Financial Bailout: Thanks but No Thanks

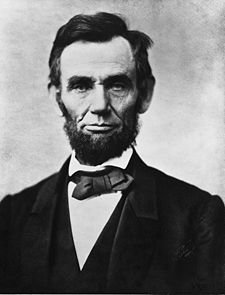

What Lincoln would have said to Paulson's $700 Billion Ransom

“These capitalists generally act harmoniously and in concert to fleece the people, and now that they have got into a quarrel with themselves, we are called upon to appropriate the people’s money to settle the quarrel.” – Abraham Lincoln, speech to Illinois legislature, January 1837

In July, Treasury Secretary Henry Paulson said of his massive underwriting scheme for Fannie Mae and Freddie Mac, “If you have a bazooka in your pocket and people know it, you probably won’t have to use it.” On September 7, Paulson pulled out his bazooka and fired, effectively nationalizing the mortgage giants. Last week, Paulson pulled out the bazooka again and held it to Congress’s head. “Seven hundred billion dollars or your credit system will collapse!” Seven hundred billion dollars is more than the country currently pays annually for Social Security; and for what do we owe this ransom? To bail out bankers from their own folly in speculating in a giant derivative Ponzi scheme that is now imploding. But policymakers justify rewarding the guilty parties at the expense of the taxpayers by arguing that “we have to do it to save the banking system.”

Abraham Lincoln was faced with a similar situation when he stepped into the Presidency in 1861. The country was suddenly in a civil war, and there was insufficient money to fund it. The British bankers, knowing they had him over a barrel, agreed to lend him money only at 24 to 36% interest, highly usurious rates that would have bankrupted the North. Our fearless forefather said, “Thanks but no thanks, I’ll print my own.” Issuing the national currency is the sovereign right of governments. A government does not need to borrow its national currency from bankers “merely pretending to have money.” That was the phrase used by Thomas Jefferson when he realized the bankers’ “fractional reserve” lending scheme meant that they were lending the same “reserves” many times over.

The federal dollars issued by Lincoln were called U.S. Notes or Greenbacks. They allowed the North not only to win the Civil War but to create the greatest industrial giant the world had ever seen. Lincoln’s government launched the steel industry, created a continental railroad system, promoted a new era of farm machinery and cheap tools, established free higher education, provided government support to all branches of science, organized the Bureau of Mines, increased labor productivity by 50 to 75 percent. The Greenback was not the only currency used to fund these achievements; but they could not have been accomplished without it, and they could not have been accomplished on money borrowed at 30% interest.

There are other historical examples. In the 1930s, Australia and New Zealand avoided the Depression conditions suffered elsewhere by drawing on a national credit card issued by publicly-owned central banks. The governments of the island states of Guernsey and Jersey have been issuing their own money for two centuries, creating thriving economies without carrying federal debt.

In none of these models has government-issued money created dangerous price inflation. Price inflation results either when the supply of money goes up but the supply of goods doesn’t, or when speculators crash currencies by massive short selling, as in those cases of Latin American hyperinflation when printing-press money was used to pay off foreign debt. When new money is used to produce new goods and services, price inflation does not result because supply and demand rise together. Prices increased during the American Civil War, but this was attributed to the scarcity of goods common in wartime. War produces weapons rather than consumer goods.

Today in most countries, money is created privately by banks when they make loans; but the banks create only the principal, not the interest necessary to pay the loans back. The interest must be borrowed into existence, continually increasing the money supply, in a Ponzi scheme that has reached its mathematical limits. The latest desperate proposal for propping up this collapsing system is to deliver $700 billion of taxpayer money to ex-Goldman Sachs CEO Henry Paulson to buy unmarketable derivative paper from the banks, shifting the loss on this dodgy paper from the banks to the taxpayers. Seven hundred billion is just the opening figure; losses on the imploding derivatives pyramid could wind up being in the trillions. And where will this money come from? It will no doubt be borrowed into existence from the banking system. We the people will be in the anomalous position of paying interest on a debt to the banks to bail out the banks! At the very least, doesn’t it seem that the banks should be paying interest on the $700 billion to us?

Rather than propping up an unsustainable system with taxpayer money, it may be time to let the private money-making scheme collapse and replace it with something better. Banks that have thrived in an unregulated free market should be left to work out their fates in that market. If they go bankrupt, they can be put into receivership and reorganized in return for an equity interest in the banks, as was done recently with AIG. The government would then own a string of banks, which could issue “the full faith and credit of the United States” directly, returning the country to productivity and prosperity just as Lincoln did.

As for the derivatives mess, there may be some derivatives that serve useful market functions, but most of them should be declared an illegal form of gambling and void. Neither party would owe on the deal; the bets would cancel each other out. True, dodgy assets transformed into “triple-A” investments by fake derivative insurance would lose that rating; but they aren’t triple-A investments, and the pension funds now holding them should dump them. The downgrades could wreak havoc on the balance sheets of some banks, but that’s the free market. If they go bankrupt and we the people have to bail them out, we should do it only in return for adequate quid pro quo in the form of their stock. Like Lincoln, we should say “Thanks but no thanks” to Paulson’s $700 billion ransom.

Ellen Brown, J.D., developed her research skills as an attorney practicing civil litigation in Los Angeles. In Web of Debt, her latest book, she turns those skills to an analysis of the Federal Reserve and “the money trust.” She shows how this private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. Her eleven books include the bestselling Nature’s Pharmacy, co-authored with Dr. Lynne Walker, and Forbidden Medicine. Her websites are www.webofdebt.com and www.ellenbrown.com.