEZ-produced metals, displacement within the South African economy would result, since as one analyst remarked, “The idea was that that instead of machinery and equipment being built in, say, Durban and shipped to a Southern African Development Community country, it could far more advantageously be done in the MMSEZ” (Ryan 2019).

As noted above, global metals overcapacity created such pressure on South Africa that international steel giant ArcelorMittal continued its own radical downsizing of existing foundries, even while a major Chinese steel mill was being built in Manhize, central Zimbabwe, with potential capacity of 5.1 million tonnes/year. (South Africa’s early-2020s national output had fallen to four million and was anticipated to drop further in coming years with more foundry closures).

And as thousands of Environmental Impact Assessment (EIA) complaints showed, vast amounts of local pollution as well as greenhouse gas emissions caused by the MMSEZ would damage Limpopo’s fragile ecology and would also far exceed limits agreed to in Pretoria in government’s official Nationally Determined Contributions to cutting emissions, as mandated in the 2015 Paris Climate Agreement.

Even the initial MMSEZ EIA practitioner, Delta BEC (2021), judged the coal-fired power plant to be indefensible without a working carbon capture system (and there was none in existence). As noted, Xi himself also rejected that strategy during a United Nations General Assembly speech in 2021 due to global climate responsibilities, promising to cancel all such plants on the Belt & Road Initiative.

Finally, the debate about an MMSEZ power source unfolded just as Eskom load-shedding became debilitating. The promised solar replacement of 400MW would not make a sufficient dent due to the extremely high electricity consumption required for the proposed MMSEZ smelters.

Furthermore, water to supply the MMSEZ was not immediately available. Although vague options for a summer-time flood-overflow dam near Musina were suggested, there was much more likelihood that the MMSEZ would rely upon an international transfer from aquifers in western Zimbabwe and eastern Botswana.

Delta BEC (2021) acknowledged that by 2040, water required for the mining, industries and power generation sectors would rise by more than five times (from 45.0 million m3/a to 249.1 million m3/a). A great deal of the water would be directed to washing both thermal and coking coal from near the MMSEZ for subsequent combustion – consequently resulting in further CO2 emissions, which in turn would contribute to droughts and floods in a province and region set to be amongst Africa’s worst affected by the climate crisis.

The overarching problem to address at the MMSEZ was whether a logic to regional economic development existed, based on mining, beneficiation and intensive energy supply in Limpopo Province and nearby countries – and indeed, whether such a logic has ever existed, especially given that returns to taxpayer investments of $5.2 billion in infrastructure were estimated to amount to only a cumulative $42 million over 20 years (Liebenberg 2022), and that resistance rose to the MMSEZ from a variety of environmental-justice, conservationist and community movements (Thompson and Mbangula 2021, Thompson et al 2021).

Infrastructure Corruption Amidst Growing Coal-export Dependency

There have been warnings of such underdevelopment since the early 1990s, what with trade-catalysed deindustrialisation due to fast-rising South African imports from China and other East Asian economies, mainly through the Durban port. Although higher capital-intensity in surviving plants also played a role, imports from Asia have been the main contributor to the closure of South Africa’s labour-intensive clothing, textile, footwear, appliance and electronic sectors.

Moreover, the danger of corruption – e.g. due to the MMSEZ’s chosen management – is also recognised in part due to the way financial and mercantile forms of underdevelopment are visible, especially in Beijing’s relationship with the transport parastatal Transnet. The Durban port’s seven new container cranes, purchased in 2011, were considered the world’s most expensive because Shanghai Zhenhua Heavy Industries (along with German-Swiss firm Liebherr) added millions of dollars in bribes to the notorious Gupta family empire when winning a $92 million tender.

In the other main infrastructure supply controversy, a 2013 order for Transnet’s rail fleet relied upon hundreds of new locomotives from Beijing-based CRRC but three problems arose: first, what Pretoria tax authorities in 2022 termed at the High Court of South Africa (2022), “evidence of large scale corruption” by CRRC as part of the Gupta ‘state capture’ of Transnet; second, “tax fraud in excess of $200 million” due to the world’s largest rolling stock manufacturer “substantially having understated its tax liability” and having “misrepresented the interest it was earning”; and third, a CRRC response to not only deny the evidence and refuse to pay its tax debt, but to also withhold vital locomotive parts during the early 2020s.

CRRC thus left more than 100 locomotives disabled, in the process crippling Transnet’s bulk exports and compelling a rail-to-road transition by mining houses, using trucks that caused severe ecological damage and dramatically lowered productivity. And to pay CRRC for the locomotives, a high-profile $5 billion China Development Bank loan was granted to South Africa by Xi in 2013 at the time Durban was the BRICS summit host city, and although not all was used and corruption was evident again via the Guptas, Beijing insisted on full repayment.

The financing of South African maldevelopment is also obvious in the continent’s worst case of parastatal debt: energy generator Eskom’s two new coal-fired power plants, Kusile and Medupi. Eskom received credits for Kusile from the China Development Bank ($2.5 billion in 2018) and for Medupi from the Shanghai-headquartered BRICS New Development Bank ($480 million in 2019), even amidst charges that the World Bank and Western financiers had over the prior decade loaded South Africa with tens of billions of dollars’ worth of Odious Debt because Hitachi bribed the ruling African National Congress to get the plants’ main construction contracts in 2007.

The Tokyo firm was successfully prosecuted in 2015 in Washington (but not yet in Pretoria) under the U.S. Foreign Corrupt Practices Act. But that did not stop Chinese lenders from adding to what at the time had reached more than $180 billion in South African foreign debt, just as Pretoria state debt was declared ‘junk’ by two credit rating agencies in 2017, and as taxpayers were told to take over the burden of repaying half of Eskom’s loans. To repay the other half, Eskom residential customers have faced a 435% rise in after-inflation prices for electricity from 2007-24.

Meanwhile, neither Kusile nor Medupi were built to specifications, e.g. resulting in seven years of delays in construction, and with 7000 cases of welding failure. Not only was the resulting inability to supply the grid with 4800 MW each responsible for extreme electricity shortages. The 35 million tonnes of CO2 emissions from each power plant also made this the worst-ever case of mega-project climate mismanagement in Africa.

Just like their Western counterparts, the two China-based banks never forgave the repayment burden, so South African taxpayers and Eskom customers have continued to repay loans at what is the world’s fourth-highest interest rate (among the leading 40 countries issuing state bonds) (Bond 2024b). And the worst damage, as leading South African environmentalist Makoma Lekalakala explained when organising several protests against the BRICS New Development Bank, is that “The projects they are funding are climate-destroying projects” (Bloom 2019).

Conclusion

What lessons are to be drawn? Very simply, the kinds of super-exploitative relations between the Southern African people and environment, on the one hand, and settler-colonial plus Western corporate consumers of cheap labour on the other, are being amplified by most of the neo-colonial trade, investment and financing controversies so evident in China-South African economic ties since the end of apartheid, at least those reviewed in the pages above.

Can these ties be reformed? Or is it more appropriate to break the chains? The reform agenda entails work within bilateral, FOCAC and BRICS+ networks but so far, the main advocacy groups, think tanks and individual academics working within these circuits find it much more appropriate to ignore the contradictions. Occasionally, the shyness associated with otherwise critical academics, when it comes to China, reflects a sense of the Communist Party’s unforgiving perspective.

As an example in 2017, the chair of the (pro-BRICS) Mumbai-based Observer Research Foundation, Sudheendra Kulkarni (2017), noted the excessive diplomacy of his colleagues at a Quanzhou Governance Seminar, where participants “paid little attention to the ongoing India-China military stand-off,” because the bloc’s “very credibility would be called into question if our two countries allowed the dispute to be escalated into an armed conflict. Obviously, the Chinese hosts did not want a divisive bilateral issue to get any kind of focus in the midst of deliberations at a BRICS seminar.”

Similarly in early 2024, leading South African BRI/BRICS scholar Bhaso Ndzendze (2024) was asked, “‘Is China taking over African infrastructure’ when they cannot pay their debts – the so-called ‘debt trap’?” He replied, “there is no such thing. It’s a classic case of fake news.” Ndzendzo traces the claim to September 2018 – just after the Beijing FOCAC ended – by Trump’s then National Security Advisor John Bolton, exaggerating a report in the Lusaka Times a few days earlier, in which talks had opened for the national electricity firm to be sold to a Chinese firm.

Ndzendze concluded, “We must locate the root problem of how fake news can find its footing on Africa-China relations: the deliberate paucity of raw data and information from either the African or Chinese governments, or the FOCAC process itself, leaves an information gap which can only be closed by speculation and exaggeration.”

It’s that attitude, of extreme caution – even failure of analytical nerve – that must be transcended, in the interest not just of truth but of seeking justice. Otherwise internal reform processes will go nowhere – as appears to be the case in early 2024.

In contrast, the selective breaking of chains with the BRI – by South African progressives, drawing from all the grievances noted above, and also applied to the chains of Western neo-colonialism – would follow from two exceptionally important activist-driven processes:

- anti-apartheid sanctions from 1965-90, which were instrumental in weakening the repressive elites and then changing power relations, to force the country’s first free, democratic election in 1994; and

- the delinking of the South African economy from international branded pharmaceutical production of AIDS medicines in 2004, which allowed local generic factories to supply the state – and seven million people living with HIV – the lifesaving drugs (now costing 1% of what Big Pharma charged), and thus led to a rise in life expectancy from 54-65 over the subsequent 15 years (before Covid-19 reversed the progress) (Saul and Bond 2014).

The dilemmas for the BRI project appear to be as extreme in South and Southern Africa as in some of the other crisis-riddled sites in Asia and Africa, where Chinese capital has run up against what sometimes appear to be insurmountable barriers and setbacks (especially Pakistan’s Gwadar Port and Sri Lanka’s Hambantota, or several African countries suffering debt crisis in part due to Chinese lending).

The potential for both analysis and activism is enormous, using the tools discussed above, even if refinement and sharpening are always needed, especially in the face of relentless hype about the BRI and FOCAC.

*

“

“

And Another

And Another

Rethinking Srebrenica

Rethinking Srebrenica

The Covid Zero Tolerance Mandate has created social havoc and hardship for millions of people, requiring the imposition of PCR tests on a regular basis using QR green, yellow and red color codes as a means of social control.

The Covid Zero Tolerance Mandate has created social havoc and hardship for millions of people, requiring the imposition of PCR tests on a regular basis using QR green, yellow and red color codes as a means of social control.

The Worldwide Corona Crisis, Global Coup d’État Against Humanity

The Worldwide Corona Crisis, Global Coup d’État Against Humanity

With the creation of The Federal Reserve as a public/private banking institution in 1913 came the financial means to fund the US as the new global hegemon, taking over where the British left off.

With the creation of The Federal Reserve as a public/private banking institution in 1913 came the financial means to fund the US as the new global hegemon, taking over where the British left off.