Controversy Regarding China’s Investments in Africa

The Anti "Belt and Road" Narrative Just Hit Peak Cognitive Dissonance Over Ethiopia

Note to readers: please click the share buttons above

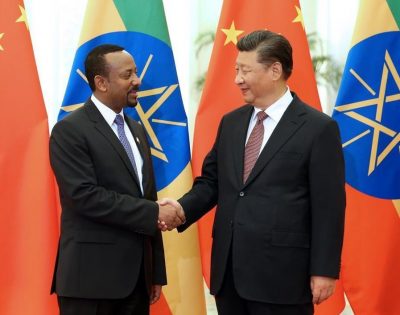

The Mainstream Media has been propagating the narrative that China’s only interest in “Global South” countries is to deviously ensnare them in so-called “debt traps” so that it can squeeze territorial concessions out of them afterwards such as was the case with Sri Lanka, but the fact that China is curtailing its investment in Ethiopia due to the latter’s debt issues isn’t being recognized as the “inconvenient” and contradictory fact that it is because of the peak level of cognitive dissonance that anti-Chinese forces are experiencing.

Reuters ran a story over the weekend titled “Trains delayed: Ethiopia debt woes curtail China funding”, in which the writers prove that Chinese investment in Africa’s second-most-populous country and its fastest-growing economy is slowing over concerns that Addis Ababa might have taken on too much debt over the years. The outlet also pointed to comments made by Chinese experts about the unexpected lack of profitability and sustainability of what the author has previously described as the “African CPEC”, the Chinese-funded Djibouti-Addis Ababa Railway (DAAR), though without mentioning the regional geopolitical context in which such a prognosis is being made.

Regional And Conceptual Background

To bring the reader up to speed, the UAE-facilitated Ethiopian-Eritrean rapprochement will see the landlocked giant diversify its access to the sea from its erstwhile dependence on Djibouti through a forthcoming corridor across its former rival’s territory to some of its ports on the Red Sea. Cynically speaking, there are grounds for speculating that some of the reasons why the UAE took the lead in this game-changing strategic realignment were to “pay China back” for CPEC (whose terminal port of Gwadar could one day rival and potentially surpass Dubai) and spite Djibouti for terminating its port contract in the country.

Whatever the origins behind these sudden regional developments may be, they certainly took China off guard, which explains why its experts are now revising their appraisal of DAAR’s long-term profitability and sustainability, leading to the knock-on effect of their country curtailing its investment in Ethiopia. There’s ordinarily nothing unusual about the dynamic of a foreign investor reevaluating their strategic interests in another country, but this takes on a completely different significance with China because it completely contradicts the narrative of the People’s Republic using predatory loans as a foreign policy instrument for luring “Global South” states into so-called “debt traps” prior to squeezing territorial concessions out of them afterwards.

Sri Lanka is commonly held up as the prime example of this supposed policy in action after China secured a 99-year lease over the Hambantota port following Colombo’s failure to repay its debt to Beijing. Critics of China’s One Belt One Road (OBOR) vision of New Silk Road connectivity immediately concocted a conspiracy theory that Sri Lanka is the rule – not the exception – to this paradigm and that Beijing is sneakily planning to expand its global influence by replicating the Hambantota model all across the world. In turn, the US and India have been waging a coordinated infowar to convince countries to reconsider their economic relations with China.

Discrediting The “Debt Trap” Model

Their efforts haven’t borne much fruit, though, as China just committed $60 billion in grants, loans, and investment to eager African recipients earlier this week during the triennial Forum on China-Africa Cooperation (FOCAC), and if the Ethiopian case is properly framed by Beijing, then it’s likely that the US and India’s infowar narrative will ultimately amount to nothing at all. Unlike what the Mainstream Media unsuccessfully tried to condition the global public to expect after decontextualizing and over-amplifying a weaponized misperception about Sri Lanka, China prudently decided to curtail its investment in Ethiopia over fears that Addis Ababa may not be able to sufficiently service its growing debt.

One should bear in mind that China’s first-ever military base is in neighboring Djibouti, so if the People’s Republic was really such an “aggressive neo-colonizing state” like it’s being made out to be by some forces, then it doesn’t make sense why it wouldn’t leverage that factor to its strategic economic advantage. Nor, for that matter, is China negotiating any sort of Hambantota-like territorial concession deal with Ethiopia in exchange for forgiving some of its debt. More and more, the truth is beginning to emerge that the Sri Lanka case study was a rare event that was maliciously exploited as a one-size-fits-all infowar model for attacking OBOR.

This realization is ironically lost on the same forces peddling the anti-OBOR narrative, however, because they’re instead more focused on sowing the seeds of doubt over China’s long-term commitment to Africa at precisely the moment that FOCAC was set to begin, with the publication of Reuters’ story just a few days before the monumental event kicked off being more than just an innocent coincidence. Another non-coincidence is that CNN all of a sudden ran a critical story about the Chinese-Ethiopian economic relationship and their political ties more generally, including accusations that Beijing bugged the Chinese-constructed African Union headquarters there.

The Shortcomings Of The New Infowar Storyline

The previous infowar obsession over China’s so-called “debt traps” in the “Global South” has been discredited by the Ethiopian example that the Mainstream Media itself decided to popularize at this given point in time, driven to do so by the rapidly changing geostrategic situation in the Horn of Africa that’s thought to be disadvantageous to Beijing’s previous Silk Road blueprint there. This explains why a bait-and-switch is on full display in forgetting about that former narrative and moving on to a new one as needed, one which criticizes the long-term planning potential of Chinese investments and the strategic foresight that goes into them.

The Achilles’ heel of this storyline is that it presents everything through a zero-sum prism in pretending that the diversification of Ethiopia’s strategic partnerships and its renewed access to the Red Sea through Eritrea are somehow contrary to China’s interests, which is only the case if one is looking purely at the profitability of DAAR. Taking stock of the business parks and other real-sector economic investments that China has made in Ethiopia over the past decade, and recognizing that it’s to Beijing’s benefit for them to reach the global marketplace one way or another, then it actually doesn’t make much of a difference whether they use DAAR or an Eritrean-transiting corridor to do so.

The argument can surely be made that there would have been tacit strategic advantages to China’s planned monopolization of Ethiopia’s international trade through DAAR given that its African partner realistically had no other reliable outlet to the sea at that time, but that’s not the only reason why Beijing committed billions to the country, and if it was, then the People’s Republic might have reacted similar to how the infowar narrative attempted to condition the global public to expect. That hasn’t happened, however, which therefore disproves the accusations of China’s “aggressive neo-imperial ambitions” in Africa, or at least in Ethiopia.

Concluding Thoughts

While being presented as some kind of a “loss” for China, the country’s curtailed investment in Ethiopia that’s presumably due to the unexpectedly changed geostrategic situation in the Horn of Africa facilitated by the UAE isn’t anything of the kind, and it’s actually a “win” for Beijing because it shows the world that the Sri Lankan case was an exception to the rule given how it’s not being applied in any shape or form in the Ethiopian example.

This reality has already produced such cognitive dissonance in the Mainstream Media that they’re doing everything that they can to avoid it, either doubling down on their discredited narrative about the so-called Hambantota model or employing a quick bait-and-switch by all of a sudden switching the storyline to one about China’s lack of strategic foresight in order to continue piling criticism on Beijing in one way or another so as to keep the anti-OBOR infowar ongoing.

While it can’t be ruled that “another Sri Lanka” won’t ever happen, it’s equally possible that Chinese-indebted countries will go the way of Ethiopia without any territorial concessions, but a detailed study must be undertaken to determine exactly what the key differences between these two cases are and why China reacted differently to them under similar economic circumstances. Even so, the very fact that this happened proves that the US & India’s negative narratives about OBOR are off-base.

*

This article was originally published on Eurasia Future.

Andrew Korybko is an American Moscow-based political analyst specializing in the relationship between the US strategy in Afro-Eurasia, China’s One Belt One Road global vision of New Silk Road connectivity, and Hybrid Warfare. He is a frequent contributor to Global Research.