Is this a “Game Changer” for Lithium? Strategic Battery Metal Known as “White Petroleum”

2018 was a terrible year for commodities, but few sectors fared as badly as lithium.

The crucial battery metal, also known as “White petroleum”, struggled through a 50 percent price correction as supply soared and demand fears spread like wildfire.

But it isn’t time to give up on lithium stocks just yet.

The rising stars of the hard-rock lithium space are transforming the industry with their remarkable ability to extract lithium at a lower cost and faster pace than the lithium majors can from their brine deposits. In short, there’s a new caliber of producer in town and – with lithium demand set to soar once again – their timing could not be better.

The three stand out companies in the hard-rock mining space at the moment are Albemarle (NYSE:ALB), Chinese Tianqi Lithium (SZSE:002466) and Power Metals (TSXV: PWM; OTC:PWRMF). And each of these companies are able to bring lithium to market faster and cleaner than their brine-based competitors.

Before examining the hard rock lithium space though, we need to take a closer look at the market itself. Overall, the supply-demand balance is actually much tighter than prices suggest. After all, the soaring demand from tech and energy sectors that triggered lithium’s meteoric rise in 2018 didn’t vanish overnight.

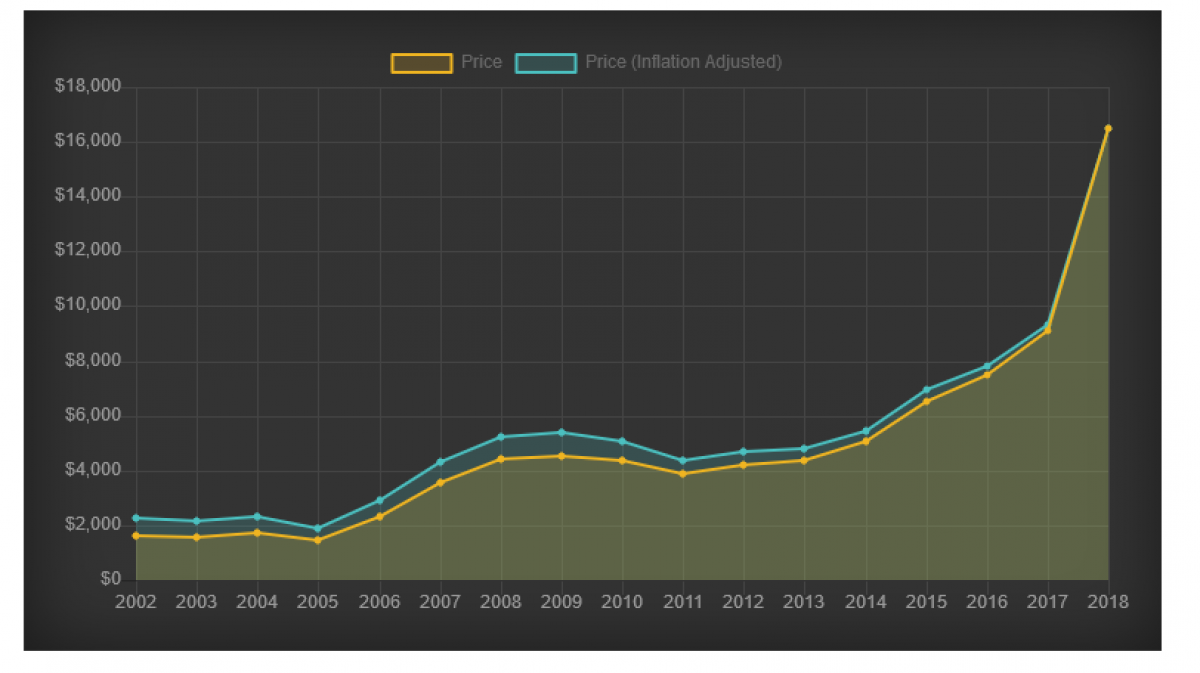

The lithium boom began in earnest in 2014, with prices rising from less than $6k a ton to more than $16k by 2018. With demand soaring, billions were invested in new mines, with salt brine deposits in Chile and China getting most of the attention.

But after a few banner years, Wall Street started looking at Lithium with more suspicion. In February 2018 Morgan Stanley issued a crushing report: the firm determined that Chilean brine would add 200kt to the market by 2025, effectively doubling supply.

That sent lithium prices plummeting. In China, lithium carbonate prices fell by 50.31%, crushed by reports of the over-supply.

But by year’s end, some of those fears had begun to dissipate. Huge projects that were expected to flood the market began experiencing delays.

You see, salt brine lithium production, which accounts for most of the market, takes a while to get going: salt water is pumped to the surface where it evaporates to form potassium deposits containing lithium.

Take Orocobre in Brisbane, Australia, and its Salar de Olaroz facility in Argentina, which was meant to supply 42.5k tons. Delays, legal troubles and mounting expenses has brought the project basically to a halt.

Mining lithium through salt brine evaporation can generate big earnings, but only for firms with the capital to see them through: for that reason, the lithium sector is dominated by larger companies such as Albemarle (NYSE:ALB), FMC (NYSE:FMC) and SQM (NYSE:SQM)

These major firms saw their prices tank last year, as the lithium bubble burst in the wake of the Morgan Stanley report and fears of future over-supply.

But that doesn’t mean the lithium party is over. In fact, it may have only just started.

Hard-rock lithium miners in hotspots such as Australia, Canada and China are warming up for the next bull run in this crucial commodity.

The legendary Greenbushes mine which is operated by Tianqi (SZSE:002466) and Albemarle (NYSE:ALB) has been in operation for 30 years, and produces a safe and ‘dry’ source of lithium gained from ‘spodumene’, a mineral that contains high-grade lithium.

On the other site of the planet in North-East Ontario, and not far from Tesla’s battery producing ‘gigafactory’ lies the prolific Case Lake property which is 100% claimed by Power Metals (TSXV: PWM; OTC:PWRMF)

The lithium holding spodumene here is found in pegmatite zones of which the metallurgy is currently being tested by SGS Canada.

Hard rock miners do not only have cleaner production methods, they also have one leg up on the competition as they are likely to bring new supply to the marketplace quicker than their brine-mining peers do.

According to Benchmark Minerals intelligence, there’s a huge discrepancy between lithium prices and the lithium demand side.

In September 2018, analysts at CRU estimated a lithium surplus for the year of only 22k tons, against demand of 277k tons.

Let’s take a look at key demand drivers for lithium.

First, there’s electric vehicles (EV). According to Argus Media, lithium ion batteries in EVs have increased from 10 GWh to 70 GWh in only a decade, with estimates placing the market to reach 223 GWh by 2025, an increase of 300x from current levels.

EVs have been taking off in the United States, with sales increasing by 81% in 2018, though a more modest increase is expected in 2019. EVs take up 2.4% of total vehicles in the United States.

Where demand is really soaring is in China. More than 2 million EVs will be sold this year, up from 1.1 million last year. It’s part of the government’s plan to have 50% market share for EVs by 2025.

Consumers in Europe are also turning towards EVs, which now make up considerable portions of total vehicle fleets in Norway, Holland and France. EV sales jumped 67% in Europe, led by affordable EV models from Renault and Nissan.

Fastmarket predicts EV market penetration of 15% by 2025, up from only 2% currently. But with such ambitious plans in place in China, one of the world’s most important car markets, that figure could be on the conservative side.

According to Simon Moores of Benchmark Minerals, EVs and an increase in battery storage demand “has sparked a wave of lithium ion battery mega factories,” such as Tesla’s famous Gigafactory. Currently, 70 lithium-ion battery “mega” factories are under construction, up from only 17 in October 2017.

Elon Musk wants 20 gigafactories producing lithium batteries for Tesla EVs by the next decade. Benchmark thinks new factories will be using up 534,000 tons in new demand (on top of current demand of 200,000 tons) by 2028.

That’s the other demand side factor: as the energy storage sector grows, demand for lithium-ion batteries will grow by leaps and bounds. By one estimate, the market could reach $92 billion by 2024, with a CAGR of 16%. The market was worth $21.6 billion in 2018.

A slightly more conservative estimate has the market reaching $40 billion by 2025, but that’s still nearly 100% in growth in less than a decade. Another estimate is $60 billion by 2024. Due to declining prices, Bloomberg raised its forecast for lithium ion batteries due to lower than expected prices.

The best estimate is from Global Market Insights, which predicts energy storage and automotive lithium ion battery demand to double by 2024.

The expectation from GMI is that the bulk of new battery production will come from China, where batteries have a large internal market.

So how will this play out in the lithium sector?

One major take-away here is that traditional lithium production—through salt-brine evaporation—may lose market share to newer and more competitive production methods, particularly spodumene or “hard-rock” lithium mining, where the lithium is extracted by drilling directly into rich deposits.

Extracting lithium in this way is cheaper, easier and faster—and it’s starting to attract more attention, with multiple spodumene operations popping up in Australia. Lithium giant Albemarle has gone so far as to halt all expansions of salt brine in South America, the so-called “lithium triangle,” and has instead been pouring resources into the Greenbushes project, where capacity is doubling.

Demand for spodumene is reflecting rising prices, which spiked in 2018 even as lithium prices across the board were slumping.

In 2018 there were four new spodumene operations. But in China, General Lithium Corp. is planning a new mineral ore converter project that will triple production capacity for lithium by the end of 2020.

The plant will take in spodumene and convert it into lithium—60,000 tons per year, according to company estimates. That’s from 135,000 tons of spodumene.

As we mentioned before, Canadian hard-rock miner Power Metals (TSXV: PWM; OTC:PWRMF) has drilled approximately 15,000 meters at its very valuable Case Lake Property in North-East Ontario. In fact, Power Metals drilled more than any other hard rock lithium company in North America last year. The size of its deposits are quite impressive and easy to mine as they are concentrated very close to the surface. The average grade is also world class, and at approximately 1.75% Li20 with intervals as high as 3.5%, it competes directly with projects like Greenbushes in Australia, the world’s largest operating hard-rock lithium mine.

Next to the prolific Case Lake project, Power Metals is also developing the Paterson Lake and Gullwing Tot Lake properties in Ontario, which, according to its VP of exploration Julie Selway, could be the next gamechanging hard-rock lithium plays in Canada.

Power Metals is just one example of this new trend in the lithium space. The entire sector is being transformed from within, and with prices stabilizing there are plenty of opportunities for investors in 2019.

A lithium renaissance is well and truly underway, and it is hard-rock miners who find themselves at the forefront of this movement.

Companies to watch in the lithium space:

FMC Corp. (NYSE:FMC): FMC was founded in 1883, and has been around the block and back. FMC has a long history stretching between many different industries, but within all of them, FMC has remained a leader in innovation.

FMC’s involvement in the lithium industry is particularly notable. The company is one of the top three in lithium and associated technologies. It is one of the largest suppliers into electric vehicle applications using lithium hydroxide.

Anno 2019, this major miner is one of the world’s top producers of lithium. FMC was struck by the negative sentiment in lithium markets back in 2018, but has rallied back to near 5-year highs.

Long-term growth in lithium demand is expected to drive margins for FMC and major expansion, and leading analysts to give it a buy rating.

Sociedad Química y Minera de Chile (NYSE:SQM): SQM benefited from skyrocketing lithium prices in 2015-2016. The price per ton shot up from $7,500 to nearly $20,000 on the back of rising demand and short supply. SQM was forced lower in 2018 after While Morgan Stanley predicted that supplies would vastly exceed demand by 2021.

This year, however, could be a turnaround year for this leading Chilean miner as it sees Chinese demand for lithium carbonate pick up once again.

The challenge in 2019 for SQM remains to keep the smart money investing in its stock while it attempts to decrease costs at its key brine operations.

Albemarle (NYSE:ALB): Albemarle is a diversified lithium miner that brings in consistent revenue.

The company was a major earner in 2017, and its stock increased by 130 percent from 2016 to 2018. The company kept on beating analyst forecasts in 2018 despite the lithium price crash, and while analyst predictions remain modest for Q1 2019, the company is set see its profits increase further by the end of the year.

Despite the fall in prices and concern surrounding over-supply, Albemarle is pumping up production for 2019. The company is planning on bringing back lithium production inside the United States: it recently acquired the Kings Mountain lithium mine, which was once in production in the 1990s. Next to that, Albemarle, together with Tianqi Lithium, operates the Greenbushes hard-rock lithium mine in Australia.

Orocobre (TSX:ORL): This company has had some serious problems in the past, and its stock price has fallen significantly from January 2018 highs. The company’s flagship project is the Salar de Olaroz lithium project located in the Jujuy province of northern Argentina.

Despite the fact that EV makers are using some 76% more lithium to produce battery packs this year, Orocobre’s CEO Perez de Solay voiced concern about price volatility and with it the increasing difficulty to find financing for new products.

*

Note to readers: please click the share buttons below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.