New York Times Pushes False Narrative on the Wall Street Crash of 2008

William D. Cohan has joined Paul Krugman and Andrew Ross Sorkin at the New York Times in pushing the patently false narrative that the repeal of the Glass-Steagall Act in 1999 had next to nothing to do with the epic Wall Street collapse of 2008 and the greatest economic calamity since the Great Depression. (See related articles on Krugman and Sorkin below.)

The New York Times has already admitted on its editorial page that it was dead wrong to have pushed for the repeal of Glass-Steagall but now it’s dirtying its hands again by publishing all of these false narratives about what actually happened.

In a July 30 column, Cohan ridicules Senators Elizabeth Warren and John McCain over their introduction of legislation to restore the Glass-Steagall Act to separate insured deposit banks from their gambling casino cousins, Wall Street investment banks. The Senators are being joined in their call to restore Glass-Steagall by a growing number of Presidential aspirants, including Senator Bernie Sanders and former Governor of Maryland, Martin O’Malley, both running as Democrats.

Hillary Clinton, another Democratic presidential hopeful whose husband, Bill Clinton, signed the bill during his presidency that repealed Glass-Steagall, does not see the need to restore Glass-Steagall, leading Cohan to make this observation:

“Mrs. Clinton is right. Despite the relentless rhetoric, the fact that commercial banks are in the investment banking business and investment banks are in the commercial banking business had almost nothing to do with causing the financial crisis of 2008.”

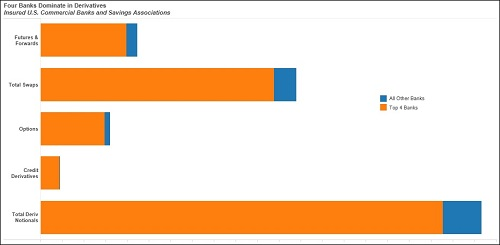

According to the OCC, Just Four Banks (JPMorgan Chase, Citigroup, Bank of America and Goldman Sachs) Hold 91.3 Percent of All Derivatives Held By More Than 6,000 U.S. Banks as of the First Quarter of 2015

The “almost nothing” Cohan refers to was the colossal collapse of the county’s largest bank at the time, Citigroup, which saw its share price drop to 99 cents (a penny stock) with the taxpayer being forced to infuse the greatest bailout in U.S. history into this bank: $45 billion in equity; over $300 billion in asset guarantees; and a cumulative total of over $2 trillion in super-cheap revolving loans from the Federal Reserve that lasted for years to resuscitate its insolvent carcass.

Cohan sheepishly concedes in his column that Citigroup “while a big commercial bank, would surely have failed without its government rescue, in large part because of the behavior of its investment bankers.”