More Financial Turmoil Ahead: A Stock Market Bear Rally Built on Sand

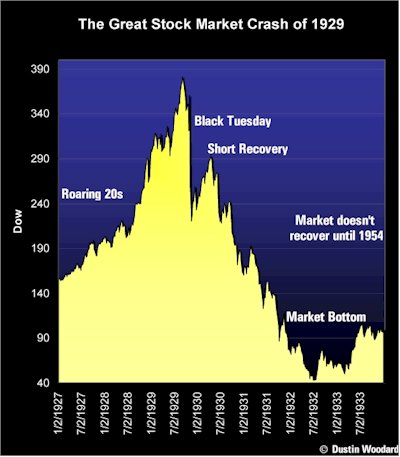

A recovery is supposed to be in the works in the midst of increased savings, declining debt balances on credit cards, more bankruptcies, higher unemployment and new wave of foreclosures. Consumer participation in GDP is down from 72% to 70.4%. Bank and other financial firms’ balance sheets are what they say they are and we have a stock market bear rally built on sand just as we had in 1931. And, lest we forget, bogus government statistics calculated to confuse professionals and investors alike.

What an upside down world. How do you make money when you are losing money? Wait until late July and in August when the second quarter earnings are released by financial firms. They won’t be pleasant reading. The market rally and much of the earnings are simply fraud. Wall Street and investors simply shrug their shoulders and look away. They know but they do not want to know. Ever present in the scams is the SEC, which has never seen a major firm they did not like. Acting on violations only when forced too at large firms and perpetually pursuing the small and medium sized brokers and brokerage firms and newsletter writers. Then there is the veracity of our government for which few have any respect, trust or confidence.

Our treasury department woefully short of revenues has the privately owned Federal Reserve monetizing sovereign debt because they cannot sell it all, some $300 billion in Treasuries and $750 billion in Agency debt as the Fed monetizes an additional $1.5 trillion in bank owned CDOs, collateralized debt obligations, so as to remove them from bank balance sheets so they can purchase Treasuries to compete the daisy chain of fraud. Ten-year Treasury note yields as a result have traded up to 3.84% from 2.35% just five months ago. Foreigners are sellers as an avalanche of Treasuries hit the street. The demand for Treasury funds over the next few years will be colossal. If government raises taxes the economy will fall further. As we forecast earlier the Fed could monetize $2.5 and $4 trillion in Treasuries and other toxic waste by the end of the calendar year. Incidentally, there is not a remote chance that the Fed will ever be able to withdraw funds from the system and every professional has to know that. The result is a collapsing dollar and higher gold and silver prices in anticipation of higher inflation. This year the dollar could easily break 71.18 on the USDX, the dollar index, versus six major weighted currencies. That would again cause, as it did from 11/07 to 6/08, countries and foreign businesses to reject taking dollars in trade. Such an event is in our crystal ball. Propaganda and smoke and mirrors won’t work this time.

Earlier this week our Secretary of the Treasury was booed, jeered and laughed at during a speech to students at Beijing University. That is what minds outside of the box think of our monetary policy. He said trust me, they said no. Needless to say, this was little reported in the mainstream media. The people representing the money powers that control our nation are viewed as an international disgrace. Foreigners recognize the financial Mafia that runs America, but most Americans are clueless to who the real power running America is.

We have heard much about the 40 to 60 times deposit ratios used by banks in the 2003 thru present period. Normally that ratio is 8 to 10 to one dollar on deposit. We painfully remember the subprime and ALT-A loans and the totally unqualified that received them. Then the loans that Fannie Mae and Freddie Mac should have never approved and finally the asset backed securities and collateralized debt obligation bonds foisted on professionals at AAA when they were in fact BBB.

What has not been publicized was the SEC position under pressure from the elitists on Wall Street during the easy money period and the steep yield curve to exempt brokerage houses from the net capital rule. That as well led to leverage of 40 to 60 to one. If the banks could do it they wanted to be able to do it too to compete. That decision ultimately led to five failures. Even a mitigating gold standard could not have surmounted lack of regulation. After almost 50 years in the markets and a former brokerage house owner we know financial institutions should never be allowed to self regulate. If we have financial regulation we cannot have regulators who are friend s with the people they regulate. No revolving door between Wall Street and the regulator. The same goes for the revolving door between Wall Street and banking and Washington, particularly in the Treasury Department. Real interest rates will always rise in a period of monetary and fiscal profligacy similar to what we are now experiencing as a result of unbridled leverage.

Keynesians will tell us such financial discipline is not possible in the real world, but of course it is. They just want to perpetually break the rules. There is no such thing as a self-regulating monetary policy. Distortion reigns instead of a slightly expansive classical free-market model. Markets can be far more rational then they are presently if the players are not allowed to run wild, as we have seen since 2002. In addition a privately owned Federal Reserve should never be allowed to exist never mind take on government responsibilities, such as financial regulation, which is currently contemplated. The Fed has always subordinated monetary policy to the desires of Wall Street and banking and at times has bowed to political expediency. The Fed is responsible for every recession and depression we have had since 1913. The great market distortions are all a product of Fed decisions. The Fed is now using adversity to expand its empire, taking on the responsibilities of government when it should not be allowed too. Its power to print money and credit has to be ended. No more papering over their mistakes or willful arrangements with Wall Street and banking. Who caused the dotcom boom and the housing bubble, they did.

As we predicted long end interest rates are already telling us that their policies are flawed as Treasuries fall in value and yields rise, a reflection of coming inflation, as the same time the dollar is falling and gold and silver are rising. The Fed is in a box and they cannot get out. From a fiscal perspective we have had five administrations that have created tremendous fiscal debt. The damage done by the last two administrations was horrendous. Don’t forget as interest rates rise on debt service the debt gets larger and larger. These higher rates are already limiting any housing recovery and we see rates moving higher; at least to 4% on the 10-year Treasury note. That would translate into a 30-year fixed rate mortgage of about 5-1/2%. That rate will disqualify many borrowers as unsold inventory increases via further foreclosures that will last into 2012. That means further price declines. That will further destabilize the banking system. The unsold housing inventory in lenders hands and the value of CDO and ABS bonds will fall as well.

The answer is elimination of the Fed. Its powers would be returned to the Treasury, which would have to be transparent and the revolving door between Treasury and Wall Street and banking closed. The Treasury would have to run a tight ship limiting money and credit creation to 5% and by raising interest rates. The crisis has to be addressed eventually and the longer it takes the worse it will be. The power to run Washington by Wall Street and banking has to end. The connection has to be broken. Treasury and Congress have to start acting responsibility and the financial service sector will have to accept lower profits, lower bonuses and a smaller industry.

Credit default swaps have to be settled and banned and all derivatives regulated. There has to be a permanent cap on leverage at banks and brokerage houses of 10 to one and their underlying financial bases have to be changed and closely monitored. If we do not make these changes the financial system as we now see it is doomed.

Within 2-1/2 years Treasury short-term debt will be $16.6 trillion, or 110% of GDP. This is close to 1`21% of GDP attained after WWII, as Thomas Jefferson said, “Loading up the nation with debt and leaving it for the following generations to pay is morally irresponsible.” This is the kind of society we have today. This year foreigners will have to buy $862 billion treasuries, up from $724 billion. We don’t see that happening so the Fed will have to buy $1.5 trillion worth, perhaps more.

Legislation to give Congress greater oversight of the Federal Reserve has been severely watered down on the Senate floor in private negotiations between Sen. Charles Grassley (R-IO), the top ranking Republican on the Finance Committee, who wanted more oversight and Richard Shelby (R-AL).

The Grassley Amendment intended to give the Comptroller General of the Government Accountability Office power to audit any action taken by the Fed – the third undesignated paragraph of Section 13 of the Federal Reserve Act, which would be almost everything that the Fed has done on an emergency basis to address the financial crisis, encompassing its massive expansion of opaque buying and lending.

Handwritten into the margins, however, is the amendment that watered it down “with respect to a single and specific partnership or corporation.” With that qualification, the Senate severely limited the scope of the oversight. Richard Shelby was fully responsible for this course of action. Actions will be limited to specific companies. This modified version does not allow the GAO to look at all taxpayer risk. It in no way threatens the Fed’s monopoly on monetary policy and their secret independence. The list of Fed actions that can be probed are listed but they still could be knocked out in committee. They are:

1. Actions related to Bear Stearns and its acquisition by JP Morgan Chase, including:

a. Loan To Facilitate the Acquisition of The Bear Stearns Companies, Inc. by JPMorgan Chase & Co. (Maiden Lane I)

b. Bridge Loan to The Bear Stearns Companies Inc. Through JPMorgan Chase Bank, N.A.

2. Bank of America — Authorization to Provide Residual Financing to Bank of America Corporation Relating to a Designated Asset Pool (taken in conjunction with FDIC and Treasury)

3. Citigroup — Authorization to Provide Residual Financing to Citigroup, Inc., for a Designated Asset Pool (taken in conjunction with FDIC and Treasury)

4. Various actions to stabilize American International Group (AIG), including a revolving line of credit provided by the Federal Reserve as well as several credit facilities (listed below). AIG has also received equity from Treasury, through the TARP, which would also be captured in amendment #1020.

a. Secured Credit Facility Authorized for American International Group, Inc., on September 16, 2008

b. Restructuring of the Government’s Financial Support to American International Group, Inc., on November 10, 2008 (Maiden Lane II and Maiden Lane III)

c. Restructuring of the Government’s Financial Support to American International Group, Inc., on March 2, 2009

5. TALF — finally, amendment #1020 would expand GAO’s authority to oversee the TARP, including the joint Federal Reserve-Treasury Term Asset-Backed Securities Loan Facility (TALF)

*Neither* Amendment #1021 nor #1020 would include short-term liquidity facilities:

1. Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility 2. (AMLF) 3. Commercial Paper Funding Facility (CPFF) 4. Money Market Investor Funding Facility (MMIFF) 5. Primary Dealer Credit Facility and Other Credit for Broker-Dealers (PDCF) 6. Term Securities Lending Facility (TSLF)

Section 404 of the Sarbanes-Oxley legislation has been a bonanza for accounting firms. It has caused a high proportion of major foreign companies to de-list themselves from the NYSE and it has erected an artificial barrier to the globalization of capital markets. Thus, it isn’t all bad as depicted by corporate America.

The size of the commercial paper market, a vital source of short-term funding for daily operations of many companies, fell $3.6 billion to $1.245 trillion, from $1.248 trillion the previous week. Asset-backed CP outstanding fell 8.3 billion to $557.4 billion after falling $8.7 billion the prior week. The top was $2.2 trillion.

Mortgage rates surged 0.38%. The 30-year fixed rate was 5.29% up from 4.91%.

Sales were weaker than expected at 63% of the 30 retailers tracked by Thomson Reuters. The S&P retailers index fell 2.5%. May same store sales fell 4.8%.

The International Council of Shopping Centers forecast a 3 to 4 percent drop in June same store sales, down from 4.6% in May.

Freight traffic on railroads continued down for the week of 5/23 yoy, off some 21.5%, but up 4.9% week-on-week. Loadings were down 16.4% in the West and 28% in the East. Farm products fell 4.8% and metallic ores fell 59.7%.

Trailers or containers fell 19.1% yoy, and container volume fell 19.1% yoy, as trailer traffic fell 37.2%.

Year-to-date carloads are off 19.3% ytd and trailers and containers 16.8%. Total volume was down 18.2%.

Something that should be remembered is that in 1930 government bonds were used massively for capital safety. In 1931, investors had doubts and started switching to gold, which ran up in price forcing interest rates higher. This is what is happening today.

In 1930, there was no shortage of bank reserves and that carried into 1931. There were excess reserves and interest rates were very low.

The financial atmosphere in 1928-29 was the same as it was here in 2005 and 2006. It was a new era, nothing could possibly go wrong. The Fed refused to reign in cheap money and credit. Commercial paper rates were 1.25% and excess reserves increased four-fold. In the late summer of 1931 gold began its run. History is about to repeat itself.

Fed Chairman Ben Bernanke deliberately lied to Congress this week. The Fed and the NY fed pumped credit aggressively after the 1929 crash and for the remainder of the 1930s. The exception was 1932 when gold took its big run. Bernanke denied this and it is an historical fact. He also duplicitously told Congress the Fed will not monetize debt, but that is exactly what he is doing. Ben is part of the fascist propaganda machine. Tell a lie long enough and big enough and everyone will believe it. This can be called Fed speak. Big Brother would have been very proud of Ben and his fellow Illuminists.

Dick Cheney attempted to win support for harsh interrogation of ‘suspected terrorists’ by controlling the information Congress would receive on the matter, a report says.

In 2005, the former US vice president directed ‘at least four’ related briefings with Congressmen during which he would produce ‘an impassioned defense’ of ‘enhanced interrogation techniques’ — the former administration’s euphemism for torture, The Washington Post reported on Wednesday.

“This is a really important issue for the security of the United States,” one official quoted Cheney as having told the lawmakers.

Officials, attending the meeting from the Central Intelligence Agency (CIA), with whom the program is associated, would also try quelling the Congressmen’s concerns about the program saying the agency owed half of its information on alleged ‘terrorists’ to the methods.

The former top gun has produced an ‘overrated’ account of the security gains of the former administrations ‘anti-terror’ campaign.

He has claimed that the Bush administration’s trademark ‘war on terror’ was likely to have saved “violent death of thousands, if not hundreds of thousands, of people” – an achievement which resembles that of World-War-II intelligence heroes.

The paper quoted Sen. Lindsey O. Graham (R-S.C.) as confirming Cheney’s leading role in selling the program. “His office was ground zero. It was his office you dealt with at the end of the day.”

Two more Iranian families accuse Blackwater, now known as Xe, of murdering their husbands and fathers in Baghdad and covering it up. Azhar Abdullah Ali, 33, a father of three, was a security guard for the Iraqi Media Network when Blackwater mercenaries killed him and two others on Feb. 7, 2007, according to the federal complaint. The family of Rahim Khalaf Sa’adoon claims drunken Blackwater mercenary Andrew Moonen killed Sa’adoon on Christmas Eve, “for no reason,” as Sa’adoon guarded the vice president of Iraq. The security guard family’s complaint states: “The Sabah Salman Hassoon, Azhar Abdullah Ali, and Nibrass Mohammed Dawood are but one of a staggering number of senseless deaths that directly resulted from Xe-Blackwater’s misconduct,” according to the complaint. Sa’adoon left two young children and his wife. Named as defendants are Erik Prince, Prince Group, EP Investments LLC, EP Investments LLC, Greystone, Total Intelligence, The Prince Group LLC, Xe, Blackwater Worldwide, Blackwater Lodge and Training Center, Blackwater Target Systems, Blackwater Security Consulting, and Raven Development Group. Both families seek punitive damages for war crimes, wrongful death, assault and battery, spoliation of evidence, and negligence. They are represented by Susan Burke with Burke O’Neil of Philadelphia.

Nonmanufacturing activity lost ground at a slightly slower pace in May, amid signs the sector may be preparing for recovery.

The Institute for Supply Management, a private research group, reported Wednesday that its NMI/PMI index stood at 44.0 from 43.7 in April and 40.8 in March.

That reading was below the 45.0 expected by economists. The ISM also said that its May business activity/production index came in at 42.4, from 45.2 in April.

The ISM report, which is comprised mainly of the service sector activities that make up the bulk of U.S. economic activity, arrives at a time when economic data are suggesting the recession may no longer be getting worse.

Factory orders rose in April less than expected, a barometer of capital spending by businesses plunged, and inventories fell an eighth straight month.

Orders for manufactured goods increased 0.7%, following a downwardly revised 1.9% decline in March, the Commerce Department said Wednesday. Originally, factory orders were seen dropping by 0.9% in March.

Economists had forecast overall April factory goods orders would rise by 1.0%. The report underscored the weakness of a sector that, while showing signs of improvement, is still limping.

Non-defense capital goods orders excluding aircraft decreased 2.4% in April after sliding 1.4% in March. Those bookings are seen as a yardstick for capital spending by businesses. Demand for durable goods were revised down to an increase of 1.7% in April. Last week, Commerce, in an early estimate, said durables surged 1.9% in April. Durables are expensive goods made to last at least three years, such as cars. Durables fell 2.2% in March.

Non-durable goods factory orders decreased 0.1%, after falling by 1.6% in March. A sign of future factory demand fell, down for seven straight months. Unfilled orders decreased 1.2% in April, after dropping 1.7% in March.

Business spending was atrocious in the first quarter of this year. Outlays fell by 36.9% January through March, after dropping 21.7% in the fourth quarter. The economy in those six months was dreary, with gross domestic product down 6.3% in the fourth quarter and 5.7% during the first quarter. Nearly half of that 5.7% drop was caused by U.S. businesses liquidating inventories to adjust for receding demand. The factory data Wednesday showed manufacturers’ inventories in April dropped 1.0%, after falling 1.2% in March.

More liquidation could be in the offing. The latest Commerce Department report on business inventories showed the inventory-to-sales ratio was a relatively high 1.44 in March. The gauge indicates how well firms are matching supply with demand. It measures how long in months a firm could sell all current inventory. A year earlier, the I/S ratio was 1.28.

The government now has an equity stake in auto lender GMAC Financial Services after providing $12.5 billion in aid to keep loans flowing to buyers of GM and Chrysler cars, the Treasury Department said Tuesday.

The Treasury holds a 35.4 percent stake in GMAC, after exchanging an $884 million loan it made to General Motors Corp. for that equity under an earlier agreement.

GM filed for Chapter 11 bankruptcy protection Monday, a historic move designed to remake the automaker as a smaller and leaner company, that also made the federal government its principal owner with a 60 percent stake.

The government has a vested interest in seeing GMAC, Chrysler and GM succeed in order to recoup the billions in aid it has doled out to the companies. Analysts have suggested the federal support for GMAC will help make it a lending powerhouse that will give GM and Chrysler a big advantage over their competitors — including U.S. rival Ford Motor Co. — which hasn’t taken government aid.

Mortgage rates rose sharply last week, and the volume of mortgage applications filed fell a seasonally adjusted 16.2% compared with the previous week, the Mortgage Bankers Association said Wednesday.

Applications were up an unadjusted 14.4% for the week ended May 29 from the comparable week in 2008, according to the Washington-based MBA’s survey, results for which were adjusted to account for the Memorial Day holiday.

The latest survey, which covers half of all U.S. retail residential mortgage applications, mirrored a similar pattern for mortgage filings seen in the week ended May 22. See full story.

Yields on Treasury notes, a key benchmark for setting mortgage rates, spiked a week ago. See Bond Report.

The most recent week-to-week drop in overall mortgage application volumes stemmed from a 24.1% decrease in refinancing activity among homeowners, the data showed. Filings seeking mortgages to purchase homes were up a seasonally adjusted 4.3%. The MBA’s four-week moving average for all mortgages was down a seasonally adjusted 9.0%. Refinancings made up 62.4% of all mortgage applications last week, down from 69.3% the previous week. Applications for adjustable-rate mortgages accounted for 3% of all activity, up from 2.6%. Interest rates charged on 30-year fixed-rate mortgages averaged 5.25% last week, up from 4.81% the previous week — the largest week-to-week jump since October 2008.

Points to obtain the rate averaged 1.02, down from 1.28 the week before. A point represents 1% of the total mortgage amount, charged as prepaid interest.

The average rate on 15-year fixed-rate mortgages came to 4.8% last week, up from 4.44% the week before, with points decreasing to 1.10 from 1.16.

And one-year ARMs averaged 6.61%, up from 6.55%, with points increasing to 0.15 from 0.12

Arthur Samberg, once the world’s biggest hedge-fund manager, said a federal insider-trading investigation is forcing him to shut Pequot Capital Management Inc. more than two decades after starting its first fund.

“With the situation increasingly untenable for the firm and for me, I have concluded that Pequot can no longer stay in business,” Samberg wrote in a letter to clients yesterday. Pequot oversees $3.47 billion, according to a May 15 regulatory filing, down from $4.3 billion in November and $15 billion in 2001, when it was the top-ranked hedge-fund firm by assets.

The U.S. Securities and Exchange Commission in January resumed a probe into whether Samberg’s funds illegally profited in 2001 by trading on inside information about Microsoft Corp., people familiar with the matter said at the time. That was about a year after the agency told Samberg and Morgan Stanley Chief Executive Officer John Mack they wouldn’t be accused of wrongdoing related to insider trading.

California is paying out so much for jobless benefits and collecting so little in payroll taxes that its unemployment insurance fund could be $17.8 billion in debt by the end of 2010, according to a new report from the state Employment Development Department.

This latest fiscal crisis won’t immediately affect the 1.1 million Californians now collecting benefits because the state is using an interest-free federal loan to cover their checks. But the state is supposed to repay that loan and restore its unemployment fund to solvency by 2011 – and right now, policymakers aren’t sure exactly how to do that, or at what cost. “The deficit that California looks like it is facing is staggering,” said Bud Bridger, fiscal officer for the unemployment insurance program.

To rebalance the system and pay back the federal loan, lawmakers must raise payroll taxes on employers, reduce benefits for recipients, or both.

In 2009 and 2010, the state expects to pay out $29 billion in benefits. It will collect just $11 billion. Counting the small positive balance that was in the fund at the end of 2008, the result is a $17.8 billion deficit at the end of 2010.

Upon further review, April Factory Orders were revised lower, to -1.9% from -0.9%.

Under the FASB’s new rules, companies can exclude non-temporary losses from net income. That’s on top of other things it already excludes.

By the comprehensive income benchmark, S%P 500 companies had combined losses in their previous four quarters of about $200 billion.

The gulf between net and comprehensive income usually isn’t as wide as it is now. General Electric CO. reported 2008 net income of $17.4 billion and a $12.8 billion comprehensive loss. Citigroup Inc.’s $48.2 billion comprehensive loss was $20.5 billion wider than the bank’s net loss.

The financial-services industry is taking steps to delay an accounting rule

that would force banks and others to bring some of their off-balance-sheet vehicles back onto their books next year, which could force some to raise additional capital.

Citigroup disclosed that it “will seek authorization from investors to increase its

outstanding common shares to as much as 60 billion, from a current limit of 15 billion.”

The government’s approach to the bankruptcies of General Motors Corp. and Chrysler LLC illustrates how this new, unstated policy works: Bondholders are told to give up legal rights, and cash, as part of a government-mandated tradeoff that favors a politically connected special-interest group.

The big threat is that this policy will extend to all bonds, including Treasury and municipal debt, not just corporate obligations.

Rising yields on long-term Treasury debt is a signal that the Federal Reserve should being raising interest rates, said Thomas Hoenig, the president of the Kansas City Federal Reserve district bank on Wednesday…”I suggest strongly that we need to be alert to the markets’ message and begin in earnest to bring monetary policy into better balance before inflation forces get out of hand,” Hoenig said.

The number of U.S. workers filing new claims for jobless benefits fell slightly as expected last week while total claims dropped for the first time since the start of the year, a fresh signal that the worst of the labor-market downturn has passed.

Still, the figures point to another sizable drop in payrolls, in excess of 500,000, when May employment data are released Friday.

Initial claims for jobless benefits fell 4,000 to 621,000 in the week ended May 30, the Labor Department said in its weekly report Thursday. The previous week’s figure was revised up slightly.

Economists surveyed by Dow Jones Newswires had expected initial claims would fall by 3,000.

The four-week average of new claims, which aims to smooth volatility in the data, rose 4,000 to 631,250. Meanwhile, the tally of continuing claims – those drawn by workers for more than one week in the week ended May 23 – slid 15,000 to 6,735,000, the first decline since Jan. 3. The unemployment rate for workers with unemployment insurance was 5%, unchanged from the previous week, which was revised down.

Not adjusted to reflect seasonal fluctuations, Illinois reported the largest jump in new claims during the May 23 week, 3,881, due to layoffs in the trade, service and manufacturing sectors.

North Carolina reported the largest decrease, 3,952, due to fewer layoffs in the construction, furniture and transportation industries

Productivity grew at a solid pace last quarter despite a steep contraction in output, suggesting companies have responded quickly to the recession by shedding workers and cutting hours. Non-farm business productivity rose 1.6%, at an annual rate, in the first quarter, the Labor Department said in revised figures released Thursday. That was double the first estimate of a 0.8% rise.

Economists in a Dow Jones Newswires survey had expected the revised data to show a 1.2% increase. Productivity, which is defined as output per hour worked, slid 0.6% in the fourth quarter of 2008.

Unit labor costs – a key gauge of inflationary pressures – rose 3% last quarter, at an annual rate, largely in line with expectations. They were up just 2.2% from one year ago, an indication that wage inflation remains contained.

Over the long run, productivity is key to improved living standards by spurring rising output, employment, incomes and asset values.

There’s a downside to that type of efficiency, though. Labor markets will likely remain under pressure in the near term as firms cut back on labor in response to, or anticipation of, weak demand. The May employment report, due Friday, is expected to show another monthly drop in payrolls in excess of 500,000, though that decline wouldn’t be quite as severe as the first four months of the year.

Non-farm business output tumbled 7.6% during the first quarter, at an annual rate, the Labor Department said Thursday. That was on the heels of a 8.8 plunge the previous quarter. Hours worked declined 9% last quarter, the biggest drop since 1975.

Productivity in the manufacturing sector slid 2.7% last quarter. Manufacturing output fell a record 21.7% and hours worked tumbled 19.5%, which was also a record.

Hourly compensation in the nonfarm business sector increased 4.6% last quarter. Real compensation, adjusted for inflation, jumped 7.1%

The Federal Deposit Insurance Corp., unable to get U.S. banks to sell toxic loans in a government program, plans to sell hard-to-price assets seized from failed lenders using guaranteed debt financing.

A test auction of illiquid bank assets, planned this month, was delayed yesterday after lenders raised capital without needing to sell bad loans, the agency said. The FDIC will instead use debt guarantees as an incentive for buyers of assets when lenders are in receivership, the agency said.

“If the FDIC can sell bad assets of failed banks, they will be a winner and it gives opportunities for the private sector as well,” said Ralph “Chip” MacDonald, a partner specializing in financial services at law firm Jones Day in Atlanta.

The Obama administration unveiled the two-part Public- Private Investment Program on March 23 as a centerpiece of its effort to shore up the financial system by removing illiquid assets. It would be funded by $75 billion to $100 billion from the

Treasury’s Troubled Asset Relief Program.

Since the program was announced, U.S. banks have raised capital through stock sales and by converting preferred shares, and as of yesterday the total reached almost $100 billion, according to data compiled by Bloomberg.

“Banks have been able to raise capital without having to sell bad assets through the LLP, which reflects renewed investor confidence in our banking system,” FDIC Chairman Sheila Bair said yesterday in a statement in Washington.

President Obama’s push for healthcare reforms gets a boost today from a new study by Harvard University researchers that shows a sizable increase over six years in bankruptcies caused in part by ever-higher medical expenses.

The study found that medical bills, plus related problems such as lost wages for the ill and their caregivers, contributed to 62% of all bankruptcies filed in 2007. On the campaign trail last year and in the White House this year, Obama had cited an earlier study by the same authors showing that such expenses played a part in 55% of bankruptcies in 2001.

Medical insurance isn’t much help, either. About 78% of bankruptcy filers burdened by healthcare expenses were insured, according to the survey, to be published in the August issue of the American Journal of Medicine.

With companies in no mood to hire, the U.S. unemployment rate jumped to 9.4 percent in May, the highest in more than 25 years. But the pace of layoffs eased, with employers cutting 345,000 jobs, the fewest since September.

If laid-off workers who have given up looking for new jobs or have settled for part-time work are included, the unemployment rate would have been 16.4 percent in May, the highest on records dating to 1994. Our calculation shows U6 to be 20.4% based on the 1980 formula which does not include the Birth/Death ratio.

Even with layoffs slowing, companies will be reluctant to hire until they feel certain that economic conditions are improving and that any recovery will last.

Since the recession began in December 2007, the economy has lost a net total of 6 million jobs.

As the recession — which is now the longest since World War II — bites into sales and profits, companies have turned to layoffs and other cost-cutting measures to survive the fallout. Those include holding down workers’ hours and freezing or cutting pay.

The average work week in May fell to 33.1 hours, the lowest on records dating to 1964. The number of people out of work six months or longer rose to more than 3.9 million in May, triple the amount from when the recession began.

Construction companies cut 59,000 jobs, down from 108,000 in April. Factories cut 156,000, on top of 154,000 in the previous month. Retailers cut 17,500 positions, compared with 36,500 in April. Financial activities cut 30,000, down from 45,000 in April. Even the government reduced employment — by 7,000 — after bulking up by 92,000 in April as it added workers for the 2010 Census.

Education, health care, leisure and hospitality were among the industries adding jobs in May.

The deepest job cuts of the recession came in January when 741,000 jobs disappeared, the most since 1949.

Federal Reserve Chairman Ben Bernanke repeated his prediction this week that the recession will end this year, but again warned that any recovery will be gradual.

Many economists believe the jobless rate will hit 10 percent by the end of this year. Some think it could rise as high as 10.7 percent by the second quarter of next year before it starts to make a slow descent. The post-World War II high was 10.8 percent at the end of 1982.

Ripple-effects from General Motors Corp.’s filing for bankruptcy protection — the fourth largest in U.S. history — could muddy the outlook, some analysts said. GM said earlier this week it will close nine factories and idle three others indefinitely as part of its restructuring. The closings, which will take place through the end of 2010, will cost up to 20,000 workers their jobs.

Government auditors would be allowed to examine the Federal Reserve’s response to the financial crisis – a move many believe would threaten the Fed’s independence – under an amendment adopted by the oversight committee of the US House of Representatives.

The amendment, proposed by congressman Dennis Kucinich, is subject to referral to the House financial services committee as well as approval in the Senate, and may never be law.

But it highlights the growing pressure in Congress for greater scrutiny of giant Fed lending and asset purchase programmes put in place to fight the financial crisis. The possibility of greater scrutiny could deter private sector companies from participating in some Fed programmes, reducing their effectiveness.

The Kucinich amendment goes far beyond legislation recently signed into law by Barack Obama, US president, which gives auditors access to Fed programmes that are blended with government bail-out funds.

It would give the Government Accountability Office authority to audit the Fed’s entire activities, including its commercial paper programme, primary dealer loans, term auction facility, foreign exchange swaps and asset purchases.

The Fed declined to comment on the amendment. But Ben Bernanke, Fed chairman, has told Congress’s joint economic committee he will “resist any attempt to dictate to the Federal Reserve how to make monetary policy”.

Mr Bernanke has said he views the Fed’s loan and asset purchase programmes as an extension of core monetary policy in extreme circumstances – a strategy he calls “credit easing”.

But critics, including within the US central bank, say its operations have crossed the line between fiscal and monetary policy, which is murky when interest rates are close to zero.

Some current and former senior Fed officials fear these actions invited a Congressional backlash against Fed independence, which is now emerging.

At the House budget committee this week, Democratic representative Lloyd Doggett told Mr Bernanke: “the Fed . . . seems to have sprung into action through the back door as a way for some to avoid another request to the Congress for public funds through the front door.”

In addition to pressure for more Fed disclosure, there has been talk of a renewed effort to strip the regional Fed presidents of votes at the federal open market committee.

The US Federal Reserve on Thursday damped expectations that it was preparing to prop up the market for distressed bubble-era securities backed by mortgages.

Hopes that the Fed would in the coming months start providing financing to investors seeking to buy residential mortgage-backed securities (RMBS) – many of which have lost their triple A credit ratings – have pushed prices on these assets higher in recent months.

William Dudley, president of the Federal Reserve Bank of New York, said on Thursday that a decision had not been made. “We have not made a final decision on whether it is doable and, if it is doable, whether it is worth the cost,” he said.

Mr. Dudley, who took over from Tim Geithner in January, has overseen the implementation of the $1,000bn term “asset-backed securities loan facility” (Talf), a key plank in the US government’s efforts to plug the hole left by the collapse of the asset-backed securities markets.

So far, the Talf has been used to finance the purchases of securities backed by loans to consumers, such as car and credit card loans. The Talf lends money to investors such as hedge funds on favourable terms, which encourages the purchases. This week, Talf financed 13 deals worth $16.4bn.

“We’re not back yet to the $200bn annual rate of issuance [for consumer loan-backed securities] before the crisis and we don’t expect to get there, but we are making a good start,” M.r Dudley said, stressing that the “securitisation markets are still significantly impaired”.

Now, the Fed is working to extend the Talf into more complex areas, such as loans backed by commercial property and also purchases of existing mortgage-backed securities, part of the pool of toxic assets that have contributed to billions of dollars of writedowns.

Funding purchases of toxic assets presents huge administrative hurdles because each security has to be analysed. Mr Dudley said many of these securities were no longer rated triple A, which may make them too risky. His comments on residential mortgage-backed securities are believed to also apply to commercial mortgage-backed securities. Although most of these are rated triple A, a wave of downgrades is anticipated soon by Standard and Poor’s.

It is in the commercial mortgage market – used to fund office blocks and shopping centres – that the Talf is most needed, however.

The 9.4 percent May unemployment rate is based on 14.5 million Americans out of work. But that number doesn’t include discouraged workers, people who gave up looking for work after four weeks. Add those 792,000 people, and the unemployment rate is 9.8 percent.

–The official rate also doesn’t include “marginally attached workers,” or people who have looked for work in the past year but stopped searching in the past month because of barriers to employment such as child care, poor health or lack of transportation. Add those 1.4 million people, and the unemployment rate would be 10.6 percent.

–The official rate also doesn’t include “involuntary part-time workers,” or the 2.2 million people like Noel who took a part-time job because that’s all they could get, plus those whose work hours dropped below the full-time level. Once those 9.1 million workers are added to the unemployment mix, the rate would be 16.4 percent.

All told, nearly 25 million Americans were either unemployed, underemployed or had given up looking for a job in May.

The ranks of involuntary part-timers has increased by 4.9 million in the past year, according to a May study by the Federal Reserve Bank of Cleveland. Many economists now predict unemployment won’t peak until 2010. And since employers generally increase the hours of existing workers before hiring new ones, workers could be looking for full-time jobs for some time.

Even so, one economist said the increase in involuntary part-timers might have a silver lining. Gary Burtless, a senior fellow in economic studies at the Brookings Institute, said employers are likely cutting back everyone’s hours instead of laying off people.

The Federal Reserve’s latest weekly money supply report Thursday shows seasonally adjusted M1 rose by $12.2 billion to $1.602 trillion, while M2 rose $30.8 billion to $8.358 trillion.

Rumor has it that JPMorgan Chase has big loan problems in the Middle East.

Russian President Dmitry Medvedev says Russia and China should consider switching to domestic currencies without using the US dollar, as China has done with Brazil and Belarus, using currency swaps. Russian – Chinese trade in 2008 was $50 billion.

Yes, there were 345,000 jobs lost in May, but the Birth/Death ratio added 220,000 jobs out of thin air. The true number of jobs lost was 565,000.

Payrolls in construction fell 59,000 versus a fall of 108,000 in April as the government stimulus package takes hold. Services lost 120,000 and manufacturing 156,000 versus 154,000 in April.

The Economic Cycle Research Institute’s US Future Inflation

Gauge designed to anticipate cyclical swings in the rate of inflation, rose to 79.8 in May from 78.1 in April. This is exactly as we predicted, the affect of monetization.

The annualized growth rate climbed to a minus 26.9% from 33.8%.

As long as China continues to both run a trade surplus and manipulate its currency it has little choice but to put the proceeds in the Treasury market.

The Fed has hired lobbyist Linda Robertson as it seeks to counter skepticism in Congress about the Fed’s growing power over the US financial system. She previously headed the Washington lobbying office for Enron. She was also an adviser to all three of Clinton’s administration’s Treasury Secretaries.

The Fed is in deep trouble and we hope we were responsible for part of it.

On Thursday, the Fed reported holding 1.114 trillion in securities: held outright of which only $18 billion were T-bills, $540 billion were T-notes, $80 billion were Agency securities and $437 billion were mortgage backed bonds. The worse the Treasury market performs the longer the Fed becomes. The Fed is in deep trouble because as time goes on at least $2.5 trillion more will be added; perhaps by the end of the year.

Benefit spending soars to new high: The recession is driving the safety net of government benefits to a historic high, as one of every six dollars of Americans’ income is now coming in the form of a federal or state check or voucher.

Benefits, such as Social Security, food stamps, unemployment insurance and health care, accounted for 16.2% of personal income in the first quarter of 2009, the Bureau of Economic Analysis reports.

That’s the highest percentage since the government began compiling records in 1929. [More than 30s]

In all, government spending on benefits will top $2 trillion in 2009 — an average of $17,000 provided to each U.S. household, federal data show.

The Treasury said it will sell $127B of bills, notes and bonds next week – $35B in 3s, $19B in 10s and $11B of 30s, $31B in three-month bills and $31B in six-month bills.

South Korea’s National Pension Service, the country’s largest investor, said it will maintain its U.S. government bond holdings even as it cuts the percentage they comprise.

“We are planning to reduce the weightings of American Treasuries, but that doesn’t mean we will be selling Treasuries because our fund size is growing,” National Pension said in a statement in response to questions from Bloomberg News. “We don’t have a specific plan to sell Treasuries.”

The Fed monetized $7.49B of 2s and 3s on Thursday. After abstaining for about a week, the Fed has conducted back-to-back monetizations.

While most key economic indicators are decreasing at a slower rate, the year-over-year contractions in truck tonnage accelerated because businesses are right-sizing their inventories, which means fewer truck shipments. The absolute dollar value of inventories has fallen, but sales have decreased as much or more, which means that inventories are still too high for the current level of sales. Until this correction is complete, freight will be tough for motor carriers.

NYSE data released yesterday shows that Goldman Sachs again is dominating program trading. For the week of May 26 to 29, Government Sachs traded 741.7m shares for its own account, 13.5m for customer facilitation, and 115.4m as agent. This is approximately 7–1 proprietary to customer.

California is paying out so much for jobless benefits and collecting so little in payroll taxes that its unemployment insurance fund could be $17.8 billion in debt by the end of 2010, according to a new report from the state Employment

Development Department.

Unemployment insurance is funded primarily by a payroll tax that costs employers up to $434 per employee, per year. That formula hasn’t been changed since 1985.

The decision, which would make it hard for Americans in London to open bank accounts and trade shares, is being discussed by executives at Britain’s banks and brokers who say it could become too expensive to service American clients. The proposals, which were unveiled as part of the president’s first budget, are designed to clamp-down on American tax evaders abroad. However bank bosses say they are being asked to take on the task of collecting American taxes at a cost and legal liability that are inexpedient.

A decision by Falls Police to use a Taser to obtain a DNA sample from a suspect in an armed robbery, shooting and kidnapping is not unconstitutional.

Ron Paul’s audit the Fed bill is now up to 186 cosponsors!

That means over 40% of the entire House of Representatives is currently signed onto HR 1207.

And thanks to your hard work, Representative Steve Scalise is one of the 186 proud cosponsors.

Not only has over forty percent of the House cosponsored HR 1207, but Barney Frank has even promised Ron Paul that he will hold hearings in the House Financial Services Committee.

When these hearings occur in a few months, Ron wants to have a majority of House members on board . . . so there will be no stopping Audit the Fed.

It is amazing what we’ve been able to accomplish in the House on the back of tireless grassroots efforts.

But now it is time to start thinking about the next step.

Pretty soon we will be turning our attention to the Senate, where we are certain to face a more difficult fight. There, corporate lobbyists and Beltway insiders wield even more powerful influence.

Many Senators are already bought and sold by Wall Street bankers and their Federal Reserve flunkies.

And the Banking Lobby is already pumping piles of cash into Senate campaign coffers in a preemptive stand against Federal Reserve transparency.

Fortunately, Campaign for Liberty has been developing a grassroots program and a massive marketing campaign to counter the banksters’ efforts.

And we’re almost ready to launch. But it won’t be cheap, and we can’t afford to run out of gas before the job is done and Audit the Fed is passed.

Can you chip in $25 to help counter the millions of Wall Street dollars and corporate contributions ?

If you can afford more, every extra dollar will be poured into our campaign to pass Audit the Fed in the Senate.

As we close in on 50% support for Audit the Fed in the House of Representatives, the time is nearing to officially unleash the Ron Paul R3volution on the Senate.

If you can, please click here to make a contribution to help Campaign for Liberty launch our Audit the Fed program in the Senate.

In Liberty,

John Tate

President

P.S. Unlike the Federal Reserve, Campaign for Liberty cannot just print money out of thin air. Can you chip in $20 today to help us restore sound money by Auditing the Fed?