America versus China: The Consequences of Moving from Industrial to Financial Capitalism

Michael Hudson and Pepe Escobar last month took a hard look at rent and rent-seeking at the Henry George School of Social Science.

Michael Hudson: Well, I’m honored to be here on the same show with Pepe and discuss our mutual concern. And I think you have to frame the whole issue that China is thriving, and the West has reached the end of the whole 75-year expansion it had since 1945.

So, there was an illusion that America is de-industrializing because of competition from China. And the reality is there is no way that America can re-industrialize and regain its export markets with the way that it’s organized today, financialized and privatized and if China didn’t exist. You’d still have the Rust Belt rusting out. You’d still have American industry not being able to compete abroad simply because the cost structure is so high in the United States.

The wealth is no longer made here by industrializing. It’s made financially, mainly by making capital gains. Rising prices for real estate or for stocks and for bonds. In the last nine months, since the coronavirus came here, the top 1 percent of the U.S. economy grew by $1 trillion. It’s been a windfall for the 1 percent. The stock market is way up, the bond market is up, the real estate market is up while the rest of the economy is going down. Despite the tariffs that Trump put on, Chinese imports, trade with China is going up because we’re just not producing materials.

America doesn’t make its own shoes. It doesn’t make some nuts and bolts or fasteners, it doesn’t make industrial things anymore because if money is to be made off an industrial company it’s to buy and sell the company, not to make loans to increase the company’s production. New York City, where I live, used to be an industrial city and, the industrial buildings, the mercantile buildings have all been gentrified into high-priced real estate and the result is that Americans have to pay so much money on education, rent, medical care that if they got all of their physical needs, their food, their clothing, all the goods and services for nothing, they still couldn’t compete with foreign labor because of all of the costs that they have to pay that are essentially called rent-seeking.

Housing in the United States now absorbs about 40 percent of the average worker’s paycheck. There’s 15 percent taken off the top of paychecks for pensions, Social Security and for Medicare. Further medical insurance adds more to the paycheck, income taxes and sales taxes add about another 10 percent. Then you have student loans and bank debt. So basically, the American worker can only spend about one third of his or her income on buying the goods and services they produce. All the rest goes into the FIRE sector — the finance, insurance and real estate sector — and other monopolies.

And essentially, we became what’s called a rent-seeking economy, not a productive economy. So, when people in Washington talk about American capitalism versus Chinese socialism this is confusing the issue. What kind of capitalism are we talking about?

America used to have industrial capitalism in the 19th century. That’s how it got richer originally but now it’s moved away from industrial capitalism towards finance capitalism. And what that means is that essentially the mixed economy that made America rich — where the government would invest in education and infrastructure and transportation and provide these at low costs so that the employers didn’t have to pay labor to afford high costs — all of this has been transformed over the last hundred years.

And we’ve moved away from the whole ethic of what was industrial capitalism. Before, the idea of capitalism in the 19th century from Adam Smith to Ricardo, to John Stuart Mill to Marx was very clear and Marx stated it quite clearly; capitalism was revolutionary. It was to get rid of the landlord class. It was to get rid of the rentier class. It was to get rid of the banking class essentially, and just bear all the costs that were unnecessary for production, because how did England and America and Germany gain their markets?

“We’ve moved away from the whole ethic of what was industrial capitalism.”

They gained their markets basically by the government picking up a lot of the costs of the economy. The government in America provided low-cost education, not student debt. It provided transportation at subsidized prices. It provided basic infrastructure at low cost. And so, government infrastructure was considered a fourth factor of production.

And if you read what the business schools in the late 19th century taught like Simon Patten at the Wharton School, it’s very much like socialism. In fact, it’s very much like what China is doing. And in fact, China is following in the last 30 or 40 years pretty much the same way of getting rich that America followed.

It had its government fund basic infrastructure. It provides low-cost education. It invests in high-speed railroads and airports, in the building of cities. So, the government bears most of the costs and, that means that employers don’t have to pay workers enough to pay a student loan debt. They don’t have to pay workers enough to pay enormous rent such as you have in the United States. They don’t have to pay workers to save for a pension fund, to pay the pension later on. And most of all the Chinese economy doesn’t really have to pay a banking class because banking is the most important public utility of all. Banking is what China has kept in the hands of government and Chinese banks don’t lend for the same reasons that American banks lend.

(When I said that China can pay lower wages than the U.S., what I meant was that China provides as public services many things that American workers have to pay out of their own pockets – such as health care, free education, subsidized education, and above all, much lower debt service.

When workers have to go into debt in order to live, they need much higher wages to keep solvent. When they have to pay for their own health insurance, they have to earn more. The same is true of education and student debt. So much of what Americans seem to be earning — more than workers in other countries — goes right through their hands to the FIRE sector. So, what seems to be “low wages” in China go a lot further than higher wages in the United States.)

Eighty percent of American bank loans are mortgage loans to real estate and the effect of loosening loan standards and increasing the market for real estate is to push up the cost of living, push up the cost of housing. So, Americans have to pay more and more money for their housing whether they’re renters or they’re buyers, in which case the rent is for paying mortgage interest.

So, all of this cost structure has been built into the economy. China’s been able pretty much, to avoid all of this, because its objective in banking is not to make a profit and interest, not to make capital gains and speculation. It creates money to fund actual means of production to build factories, to build research and development, to build transportation facilities, to build infrastructure. Banks in America don’t lend for that kind of thing.

“So, you have a diametric opposite philosophy of how to develop between the United States and China.”

They only lend against collateral that’s already in place because they won’t make a loan if it’s not backed by collateral. Well, China creates money through its public banks to create capital, to create the means of production. So, you have a diametric opposite philosophy of how to develop between the United States and China.

The United States has decided not to gain wealth by actually investing in means of production and producing goods and services, but in financial ways. China is gaining wealth the old-fashioned way, by producing it. And whether you call this, industrial capitalism or a state capitalism or a state socialism or Marxism, it basically follows the same logic of real economics, the real economy, not the financial overhead. So, you have China operating as a real economy, increasing its production, becoming the workshop of the world as England used to be called and America trying to draw in foreign resources, live off of foreign resources, live by trying to make money by investing in the Chinese stock market or now, moving investment banks into China and making loans to China not actual industrial capitalism ways.

“China is gaining wealth the old-fashioned way, by producing it.”

So, you could say that America has gone beyond industrial capitalism, and they call it the post-industrial society, but you could call it the neo-feudal society. You could call it the neo-rentier society, or you could call it debt peonage but it’s not industrial capitalism.

And in that sense, there’s no rivalry between China and America. These are different systems going their own way and I better let Pepe pick it up from there.

Pepe Escobar: Okay. Thank you, Michael, this is brilliant. And you did it in less than 15 minutes. You told the whole story in 15 minutes. Well, my journalistic instinct is immediately to start questions to Michael. So, this is exactly what I’m gonna do now. I think it is much better to basically illustrate some points of what Michael just said, comparing the American system, which is finance capitalism essentially, with industrial capitalism that is in effect in China. Let me try to start with a very concrete and straight to the point question, Michael.

Okay. let’s says that more or less, if we want to summarize it, basically they try to tax the nonproductive rentier class. So, this would be the Chinese way to distribute wealth, right? Sifting through the Chinese economic literature, there is a very interesting concept, which is relatively new (correct me if I am wrong, Michael) in China, which they call stable investment. So stable investment, according to the Chinese would be to issue special bonds as extra capital in fact, to be invested in infrastructure building all across China, and they choose these projects in what they call weak areas and weak links. So probably in some of the inner provinces, or probably in some parts of Tibet or Xinjiang for instance. So, this is a way to invest in the real economy and in real government investment projects.

Right? So, my question in fact, is does this system create extra local debt, coming directly from this financing from Beijing? Is this a good recipe for sustainable development, the Chinese way and the recipe that they could expand to other parts of the Global South?

Michael: Well, this is a big problem that they’re discussing right now. The localities, especially rural China, (and China is still largely rural) only cover about half of their working budget from taxation. So, they have a problem. How are they going to get the balance of the money? Well, there is no official revenue sharing between the federal government and its state banks and the localities.

So, the localities can’t simply go to central government and say, give us more money. The government lets the localities be very independent. And it is sort of the “let a hundred flowers bloom” concept. And so, they’ve let each locality just go the long way, but the localities have run a big deficit.

What do they do? Well in the United States they would issue bonds on which New York is about to default. But in China, the easiest way for the localities to make money, is unfortunately they will do something like Chicago did. They will sell their tax rights for the next 75 years for current money now.

So, a real estate developer will come in and say; look we will give you the next 75 years of tax on this land, because we want to build projects on this (a set of buildings). So, what this means is that now the cities have given away all their source of rent.

Let me show you the problem by what Indiana and Chicago did. Chicago also was very much like China’s countryside cities. So, it sold parking meters and its sidewalks to a whole series of Wall Street investors, including the Abu Dhabi Investment Fund for seventy-five years. And that meant that for 75 years, this Wall Street consortium got to control the parking meters.

So, they put up the parking meters all over Chicago, raised the price of parking, raised the cost of driving to Chicago. And if Chicago would have a parade and interrupt parking, then Chicago has to pay the Abu Dhabi fund and Wall Street company what it would have made anyway. And this became such an awful disaster that finally Wall Street had to reverse the deal and undo it because it was giving privatization a bad name here. The same thing happened in Indiana.

High School marching band in Chicago’s 2008 Bud Billiken Parade. (Curtis Morrow, CC BY 2.0, Wikimedia Commons)

Indiana was running a deficit and it decided to sell its roads to a Wall Street investment firm to make a toll road. The toll on the Indiana turnpike was so high that drivers began to take over the side roads. That’s the problem if you sell future tax revenues in advance.

Now what China and the localities there are discussing is that we’ve already given the real estate tax at very low estimates to the commercial developers, so what do we do? Well, I’ve given them my advice. I’m a professor of economics at the Peking University, School of Marxist studies and I’ve had discussions with the Central Committee. I also have an official position at Wuhan University. There, we’re discussing how China can put an added tax for all of the valuable land, that’s gone up. How can it be done to let the cities collect this tax? Our claim is that the cities, in selling these tax rights for 75 years, have sold what in Britain would be called ground rent (i.e. what’s paid to the landed aristocracy).

Over and above that there’s the market rent. So, China should pass a market-rent tax over and above the ground rent tax to reflect the current value. And there they’re thinking of, well, do we say that this is a capital gain on the land? Well, it’s not really a capital gain until you sell the land, but it’s value. It’s the valuation of the capital. And they’re looking at whether they should just say this is the market rent tax over and above the flat tax that has been paid in advance, or it’s a land tax on the capital gain for land.

Now, all of this requires that there be a land map of the whole country. And they are just beginning to create such a land map as a basis for how you calculate how much the rent there is.

What I found in China is something very strange. A few years ago, in Beijing, they had the first, International Marxist conference where I was the main speaker and I was talking about Marx’s discussion of the history of rent theory in Volume II and Volume III of Capital where Marx discusses all of the classical economics that led up to his view; Adam Smith, Ricardo, Malthus, John Stuart Mill, and Marx’s theory of surplus value was really the first history of economic thought that was written, although it wasn’t published until after he died. Well, you could see that there was a little bit of discomfort with some of the Marxists at the conference. And so, they invited for the next time my colleague David Harvey to come and talk about Marxism in the West.

Well, David gave both the leading and the closing speech of the conference and said, you’ve got to go beyond volume I of Capital. Volume I was what Marx wrote as his addition to classical economics, saying that there was exploitation in industrial employment of labor as well as rent seeking and then he said, now that I’ve done my introduction here, let me talk about how capitalism works in Volumes II and III. Volumes II and III are all about rent and finance and David Harvey has published a book on Volume III of Capital and his message to Peking University and the second Marxist conference was – you’ve got to read Volume II, and III.

Well, you can see that, there’s a discussion now over what is Marxism and a friend and colleague at PKU said Marxism is a Chinese word; It’s the Chinese word for politics. That made everything clear to me. Now I get it! I’ve been asked by the Academy of Social Sciences in China to create a syllabus of the history of rent theory and value theory. And essentially in order to have an idea of how you calculate rent, how do you make a national income analysis where you show rent, you have to have a theory of value and price and rent is the excess of price over the actual cost value. Well, for that you need a concept of cost of production and that’s what classical economics is all about. Post-classical economics denied all of this. The whole idea of classical economics is that not all income is earned.

Landlords don’t earn their income for making rent in their sleep as John Stuart Mill said. Banks don’t earn their income by just sitting there and letting debts accrue and interest compounding and doubling. The classical economists separated actual unearned income from the production and consumption economy.

Well, around the late 19th century in America, you had economists fighting against not only Marx, but also even against Henry George, who at that time, was urging a land tax in New York. And so, at Columbia University, John Bates Clark developed a whole theory that everybody earns whatever they can get. That there was no such thing as unearned income and that has become the basis for American national income statistics and thought ever since. So, if you look at today’s GDP figures for the United States, they have a figure for 8 percent of the GDP for the homeowners’ rent. But homeowners wouldn’t pay themselves if they had to rent the apartment to themselves, then you’ll have interest at about 12 percent of GDP.

And I thought, well how can interest be so steady? What happens to all of the late fees; that 29 percent that credit card companies charge? I called up the national income people in Washington, when I was there. And they said well, late fees and penalties are considered financial services.

And so, this is what you call a service economy. Well, there’s no service in charging a late fee, but they add all of the late fees. When people can’t pay their debts and they owe more and more, all of that is considered an addition to GDP. When housing becomes more expensive and prices American labor out of the market, that’s called an increase in GDP.

This is not how a country that wants to develop is going to create a national income account. So, there’s a long discussion in China about, just to answer your question, how do you create an account to distinguish between what’s the necessary cost to production and what’s an unnecessary production cost and how do we avoid doing what the United States did. So again, no rivalry. The United States is an object lesson for China on what to avoid, not only in industrializing the economy, but in creating a picture of the economy as if everybody earns everything and there’s no exploitation, no earned income, nobody makes money in their sleep and there’s no 1 percent. Well, that’s what’s really at issue and why the whole world is splitting apart as you and I are discussing in what we’re writing.

“When people can’t pay their debts and they owe more and more, all of that is considered an addition to GDP.”

Pepe: Thank you, Michael. Thank you very much. So just to sum it all up, can we say that Beijing’s strategy is to save especially provincial areas from leasing their land, their infrastructure for 60 years or 75 years? As you just mentioned, can we say that the fulcrum of their national strategy is what you define as the market rent tax? Is this the No. 1 mechanism that they are developing?

Michael: Ideally, they want to keep rents as low as possible because rent is a cost of living and a cost of doing business. They don’t have banks that are lending to inflate the real estate market.

However, in almost every Western country — the U.S., Germany England — the value of stocks and bonds and the value of real estate is just about exactly the same. But for China, the value of real estate is way, way larger than the value of stocks.

And the reason is not because the Chinese Central bank, the Bank of China lends for real estate; it’s because they lend to intermediaries and the intermediaries have financed a lot of housing purchases in China. And, this is really the problem for if they levy a land tax, then you’re going to make a lot of these financial intermediaries go bust.

That’s what I’m advocating, and I don’t think that’s a bad thing. These financial intermediaries shouldn’t exist, and this same issue came up in 2009 in the United States. You had the leading American bank being the most crooked and internally corrupt bank in the country, Citibank making junk mortgage, and it was broke.

Its entire net worth was wiped out as a result of its fraudulent junk mortgages. Well, Sheila Bair, the head of the Federal Deposit Insurance Corporation (FDIC) wanted to close it down and take it over. Essentially that would have made it into a public bank and that would be a wonderful thing. She said, look Citibank shouldn’t be doing what it’s doing. And she wrote all this up in an autobiography. And, she was overruled by President Obama and Tim Geithner saying, but wait a minute, those are our campaign contributors. So, they were loyal to the campaign contributors, but not the voters; and they didn’t close Citibank down.

And the result is that the Federal Reserve ended up creating about $7 trillion of quantitative easing to bail out the banks. The homeowners weren’t bailed out. Ten million American families lost their homes as a result of junk mortgages in excess of what the property was actually worth.

All of this was left on the books, foreclosed and sold to a private capital companies like Blackstone. And the result is that home ownership in America declined from 68 percent of the population down to about 61 percent. Well, right where the Obama administration left off, you’re about to have the Biden administration begin in January with an estimated 5 million Americans losing their homes. They’re going to be evicted because they’ve been unemployed during the pandemic. They’ve been working in restaurants or gyms or other industries that have been shut down because of the pandemic. They’re going to be evicted and many homeowners and, low-income homeowners have been unable to pay their mortgages.

There’s going to be a wave of foreclosures. The question is, who’s going to bear the cost? Should it be 15 million American families who lose their homes just so the banks won’t lose money? Or should we let the banks that have made all of the growth since 2008? Ninety five percent of American GDP of the population has seen its wealth go down. All the wealth has been accumulating for the 5 percent in statistics. Now the question is should this 5 percent that’s got all the wealth lose or should the 95 percent lose?

Worker installs security panels over windows after police evict woman from her foreclosed home in South Minneapolis, 2009. (Tony Webster, CC BY 2.0, Wikimedia Commons)

The Biden administration says the 95 percent should lose basically. And you’re going to see a wave of closures so that the question in China should be that, these intermediate banks (they’re not really banks they are sort of like payday loan lenders), should they come in and, bear the loss or should Chinese localities and the people bear the loss? Somebody has to lose when you’re charging, you’re collecting the land’s rent that was paid to the creditors, and either the creditors have to lose or, the tax collector loses and that’s the conflict that exists in every society of the world today. And, in the West, the idea is the tax collectors should lose and whatever the tax collector relinquishes should be free for the banks to collect. In China obviously, they don’t want that to happen and they don’t want to see a financial class developing along US lines.

Pepe: Michael, there’s a quick question in all this, which is the official position by Beijing in terms of helping the localities. Their official position is that there won’t be any bailouts of local debt. How do they plan to do that?

Michael: What they’re discussing, how are you not going to do it? They think they sort of let localities go their own way. And they think, well you know which ones are going to succeed, and which ones aren’t, they didn’t want to have a one-size-fits all central planning. They wanted to have flexibility. Well, now they have flexibility. And when you have many different “let a hundred flowers bloom,” not all the flowers are going to bloom at the same rate.

And the question is, if they don’t bail out the cities, how are the cities going to operate? Certainly, China has never let markets steer the economy, the government steers the markets. That’s what socialism is as opposed to finance capitalism. So, the question is, you can let localities go broke and yet you’re not going to destroy any of the physical assets of the localities, and all of this is going to be in place. The question is how are you going to arrange the flow of income to all of these roads and buildings and land that’s in place? How do you create a system? Essentially, they’re saying well, if we’re industrial engineers, how do we just plan things? Forget credit, forget property claims, forget the rentier claims. How are we just going to design an economy that operates most efficiently? And that’s what they’re working on now to resolve this situation because it’s gotten fairly critical.

Pepe: Yes, especially in the countryside. Well, I think, a very good metaphor in terms of comparing both systems are investment in infrastructure. You travel to China a lot so, you’ve seen. You’ll travel through high-speed rail. You’ll see those fantastic airports, in Pudong or the new airport in Beijing. And then you’ll take the Acela to go from Washington to New York City, which is something that I used to do years ago. And the comparison is striking. Isn’t it?

Or if you go to France, for instance, when France started development of the TGV, which in terms of a national infrastructure network, is one of the best networks on the planet. And the French started doing this 30 years ago, even more. Is there……, it’s not in terms of way out, but if we analyze the minutia, it’s obvious that following the American finance utilization system, we could never have something remotely similar happening in United States in terms of building infrastructure.

So, do you see any realistic bypass mechanism in terms of improving American infrastructure, especially in the big cities?

TGV 2N2 Lyria train at Paris’ Gare de Lyon station. (CC BY-SA 4.0, Wikimedia Commons)

Michael: No, and there are two reasons for that. No. 1, let’s take a look at the long-term railroads. The railroads go through the center of town or even in the countryside, all along the railroads, the railroads brought business and all the businesses had been located as close to the railroad tracks as they could. Factories with sightings off the railroad, hotels and especially right through the middle of town where you have the railway gates going up and down. In order to make a high-speed rail as in China, you need a dedicated roadway without trucks and cars, imagine a car going through a railway gate at 350 miles an hour.

So, when I would go from Beijing to Tianjin, here’s the high-speed rail, there’s one highway on one side, one highway on the other side. There’ll be underpasses. But there it goes straight now. How can you suppose you would have a straight Acela line from Washington up to Boston when all along the line, there’s all this real estate right along the line that has been built up? There’s no way you can get a dedicated roadway without having to tear down all of this real estate that’s on either side and the cost of making the current owners whole would be prohibitive. And anywhere you would go, that’s not in the center of the city, you would also have to have the problem that there’s already private property there.

And there’s no legal, constitutional way for such a physical investment to be made. China was able to make this investment because it was still largely rural. It wasn’t as built up along the railways. It didn’t have any particular area that was built up right where the railroad already was.

President Donald Trump visiting China in 2017. (PAS China via Wikimedia Commons)

So certainly, any high-speed rail could not go where the current railways would be, and they’d have to go on somebody’s land. And, there’s also, what do you do if you want to get to New York and Long Island from New Jersey?

Sixty years ago, when I went into Wall Street, the cost of getting and transporting goods from California to Newark, New Jersey, was as large as from Newark right across the Hudson River to New York, not only because of the mafia and control of the local labor unions, but because of the tunnels. Right now, the tunnels from New Jersey to New York are broke, they are leaking, the subways in New York City, which continually break down because there was a hurricane a few years ago and the switches were made in the 1940s. The switches are 80 years old. They had water damage and the trains have to go at a crawl. But the city and state, because it is not collecting the real estate tax and other taxes and because ridership fell on the subways to about 20 percent, the city’s broke. They’re talking about 70 percent of city services being cut back. They’re talking about cutting back the subways to 40 percent capacity, meaning everybody will have to get in — when there’s still a virus and not many people are wearing masks, and there was no means of enforcing masks here.

So, there’s no way that you can rebuild the infrastructure because, for one thing the banking system here has subsidized for a hundred years junk economics saying you have to balance the budget. If the government creates credit it’s inflationary as if when banks create credit, it’s not inflationary. Well, the monetary effect is the same, no matter who creates the money. And so, Biden has already said that President Trump ran a big deficit, we’re going to run a bunch of surpluses or a budget balance. And he was advocating that all along. Essentially Biden is saying we have to increase unemployment by 20 percent, lower wages by 20 percent, shrink the economy by about 10 percent in order to, in order for the banks not to lose money.

“You’re going to price the American economy even further out of business because they say that public investment is socialism.”

And, we’re going to privatize but we are going to do it by selling the hospitals, the schools, the parks, the transportation to finance, to Wall Street finance capital groups. And so, you can imagine what’s going to happen if the Wall Street groups buy the infrastructure. They’ll do what happened to Chicago when it sold all the parking meters, they’ll say, OK, instead of 25 cents an hour, it’s now charged $3 an hour. Instead of a $2 for the subway, let’s make it $8.

You’re going to price the American economy even further out of business because they say that public investment is socialism. Well, it’s not socialism. It’s industrial capitalism. It’s industrialization, that’s basic economics. The idea of what, and how an economy works is so twisted academically that it’s the antithesis of what Adam Smith, John Stewart Mill and Marx all talked about. For them a free- market economy was an economy free of rentiers. Free of rent, it didn’t have any rent seeking. But now for the Americans, a free-market economy is free for the rentiers, free for the landlord, free for the banks to make a killing. And that is basically the class war back in business with a vengeance. That blocks and is preventing any kind infrastructure recovery. I don’t see how it can possibly take place.

Pepe: Well, based on what you just described, there is a process of turning the United States into a giant Brazil. In fact, this is what the Brazilian Finance Minister Paulo Guedes, a Pinochetista, as you know Michael, has been doing with the Brazilian economy for the past two years, privatizing everything and selling everything to big Brazilian interests and with lots of Wall Street interests involved as well. So, this is a recipe that goes all across the Global South as well. And it’s fully copied all across the Global South with no way out now.

Michael: Yes, and this is promoted by the World Bank and the International Monetary Fund. And when I was brought down to Brazil to meet with the council of economic advisers under Lula, [Luiz Inácio Lula da Silva, former president of Brazil], they said, well the whole problem is that Lula’s been obliged to let the banks do the planning.

So, basically free markets and libertarianism is adopting central planning, but with central planning by the banks. America is a much more centrally planned economy than China. China is letting a hundred flowers bloom; America has concentrated the planning and the resource allocation in Wall Street. And that’s the central planning that is much more corrosive than any government planning, could be. Now the irony is that China’s sending its students to America to study economics. And, most of the Chinese I had talked to say, well we went to America to take economics courses because that gives us a prestige here in China.

I’m working now, with Chinese groups trying to develop a “reality economics” to be taught in China as different from American economics.

“America has concentrated the planning and the resource allocation in Wall Street. And that’s the central planning that is much more corrosive than any government planning, could be.”

Pepe: Exactly, because of what they study at Beijing University, Renmin or Tsinghua

is not exactly what they would study in big American universities. Probably what they study in the U.S. is what not to do in China. When they go back to China, what they won’t be doing. It’s an object lesson for what to avoid.

Michael, I’d like to go back to what the BRICS [Brazil, Russia, India, China and South Africa] had been discussing in the 2000s when Lula was still president of Brazil and many of his ideas deeply impressed, especially Hu Jintao at the time, which is bypassing the U.S. dollar. Well, at the moment obviously we’re still at 87 percent of international transactions still in U.S. dollars. So, we are very far away from it, but if you have a truly sovereign economy, which is the case of China, which we can say is the case of Russia to a certain extent and obviously in a completely different framework, Iran. Iran is a completely sovereign, independent economy from the West. The only way to try to develop different mechanisms to not fall into the rentier mind space would be to bypass the U.S. dollar.

Occupy Wall Street picket of HSBC, midtown Manhattan; Feb. 14, 2013. (Michael Fleshman Via Flickr)

Michael: Yes, for many reasons. For one thing the United States can simply print the dollars and lend to other countries and then say, now you have to pay us interest. Well, Russia doesn’t need American dollars. It can print its own rubles to provide labor. There’s no need for a foreign currency at all for domestic spending, the only reason you would have to borrow a foreign currency is to balance your exchange rate, or to finance a trade deficit. But China doesn’t have a trade deficit. And in fact, if China were to work to accept more dollars, Americans would love to buy into the Chinese market and make a profit there, but that would push up China’s exchange rate and that would make it more difficult for her to make its exports because the exchange rate would come up not because it’s exporting more but because it’s letting American dollars come in and push it up.

Well, fortunately, President Trump as if he works for the Chinese National Committee, said, look, we don’t want to really hurt China by pushing up its currency and we want to keep it competitive. So, I’m going to prevent American companies from lending money to China, I’m going to isolate it and so he’s helping them protect their economy. And in Russia he said, look Russia really needs to feed itself. And, there’s a real danger that when the Democrats come in, there are a lot of anti-Russians in the Biden administration. They may go to war. They may do to Russia what they tried to do to China in the ‘50s. Stop exporting food and grain. And only Canada was able to break the embargo. So, we’re going to impose sanctions on Russia. So immediately, what happened is Russia very quickly became the largest grain exporter in the world. And instead of importing cheese from the Baltics, it created its own cheese industry. So, Trump said look, I know that Russians followed the American idea of not having protective tariffs, they need protective tariffs. They’re not doing it. We’re going to help them out by just not importing from them and really helping them.

Pepe: Yeah. Michael, what do you think Black Rock wants from the Chinese? You know that they are making a few inroads at the highest levels? Of course, I’m sure you’re aware of that. And also, JP Morgan, Citybank, etc. What do they really want?

Michael: They’d like to be able to create dollars to begin to buy and make loans to real estate; let companies grow, let the real estate market grow and make capital gains.

The way people get wealthy today isn’t by making an income, it’s been by making a capital gain. Total returns are current income plus the capital gains. As for capital gains each year; the land value gains alone are larger than the whole GDP growth from year to year. So that’s where the money is, that’s where the wealth is. So, they are after speculative capital gains, they would like to push money into the Chinese stock market and real estate market. See the prices go up and then inflate the prices by buying in and then sell out at the high price. Pull the money out, get a capital gain and let the economy crash, I mean that’s the business plan.

Pepe: Exactly. But Beijing will never allow that.

Michael: Well, here’s the problem right now, they know that Biden is pushing militarily aggressive people in his cabinet. There’s one kind of overhead that China is really trying to avoid and that’s the military overhead because if you spend money on the military, you can’t spend it on the real economy. They’re very worried about the military and they say, how do we deter the Biden administration from actually trying a military adventure in the South China Sea or elsewhere? They said well, fortunately America is multi-layered. They don’t think of America as a group. They realize there’s a layer and they say, who’s going to represent our interests?

“There’s one kind of overhead that China is really trying to avoid and that’s the military overhead because if you spend money on the military, you can’t spend it on the real economy.”

Well, Blackstone and Wall Street are going to represent their interests. Then I think one of the, Chinese officials last week gave a big speech on this very thing, saying look, our best hope in stopping America’s military adventurism in China is to have Wall Street acting as our support because after all, Wall Street is the main campaign contributor and the president works for the campaign contributors.

The politician works for the campaign contributors. They’re in it for the money! So fortunately, we have Wall Street on our side, we’ve got control of the political system and they’re not there to go to war so that helps explain why a month ago they let wholly-owned U.S. banks and bankers in. On the one hand, they don’t like the idea of somebody outside the government creating credit for reasons that the economy doesn’t need. If they needed it, the Bank of China would do it. They have no need for foreign currency to come in to make loans in domestic currency, out of China.

The only reason that they could do it is No. 1, it helps meet the World Trade Organization’s principles and, No. 2, especially during this formative few months of the Biden administration, it helps to have Wall Street saying; we can make a fortune in China, go easy on them and that essentially counters the military hawks in Washington.

Pepe: So, do you foresee a scenario when Black Rock starts wreaking havoc in the Shanghai stock exchange for instance?

Wall Street, Nov. 21, 2009. (Dave Center, Flickr)

Michael: It would love to do that. It would love to move things up and down. The money’s made by companies with the stock market going up and down; the zigzag. So of course, it wants to do a predatory zigzag. The question is whether China will impose a tax to stop this, all sorts of financial transactions. That’s what’s under discussion now. They know exactly what Black Rock wants to do because they have some very savvy billionaire Chinese advisers that are quite good. I can tell you stories, but I better not.

Pepe: Okay. If it’s not okay to tell it all, tell us part of the story then.

Michael: The American banks have been cultivating leading Chinese people by providing them enough money to make money here, that they think that, okay they will now try to make money in the same way in China and we can join in. It’s a conflict of systems again, between the finance capital system and industrial socialism. You don’t get any of this discussion in the U.S. press, which is why I read what you write because in the U.S. press, the neocons talk about the fake idea of Greek history and fake idea of the Thucydides’ problem of a country jealous of another country’s development.

There’s no jealousy between America and China. They’re different, they have their own way. We are going to destroy them. And if you look at the analogy that the Americans draw —and this is how the Pentagon thinks — with the war between Athens and Sparta. It’s hard to tell, which is which. Here you have Athens, a democracy backing other democracies and having the military support of the democracies and the military in these democracies all had to pay Athens protection money for the military support and that’s the money that Athens got to ostensibly support its navy and protection that built up all of the Athenian public buildings and everything else. So, that’s a democracy exploiting its allies, to enrich itself via the military. Then you have Sparta, which was funding all of the oligarchies, and it was helping the oligarchies overthrow democracies. Well, that was America too. So, America is both sides of the Thucydides war if the democracy is exploiting the fellow democracies and is the supporter of oligarchies in Brazil, Latin America, Africa and everyone else.

So, you could say the Thucydides problem was between two sides, two aspects of America and has nothing to do with China at all except, for the fact that the whole war was a war between economic systems. They’re acting as if somehow if only China did not export to us, we could be re-industrialized and somehow export to Europe and the Third World.

And as you and I have described, it’s over. We painted ourselves into such a debt corner that without writing down the debts, we’re in the same position that the Eurozone is in. There’s so much money that goes to the creditors to the top 1 percent or 5 percent that there is no money for capital investment, there is no money for growth. And, since 1980 as you know, real wages in America have been stable. All the growth has been in property owners and predators and the FIRE sector, the rest of the economy is in stagnation. And now the coronavirus has simply acted as a catalyst to make it very clear that the game is over; it’s time to move away from the homeowner economy to rentier economy, time for Blackstone to be the landlord. America wants to recreate the British landlord class and essentially what we’re seeing now is like the Norman invasion of England taking over the land and the infrastructure. That’s what Blackstone would love to do in China.

“There’s so much money that goes to the creditors to the top 1 percent or 5 percent that there is no money for capital investment, there is no money for growth.”

Pepe: Wow. I’m afraid that they may have a lot of leeway by some members of the Beijing leadership now, because as you know very well, it’s not a consensus in the political arena.

Michael: We’re talking about Volume II and III of Capital.

Pepe: Exactly. But you know, you were talking about debt. Coming back to that, in fact I just checked this morning, apparently global debt as it stands today is $277 trillion, which is something like 365 percent of global GDP. What does that mean in practice?

Michael: Yeah, well fortunately this is discussed in the 19th century and there was a word for that — fictitious capital — it’s a debt that can’t be paid, but you’ll keep it on the books anyway. And every country has this. You could say the question now, and The Financial Times just had an article a few days ago that China’s claims on Third World countries on the Belt and Road Initiative is fictitious capital, because how can it collect?

Well, China’s already thought of that. It doesn’t want money. It wants the raw materials. It wants to be paid in real things. But a debt that can’t be paid, can only be paid either by foreclosing on the debtors or by writing down the debts and obviously a debt that can’t be paid won’t be paid.

“Fictitious capital — it’s a debt that can’t be paid, but you’ll keep it on the books anyway. And every country has this.”

And so, you have not only Marx using the word fictitious capital. At the other end of the spectrum, you had Henry George talking about fictive capital. In other words, these are property claims that have no real capital behind them. There’s no capital that makes profit. That’s just a property claim for payment or a rentier claim for payment.

So, the question is, can you make money somehow without having any production at all, without having wages, without having profits, without any capital? Can you just have asset grabbing and buying-and-selling assets? And as long as you have the Federal Reserve in America, come in, Trump’s $10 trillion Covid program gave $2 trillion to the population at large with these $1,200 checks, that my wife and I got, and $8 trillion all just to buy stocks and bonds. None of this was to build infrastructure. None of this $8 trillion was to build a single factory. None of this 8 trillion was to employee a single worker. It was all just to support the prices of stocks and bonds, and to keep the illusion that the economy had not stopped growing. Well, it’s growing for the 5 percent. So, it’s all become fictitious. And if you look at the GDP as I said, it’s fictitious.

Pepe: And the most extraordinary thing is none of that is discussed in American media. There’s not a single word about what you would have been describing.

Michael: It’s not even discussed in academia. Our graduates at the university of Missouri at Kansas City, we’re all trained in Modern Monetary Theory. And as hired professors they have to be able to publish in the refereed journals and the refereed journals are all essentially controlled by the Chicago School. So, you have a censorship of the kind of ideas that we’re talking about. You can’t get it into the economic journals, so you can’t get it into the economics curriculum. So, where on earth are you going to get it? If you didn’t have the internet you wouldn’t be discussing at all. Most of my books sell mainly in China, more than in all the other countries put together so I can discuss these things there. I stopped publishing in orthodox journals so many years ago because it’s talking to the deaf.

“None of this $8 trillion was to build a single factory, employee, a single worker.”

Pepe: Absolutely. Yeah. Can I ask you a question about Russia, Michael? There is a raging, debate in Russia for many years now between let’s say the Eurasianists and the Atlanticists. It involves of course, economic policy under Putin, industrial capitalism Russian style. The Eurasianists basically say that the central problem with Russia is how the Russian central bank is basically affiliated with all the mechanisms that you know so well, that it is an Atlanticist Trojan Horse inside the Russian economy. How do you see it?

Michael: Russia was brainwashed by the West when the Soviet Union broke up in 1991. First of all, the IMF announced in advance that there was a big meeting in Houston with the IMF and the World Bank. And the IMF published all of its report saying, first you don’t want inflation in Russia so let’s wipe out all of the Russian savings with hyperinflation, which they did. They then said, well now to cure the hyperinflation the Russian central bank needs a stable currency and you need a backup for the currency. You will need to back it with U.S. dollars.

“Russia was brainwashed by the West when the Soviet Union broke up in 1991.”

So, from the early 1990s, as you know, labor was going unpaid. The Russian central bank could have created the rubles to pay the domestic labor and to keep the factories in place. But, the IMF advisers from Harvard said, no you’ll have to borrow U.S. dollars. I met with people from the Hermitage Fund and the Renaissance Fund and others. We had meetings and I met with the investors. Russia was paying 100 percent interest for years to leading American financial institutions for money that it didn’t need and could have created itself. Russia was so dispirited with Stalinism that, essentially, it thought the opposite of Stalinism must be what they have in America.

They thought that America was going to tell it how America got rich, but America didn’t want to tell Russia how it got rich, but instead wanted to make money off Russia. They didn’t get it. They trusted the Americans. They really didn’t understand that, industrial capitalism that Marx described had metamorphosized into finance capitalism and was completely different.

And that’s because Russia didn’t charge rent, it didn’t charge interest. I gave three speeches before the Duma, urging it to impose a land tax. Some of the people I noticed, Ed Dodson was there with us and we were all trying to convince Russia, don’t let this land be privatized. If you let it be privatized, then you’re going to have such high rents and housing costs in Russia that you’re not going to be able to essentially compete for an industrial growth. Well, the politician who brought us there, Viatcheslav Zolensky was sort of maneuvered out of the election by the American advisers.

Russian Duma Building, Moscow, 2017. (Wikimedia Commons)

The Americans put billions of dollars in to essentially finance American propagandists to destroy Russia, mainly from the Harvard Institute of International Development. And essentially, they were a bunch of gangsters and the prosecutors in Boston were about to prosecute them.

The attorney general of Boston was going to bring a big case for Harvard against the looting of Russia and the corruption of Russia. And I was asked to organize and to bring a number of Russian politicians and industrialists over to say how this destroyed everything. Well, Harvard settled out of court and essentially that made the perpetrators the leading university people up there. (I’m associated with Harvard Anthropology Department, not the Economics Department.)

So, we never had a chance to bring my witnesses, and have our report on what happened, but I published for the Russian Academy of Sciences a long study of how all of this destruction of Russia was laid out in advance at the Houston meetings by the IMF. America went to the leading bureaucrats and said; look, we can make you rich why don’t you register the factories in your own name, and if you’re registered in your own name, you know, then you’ll own it. And then you can cash out. You can essentially sell, but obviously you can’t sell to the Russians because the IMF has just wiped out all of their savings.

You can only cash out by selling to the West. And so, the Russian stock market became the leading stock market in the world from 1994 with the Norilsk Nickel and the seven bankers in the bank loans for shares deal through 1997. And, I had worked for a firm Scutter Stevens and, the head adviser, a former student of mine didn’t want to invest in Russia because she said, this is just a rip off, it’s going to crash. She was fired for not investing. They said look, we know that’s going to crash. That’s the whole idea it’s going to crash. We can make a mint off it before the crash. And then when it crashes, we can make another mint by selling short and then all over again. Well, the problem is that the system that was put in with the privatization that’s occurred, how do you have Russia’s wealth used to develop its own industry and its own economy like China was doing. Well, China has rules for all of this, but Russia doesn’t have rules, it’s really all centralized, it’s President Putin that keeps it this way.

Well, this was the great fear of the West. When you had Mikhail Gorbachev beginning to plan to do pretty much what is done today, to restrain private capital, the IMF said hold off. We’re not going to make any loans to stabilize the Russian currency until you remove Mr. Primakov.

The U.S. said we won’t deal with Russia until you remove him. So, he was pushed out and he was probably the smartest guy at the time there. So, they thought [President Vladimir] Putin was going to be sort of the patsy. And he almost single-handedly, holding the oligarchs in and saying, look, you can keep your money as long as you do exactly what the government would do. You can keep the gains as long as you’re serving the public interest.

But none of this resulted into a legal system, a tax system, and a system where the government actually does get most of the benefits. Russia could have emerged in 1990 as one the most competitive economies in Eurasia by giving all of the houses to its people instead of giving Norilsk Nickel and the oil companies to Yukos. It could have given everybody their own house and their own apartment, the same thing in the Baltics. And instead it didn’t give the land out to the people. And Russians were paying 3 percent of their income for housing in 1990. And rent is the largest element in every household’s budget.

“Russia could have emerged in 1990 as one the most competitive economies in Eurasia by giving all of the houses to its people.”

So, Russia could have had low-price labor. It could have financed all of its capital investment for the government by taxing, collecting the rising rental value. Instead, Russian real estate was privatized on credit and it was even worse in the Baltics.

In Latvia, where I was research director for the Riga Graduate School of Law, Latvia borrowed primarily from Swedish banks. And so, in order to buy a house, you had to borrow from Swedish banks. And they said, well, we’re not going to lend in the Latvian currency because it can go down. So, you have a choice; Swiss Francs or German Marks or U.S. Dollars. And so, all of this rent was paid in foreign currency. There came an outflow that essentially drained all the Baltic economies. Latvia lost 20 percent of its population. Estonia and Lithuania followed suit.

And of course, the worst hit by neo-liberalism was Russia. As you know, President Putin said that neo-liberalism cost Russia more of its population than World War II. And you know that to destroy a country, you don’t need an army anymore. All you have to do is teach it American economics.

Pepe: Yes, I remember well, I arrived in Russia in the winter of 91 coming from China. So, I transited from the Chinese miracle. In fact, a few days after Deng Xiaoping’s famous Southern tour when he went to Guangzhou and Shenzhen. And that was the kick for the 1990s boom, in fact a few years before the handover, and then I took the Trans-Siberian and I arrived in Moscow a few days after the end, in fact, a few weeks after the end of the Soviet Union.

But yeah, I remember the Americans arrived almost at the exact minute, wasn’t it, Michael? I think they already were there in the spring of 1992. If I’m not mistaken.

Image on the right: Russian 1992 privatization voucher. (Wikimedia Commons)

Michael: The Houston meeting was in 1990. But all before that already in, 1988 and 1989, there was a huge outflow of embezzlement money via Latvia. The assistant dean of the university who ended up creating Nordex, essentially the money was all flying out because Ventspils in Latvia, was where Russian oil was exported and it was all fake invoicing. So, the Russian kleptocrats basically made their money off false export invoicing, ostensibly selling it for one price and having the rest paid abroad and, this was all organized through Latvia and the man who did it later moved to Israel and finally gave a billion dollars back to Russia so that he went on to live safely for the rest of his life in Israel.

Pepe: Well, the crash of the ruble in 1998 was what, roughly one year after the crash of the baht and the whole Asian financial crisis, no? It was interlinked of course, but let me see if I have a question for you, in fact, I’m just thinking out loud now. If the economies of Southeast Asia and Northeast Asia, the case of South Korea and Russia, were more integrated at the time as they are trying to integrate now, do you think that the Asian financial crisis would have been preventable in 1997?

Michael: Well, look at what happened in Malaysia with Mohammad Mahathir. Malaysia avoided it. So of course, it was preventable, and they had the capital controls. All you would have needed was to do what Malaysia did. But you needed an economic theory for that.

And essentially the current mode of warfare is to conquer the brains of a country to shape how people think and how they perceive the economy. And if you can twist their view into an unreality economics, where they think that you’re there to help them not to take money out of them, then you’ve got them hooked. That was what happened in Asia. Asia thought it was getting rich off the dollars inflows and then the IMF and all the creditors pulled the plug, crash the industry. And now that all of a sudden you had a crash, they bought up Korean industry and other South Asian industries at giveaway prices.

That’s what you do. You lend the money; you pull the plug. You then let them go under and you pick up the pieces. That’s what Blackstone did after the Obama depression began, when Obama saved the banks, not the constituency, the mortgage borrowers. Essentially that’s Blackstone’s modus operandito pick up distressed prices at a bankruptcy sale, but you need to lend money and then crash it in order to make that work.

Pepe: Michael, I think we have only five minutes left. So, I would expect you to go on a relatively long answer and I’m really dying for it. It’s about debt, it about the debt trap. And it’s about the New Silk Roads, the Belt and Road Initiative, because I think rounding up our discussion and coming back to the theme of debt and global debt.

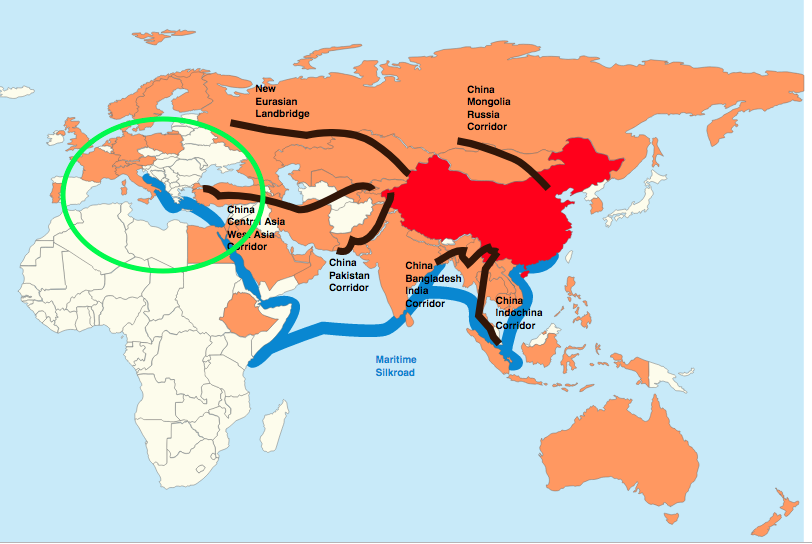

The No. 1 criticism apart from the demonization of China that you hear from American media and a few American academics as well against the Belt and Road is that it’s creating a debt trap for Southeast Asian nations, Central Asian nations and nations in Africa, etc…. Obviously, I expect you to debunk that, but the framework is there is no other global development project as extensive and as complex as Belt and Road, which as you know very well was initially dreamed up by the Ministry of Commerce. Then they sold it more or less to Xi Jinping who got the geopolitical stamp on it, announcing it, simultaneously, (which was a stroke of genius) in Central Asia in Astana and then in Southeast Asia in Jakarta. So, he was announcing the overland corridors through the heartland and the Maritime Silk Road at the same time.

At the time people didn’t see the reach and depth of all that. And now of course, finally the Trump administration woke up and saw what was in play, not only across Eurasia but reaching Africa and even selected parts of Latin America as well. And obviously the only sort of criticism, and it’s not even a fact-based criticism, that I’ve seen about the Belt and Road is it’s creating a debt trap because as you know Laos is indebted, Sri Lanka is indebted, Kyrgyzstan is indebted etc. So, how do you view Belt and Road within the large framework of the West and China, East Asia and Eurasia relations? And how would you debunk misconceptions created, especially in the U S that this is a debt trap.

Six proposed corridors of Belt and Road Initiative, showing Italy inside circle, on maritime blue route. (Lommes, CC BY-SA 4.0, Wikimedia Commons)

Michael: There are two points to answer there. The first is how the Belt and Road began. And as you pointed out, the Belt and Road began, when China said, what is it we need to grow and how do we grow within our neighboring countries so we don’t have to depend upon the West, and we don’t have to depend on sea trade that can be shut down? How do we get to roads instead of seas in a way that we can integrate our economy with the neighboring economies so that there can be mutual growth?

So, this was done pretty much on industrial engineering grounds. Here’s where you need the roads and the railroads. And then how do we finance it? Well, The Financial Times article, last week, said didn’t the Chinese know that [with past] railroad development, they’ve all gone broke? The Panama Canal went broke, you know, the first few times there were European railway investment in Latin America in the 19th century, that all went broke.

Well, what they don’t get is China’s aim was not to make a profit off the railroads. The railroads were built to be part of the economy. They don’t want to make profit. It was to make the real economy grow, not to make profits for the owners of the railroad stocks. The Western press can’t imagine that you’re building a railroad without trying to make money out of it.

Then you get to the debt issue. Countries only have a debt crisis if their debt is in a foreign currency. The first way that the United States gained power was to fight against its allies. The great enemy of America was England and it made the British block their currency in the 1940s. And so, India and other countries, that had all these currencies holdings in sterling, were able to convert it all into dollars.

The whole move of the U.S. was to denominate world debt in dollars. So that No. 1, U.S. banks would end up with the interest in financing the debt. And No. 2, the United States could, by using the debt leverage, control domestic politics.

Well, as you’re seeing right now in Argentina, for instance, Argentina is broke because it owes foreign-dollar debt. When I started the first Third World bond fund in 1990 at Scutter Stevens, Brazil and China and Argentina were paying 45 percent interest per year, 45 percent per year in dollars debt. Yet we tried to sell them in America. No American would buy. We went to Europe, no European buy this debt. And so, we worked with Merrill Lynch and Merrill Lynch was able to make an offshore fund in the Dutch West Indies and all of the debt was sold to the Brazilian ruling class in the central bank and the Argentinian bankers in the ruling class, we thought oh, that’s wonderful.

We know that they’re going to pay the foreign Yankee Dollars debt because the Yankee Dollars debt is owed to themselves. They’re the Yankees! They’re the client oligarchy. And you know, from Brazil client oligarchy is, you know, they’re cosmopolitan, that’s the word. So, the problem is that on the Belt and Road, how did these other countries pay the debt to China?

Well, the key there again is the de-dollarization, and one way to solve it is since we’re trying to get finance out of the picture, we’re doing something very much like, Japan did with Canada in the 1960s. It made loans to develop Canadian copper mines taking its payment, not in Canadian dollars, that would have pushed up the yen’s exchange rate, but in copper.

So, China says, you know you don’t have to pay currency for this debt. We didn’t build a railroad to make a profit and you want, we can print all the currency we want. We don’t need to make a profit. We made the Belt and Road because it’s part of our geopolitical attempt to create what we need to be prosperous and have a prosperous region. So, these are self-reinforcing mutual gain. Well, so that’s what the West doesn’t get — mutual gain? Are we talking anthropology? What do you mean mutual? This is capitalism! So, the West doesn’t understand what the original aim of the Belt and Road was, and it wasn’t to make a profitable railroad to enable people to buy and sell railway stocks. And it wasn’t to make toll roads to sell off to Goldman Sachs, you know. We’re dealing with two different economic systems, and it’s very hard for one system to understand the other system because of the tunnel vision that you get when you get a degree in economics.

“We’re dealing with two different economic systems, and it’s very hard for one system to understand the other system because of the tunnel vision that you get when you get a degree in economics.”

Pepe: Belt and Road loans are long-term and at very low interest and they are renegotiable. They are renegotiating with the Pakistanis all the time for instance.

Michael: China’s intention is not to repeat an Asia crisis of 1997. It doesn’t gain anything by forcing a crisis because it’s not trying to come in and buying property at a discount at a distressed sale. It has no desire to create a distressed sale. So obviously, the idea is the capacity to pay. Now, this whole argument occurred in the 1920s, between [John Maynard] Keynes and his opponents that wanted to collect German reparations and, Keynes made it very clear. What is the capacity to pay? It’s the ability to export and the ability to obtain foreign currency. Well, China’s not looking for foreign currency. It is looking for economic returns but the return is to the whole society, the return isn’t from a railroad. The return is for the entire economy because it’s looking at the economy as a system.

The way that neoliberalism works, it divides the economy in parts, and it makes every part trying to make a gain, and if you do that, then you don’t have any infrastructure that’s lowering the cost for the other parts. You have every part fighting for itself. You don’t look at in terms of a system the way China’s looking at it. That’s the great advantage of Marxism, you’ll look at the system, not just the parts.

Pepe: Exactly and this is at the heart of the Chinese concept of a community with a shared future for mankind, which is the approximate translation from Mandarin. So, we compare community with a shared future for mankind, which is, let’s say the driving force between the idea of Belt and Road, expanded across Eurasia, Africa and Latin America as well with our good old friends’, “greed is good” concept from the eighties, which is still ruling America apparently.

Michael: And the corollary is that non-greed is bad.

Pepe: Exactly and non-greed is evil.

Michael: I see. I think we ran out of time. I do. I don’t know if Alanna wants to step in to wrap it up.

Michael: There may be somebody who has a question.

Pepe: Somebody has a question? That’ll be fantastic.

Alanna: There is a question from Ed Dodson. He wanted to know why there are these ghost cities in China? And who’s financing all this real estate that’s developed, but nobody’s living there? We’ve all been hearing about that. So, what is happening with that?

Michael: Okay. China had most of its population living in the countryside and it made many deals with Chinese landholders who have land rights, and they said, if you will give up your land right to the community, we will give you free apartment in the city that you could rent out.

So, China has been building apartments in cities and trading these basically in exchange to support what used to be called a rural exodus. China doesn’t need as many farmers on the land as it now has, and the question is how are you going to get them into cities? So, China began building these cities and many of these apartments are owned by people who’ve got them in exchange for trading their land rights. The deals are part of the rural reconstruction program.

Alanna: Do you think it was a good deal? Vacant apartments everywhere.

Pepe: You don’t have ghost cities in Xinjiang for instance, Xinjiang is under-populated, it’s mostly desert. And it’s extremely sensitive to relocate people to Xinjiang. So basically, they concentrated on expanding Urumqi. When you arrive in Urumqi it is like almost like arriving in, Guangzhou. It’s enormous. It’s a huge generic city in the middle of the desert. And it’s also a high-tech Mecca, which is something that very few people in the West know. And is the direct link between the eastern seaboard via Belt and Road to Central Asia.

Pepe Escobar at the Khunjerab pass, China-Pak border, on New Silk Road overdrive.

Last year I was on an amazing trip. I went to the three borders, the Tajik-Xinjiang border, Kyrgiz-Xinjiang border and the Kazakh-Xinjiang border, which is three borders in one. It’s a fascinating area to explore and specially to talk to the local populations, the Kyrgiz, the Kazakhs and the Tajiks. How do they see the Belt and Road directly affecting their lives from now on? So, you don’t see something spectacular for instance, in the Xinjiang – Kazakh boarder, there is one border for the trucks, lots of them like in Europe, crossing from all points, from Central Asia to China and bringing Chinese merchandise to Central Asia.

There’s the train border, which is a very simple two tracks and the pedestrian border, which is very funny because you have people arriving in buses from all parts of Central Asia. They stop on the Kazakh border. They take a shuttle, they clear customs for one day, they go to a series of shopping malls on the Chinese side of the border. They buy like crazy, shop till it drops, I don’t know for 12 hours? And then they cross back the same day because the visa is for one day. They step on their buses and they go back.

So, for the moment it’s sort of a pedestrian form of Belt and Road, but in the future, we’re going to have high-speed rail. We’re going to have, well the pipelines are already there as Michael knows, but it’s fascinating to see on the spot. You see the closer integration; you see for instance Uyghurs traveling back and forth. You know, Uyghurs that have families in Kyrgizstan for instance, I met some Uyghurs in Kyrgyzstan who do the back-and-forth all the time. And they said, there’s no problem. They are seen as businessmen so there’s no interference. There are no concentration camps involved, you know, but you have to go to these places to see how it works on the ground and with Covid, that’s the problem for us journalists who travel, because for one year we cannot go anywhere and Xinjiang was on my travel list this year, Afghanistan as well, Mongolia.

These are all parts of Belt and Road or future parts of Belt and Road, like Afghanistan. The Chinese and the Russians as well; they want to bring Afghanistan in a peace process organized by Asians themselves without the United States, within the Shanghai Cooperation Organization, because they want Afghanistan to be part of the intersection of Belt and Road and Eurasian Economic Union. This is something Michael knows very well. You don’t see this kind of discussions in the American media for instance, integration of Eurasia on the ground, how it’s actually happening.

Michael: That’s called cognitive dissonance.

Alanna: To try to understand it gets you cognitive dissonance.

Pepe: Oh yeah, of course. And obviously you are a Chinese agent, a Russian agent. And so, I hear that all the time. Well, in our jobs we hear that all the time. Especially, unfortunately from our American friends.

Alanna: Okay. I know you have other things to do. This has been fabulous. I want to thank you so much, both of you, uh, with so easy to get attendance for this webinar. There were 20 people in five minutes enrolled and in two days we were at capacity. So, I know there are many more people who would love to hear you talk another time, whenever you two are so willing. And I think you both got much out of your first conversation in person. Everybody listening knows these two wonderful gentlemen, they have written more than 10 books, and they have traveled all over the world. They are on the top of geopolitical and geoeconomic analysis, and they are caring, loving people. So, you can see that these are the people we need to be listening to and understanding all around the world.

So, thank you so much. Ibrahima Drame from the Henry George School is now going to say goodbye to you and will wrap this up. Thank you again.

Pepe: Michael it was a huge pleasure. Really, it was fantastic. Really nice, we’re on the same website. So, let’s have a second version of this.

Ibrahima: So, let’s have a second version of this two months from now. Thank you very much for participating and I really hope you liked this event. And, we also want to ask for your support by making a tax-deductible donation to the Henry George School. I believe I shared the link on the chat. Thank you. And see you soon.

Pepe: Thank you very much. Thanks Michael. Bye!

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

Michael Hudson is an American economist professor of economics at the university of Missouri Kansas City and a researcher at the Levy Economics Institute at Bard College. He’s a former Wall Street analyst political consultant commentator and journalist. He identifies himself as a classical economist. Michael is the author of J is for Junk Economics, Killing the Host, The Bubble and Beyond, Super Imperialism: The Economic Strategy of American Empire, Trade Development and Foreign Debtand The Myth of Aid, among others. His books have been published translated into Japanese, Chinese, German, Spanish and Russian.

Pepe Escobar, born in Brazil, is a correspondent and editor-at-large at Asia Times and columnist for Consortium News and Strategic Culture in Moscow. Since the mid-1980s he’s lived and worked as a foreign correspondent in London, Paris, Milan, Los Angeles, Singapore, Bangkok. He has extensively covered Pakistan, Afghanistan and Central Asia to China, Iran, Iraq and the wider Middle East. Pepe is the author of Globalistan – How the Globalized World is Dissolving into Liquid War; Red Zone Blues: A Snapshot of Baghdad during the Surge. He was contributing editor to The Empire and The Crescent and Tutto in Vendita in Italy. His last two books are Empire of Chaos and 2030. Pepe is also associated with the Paris-based European Academy of Geopolitics. When not on the road he lives between Paris and Bangkok.

Featured image: High-ended retailer Saks Fifth Avenue added private security, fencing and barbed wire ahead of a Black Lives Matter protest in New York, June 7. 2020. (Anthony Quintano, CC BY 2.0, Wikimedia Commons)