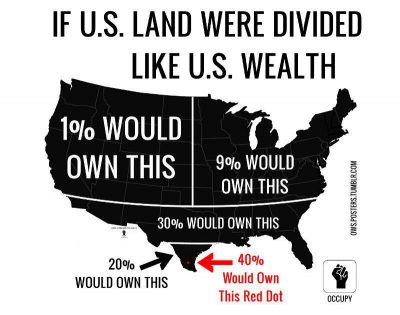

Outrageous Wealth Disparity in America. 400 Richest More Wealth than Bottom 64%

VISIT MY NEW WEB SITE:

Contact at [email protected].

According to an Institute for Policy Studies (IPS) report titled “Billionaire Bonanza 2017,” America’s 400 richest individuals have more total wealth than the nation’s bottom 64%.

The three richest billionaires are wealthier than the bottom 50%. The bottom 1% of Americans have a negative net worth of $196 billion. The top 1% has a combined net worth of $33.4 trillion.

Shocking stuff! It happened by design, not accident – neoliberal harshness for most Americans, near-zero interest rates and trillions of dollars of money printing madness by the Wall Street owned and controlled Fed, near-free money, making super-rich Americans far richer.

Transferring wealth from most Americans to wealthy elites has been going on for years, a deliberate scheme to concentrate it in the hands of the nation’s privileged class at the expense of most others.

Below are the highlights of the IPS report:

Bill Gates, Jeff Bezos, and Warren Buffett own more wealth than 63 million US household – 160 million people.

America’s wealthiest billionaires are as rich as 70 million US households – 178 million people.

Billionaires comprising Forbes’ 400 have more wealth than 64% of the US population – 204 million people.

Median US family net worth is $80,000, excluding automobiles owned.

Forbes 400 members are wealthier than 33 million US families with the above net worth.

One-fifth of US households have zero or negative net worth. Over 30% of Black households and 27% of Latino ones have no wealth or they’re underwater.

Since the Forbes 400 list was published on October 17, Bezos increased his wealth by $7 billion – in a few weeks.

According to IPS, figures in its report “underestimate our current levels of wealth concentration. The growing use of offshore tax havens and legal trusts has made the concealing of assets more widespread than ever before.”

Rich elites worldwide shelter their wealth offshore, paying minimal or no taxes on it. Lawyers and accountants enable them to avoid paying their fair share of taxes on wealth maintained at home.

Many large US corporations pay nothing. On average, they pay around 14% of their income in federal taxes. The current corporate rate is 35%.

From 2008 – 2015, over half of S&P 500 companies paid no federal income taxes, despite combined profits of over $3.8 trillion, according to the Institute of Taxation and Economic Policy – calling the 35% corporate rate a “myth.”

The GOP tax plan will increase inequality further, a bonanza for super-rich Americans, crumbs for most others, and for some a tax increase.

According to IPS researchers Chuck Collins and Josh Hoxie,

“(o)ver recent decades, an incredibly disproportionate share of America’s income and wealth gains has flowed to the top of our economic spectrum.”

“At the tip of that top sit the nation’s richest 400 individuals, a group that Forbes magazine has been tracking annually since 1982.”

“Americans at the other end of our economic spectrum, meanwhile, watch their wages stagnate and savings dwindle.”

The net worth of super-rich Americans continues growing. Most others struggle to get by on low wages, poor or no benefits, along with millions of students entrapped by over $1.3 trillion in debts incurred to pay tuition and other school expenses.

America’s out-of-control wealth disparity is a national disgrace. Bipartisan policies make things worse, not better.

VISIT MY NEW WEB SITE: stephenlendman.org (Home – Stephen Lendman). Contact at [email protected].

My newest book as editor and contributor is titled “Flashpoint in Ukraine: How the US Drive for Hegemony Risks WW III.”

http://www.claritypress.com/LendmanIII.html

Featured image is from Stephen Ewen / Wikimedia Commons.