Historical Analysis of the Global Elites: Ransacking the World Economy Until ‘You’ll Own Nothing’

Part 1: 5,000 Years Setting the Stage

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

First published on December 27, 2023

***

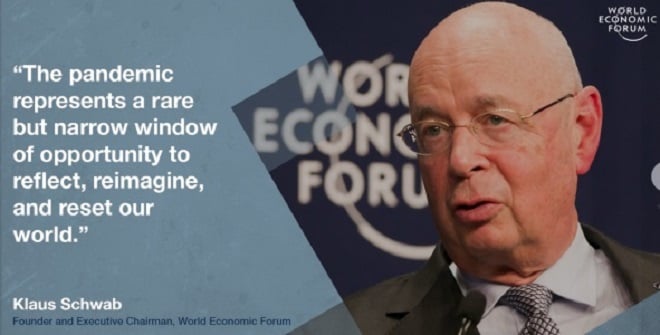

According to a video published by the World Economic Forum in 2016, by 2030 ‘You’ll Own Nothing. And You’ll Be Happy.’

See ‘8 predictions for the world in 2030’.

Clearly, if this prediction is to come true, then many things must happen. Let me identify why the World Economic Forum believes it will happen and then investigate these claims. Among other questions, I will examine whether those who will own nothing will include the Rothschild, Rockefeller and other staggeringly wealthy families. Or, perhaps, whether they just mean people like you and me.

In fact, a primary intention behind the Elite’s ongoing technocratic coup, initiated in January 2020, is to trigger a process of depopulation, as well fundamentally reshape world order including by turning those humans left alive into “transhuman slaves”, drive the global economy to collapse and implement the final redistribution of global wealth from everyone else to this Elite.

In fact, a primary intention behind the Elite’s ongoing technocratic coup, initiated in January 2020, is to trigger a process of depopulation, as well fundamentally reshape world order including by turning those humans left alive into “transhuman slaves”, drive the global economy to collapse and implement the final redistribution of global wealth from everyone else to this Elite.

Let me start with the briefest of histories so that what is happening can be understood as the ultimate conclusion of a long-standing agenda, identify who I mean by the ‘Global Elite’ (and its agents), then present the evidence to explain how this is happening and, most importantly, a comprehensive strategy to defeat it.

Needless to say, in the interests of keeping this study manageable, many critical historical events – including how imperialism and colonialism, the international slave trade, a great number of wars and coups, Wall Street support for the Bolshevik Revolution in Russia in 1917 and precipitation of the Great Depression in 1929, were used to advance the Elite program – are not addressed in this investigation. But for accounts of the latter two events which provide evidence consistent with the analysis offered below, see Wall Street and The Bolshevik Revolution and The Secrets of the Federal Reserve.

A Brief Economic History

Following the Neolithic revolution 12,000 years ago, agriculture allowed human settlement to supersede the hunter-gatherer economy. However, while the Neolithic revolution occurred spontaneously in several parts of the world, some of the Neolithic societies that emerged in Asia, Europe, Central America and South America resorted to increasing degrees of social control, ostensibly to achieve a variety of social and economic outcomes, including increased efficiency in food production.

Civilizations emerged just over 5,000 years ago and, utilizing this higher degree of social control, were characterized by towns or cities, efficient food production allowing a large minority of the community to be engaged in more specialized activities, a centralized bureaucracy and the practice of skilled warfare. See ‘A Critique of Human Society since the Neolithic Revolution’.

With the emergence of civilization, elites of a local nature (such as the Pharoahs of Egypt), elites with imperial reach (including Roman emperors), elites of a religious nature (such as Popes and officials of the Vatican), elites of an economic character (particularly the City of London Corporation) and elites of a ‘national’ type (especially the monarchies of Europe) progressively emerged, essentially to manage the administration associated with maintaining and expanding their realms (political, economic and/or religious).

The Peace of Westphalia in 1648 formally established the nation-state system in Europe. Enriched by the long-standing and profitable legacy of their control over local domestic populations, support for the imperial conquest of non-European lands, colonial subjugation of indigenous peoples and the international slave trade, European elites, backed by military violence, were able to impose a long series of changes over national political, economic and legal systems which facilitated the emergence of industrial capitalism in Europe in the 18th century.

These interrelated political, economic and legal changes facilitated scientific research that was increasingly geared towards utilizing new resources and technological innovation that drove the ongoing invention of machinery and the harnessing of coal-fired power to make industrial production possible.

Beyond this, and following several centuries of more and less formal versions of it, Elite political and economic imperatives drove the ‘legal’ enclosure of the Commons to force people off their land and into the poorly-paid labour force needed in the emerging industrial cities. In these cities, an ongoing series of developments in the organization of work in factories, electrification, banking, and other changes and technologies dramatically expanded the gap between rich and poor. Along with subsequently imposed changes to education and, later, healthcare, national economies and the global economy were increasingly structured to profoundly disconnect ‘ordinary’ people from their land, traditional knowledge and long-standing healthcare practices to make them dependent while dramatically reinforcing an institutional reality progressively consolidated since the dawn of human civilization: Elite control ensured that the economy perpetually redistributed wealth from those who have less to those who have more.

As noted by Adam Smith, for example, in his classic work An Inquiry into the Nature and Causes of the Wealth of Nations published in 1775: ‘All for ourselves, and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind’.

And this was exemplified, for example, by the 150-year struggle between the bankers working to establish a privately-owned central bank in the newly independent United States and those Presidents (such as Andrew Jackson and Abraham Lincoln) and members of Congress who worked tirelessly to defeat it. In fact: ‘Most of the founding fathers realized the potential dangers of banking and feared bankers’ accumulation of wealth and power.’ Why?

Having observed how the privately-owned British central bank, the Bank of England, had run up the British national debt to such an extent that Parliament had been forced to place unfair taxes on the American colonies, the founders in the US understood the evils of a privately-owned central bank, which Benjamin Franklin later claimed was the real cause of the American Revolution.

As James Madison, principal author of the US Constitution argued: ‘History records that the Money Changers used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money, and its issuance.’ Another founder, Thomas Jefferson, put it this way: ‘I sincerely believe that banking institutions are more dangerous to our liberties than standing armies. The issuing power should be taken from the banks and restored to the people to whom it properly belongs.’ As it turns out, the battle over who would get the power to issue US money raged from 1764, changing hands eight times, until the bankers’ final deceitful victory in 1913 with the establishment of the Federal Reserve System. ‘The battle over who gets to issue our money has been the pivotal issue throughout the history of the United States. Wars are fought over it. Depressions are caused to acquire it. Yet after WWI, this battle was rarely mentioned in the newspapers or history books. Why? By WWI, the Money Changers with their dominant wealth had seized control of most of the nation’s press.’ Watch The Money Masters: How International Bankers Gained Control of America (with the relevant section of the four-part transcript of the video available here: ‘The Money Masters: Part I’.)

Why the objection to a private central bank? Well, consider the formation and ownership of the inaccurately named Bank of England, established in 1694.

By the end of the C17th, England was in financial ruin: 50 years of more or less continuous wars with France and Holland had depleted it. So government officials asked the bankers for the loans necessary to pursue their political purposes. What did these bankers want in return? ‘The price was high: a government-sanctioned, privately owned bank which could issue money created out of nothing.’ It became the world’s first privately-owned central bank and, although it was deceptively called the Bank of England to make people think it was part of the government, it was not. Moreover, like any other private corporation, the Bank of England sold shares to get started. ‘The investors, whose names were never revealed, were supposed to put up 1,250,000 British pounds in gold coins, to buy their shares in the bank. But only 750,000 pounds was ever received.’ Despite that, the bank was duly chartered in 1694 and started the business of loaning out several times the money it supposedly had in reserves, all at interest.

Let me restate that for clarity: The British government legislated to create a privately-owned central bank (that is, a bank owned by a small group of wealthy individuals) that loaned out vast amounts of money it did not have so that it could make a profit by charging interest.

This practice is called ‘fractional reserve banking’ to make it sound like some sophisticated economic concept rather than a deceitful practice that, should you or I do it, we would be jailed. ‘In exchange the Bank would loan the British politicians as much of the new currency as they wanted, as long as they secured the debt by direct taxation of the British people.’ In other words, the Bank could not lose.

So, as William T. Still notes: ‘legalization of the Bank of England amounted to nothing less than the legal counterfeiting of a national currency for private gain.’

‘Unfortunately’, he goes on, ‘nearly every nation now has a privately controlled central bank, using the Bank of England as their basic model. Such is the power of these central banks, that they soon take total control over a nation’s economy. It soon amounts to nothing else than a plutocracy, rule by the rich.’ Watch The Money Masters: How International Bankers Gained Control of America (with the relevant section of the four-part transcript of the video available here: ‘The Money Masters: Part I’.)

Before proceeding, if how the banking system works isn’t your strong point, this brief video does a good job of spelling out essential points in a non-technical way. Watch ‘Banking – the Greatest Scam on Earth’.

And for a thoughtful explanation of the meaning and history of money, see Nick Szabo’s superb article ‘Shelling Out: The Origins of Money’.

In any case, the fundamental point is simple: After 5,000 years, the various processes by which local elites, then ‘national’ elites, then international elites, and now the Global Elite have continuously asserted their control to enhance their capacity to shape how the world works and to accumulate wealth has now reached its climax. Thus we are on the brink of being herded into an Elite-controlled technocracy in which, as the World Economic Forum makes clear: By 2030 ‘You’ll Own Nothing. And You’ll Be Happy.’

So you will own nothing.

And why would you be happy about that? Because you will be a transhuman slave: an organism that no longer even owns their own mind.

Who is the Global Elite and How does it Operate?

Many authors have, directly or indirectly, addressed this question and each has come up with their own nuanced combination of wealthy individuals and families, their political connections, as well as the financial instruments and organizational structures through which their power is gained and exercised.

For the purposes of this study, I am going to define the Global Elite as those families that had acquired their vast wealth and firmly established their preeminent political and economic power in global society by the end of the 19th century. These families have thus played the central role in shaping institutions and events both before but also since that time, thus providing the framework in which other wealthy people have since emerged.

In order to perform their fundamental role in shaping the modern world to serve their purposes, this Elite has facilitated the creation of a vast network of agents – corporations, institutions, other families and individuals – who are owned and/or controlled by this Elite and act as ‘fronts’ to advance Elite interests. In any given period, the Elite families remain largely unchanged (while succeeding generations of individuals further the families’ interests) but the organizational and individual agents through which these families work vary, depending on Elite aims in the contexts it precipitates.

Let me briefly illustrate my approach by using one family – the ‘House of Rothschild’ – as a case study before moving onto a wider description of how Elite families use their wealth to shape corporations, institutions, events and people to serve their own purposes.

This example is drawn from the official Rothschild Archive and two (sometimes conflicting) Rothschild-authorized accounts of the family’s history written at different times. See The Rothschild Archive, The House of Rothschild – Money’s Prophets, 1798-1848 and The Rothschilds: A Family Portrait.

In addition, the account draws on sources that report neutrally on Rothschild involvement as well as some sources that are critical. These sources are cited in context below.

By the mid-18th century, the ancestors of Mayer Amschel had long been small merchants in the town ghetto of Frankfurt. But, as a Jew without a family name and before street numbering was used, Mayer was also known by the name some ancestors had used on the house sign where they once lived: Rothschild (Red Shield). With more ability than other merchants and having been sent to learn the rudiments of business in the firm of Wolf Jakob Oppenheim, he became a dealer in rare coins, medals and antiques, the buyers of which were almost invariably aristocratic collectors, including William, Hereditary Prince of Hesse-Kassel. It was this business that enabled Mayer Amschel to accumulate the capital to move into banking, a natural outgrowth of his policy of extending credit to some of his clients. His wealth started to increase rapidly as he focused more on state and merchant banking, both local and international.

Image: Jacob Rothschild (Source: Wikimedia Commons)

With a policy of seeking little profit from interest on loans while seeking trade concessions in other areas, seeking clientele only among ‘the noblest personages in Germany’, secret bookkeeping in parallel with the official one and, later, deploying his five sons to replicate his style and activities in England (Nathan, who, after a few years in Manchester, established himself in the City of London), Paris (Jakob, known as James), Naples (Kalman, or Carl), Vienna (Salomon) as well as Frankfurt (where eldest son Amschel eventually succeeded father Mayer), the Rothschild dynasty and ‘multinational business model’ quickly established itself throughout Europe. Critically, it was serviced by the maintenance of close relationships with leading political figures and salaried agents working in financial markets who provided essential political and commercial news, as well as private communications channels (including coaches with secret compartments) that worked with enormous efficiency.

And it was this ‘Red Shield’ communication network, later operating under Royal patronage, combined with a certain audacity, that enabled the Rothschilds to profit handsomely from a variety of adverse circumstances including the restrictions on trade between England and the continent which characterized the Napoleonic period, and the Napoleonic Wars as well. This included smuggling vast amounts of contraband goods from England to the continent and transferring a substantial hoard of gold bullion through France to finance the feeding of Wellington’s army.

Most spectacularly, and despite family efforts to suppress awareness of this fact, the Rothschilds profited enormously from their privileged notice that Wellington defeated Napoleon at Waterloo in 1815, as recorded by William T. Still and Patrick S.J. Carmack in their 3.5 hour documentary The Money Masters: How International Bankers Gained Control of America (with the relevant section of the four-part transcript of the video available here: ‘The Money Masters: Part II’.)

How did this happen?

Following a long series of wars across Europe and the western Mediterranean, during which he was very successful, rapidly promoted and, in 1804, elected Emperor of France, Napoleon was eventually defeated. He abdicated and was exiled to Elba, an island off the Tuscan coast, in 1814 but escaped nine months later in February 1815.

As he returned to Paris, French troops were sent out to capture Napoleon but such was his charisma that ‘the soldiers rallied around their old leader and hailed him as their emperor once again.’ And, having borrowed funds to rearm, in March 1815 Napoleon’s freshly equipped army marched out to be ultimately defeated by Britain’s Duke of Wellington at Waterloo less than three months later. As Still remarks: ‘Some writers claimed Napoleon borrowed 5 million pounds from the Bank of England to rearm. But it appears these funds actually came from Ubard Banking House in Paris. Nevertheless, from about this point on, it was not unusual for privately controlled central banks to finance both sides in a war.’

‘Why would a central bank finance opposing sides in a war?’ Still asks. ‘Because war is the biggest debt generator of them all. A nation will borrow any amount for victory. The ultimate loser is loaned just enough to hold out the vain hope of victory, and the ultimate winner is given enough to win. Besides, such loans are usually conditioned upon the guarantee that the victor will honor the debts of the vanquished.’

While the outcome of the battle at Waterloo was certainly in doubt, back in London Nathan Rothschild planned to use the outcome, no matter who won or lost, to try to seize control over the British stock and bond market and possibly even the Bank of England. How did he do this? Here is one account. ‘Rothschild stationed a trusted agent, a man named Rothworth, on the north side of the battlefield, closer to the English Channel.’ Once the battle had been decided, at the cost of many thousands of French, English and other European lives, Rothworth headed immediately for the Channel. He delivered the news to Nathan Rothschild, a full 24 hours before Wellington’s own courier arrived with the news.

Rothschild hurried to the stock market and, with all eyes on him given the Rothschild’s legendary communications network was well known, others present observed Rothschild knowing that if Wellington had been defeated, and Napoleon was again at large in Europe, the British financial situation would become grave indeed. Rothschild began selling his consoles (British government bonds). ‘Other nervous investors saw that Rothschild was selling. It could only mean one thing: Napoleon must have won, Wellington must have lost.’

The market plummeted. Soon everyone was selling their own consoles and prices dropped sharply. ‘But then Rothschild started secretly buying up the consoles through his agents for only a fraction of their worth hours before.’

Fallacious? As Still concludes this recounting of the episode: ‘One hundred years later, the New York Times ran the story that Nathan Rothschild’s grandson had attempted to secure a court order to suppress a book with that stock market story in it. The Rothschild family claimed that the story was untrue and libelous. But the court denied the Rothschilds’ request and ordered the family to pay all court costs.’

In any case, having built their initial fortune using various means – some of which, as just illustrated, were neither moral nor legal – throughout the 19th century the Rothschild family continued to accumulate wealth through the international bond market, which they played a key role in developing, as well as other forms of financial business: bullion broking and refining, accepting and discounting commercial bills, direct trading in commodities, foreign exchange dealing and arbitrage, even insurance. The Rothschilds also had a select group of clients – usually royal and aristocratic individuals whom they wished to cultivate – to whom they offered a range of ‘personal banking services’ ranging from large personal loans (such as that to the Austrian Chancellor Prince Metternich) to a first class private postal service (for Queen Victoria). The family also had substantial mining interests and was a major industrial investor backing the construction of railway lines in Europe in the 1830s and 1840s. But, apart from its other interests, the family continued to be heavily involved in ‘the money trade’.

‘From 1870 onwards, London was the centre of Britain’s greatest export: money. Vast quantities of savings and earnings were gathered and invested at considerable profit through the international merchant banks of Rothschild, Baring, Lazard, and Morgan in the City’. See Hidden History: The Secret Origins of the First World War, p. 220.

But what, exactly, is the City?

The City of London Corporation, an independent square mile in the heart of London, was founded in about AD50 and quickly established itself as an important commercial centre which ultimately gave birth to some of the world’s greatest financial institutions such as the London Stock Exchange, Lloyd’s of London and, in 1694, the Bank of England. The City’s ‘modern period’ is sometimes dated from 1067.

However, as explained by Nicholas Shaxson, the City ‘is an ancient, [semi-foreign] entity lodged inside the British nation state; a “prehistoric monster which had mysteriously survived into the modern world”, as a 19th century would-be City reformer put it…. the corporation is an offshore island inside Britain, a tax haven in its own right.’ Of course, the term ‘tax haven’ is a misnomer, ‘because such places aren’t just about tax. What they sell is escape: from the laws, rules and taxes of jurisdictions elsewhere, usually with secrecy as their prime offering. The notion of elsewhere (hence the term “offshore”) is central. The Cayman Islands’ tax and secrecy laws are not designed for the benefit of the 50,000-odd Caymanians, but help wealthy people and corporations, mostly in the US and Europe, get around the rules of their own democratic societies. The outcome is one set of rules for a rich elite and another for the rest of us.’

In the words of Shaxson:

The City’s ‘elsewhere’ status in Britain stems from a simple formula: over centuries, sovereigns and governments have sought City loans, and in exchange the City has extracted privileges and freedoms from rules and laws to which the rest of Britain must submit. The City does have a noble tradition of standing up for citizens’ freedoms against despotic sovereigns, but this has morphed into freedom for money. See ‘The tax haven in the heart of Britain’.

As Gerry Docherty and Jim Macgregor explain it then, by 1870:

City influence and investments crossed national boundaries and raised funds for governments and companies across the entire world. The great investment houses made billions, their political allies and agents grew wealthy…. Edward VII, both as king and earlier as Prince of Wales, swapped friendship and honours for the generous patronage of the Rothschilds, Cassel, and other Jewish banking families like the Montagus, Hirschs and Sassoons…. The Bank of England was completely in the hands of these powerful financiers, and the relationship went unchallenged….

The flow of money into the United States during the nineteenth century advanced industrial development to the immense benefit of the millionaires it created: Rockefeller, Carnegie, Morgan, Vanderbilt and their associates. The Rothschilds represented British interests, either directly through front companies or indirectly through agencies that they controlled. Railroads, steel, shipbuilding, construction, oil and finance blossomed…. These small groups of massively rich individuals on both sides of the Atlantic knew one another well, and the Secret Elite in London initiated the very select and secretive dining club, the Pilgrims, that brought them together on a regular basis. See Hidden History: The Secret Origins of the First World War, p. 220.

To choose one example from those just listed, you can read an official account of the Rothschild family’s early involvement in oil production, including its ‘decisive influence’ in the formation of Royal Dutch Shell, in the Rothschild Archive. See ‘Searching for Oil in Roubaix’.

Beyond their investments in the industries just listed, however, the Rothschilds had significant media interests: Their Paribas Bank ‘controlled the all-powerful news agency Havas, which in turn owned the most important advertising agency in France.’ See Hidden History: The Secret Origins of the First World War, p. 214.

And, by the late 19th century, direct Rothschild investment in major ‘armaments companies’ (now better known as weapons corporations) and related industries was substantial with official biographer Niall Ferguson candidly noting ‘If late-nineteenth-century imperialism had its “military-industrial complex” the Rothschilds were unquestionably part of it.’ See The House of Rothschild – Volume 2 – The World’s Banker, 1849-1998, p. 579.

Of course, as noted previously, the Rothschild family is not the only family that uses its wealth to exercise enormous economic and political power and to profit from war, but the evidence suggests that it has long been the most deeply entrenched in the institutions, including those it has created, that facilitate the exercise of this power. Moreover, it is linked to many other wealthy families through a multitude of arrangements as will be shown.

Consider the following examples of how the power of wealth is exercised and note the names of some other wealthy families.

Invariably working ‘in the background’, elite figures spend considerable time manipulating ‘well-positioned’ people, and none are more adept at this than the Rothschilds. To cite just one of many examples, ‘both the great estates of Balmoral and Sandringham, so intimately associated with the British royal family, were facilitated, if not entirely paid for, through the largess of the House of Rothschild’ thus maintaining the long-standing Rothschild tradition of gifting ‘loans’ – that is, bribes, as the brothers had long before privately acknowledged – to royalty (and other key officials).

Of course, this manipulation of people is done to ensure the creation of particular institutions or to precipitate or facilitate a particular sequence of events. Just one obvious example of this occurred when the British government was manipulated into the Boer War of 1899-1902 by ‘the secret society of Cecil Rhodes’ as it was originally known and of which Lord (Nathan) Rothschild was a founding member along with Alfred, later Lord, Milner who succeeded Rhodes as head of this exclusive secret club. While the British public was given a more palatable pretext for this war via the media, it was fundamentally fought to defend and consolidate the rich South African gold-mining interests of wealthy businesspeople, including the Rothschilds. By the time the war ended, the Transvaal’s gold was finally in their hands. The cost? ‘32,000 deaths in the concentration camps, [of whom more than 26,000 were women and children]; 22,000 British Empire troops were killed and 23,000 wounded. Boer casualties numbered 34,000. Africans killed amounted to 14,000.’ See Hidden History: The Secret Origins of the First World War, pp. 23 & 38-50 and The Anglo-American Establishment: From Rhodes to Cliveden.

The US Federal Reserve System

In his classic work The Creature from Jekyll Island: A Second Look at the Federal Reserve, in which he describes the formation, structure and function of the US Federal Reserve System, which governs banking in the United States, G. Edward Griffin identified the seven men and who they represented, at the secret meeting held at the private resort of J.P. Morgan on Jekyll Island off the coast of Georgia in November 1910 when the System was conceived (and later passed as The Federal Reserve Act in 1913).

The seven men at this meeting represented the great financial institutions of Wall Street and, indirectly, Europe as well: that is, they represented one-quarter of the total wealth of the entire world. They were Nelson W. Aldrich, Republican ‘whip’ in the US Senate, Chair of the National Monetary Commission and father-in-law of John D. Rockefeller Jr.; Henry P. Davison, senior partner of J.P. Morgan Company; Charles D. Norton, President of the 1st National Bank of New York; A. Piatt Andrew, Assistant Secretary of the Treasury; Frank A. Vanderlip, President of the National City Bank of New York, representing William Rockefeller; Benjamin Strong, head of J.P. Morgan’s Bankers Trust Company and later to become head of the System; and Paul M. Warburg, a partner in Kuhn, Loeb & Company, representing the Rothschilds and Warburgs in Europe.

But lest you think that there is some ‘diversity’ here, long-standing ties generated from huge financial injections at crucial times meant that several other key banks owed much to Rothschild wealth. For example, in 1857 a run on U.S. banks saw the bank Peabody, Morgan and Company in deep trouble as four other banks were driven out of business. But Peabody, Morgan and Company was saved by the Bank of England. Why? Who initiated the rescue? According to Docherty and Macgregor, ‘The Rothschilds held immense sway in the Bank of England and the most likely answer is that they intervened to save the firm. Peabody retired in 1864, and Junius Morgan inherited a strong bank with powerful links to Rothschild.’ Junius was the father of J.P. Morgan. See Hidden History: The Secret Origins of the First World War, p. 222.

A similar thing happened when Nathaniel Rothschild headed the Bank of England committee that rescued Barings Bank from imminent collapse in 1890. But other big banks ‘were beholden to or fronts for the Rothschilds…. Like J.P. Morgan, Barings and Kuhn Loeb, the M.M. Warburg Bank owed its survival and ultimate success to Rothschild money.’ To reiterate then: ‘by the early twentieth century numerous major banks, including J.P. Morgan and Barings, and armaments firms, were beholden to or fronts for the Rothschilds.’ And this had many advantages. J.P. Morgan, who was deeply involved with the Pilgrims – an exclusive club that linked major U.K. and U.S. businesspeople – was clearly perceived as an upright Protestant guardian of capitalism, who could trace his family roots to pre-Revolutionary times, so by acting in the interests of the London Rothschilds he shielded their American profits from the poison of anti-Semitism.

But the connections do not end there. Superficially, ‘there were periods of blistering competition between the investment and banking houses, the steel companies, the railroad builders and the two international goliaths of oil, Rockefeller and Rothschilds, but by the turn of the century the surviving conglomerates adopted a more subtle relationship, which avoided real competition.’ A decade earlier, Baron de Rothschild had accepted an invitation from John D. Rockefeller to meet in New York behind the closed doors of Standard Oil’s headquarters on Broadway where they had quickly reached a confidential agreement. ‘Clearly both understood the advantage of monopolistic collusion.’ The apparent rivalry between major stakeholders in banking, industry and commerce has long been a convenient facade, which they are content to leave much of the world believing. See Hidden History: The Secret Origins of the First World War, pp. 222-225.

Beyond business and financial links of this nature, of course, there is marriage. For example, according to Dean Henderson: ‘The Warburgs, Kuhn Loebs, Goldman Sachs, Schiffs and Rothschilds have intermarried into one big happy banking family. The Warburg family… tied up with the Rothschilds in 1814 in Hamburg, while Kuhn Loeb powerhouse Jacob Schiff shared quarters with Rothschilds in 1785. Schiff immigrated to America in 1865. He joined forces with Abraham Kuhn and married Solomon Loeb’s daughter. Loeb and Kuhn married each others sisters and the Kuhn Loeb dynasty was consummated. Felix Warburg married Jacob Schiff’s daughter. Two Goldman daughters married two sons of the Sachs family, creating Goldman Sachs. In 1806 Nathan Rothschild married the oldest daughter of Levi Barent Cohen, a leading financier in London.’ See Big Oil and Their Bankers in the Persian Gulf: Four Horsemen, Eight Families and Their Global Intelligence, Narcotics and Terror Network, p. 488.

So to return to the foundation of the US Federal Reserve System, according to Griffin:

The reason for secrecy was simple. Had it been known that rival factions of the banking community had joined together, the public would have been alerted to the possibility that the bankers were plotting an agreement in restraint of trade – which, of course, is exactly what they were doing.

What emerged was a cartel agreement with five objectives:

stop the growing competition from the nation’s newer banks;

obtain a franchise to create money out of nothing for the purpose of lending;

get control of the reserves of all banks so that the more reckless ones would not be exposed to currency drains and bank runs;

get the taxpayer to pick up the cartel’s inevitable losses; and convince Congress that the purpose was to protect the public.

It was realized that the bankers would have to become partners with the politicians and that the structure of the cartel would have to be a central bank. The record shows that the Fed has failed to achieve its stated objectives. That is because those were never its true goals. As a banking cartel, and in terms of the five objectives stated above, it has been an unqualified success.

To reiterate Griffin’s key point: ‘a primary objective of that cartel was to involve the federal government as an agent for shifting the inevitable losses from the owners of those banks to the taxpayers.’ And this is confirmed by the ‘massive evidence of history since the System was created’.

Or, in the words of economics Professor Antony C. Sutton, who carefully detailed the longstanding links between Wall Street and the family of US President Franklin D. Roosevelt, including Roosevelt himself (a banker and speculator from 1921 to 1928): ‘The Federal Reserve System is a legal private monopoly of the money supply operated for the benefit of a few under the guise of protecting and promoting the public interest.’ See Wall Street and F.D.R.

And, as U.S. Congressman Louis Thomas McFadden, chairman of the House Committee on Banking and Currency, observed in 1932: ‘When the Federal Reserve Act was passed, the people of the United States did not perceive that… this country was to supply financial power to an international superstate – a superstate controlled by international bankers and international industrialists acting together to enslave the world for their own pleasure.’ See ‘Speech by Rep. Louis T. McFadden denouncing the Federal Reserve System’.

Equally importantly, creation of the Federal Reserve was just one of many preliminary steps taken over a 25-year period by a select group of men in key positions who conspired to ignite The Great War to both shape the future world order and profit enormously from the death and destruction. You can read detailed accounts of what took place, including key players, their motives and instigation of the Boer War in South Africa, touched on above, as part of the process, in books such as these:

Hidden History: The Secret Origins of the First World War,

The Anglo-American Establishment: From Rhodes to Cliveden,

The House of Rothschild – Volume 2 – The World’s Banker, 1849-1998 and

There is also a thoughtful summary in ‘A crime against humanity: the Great Reset of 1914-1918’ and an excellent video on the subject: ‘The WWI Conspiracy’.

The primary cost of World War I was 20 million human lives, but it was immensely profitable for some.

The Bank for International Settlements

Another critical development in this period was the creation of the Bank for International Settlements (BIS) – as ‘the central bank of central banks’ – in 1930. As described by Professor Carroll Quigley, the BIS was the apex of efforts by elite bankers ‘to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole.’

But the push started many years before with Montagu Norman (Bank of England) and Benjamin Strong (the first governor of the Federal Reserve Bank of New York) both committed advocates. ‘In the 1920’s, they were determined to use the financial power of Britain and of the United States to force all the major countries of the world to go on the gold standard and to operate it through central banks free from all political control, with all questions of international finance to be settled by agreements by such central banks without interference from governments.’

This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.

Each central bank, in the hands of men like Montagu Norman of the Bank of England, Benjamin Strong of the New York Federal Reserve Bank, Charles Rist of the Bank of France, and Hjalmar Schacht of the Reichsbank, sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world. The B.I.S. as a private institution was owned by the seven chief central banks and was operated by the heads of these, who together formed its governing board.

But, Quigley points out:

It must not be felt that these heads of the world’s chief central banks were themselves substantive powers in world finance. They were not. Rather, they were the technicians and agents of the dominant investment bankers of their own countries, who had raised them up and were perfectly capable of throwing them down.

The substantive financial powers of the world were in the hands of these investment bankers (also called ‘international’ or ‘merchant’ bankers) who remained largely behind the scenes in their own unincorporated private banks.

These formed a system of international cooperation and national dominance which was more private, more powerful, and more secret than that of their agents in the central banks. This dominance of investment bankers was based on their control over the flows of credit and investment funds in their own countries and throughout the world. They could dominate the financial and industrial systems of their own countries by their influence over the flow of current funds through bank loans, the discount rate, and the re-discounting of commercial debts; they could dominate governments by their control over current government loans and the play of the international exchanges. Almost all of this power was exercised by the personal influence and prestige of men who had demonstrated their ability in the past to bring off successful financial coupe, to keep their word, to remain cool in a crisis, and to share their winning opportunities with their associates. In this system the Rothschilds had been preeminent during much of the nineteenth century. See Tragedy & Hope: A History of the World in Our Time, pp. 242-3 & 245.

Ensuring that this select group of international bankers could operate without any form of accountability to any other authority in the world, the BIS ‘Headquarters Agreement with Switzerland’ Articles 4 and 12 specifically identify a range of ‘privileges and immunities’ that, among others, provide that ‘The Bank shall enjoy immunity from jurisdiction’ and ‘members of the Board of Directors of the Bank, together with the representatives of those central banks which are members of the Bank’ with ‘immunity from arrest or imprisonment’. See ‘Agreement between the Swiss Federal Council and the Bank for International Settlements to determine the Bank’s legal status in Switzerland’.

In plain language, the BIS and its members are beyond the reach of governments, key international organizations and the rule of law. They are accountable to no-one. And this is why the BIS was never held to account for its commission of war crimes. See ‘History – the BIS during the Second World War (1939-48)’. For an excellent and detailed account of the Bank for International Settlements, see Adam LeBor’s Tower of Basel: The Shadowy History of the Secret Bank that Runs the World.

Beyond this, as Sutton notes, because politicians sympathetic to financial capitalism and academics with ideas about world control are kept in line with a system of rewards and penalties, ‘in the early 1930s the guiding vehicle for this international system of financial and political control’ was the BIS, headquartered in Basle. The BIS ‘continued its work during World War II as the medium through which the bankers – who… were not at war with each other – continued a mutually beneficial exchange of ideas, information, and planning for the post-war world.’ In this sense only, the war was irrelevant to them. See Wall Street and The Rise of Hitler, pp. 11-12.

So while elite figures, including the Rothschilds, continued to shape institutions and events to restructure world order and make it more profitable for themselves, virtually everyone else in the world was an unwitting victim of their secret programs, many at the cost of their own life.

A notable exception was US Major General Smedley Butler who at least spelled out the critical role that war played in wealth creation for the elite. Following more than three decades of highly-decorated service in the US Marine Corp, Butler later described his experience in the following terms: ‘I spent most of my time being a high-class muscle man for Big Business, for Wall Street and for the bankers. In short, I was a racketeer for capitalism.’ See ‘Major General Smedley Butler’.

In his book published in 1935, he wrote:

‘War is a racket. It always has been. It is possibly the oldest, easily the most profitable, surely the most vicious…. It is the only one in which the profits are reckoned in dollars and the losses in lives…. It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make huge fortunes.’

He went on to describe some of the individuals and corporations that made huge profits out of World War I. See War Is A Racket.

World War II

And, just a few years later, World War II demonstrated that ‘war is a racket’ yet again. By carefully penetrating the cloak of deception behind which it was hidden, Professor Antony C. Sutton considered original documentation and eyewitness accounts to reveal what remains one of the most remarkable and under-reported facts of World War II. In his account of this orchestrated conflagration, Sutton carefully documents how prominent Wall Street banks and US businesses supported Hitler’s rise to power by financing and trading with Nazi Germany, reaching the unsavory conclusion that ‘the catastrophe of World War II was extremely profitable for a select group of financial insiders’ including J.P. Morgan, T.W. Lamont, the Rockefeller interests, General Electric, Standard Oil, and the National City, Chase, and Manhattan banks, Kuhn, Loeb and Company, General Motors, Ford Motor Company, and scores of others in ‘the bloodiest, most destructive war in history’. See Wall Street and The Rise of Hitler.

To illustrate the complex and wide-ranging collaboration between US business interests and the Nazis throughout the war, consider just one example: On the eve of World War II the German chemical complex of I.G. Farben, which included the banker Max Warburg (brother of Paul of the US Federal Reserve) on its Board of Directors, was the largest chemical manufacturing enterprise in the world, with extraordinary political and economic power within Hitler’s Nazi state. The Farben cartel dated from 1925 and had been created with financial assistance from Wall Street by the organizing genius of Hermann Schmitz, a prominent early Nazi who, through I.G. Farben, helped fund Hitler’s seizure of control in March 1933. Schmitz created the super-giant chemical enterprise out of six already giant German chemical companies.

So critical was I.G. Farben to the Nazi war effort that it produced 100% of its lubricating oil and various other products, 95% of its poison gas – ‘enough gas to kill 200 million humans’ – used in the extermination chambers, 84% of its explosives, 70% of its gunpowder, and very high proportions of many other critical products including aviation fuel. As Sutton concludes: ‘Without the capital supplied by Wall Street, there would have been no I.G. Farben in the first place and almost certainly no Adolf Hitler and World War II.’ See Wall Street and The Rise of Hitler, pp.17-20.

The cost in human lives of World War II was 70-85 million. But there was no cost to those Wall Street corporations and their fellow war profiteers that collaborated with Nazi Germany. Just massive profits.

Following World War II

Documenting what had become the long-standing collusion between political, corporate and military elites, sociology Professor C. Wright Mills published his classic work The Power Elite in 1956. This scholarly effort was among the earliest of the post-World War II era to document the nature of the US elite and how it functioned, highlighting the interlocking power of corporate, political and military elites as they exercised control over US national society and went about the task of exploiting the general population.

But a weakness of the account by Mills was his failure to grapple with the already long-standing power of a global elite to manipulate key events in any one country, and certainly the United States, even if much of this was done through the relevant national elite(s).

This ‘global reach’ of the Elite is again clearly apparent in any study of ownership of the world’s oil resources. In his 1975 book The Seven Sisters, Anthony Sampson popularized this collective name for the shadowy oil cartel that, throughout its history, had vigorously worked to eliminate competitors and control the world’s oil. See The Seven Sisters: The Great Oil Companies and the World They Shaped. Several decades later, Dean Henderson simply observed that ‘After a tidal wave of mergers at the turn of the millennium, Sampson’s Seven Sisters were Four Horsemen: Exxon Mobil, Chevron Texaco, BP Amoco and Royal Dutch/Shell.’ Beyond this, however, Henderson noted the following:

The oil wealth generated in the Persian Gulf region is the main source of capital [for the international mega-banks]. They sell the Gulf Cooperation Council sheiks 30-year treasury bonds at 5% interest, then loan the sheiks’ oil money out to Third World governments and Western consumers alike at 15-20% interest. In the process these financial overlords – who produce nothing of economic import – use debt as their lever in consolidating control over the global economy.

See Big Oil and Their Bankers in the Persian Gulf: Four Horsemen, Eight Families and Their Global Intelligence, Narcotics and Terror Network, pp. 168, 451.

And, following a series of mergers and then the 2008 banking crisis, four giant banks emerged to dominate the US economy: JP Morgan Chase, Citigroup, Bank of America and Wells Fargo. Moreover, these banks, along with Deutsche Bank, Banque Paribas, Barclays ‘and other European old money behemoths’, own the four oil giants and are also ‘among the top 10 stock holders of virtually every Fortune 500 corporation’ giving them vast control over the global economy.

See Big Oil and Their Bankers in the Persian Gulf: Four Horsemen, Eight Families and Their Global Intelligence, Narcotics and Terror Network, pp. 470, 473.

So who owns these banks? By now it should come as no surprise that several scholars at different times during the past 100 years have investigated this issue and come to essentially the same conclusion: the major families, increasingly interrelated by blood, marriage and/or business interests, have simply consolidated their control over the banks. Apart from scholars already mentioned above, in the 1983 revision of his book, Eustace Mullins noted that a few families still controlled the New York City banks which, in turn, hold the controlling stock of the Federal Reserve Bank of New York. Mullins identified the families of the Rothschilds, Morgans, Rockefellers, Warburgs and others.

See The Secrets of the Federal Reserve, p. 224.

Several scholars have written on the subject of elite power since Mills with Professor Peter Phillips penning the 2018 book Giants: The Global Power Elite which reviews ‘the transition from the nation state power elites described by Mills to a transnational power elite centralized on the control of global capital around the world. The Global Power Elite function as a nongovernmental network of similarly educated wealthy people with common interests of managing, facilitating, and protecting concentrated global wealth and insuring the continued growth of capital.’

Aside from the obvious criticism that Phillips effectively repeats the mistake made by Mills in assuming that there was no pre-existing ‘transnational power elite’ even if in different form, Phillips goes on to usefully identify the world’s top seventeen asset management firms, such as BlackRock and J.P Morgan Chase, that collectively manage (by now) more than $US50 trillion in a self-invested network of interlocking capital that spans the globe.

More precisely, Phillips identifies the 199 individual directors of the seventeen global financial Giants and the importance of those transnational institutions that serve a unifying function – including:

the World Bank, International Monetary Fund, G20, G7, World Trade Organization (WTO),

World Economic Forum (WEF), Trilateral Commission,

Bilderberg Group(with a review of Daniel Estulin’s book The True Story of the Bilderberg Group here:

‘“The True Story of the Bilderberg Group” and What They May Be Planning Now’),

Bank for International Settlements and the Council on Foreign Relations

(see ‘One World Governance and the Council on Foreign Relations. “We Shall have World Government… by Conquest or Consent.”’) – and particularly two very important global elite policy-planning organizations:

the Group of Thirty (which has 32 members) and the extended executive committee of the Trilateral Commission (which has 55 members).

And Phillips carefully explains why and how the Global Elite defends its power, profits and privilege against rebellion by the ‘unruly exploited masses’: ‘the Global Power Elite uses NATO and the US military empire for its worldwide security…. The whole system continues wealth concentration for elites and expanded wretched inequality for the masses.’ Advocating the importance of systemic change and the redistribution of wealth, Phillips goes on to argue that ‘This concentration of protected wealth leads to a crisis of humanity, whereby poverty, war, starvation, mass alienation, media propaganda, and environmental devastation are reaching a species-level threat.’

Hence, it is worth reiterating: War plays an ongoing and vital role in the exercise of Elite power to reshape world order to maximize wealth concentration by the Elite. If you want further evidence of this, you might find these recent reports instructive: the US Congressional Research Service report

‘Instances of Use of United States Armed Forces Abroad, 1798-2022’,

the Tufts University Fletcher Center for Strategic Studies report ‘Military Intervention Project (MIP) Research’

and an article and video that summarize and discuss these two reports in ‘US launched 251 military interventions since 1991, and 469 since 1798’.

But, as the discussion above and below illustrates, war is not the only mechanism the Elite uses.

For an account which focuses on identifying many of the world’s largest corporations, in many industries, and then illustrates the interlocking nature of corporate ownership while demonstrating that they are all owned by the same small group of giant asset management corporations – notably including Vanguard, BlackRock and State Street – this video is very instructive: ‘Monopoly: Who Owns the World?’

And for a penetrating critique of BlackRock and its overall strategy to acquire vast worldwide control, including by using its Aladdin investment analysis technology (which employs massive data collection, artificial intelligence and machine learning to derive investment insight),

see ‘BlackRock: Bringing Together Man and Machine’

and this three-part series by James Corbett: ‘How BlackRock Conquered the World’.

In the ‘Monopoly’ video, you will again see the names of some familiar individuals and families who own significant shareholdings in these corporations and asset management firms. After showcasing families such as the Rothschilds, Rockefellers and Morgans, the narrator simply observes in relation to Vanguard that its ‘largest shareholders are the private funds and nonprofit organizations of these families’.

And if you think that national Elites in countries like China and Russia are somehow not involved in all this, you might find it interesting to read articles that discuss the wealth and political influence of the Chinese ‘immortals’ and the Russian oligarchs –

see ‘China’s red aristocracy’ and

‘List of Oligarchs and Russian elites featured in ICIJ investigations’ –

or to read the ‘Joint Statement of the Russian Federation and the People’s Republic of China on the International Relations Entering a New Era and the Global Sustainable Development’.

Beyond this, however, Emanuel Pastreich points out that if anyone attributes responsibility for Chinese policies in relation to data collection and control based on QR codes and contact tracing, they inevitably identify the Chinese government.

‘But the truth is that few, or none, of these policies were made up or implemented by the Chinese government itself, but rather that the Chinese government is occupied by IT corporations that report to the billionaires (often through Israel and the United States) and bypass the Chinese government altogether.’

Pastreich goes on to offer some insight into how key Elite intelligence and finance corporations are driving the technocratic social control policies being implemented under cover of the ‘virus’ in China.

See ‘The Third Opium War Part One: The agenda behind the COVID-19 assault on China’and

‘The Third Opium War Part Two: The True Threat Posed by China’ or watch

‘Western Tech & China: Who Serves whom?’

In fact, as Patrick Wood points out, referencing a much earlier book of his own and Professor Antony Sutton – see Trilaterals Over Washington Volumes I & II – ‘Thanks to early members of the [Elite’s] Trilateral Commission, China was brought out of its dark ages Communist dictatorship and onto the world stage. Furthermore, the Trilateral Commission orchestrated and then facilitated a massive transfer of technology to China in order to build up its non-existent infrastructure…. As a failed Communist dictatorship, China was a blank slate with over 1.2 billion citizens under its control. However, Chinese leadership knew nothing about capitalism and free enterprise, and [key Trilateralist Zbigniew] Brzezinski made no effort to teach them about it. Instead, he planted seeds of Technocracy…. In the 20-year period from 1980 to 2000, a transformation took place that was considered nothing short of an economic miracle; but it was not of China’s doing. Rather, it can be fully attributed to the masters of Technocracy within the ranks of the Trilateral Commission.’ After listing several key features of China’s technocracy (5G, AI, social credit scores…), Wood concludes that ‘China is a full-blown Technocracy and it is the first of its kind on planet earth.’ See this article on China as one of Wood’s 12-part series on technocracy: ‘Day 7: China Is A Technocracy’.

And in relation to Russia, Riley Waggaman simply observes that ‘As for “COVID-triggered” economic restructuring: the Russian government has openly embraced the World Economic Forum’s Fourth Industrial Revolution. In October [2021], the Russian government and the WEF signed a memorandum on the establishment of a Center for the Fourth Industrial Revolution in Russia.

Russia has already adopted a law allowing for “experimental legal regimes” to allow corporations and institutions to deploy AI and robots into the economy, without being encumbered by regulatory red tape. Returning to Gref and his digital Sbercoin: Russia’s central bank is already planning to test-run a digital ruble that, among other nifty features, could be used to restrict purchases.’ See ‘I believe we are facing an evil that has no equal in human history’.

Moreover, according to Mikhail Delyagin, a deputy of the State Duma of the Russian Federation: ‘In the 90s, under Yeltsin, the external management of global banksters was carried out through the IMF and through [Russian oligarch Anatoly] Chubais. Now under Putin, external management will be done by Big Tech, social global platforms, and Big Pharma through the WHO. Exactly the same management.’ Cited in ‘Duma deputy: “Protect yourself and Russia from a coup d’état!”. Russian lawmaker issues video appeal to the nation. Will anyone listen?’

Separately from this, bear in mind that the Elite, as well as its agents and organizations (including those in China and Russia), have vast wealth stashed in ‘secrecy jurisdictions’ (better known as tax havens): locations around the world where wealthy individuals, criminals and terrorists, as well as governments and government agencies (such as the CIA), banks, corporations, hedge funds, international organizations (such as the Vatican) and crime syndicates (such as the Mafia), can stash their money so that they can avoid regulation and oversight, and evade tax. Just how much wealth is stashed in tax havens? While this is impossible to know precisely, it can only be measured in tens of trillions of dollars as well as an unknown number of gold bricks, artworks, yachts and racehorses.

See ‘Elite Banking at Your Expense: How Secretive Tax Havens are Used to Steal Your Money’.

How is this possible? Well, it is protected by government legislation and legal systems, with an ‘army’ of Elite agents – accountants, auditors, bankers, businesspeople, lawyers and politicians – ensuring that they remain protected. The point here is simple: if you have enough money, the law simply does not exist. And you can evade taxes legally and in the full knowledge that your vast profits (even from immorally-acquired wealth such as sex trafficking, gun-running, endangered species trafficking, conflict diamonds and drug trafficking) are ‘lawful’ and will escape regulation and oversight of any kind. See ‘The Rule of Law: Unjust and Violent’.

But legal systems facilitate monstrous injustice in other ways too. For example, they ensure that owners of corporations are enabled to ruthlessly exploit both their workers and all taxpayers as well. For a thoughtful and straightforward account of how this works, see this article by Professor James Petras: ‘How Billionaires Become Billionaires’.

And to briefly revisit a subject discussed above: Who owns the US Federal Reserve System now?

According to Dean Henderson writing in 2010, it is ‘the Goldman Sachs, Rockefellers, Lehmans and Kuhn Loebs of New York; the Rothschilds of Paris and London; the Warburgs of Hamburg; the Lazards of Paris; and the Israel Moses Seifs of Rome.’

Henderson goes on to state that ‘The control that these banking families exert over the global economy cannot be overstated and is quite intentionally shrouded in secrecy. Their corporate media arm is quick to discredit any information exposing these money powers as halfbaked conspiracy theory. The word “conspiracy” itself has been demonized, much like the word “communism”. Anyone who dare utter the word is quickly excluded from public debate and written off as insane. Yet the facts remain.’

See Big Oil and Their Bankers in the Persian Gulf: Four Horsemen, Eight Families and Their Global Intelligence, Narcotics and Terror Network, pp. 473-4.

Other scholars in the field agree.

In his exceptionally detailed investigation into three major historical events of the C20th – the Bolshevik Revolution, the rise of Franklin D. Roosevelt and the rise of Hitler – Professor Antony Sutton identified the seat of political power in the United States not as the US Constitution authorized but ‘the financial establishment in New York: the private international bankers, more specifically the financial houses of J.P. Morgan, the Rockefeller-controlled Chase Manhattan Bank, and in earlier days (before amalgamation of their Manhattan Bank with the former Chase Bank), the Warburgs.’

For most of the twentieth century the Federal Reserve System, particularly the Federal Reserve Bank of New York (which is outside the control of Congress, unaudited and uncontrolled, with the power to print money and create credit at will), has exercised a virtual monopoly over the direction of the American economy. In foreign affairs the Council on Foreign Relations, superficially an innocent forum for academics, businessmen, and politicians, contains within its shell, perhaps unknown to many of its members, a power center that unilaterally determines U.S. foreign policy. The major objective of this submerged – and obviously subversive – foreign policy is the acquisition of markets and economic power (profits, if you will), for a small group of giant multi-nationals under the virtual control of a few banking investment houses and controlling families. See Wall Street and The Rise of Hitler, pp.125-126.

So what has changed?

Nothing has changed.

But it is not just fine scholars who have reached this conclusion. Consider David Rockefeller’s delusionary whitewashing of his own family’s key role in the killing, devastation and destruction outlined above: ‘Some even believe we are part of a secret cabal working against the best interests of the United States, characterizing my family and me as “internationalists” and of conspiring with others around the world to build a more integrated global political and economic structure – one world, if you will. If that’s the charge, I stand guilty, and I am proud of it…. one of the most enduring [conspiracies] is that a secret group of international bankers and capitalists, and their minions, control the world’s economy…. [but these people] ignore the tangible benefits that have resulted from our active international role during the past half-century’. See Memoirs, p. 483.

If you are wondering how all of this happens without any significant pushback from within elite circles, there is a simple answer: They are all insane and control to maximize resource accumulation has become the perpetual substitute for their destroyed capacity to engage emotionally in their own lives and empathize with their fellow human beings. For more detail, see ‘Love Denied: The Psychology of Materialism, Violence and War’ and ‘The Global Elite is Insane Revisited’.

So while some of us occasionally ponder how we can contribute more to improve the human condition and the state of the world, and then endeavour to do something along those lines, there are plenty of terrified people whose daily life is consumed (consciously or unconsciously) by the question ‘How can I take more?’ And people like that have been taking more since the dawn of human civilization and, no doubt, earlier.

The Global Elite is simply those who have been insanely ruthless and organized enough to take more, whatever the cost to humanity and all other life on Earth.

The Post World War II Superstructure to Transform World Order, Destroy the World Economy and Capture All Wealth

So how, precisely, is the Global Elite driving the transformation of world order, the collapse of the world economy and capturing final control of all wealth?

There are three parts to the answer to this question: 1. The foundations progressively laid over the past 5,000 years, as outlined above; 2. The superstructure (including such institutions as the United Nations, the World Bank and International Monetary Fund) that has been built since World War II and, more recently, under the guise of the United Nation’s Sustainable Development agenda, to impose global governance on the human population and, particularly, to intrude global financial governance into every aspect of our lives. In the words of Iain Davis and Whitney Webb, this is because the UN’s sustainable development goals ‘do not promote “sustainability” as most conceive it and instead utilise the same debt imperialism long used by the Anglo-American Empire to entrap nations in a new, equally predatory system of global financial governance’ – see ‘Sustainable Debt Slavery’ – and 3. The final part relates to political, economic and, especially, technological measures being imposed as part of the World Economic Forum’s ‘Great Reset’ under cover of the fake narrative about a Covid-19 ‘pandemic’.

If we briefly consider elements of the post-World War II superstructure, for example, both the World Bank and International Monetary Fund have historically used debt to force countries, mostly in the developing world, to adopt policies that redistribute wealth to the elite via their banks, corporations and institutions. But corporations have employed their own ‘economic hit men’ to do the same thing: By identifying and ‘persuading’ leaders of developing nations, using a variety of devices – ranging from false economic projections and bribes to military threats and assassinations – to accept enormous ‘development’ loans for projects which are contracted with western corporations, countries quickly become entrapped in debt. This is then used to force those countries to implement unpopular austerity policies, deregulate financial and other markets, and privatize state assets, thus eroding national sovereignty. See The New Confessions of an Economic Hit Man.

If you want to read further evidence of the role of the World Bank and the IMF as agents of Elite policy against nation-states, you might find the US Army’s manual of unconventional warfare interesting. See ‘Army Special Operations Forces: Unconventional Warfare’. Originally released by Wikileaks in 2008 and described by them as the US military’s ‘regime change handbook’, as elaborated by Webb, ‘the U.S. Army states that major global financial institutions – such as the World Bank, International Monetary Fund (IMF), the Organization for Economic Cooperation and Development (OECD) [and the Bank for International Settlements (BIS] – are used as unconventional, financial “weapons in times of conflict up to and including large-scale general war,” as well as in leveraging “the policies and cooperation of state governments.”’ See ‘Leaked Wikileaks Doc Reveals US Military Use of IMF, World Bank as “Unconventional” Weapons’.

Beyond this, however, what we have seen since the UN, increasingly a tool of corporations since the 1990s, adopted its Sustainable Development Goals is a dramatically expanded set of mechanisms designed to enslave the bulk of the human population, not just those in ‘developing’ countries, and take complete control of Earth’s ecosystems and natural processes.

Source: NaturalNews.com

Among many initiatives, for example, the Global Public-Private Partnership has been presented by Klaus Schwab and Peter Vanham, on behalf of the World Economic Forum. See Stakeholder Capitalism: A Global Economy that Works for Progress, People and Planet summarized in ‘What is stakeholder capitalism?’

While this sanitized account obscures the threat it poses to humankind, Iain Davis and Whitney Webb have thoughtfully critiqued it – see ‘Sustainable Debt Slavery’ – noting that even a 2016 UN Department of Economic and Social Affairs report – see ‘Public-Private Partnerships and the 2030 Agenda for Sustainable Development: Fit for purpose?’ – also found it ‘unfit for purpose’. So what is it? According to Davis, the Global Public-Private Partnership (G3P) is a worldwide network of stakeholder capitalists and their partners: the Bank for International Settlements, central banks, global (including media) corporations, the ‘philanthropic’ foundations of multi-billionaires, policy think tanks, governments (and their agencies), key non-governmental organizations and global charities, selected academic and scientific institutions, labour unions and other chosen ‘thought leaders’. (You can see an instructive diagram in the article cited below.)

The G3P controls the world economy and global finance. ‘It sets world, national and local policy (via global governance) and then promotes those policies using the mainstream media’, typically distributes the policies through an intermediary such as the IMF, WHO or IPCC and uses governments to transform G3P global governance into hard policy, legislation and law at the national level. ‘In this way, the G3P controls many nations at once without having to resort to legislation. This has the added advantage of making any legal challenge to the decisions made by the most senior partners in the G3P (an authoritarian hierarchy) extremely difficult.’ In short: global governance has already superseded the national sovereignty of states: ‘National governments had been relegated to creating the G3P’s enabling environment by taxing the public and increasing government borrowing debt.’ See ‘What Is the Global Public-Private Partnership?’

As Davis notes: We are supposed to believe that a G3P-led system of global governance is beneficial for us and to accept that global corporations are committed to putting humanitarian and environmental causes before profit, when the conflict of interest is obvious. ‘Believing this requires a considerable degree of naïveté.’ Davis clearly perceives ‘an emergent global, corporate dictatorship that cares not one whit about truly stewarding the planet. The G3P will determine the future state of global relations, the direction of national economies, the priorities of societies, the nature of business models and the management of a global commons. There is no opportunity for any of us to participate in either their project or the subsequent formation of policy.’ Davis goes on: ‘in theory, governments do not have to implement G3P policy, in reality they do. Global policies have been an increasing facet of our lives in the post-WW2 era…. It doesn’t matter who you elect, the policy trajectory is set at the global governance level. This is the dictatorial nature of the G3P and nothing could be less democratic.’

Another initiative was launched at the COP26 conference in November 2021. The Glasgow Financial Alliance for Net Zero (GFANZ) is an industry-led and UN-convened alliance of private banking and financial institutions that announced plans to overhaul the role of global and regional financial institutions, including the World Bank and IMF, as part of a broader plan to ‘transform’ the global financial system. See ‘Our progress and plan towards a net-zero global economy’.

But this report makes it clear that GFANZ will simply employ the same exploitative tactics that the ‘economic hitmen’ and agents such as the multilateral ‘development’ banks (MDBs) – including the World Bank, Inter-American Development Bank, Asian Development Bank, the African Development Bank and the European Bank for Reconstruction and Development – have long used to force even greater deregulation on ‘developing’ countries to facilitate supposedly climate and environmentally-friendly investments by alliance members. In fact, composed of several “subsector alliances”, including the Net Zero Asset Managers Initiative, the Net Zero Asset Owner Alliance and the Net Zero Banking Alliance, GFANZ commands ‘a formidable part of global private banking and finance interests’. Moreover, the ‘largest financial players’ who dominate GFANZ include the CEOs of BlackRock, Citi, Bank of America, Banco Santander and HSBC as well as the CEO of the London Stock Exchange Group and chair of the Investment Committee of the David Rockefeller Fund. In essence then, as Whitney Webb goes on to explain it:

[T]hrough the proposed increase in private-sector involvement in MDBs, such as the World Bank and regional development banks, alliance members seek to use MDBs to globally impose massive and extensive deregulation on developing countries by using the decarbonization push as justification. No longer must MDBs entrap developing nations in debt to force policies that benefit foreign and multinational private-sector entities, as climate change-related justifications can now be used for the same ends….

Though GFANZ has cloaked itself in lofty rhetoric of ‘saving the planet,’ its plans ultimately amount to a corporate-led coup that will make the global financial system even more corrupt and predatory and further reduce the sovereignty of national governments in the developing world. See ‘UN-Backed Banker Alliance Announces “Green” Plan to Transform the Global Financial System’.

But, again, it is not just their fellow human beings over whom the Elite wants total control. They want that control over nature too, and that is yet another project in which the Elite has been long engaged.

Hence, in September 2021, the New York Stock Exchange (NYSE) announced the launch of a new asset class, jointly developed with Intrinsic Exchange Group (IEG) – whose founding investors included the Inter-American Development Bank and the Rockefeller Foundation – for Natural Asset Companies: ‘sustainable enterprises that hold the rights to ecosystem services’ that enable natural asset owners ‘to convert nature’s value into financial capital, providing additional resources necessary to power a sustainable future’.

According to the IEG: ‘Natural areas, underpinned by biodiversity, are inherently valuable in and of themselves.’ See ‘Natural Areas’. Either unaware of their ignorance or, perhaps, making hypocritically tokenistic use of some key words often-expressed by indigenous peoples and deep ecologists (including the inventor of the term ‘deep ecology’, Professor Arne Naess, in his 1973 article ‘The Shallow and the Deep, Long-Range Ecology Movement’) – the IEG goes on to express this ‘value’ in strictly economic terms: ‘They also contribute life supporting services upon which humanity and the global economy depends. These include provisioning services such as food, water, timber, and genetic resources; regulating services that affect climate, floods, disease, and water quality; cultural services that provide recreational, aesthetic, and spiritual benefits; and supporting services such as soil formation, photosynthesis, and nutrient cycling.’

And in its report on this subject, the World Economic Forum’s Global Future Council on Nature-Based Solutions urged investors, corporations and governments ‘to create and strengthen market-based mechanisms for valuing nature.’ See ‘Scaling Investments in Nature: The Next Critical Frontier for Private Sector Leadership’, p.14.

Elaborating the IEG’s delusional conception of how further business investment in natural resources will work, Douglas Eger, the CEO of IEG, suggests that ‘This new asset class on the NYSE will create a virtuous cycle of investment in nature that will help finance sustainable development for communities, companies and countries.’ Really? I wonder how. But IEG’s motives are more likely revealed in this fact: ‘The asset class was developed to enable exposure to the opportunities created by the estimated $125 trillion annual global ecosystem services market, encompassing areas such as carbon sequestration, biodiversity and clean water.’

See ‘NYSE to List New “Natural Asset Companies” Asset Class, Targeting Massive Opportunity in Ecosystem Services’.

Hence, to clarify: corporations are now engaged in the largest land and resource grab in history. This will enable Elite corporations to privately own the ecosystem services of a pristine rainforest, a majestic waterfall plunging into a lagoon, an expansive grassland, a picturesque cave, a magnificent wetland, a trout-filled lake, a beautiful coral reef or other natural area and then sell clean air, fresh water, pollination services, food, medicines, and a range of biodiversity services such as the enjoyment of nature, while displacing the world’s remaining indigenous populations.

So what about the Commons? ‘The Commons is property shared by all, inclusive of natural products like air, water, and a habitable planet, forests, fisheries, groundwater, wetlands, pastures, the atmosphere, the high seas, Antarctica, outer space, caves, all part of ecosystems of the planet.’ Or are corporations finally about to own the Commons as well? See ‘Mother Nature, Inc.’

Are we to reduce everything in nature to its value as a profit-making commodity?