For the New York Times, US Labor Abuses Abroad Are a Thing of Decades Past

Does foreign investment make the US economy more vulnerable?

Apparently the New York Times believes it does. A lengthy article on the growth of Chinese foreign investment told readers:

But the show of financial strength [foreign investment by China] also makes China — and the world — more vulnerable. Long an engine of global growth, China is taking on new risks by exposing itself to shaky political regimes, volatile emerging markets and other economic forces beyond its control.

Any major problems could weigh on China’s growth, particularly at a time when it is already slowing.

Usually investing in other countries is thought to both increase returns to the country doing the investment and diversify risks, since it is unlikely that foreign countries will be subject to the same problems that may be hitting China (or the US) at the same time. It is interesting that the New York Times seems to hold the opposite perspective.

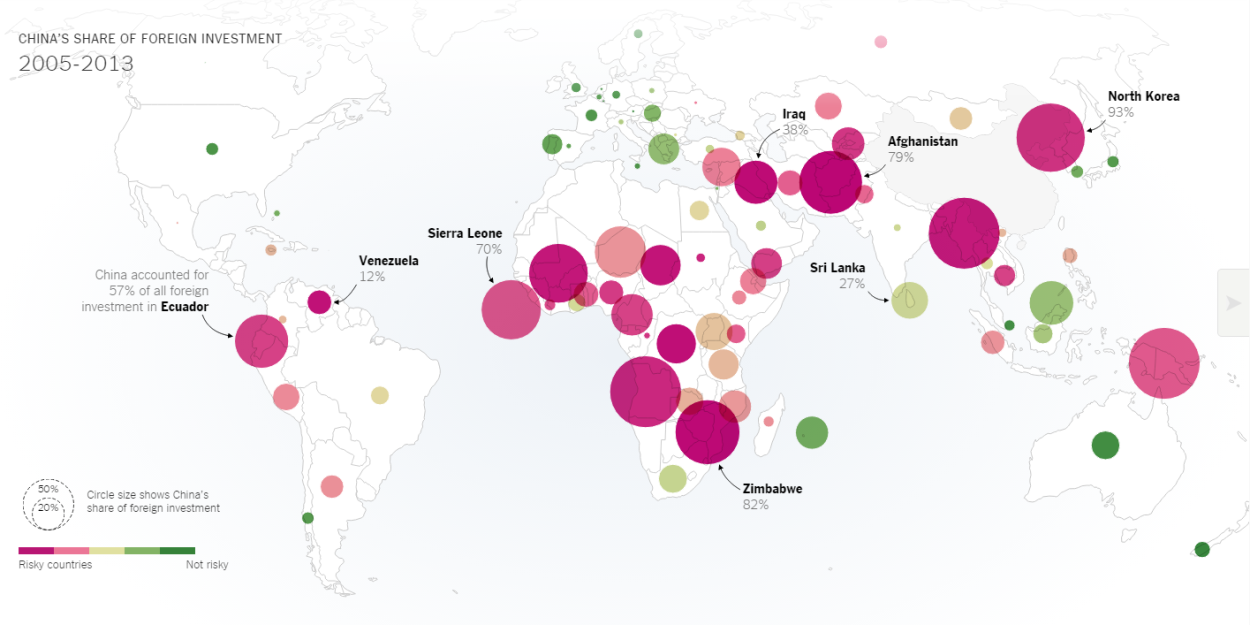

A New York Times graphic shows the share of Chinese investment in “risky countries” (red) and countries that are “not risky” (green).

The piece seems to imply that China is unusual in the demands it makes on the countries in which it invests:

China is forcing countries to play by its financial rules, which can be onerous. Many developing countries, in exchange for loans, pay steep interest rates and give up the rights to their natural resources for years. China has a lock on close to 90 percent of Ecuador’s oil exports, which mostly goes to paying off its loans.

The United States took the lead in establishing the International Monetary Fund, which often acts as its agent in disputes. For example, in the East Asian financial crisis, the IMF imposed very detailed programs on the countries of the region, which set tax and spending schedules, changed regulations throughout the economy and required the privatization of various industries. The conditions placed by China on the countries in which it invests may be different, but they are not without precedent.

The piece also bizarrely implies that labor abuses by US companies or their contractors are a thing of the past, telling readers:

Chinese mining and manufacturing operations, like many American and European companies in previous decades, have been accused of abusing workers overseas.

Of course there are many places in the world, most notably Bangladesh and Cambodia, where there are regular reports of workers, often children, working long hours in dangerous conditions to make goods under contract with U.S. corporations. Sometimes these workers are held against their will and have their pay stolen by their employers. This is an ongoing problem, not a historical concern.

In discussing the new Chinese infrastructure bank, the piece tells readers:

Washington is worried that China will create its own rules, with lower expectations for transparency, governance and the environment.

It would be helpful to know who in Washington says they are worried about these issues. Presumably all of Washington does not have these concerns. Also, just because politicians say these are their concerns, it doesn’t mean they are their actual concerns. For example, it may just be possible they fear competition from a Chinese investment bank.

Thanks to Keane Bhatt for calling this piece to my attention.

Economist Dean Baker is co-director of the Center for Economic and Policy Research in Washington, DC. A version of this post originally appeared on CEPR’s blog Beat the Press (7/28/15).

You can send a message to the New York Times at [email protected], or to public editor Margaret Sullivan at [email protected] (Twitter:@NYTimes or @Sulliview). Please remember that respectful communication is the most effective.