NATO/EU Aggression Plunges Germany Into Crisis. “Deindustrialization”

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

First published on August 17, 2023

Important article by Rodney Atkinson

***

It is perhaps justified that the country which has done most to force the expansion of the EU Eastwards and most loyally followed American neocons in the aggressive expansion of NATO towards (an imperially retreating) Russia – Germany – should now be suffering its biggest economic crisis since the second world war.

NATO/EU’s attack on Russian gas supplies to Europe, the US bombing of the Nordstream pipelines to Germany and trade sanctions against Russia have removed an important German export market and greatly increased the energy costs for German industry which for decades has relied on consistent and reasonably priced energy for its critical industries – chemicals, cars, engineering.

Add to this a big rise in borrowing costs and a fanatical green agenda it is no surprise that the Federal Statistical Office in Wiesbaden announced that nearly a quarter (23.8%) more companies filed for insolvency in July 2023 compared to the same month last year. Steep Surge in Bankruptcies.

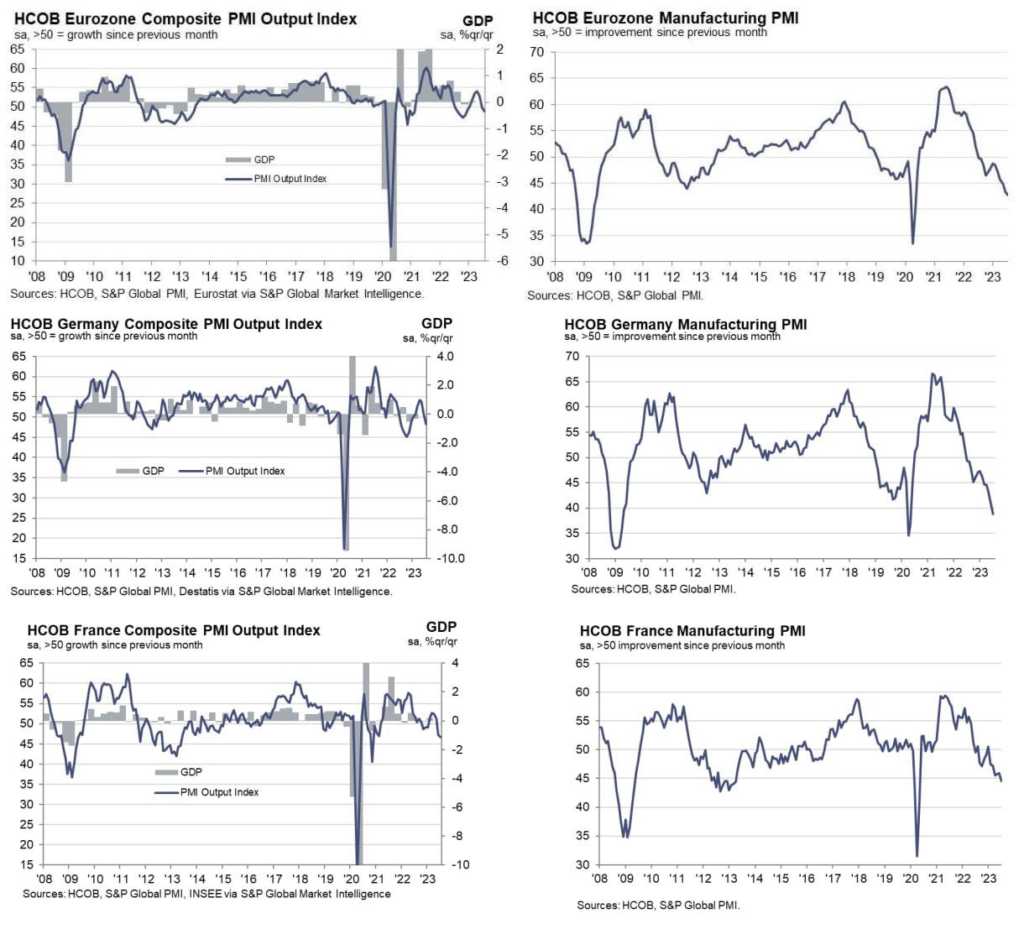

When Germany suffers this much, the EU as a whole suffers as well and France’s industrial production has also collapsed:

Even as this economic disaster unfolds the German government (which has already contributed $22bn to Ukraine in finance and armaments) is committing to a further $5bn per annum up to 2027! – thus helping to stoke the war which is leading to their own industrial downfall.

German De-industrialisation

“We are witnessing the beginning of German [and thus European] deindustrialisation”. said the leading “German Economic Institute”. The same institute also reported that Germany’s ability to attract business investment suffered an “alarming” decline last year, when more than €135bn of foreign direct investment flowed out of the country and only €10.5bn came in. The gap was the largest on record – and that was largely before the new incentives to invest in the USA, following Biden’s grotesque trade distorting green subsidies.

Germany has some of the highest electricity costs in Europe, as the fanatical Greens in the Social Democrat-led coalition demand ever more costly “clean power” just as Germany has closed its remaining nuclear power stations.

Germany is planning to build a vast infrastructure to import hydrogen from countries like Australia, Canada and Saudi Arabia but the technology is not at all assured especially at the levels of imports needed to rescue Germany from its energy crisis.

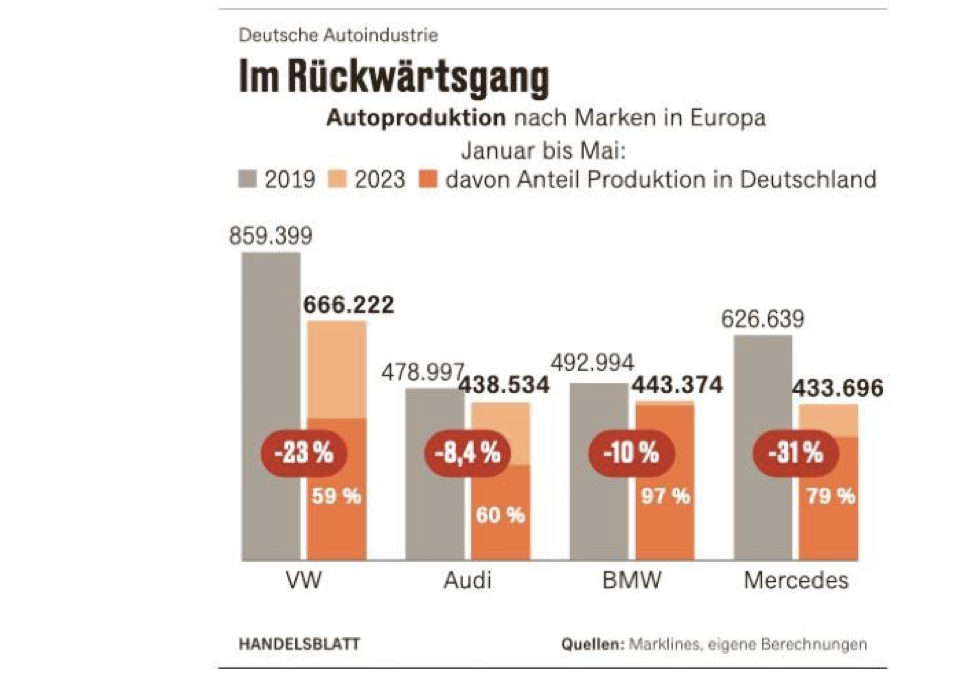

The German car industry is in crisis, with production of its major manufacturers falling dramatically between 2019 and 2023: VW down 23%. Audi down 8.4%, BMW down 10% and Mercedes down 31%:

Of the total German exports to China of $113bn, $30bn was in cars but those exports face fierce competition from Chinese electric car manufacturers both in China and in Europe. (And the more the Green Party dominated Scholz government pursues “net zero” the more Chinese cars will dominate europe, Germany’s main market) China’s BYD Co overtook VW as the best selling car brand in China with a car which costs one third of that of VW’s electric car.

In Banking Germany’s two biggest listed banks – Deutsche Bank AG and Commerzbank AG have been in crisis for years and their combined market capitalization is less than a tenth of JPMorgan Chase.

Here too there is a lack of new technology compared to its competitors – particularly in FinTech compared to e.g. London.

Digital Technology

Germany’s digital technology infrastructure is poor and ranks the country 51st in the world for fixed-line Internet speeds, with a lack of investment (it had the fourth-lowest spending among OECD countries relative to the economy’s size.)

Ageing Population

Germany’s ageing population has affected the workforce and surveys have found 50% of firms cut output due to staffing problems, costing the economy as much as $85 billion per year.

A Litany of Historic Industrial Destruction

The extent to which this German industrial crisis is fundamental and historic, and therefore critical for Germany’s future, can be seen from these reports of the bankruptcy of companies, some of which were over a hundred years old (in one case 600 years!):

Textile company Hofer Spinnerei Neuhof files for bankruptcy after 125 years of spinning mill operations.

One of the country’s largest mail order co.’s, Klingel, from Pforzheim, existing since 1923 is insolvent.

Glass manufacturer Weck GmbH & Co of Dortmund is bankrupt after 120 years in operation. their glass in almost every german home. energy intensive!

Germany’s central bank may need a bailout to cover losses on the debt it hovered up as part of it’s massive €650bn bond-buying programme from the ECB.

Heads of the Employers’ Association in North Rhine-Westphalia are worried the nation is at a dangerous point. Almost one-third of German medium-sized Mittelstand firms are thinking about transferring production and jobs abroad.

Part 7 – May ’23 – 300-year-old traditional slaughterhouse Röhrs Butchery filed for bankruptcy along with 2 other century old business.

Part 6 – Mar ’23 – Eisenwerk Erla of Saxony, files for bankruptcy after more than 600 years of existence. Other century old businesses go bankrupt.

Germany is the geographic, business and financial core of the European Union and the principal guarantor of the Euro currency. As the centre of the clearing system for the currency and its enormous Target 2 claims of over one trillion Euros on other member states (due to its accumulated positive trade and capital balances with them) a crisis for Germany could turn into the collapse of the Euro and the massive costs of unwinding the currency.

The 20 year attack on Russia, the exploitation of Ukraine as a military battering ram against Russia, the ruinous (for the West) trade sanctions, the destruction of the Nordstream pipelines, the growing Russia-China alliance and the rising competitiveness of Chinese industry have all hit Germany and the EU hard.

Only a negotiated peace with Russia (and a calming of the Taiwan rhetoric) will restore prosperity to Germany, the EU and the West in general.

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

This article was originally published on Freenations. Rodney Atkinson is a regular contributor to Global Research

Featured image is from Freenations