China Inks Military Deal with Iran Under Secretive 25-Year Plan

Last August, Iran’s Foreign Minister, Mohammad Zarif, paid a visit to his China counterpart, Wang Li, to present a roadmap on a comprehensive 25-year China-Iran strategic partnership that built upon a previous agreement signed in 2016. Many of the key specifics of the updated agreement were not released to the public at the time but were uncovered by OilPrice.com at the time. Last week, at a meeting in Gilan province, former Iran President Mahmoud Ahmadinejad alluded to some of the secret parts of this deal in public for the first time, stating that:

“It is not valid to enter into a secret agreement with foreign parties without considering the will of the Iranian nation and against the interests of the country and the nation, and the Iranian nation will not recognize it.”

According to the same senior sources closely connected to Iran’s Petroleum Ministry who originally outlined the secret element of the 25-year deal, not only is the secret element of that deal going ahead but China has also added in a new military element, with enormous global security implications.

One of the secret elements of the deal signed last year is that China will invest US$280 billion in developing Iran’s oil, gas, and petrochemicals sectors. This amount will be front-loaded into the first five-year period of the new 25-year deal, and the understanding is that further amounts will be available in each subsequent five year period, provided that both parties agree. There will be another US$120 billion of investment, which again can be front-loaded into the first five-year period, for upgrading Iran’s transport and manufacturing infrastructure, and again subject to increase in each subsequent period should both parties agree. In exchange for this, to begin with, Chinese companies will be given the first option to bid on any new – or stalled or uncompleted – oil, gas, and petrochemicals projects in Iran. China will also be able to buy any and all oil, gas, and petchems products at a minimum guaranteed discount of 12 per cent to the six-month rolling mean average price of comparable benchmark products, plus another 6 to 8 per cent of that metric for risk-adjusted compensation. Additionally, China will be granted the right to delay payment for up to two years and, significantly, it will be able to pay in soft currencies that it has accrued from doing business in Africa and the Former Soviet Union states. “Given the exchange rates involved in converting these soft currencies into hard currencies that Iran can obtain from its friendly Western banks, China is looking at another 8 to 12 per cent discount, which means a total discount of around 32 per cent for China on all oil gas, and petchems purchases,” one of the Iran sources underlined.

Another key part of the secret element to the 25-year deal is that China will be integrally involved in the build-out of Iran’s core infrastructure, which will be in absolute alignment with China’s key geopolitical multi-generational project, ‘One Belt, One Road’ (OBOR). To begin with, China intends to utilise the currently cheap labour available in Iran to build factories that will be financed, designed, and overseen by big Chinese manufacturing companies with identical specifications and operations to those in China. The final manufactured products will then be able to access Western markets through new transport links, also planned, financed, and managed by China.

In this vein, around the same time as the draft new 25-year deal was presented last year by Iran’s Vice President, Eshaq Jahangiri (and senior figures from the Islamic Revolutionary Guard Corps and intelligence agencies) to Iran’s Supreme Leader, Ali Khamenei, Jahangiri announced that Iran had signed a contract with China to implement a project to electrify the main 900 kilometre railway connecting Tehran to the north-eastern city of Mashhad. Jahangiri added that there are also plans to establish a Tehran-Qom-Isfahan high-speed train line and to extend this upgraded network up to the north-west through Tabriz. Tabriz, home to a number of key sites relating to oil, gas, and petrochemicals, and the starting point for the Tabriz-Ankara gas pipeline, will be a pivot point of the 2,300 kilometre New Silk Road that links Urumqi (the capital of China’s western Xinjiang Province) to Tehran, and connecting Kazakhstan, Kyrgyzstan, Uzbekistan and Turkmenistan along the way, and then via Turkey into Europe.

Now, though, another element that will change the entire balance of geopolitical power in the Middle East has been added to the deal.

“Last week, the Supreme Leader [Ali Khamenei] agreed to the extension of the existing deal to include new military elements that were proposed by the same senior figures in the IRGC [Islamic Revolutionary Guard Corps] and the intelligence services that proposed the original deal, and this will involve complete aerial and naval military co-operation between Iran and China, with Russia also taking a key role,” one of the Iran sources told OilPrice.com last week. “There is a meeting scheduled in the second week of August between the same Iranian group, and their Chinese and Russian counterparts, that will agree the remaining details but, provided that goes as planned, then as of 9 November, Sino-Russian bombers, fighters, and transport planes will have unrestricted access to Iranian air bases,” he said.

“This process will begin with purpose-built dual-use facilities next to the existing airports at Hamedan, Bandar Abbas, Chabhar, and Abadan,” he said.

OilPrice.com understands from the Iranian sources that the bombers to be deployed will be China-modified versions of the long-range Russian Tupolev Tu-22M3s, with a manufacturing specification range of 6,800 kilometres (2,410 km with a typical weapons load), and the fighters will be the all-weather supersonic medium-range fighter bomber/strike Sukhoi Su-34, plus the newer single-seat stealth attack Sukhoi-57. It is apposite to note that in August 2016, Russia used the Hamedan airbase to launch attacks on targets in Syria using both Tupolev-22M3 long-range bombers and Sukhoi-34 strike fighters. At the same time, Chinese and Russian military vessels will be able to use newly-created dual-use facilities at Iran’s key ports at Chabahar, Bandar-e-Bushehr, and Bandar Abbas, constructed by Chinese companies.

These deployments will be accompanied by the roll-out of Chinese and Russian electronic warfare (EW) capabilities, according to the Iran sources. This would encompass each of the three key EW areas – electronic support (including early warning of enemy weapons use) plus electronic attack (including jamming systems) plus electronic protection (including of enemy jamming). Based originally around neutralising NATO’s C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems, part of the new roll-out of software and hardware from China and Russia in Iran, according to the Iran sources, would be the Russian S-400 anti-missile air defence system: “To counter U.S. and/or Israeli attacks.” The Krasukha-2 and -4 systems are also likely to feature in the overall EW architecture, as they proved their effectiveness in Syria in countering the radars of attack, reconnaissance and unmanned aircraft. The Krasukha-2 can jam Airborne Warning And Control Systems (AWACS) at up to 250 km, and other airborne radars such as guided missiles, whilst the Krasukha-4 is a multi-functional jamming system that not only counters AWACS but also ground-based radars, with both being highly mobile.

It is again apposite to note here that an entire EW company (encompassing the three core elements of EW) can consist of as little as 100 men and, according to the Iran sources, part of the new military co-operation includes an exchange of personnel between Iran and China and Russia, with up to 110 senior Iranian IRGC men going for training every year in Beijing and Moscow and 110 Chinese and Russians going to Tehran for their training. It is also apposite to note that Iran’s EW system can easily be tied in to Russia’s Southern Joint Strategic Command 19th EW Brigade (Rassvet) near Rostov-on-Don, which links into the corollary Chinese systems. “One of the Russian air jamming systems is going to be based in Chabahar and will capable of completely disabling the UAE’s and Saudi Arabia’s air defences, to the extent that they would only have around two minutes of warning for a missile or drone attack from Iran,” one of the Iran sources told OilPrice.com last week.

An indication of what Iran hopes to receive in return its co-operation with China, and Russia, came last week when Zhang Jun, China’s permanent United Nations (U.N.) representative, in a statement to the Security Council, told the U.S.: “To stop its illegal unilateral sanctions on Iran… The root cause of the current crisis is the U.S.’s withdrawal from the Iran nuclear deal in May 2018 and the re-imposition of unilateral sanctions against Iran.” He also opposed the U.S.’s push for the extension of the U.N. arms embargo on Iran, which expires in October. “This has again undermined the joint efforts to preserve the JCPOA [Joint Comprehensive Plan of Action],” Zhang said, and added: “The [JCPOA] agreement was endorsed by the U.N. Security Council [UNSC] and is legally binding.”

He concluded:

“We urge the U.S. to stop its illegal unilateral sanctions and long-arm jurisdiction, and return to the right track of observing the JCPOA and Resolution 2231 [of the UNSC].”

Securing China’s support was a key reason for the original secret part of the deal agreed last year, along with that of Russia, as the two countries have two-fifths of the total Permanent Member votes on the UNSC, with the others being the U.S., the U.K., and France. Aside from this support and the US$400 billion+ of investments pledged by China, the other reason that Iran has agreed to such Chinese (and Russian) influence in its country going forward is that China has guaranteed that it will continue to take all of the oil, gas, and petchems that Iran requires.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

Simon Watkins is a former senior FX trader and salesman, financial journalist, and best-selling author. He was Head of Forex Institutional Sales and Trading for Credit Lyonnais, and later Director of Forex at Bank of Montreal. He was then Head of Weekly Publications and Chief Writer for Business Monitor International, Head of Fuel Oil Products for Platts, and Global Managing Editor of Research for Renaissance Capital in Moscow.

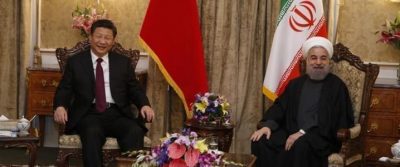

Featured image is from OilPrice.com