New Data Shows a 45% Spike in Tariffs Being Paid by American Businesses and Consumers

Today, Tariffs Hurt the Heartland – a nationwide, nonpartisan, grassroots campaign against tariffs – published new data about the costs of tariffs across the United States. The data was released during a town hall meeting in Pennsylvania to discuss the tariffs’ impacts, featuring local distillers, pork producers, frame manufacturers and other experts.

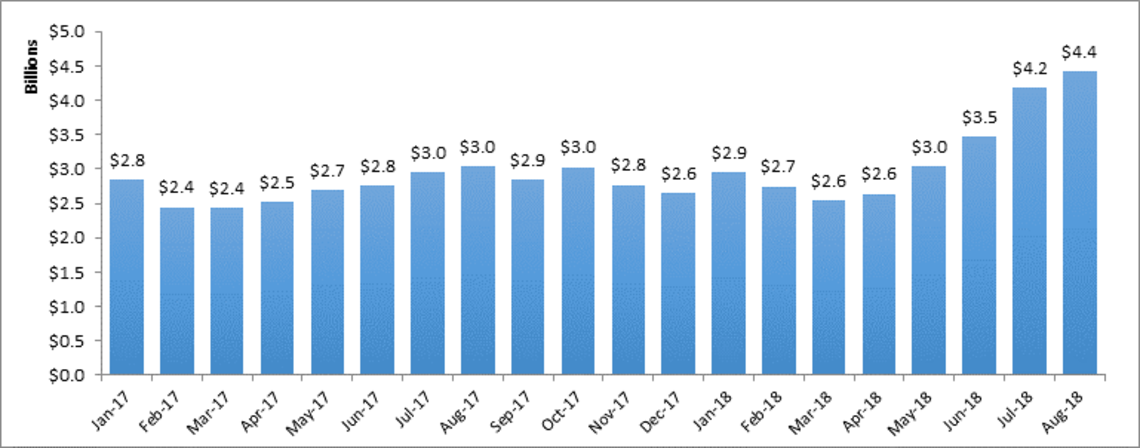

Specifically, the data found that the for the most recent month available, August 2018, the amount of tariffs paid increased by $1.4 billion – or 45 percent – as compared to tariffs paid in August 2017. Tariff costs in Michigan tripled to $178 million and more than doubled in multiple states – to $424 million in Texas, $193 million in Illinois, $50 million in Alabama, $29 million in Oklahoma, $23 million in Louisiana, and $7.3 million in West Virginia. These costs strain businesses of all sizes, but are particularly painful for small businesses, manufacturers, and consumers who bear the burden of tariff increases in the form of higher prices. The data was compiled by The Trade Partnership and released by Tariffs Hurt the Heartland.

Graph: Tariffs Paid on Products Subject to Trump Tariffs by Month, all months

“These tariffs are taxes on American businesses and consumers,” said Tariffs Hurt the Heartland spokesperson Angela Hofmann. “They aren’t paid by other countries. They are paid here at home. What this data shows is that we are already seeing a steep increase both nationally and at the state level in the tariff costs businesses and consumers are paying.

“This is just the very tip of the iceberg. The data released today offers a glimpse at what the coming pain from the trade war. Once the tariffs on an additional $200 billion in good kick in these numbers will continue to trend sharply upward. We are hopeful that this data, combined the personal stories of harm that we’re sharing across America, will encourage this administration to move away from tariffs and to find new solutions to growing access to foreign markets.”

Unfortunately, this data is only telling the first part of the story; costs will continue to increase as the other announced tariffs go into effect. For example, the section 301 tariffs have not even kicked in, so American businesses are expected to see even higher costs in the future.

“In Pennsylvania alone, we are seeing 55 percent higher costs or $45 million a month for state businesses from last year to this year. And it’s only going to get worse once additional tariffs kick in. Continuing to go down this track will only lead to more layoffs and higher prices.” added Hofmann.

The steel and aluminum tariffs have had significant cost implications for the states. The section 232 steel tariffs have cost American companies an additional $1.5 billion, including $475 million in August. Previously, these products were duty free. Imports into these states paid the most taxes for steel subject to the section 232 tariffs: Texas ($389 million), Michigan ($139 million), California ($104 million), Illinois ($103 million), Pennsylvania ($98 million) and Ohio ($77 million).

Aluminum tariffs also hurt producers throughout the country, costing American companies more than $125 million in the month of August alone. The largest increases to existing tariffs were paid in Texas ($14 million), New York ($11 million), California ($10 million), Maryland ($10 million), Kentucky ($7.4 million) and Illinois ($6 million).

Lastly, section 301 tariffs cost American companies roughly $550 million in August. Products subject to the Section 301 remedies faced $594 million in tariffs in August, compared to just $46 million in August 2017. The large increase in tariffs came despite a less than 1 percent increase in the value of imports. Keep in mind: the “List 2” tariffs did not take effect until August 23 and another batch of “List 3” tariffs will take effect in September, so tariff costs should rise significantly in future months.

The data was compiled by The Trade Partnership and released by Tariffs Hurt the Heartland. Use the contact information below to obtain more information about the data.

*

Note to readers: please click the share buttons above. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.