Clinton Opposes Transferring Government Costs Onto Rich People

Hillary Clinton opposes fixing Social Security by taxing rich people more; she wants it to be done by cutting benefits to the recipients.

In 2008, Barack Obama said that he would consider eliminating the cap on Social Security taxes that blocks income above $97,000/year from being SS-taxed. The argument for that cap has been that above that income-level, the person is too rich to be included in either the benefits or the costs of the SS system.

However, because in recent decades all of the increase in benefits in the economy has been going to the few extremely rich, the proposal has been made that some of that increase in money should be rerouted, via the tax-system, to “the bottom 99%.” Hillary Clinton rejected this idea and proposed instead that the SS cost-of-living increases should gradually reduce so that in real-dollar terms, beneficiaries will have lower and lower incomes in their retirements, but it would be done so gradually that people wouldn’t much notice it.

During the 16 April 2008 Pennsylvania Democratic primary debate in Philadelphia broadcast on ABC, she said: “I’m certainly against one of Senator Obama’s ideas, which is to lift the cap on the payroll tax, because that would impose additional taxes on people who are educators, police officers, firefighters and the like.”

Obama replied:

“Well, Charlie [Gibson], I just have to respond real quickly to Senator Clinton’s last comment. What I have proposed is that we raise the cap on the payroll tax because millionaires and billionaires don’t have to pay beyond $97,000 a year. That is where it is capped.

Now, most firefighters, most teachers, you know, they’re not making over $100,000 a year. In fact, only 6 percent of the population does.

And I’ve also said that I’d be willing to look at exempting people who are making slightly above that.

But understand the alternative is that, because we’re going to have fewer workers to more retirees, if we don’t do anything on Social Security, then those benefits will effectively be cut because we’ll be running out of money.”

Gibson sided with Clinton on that, by saying, “But, Senator, but that’s a tax,” and Obama interjected with a lie:

“Well, no, no, look … Let me finish my point here, Charlie. Senator Clinton said she certainly wouldn’t do this, this was a bad idea. In Iowa, when she was outside of camera range, said to an individual there she’d certainly consider the idea and then that was recorded. And she apparently wasn’t aware that it was being recorded. So this is an option that I would strongly consider, because the alternatives, like raising the retirement age or cutting benefits or raising the payroll tax on everybody, including people who make less than $97,000 a year,”

And as President, Obama did try to get the Republicans under John Boehner to agree to raising the retirement age and to cutting benefits (via reducing the annual inflation-adjustment calculation) but he wasn’t able to get Republicans to agree to doing that, because they found more effective to simply block whatever he proposed, so as to convince their electoral base that they were authentic Republicans and should therefore be re-elected.

Obama’s response denied that applying the SS tax to income above $97,000 a year would be “a tax” as Gibson put it. However, it would be that — obviously. Then, Obama said that Hillary herself had privately told someone that she as President would consider the same thing that Obama had publicly said he would consider.

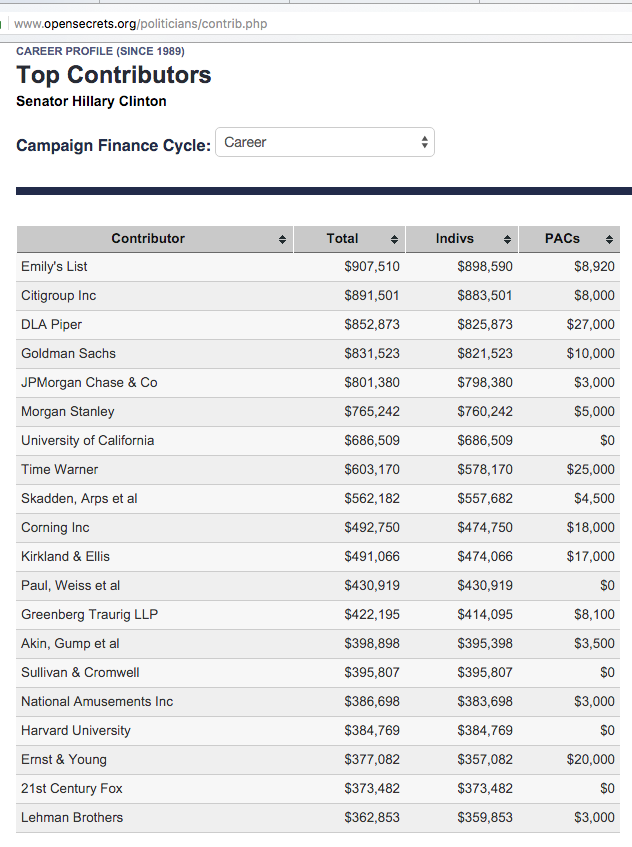

Both of them were liars, but Clinton did say, even publicly, “I’m certainly against one of Senator Obama’s ideas, which is to lift the cap on the payroll tax, because that would impose additional taxes on people who are educators, police officers, firefighters and the like.” Was she really concerned there about “educators, police officers, firefighters and the like”? Look at her career-donors:

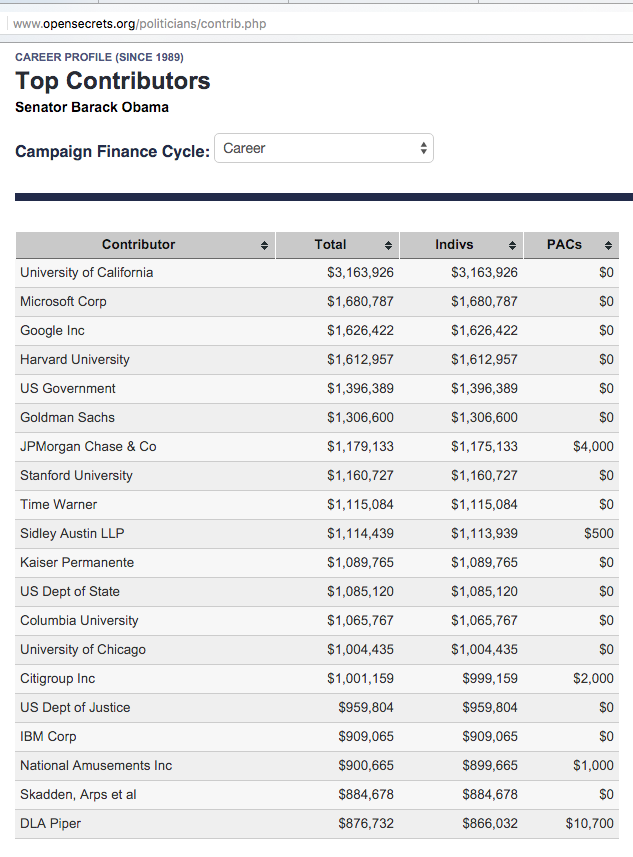

Here are Obama’s:

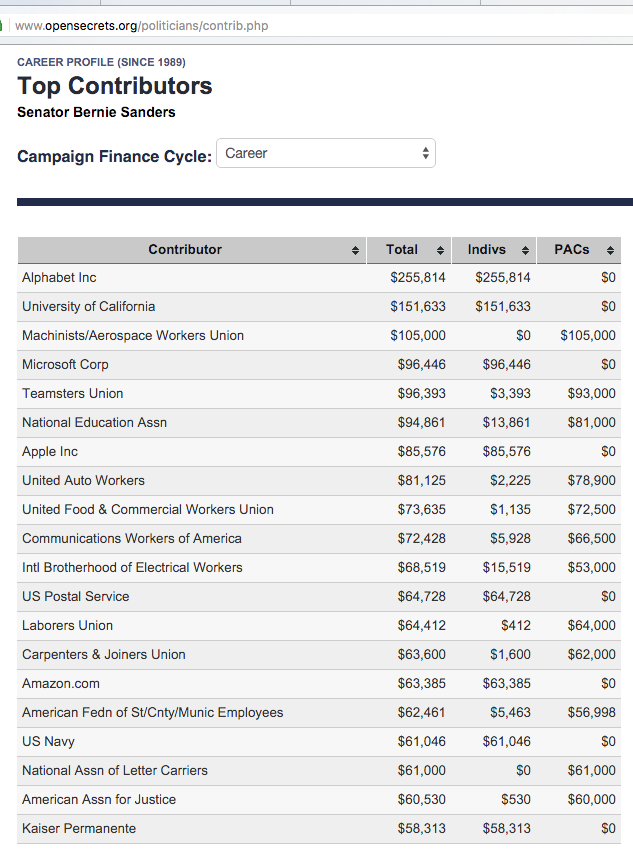

Here are Sanders’s:

The real question should not be what a politician says, but what he/she has done — which is reflected in that top-donor list.

Clearly: Clinton opposes transferring government-costs more onto the rich than onto the poor.

Looking at the top-donor list shows the reality about a politician.

It’s a question, for example, of whether one views one’s own interests as coinciding more with those of the members of labor unions, and of students and faculty of universities, and employees of high tech firms; or, instead, a mix of universities and Wall Street along with lobbying firms; or, instead, a mix of Wall Street and lobbying firms and Emily’s List.

But then one can also consider the likelihood that the given politician will be more inclined to shift the costs of government more onto the rich, or instead more onto the poor. However: those top-donor lists don’t include any really poor people, but instead organized interest groups and corporations and (in the case of Sanders) labor unions. That too is real information, not fake.

The difference between Hillary Clinton and Barack Obama, based upon the top-donor lists, is vastly less than the difference between Hillary Clinton and Bernie Sanders.

Investigative historian Eric Zuesse is the author, most recently, of They’re Not Even Close: The Democratic vs. Republican Economic Records, 1910-2010, and of CHRIST’S VENTRILOQUISTS: The Event that Created Christianity.