Banks are Responsible for the Economic and Social Crisis in Greece

The present study shows that the Greek crisis that broke out in 2010 originated in private banks, not in excessive public spending. The so-called bail-out was designed to serve the interests of private bankers and those of dominant countries in the Eurozone.

Greece adopting the euro played a major role among the various factors that contributed to the crisis. The analysis developed here was first presented in Athens on 6 November 2016 during a meeting of the Truth Committee on Greek Public Debt.

At first sight, between 1996 and 2008, the development of Greece’s economy looked like a success story! The integration of Greece within the EU and from 2001 on within the Eurozone seemed successful. The rate of Greece’s economic growth was higher than that of the stronger economies in Europe.

This apparent success actually concealed a vicious flaw, just as had been the case in several other countries – not only Spain, Portugal, Ireland, Cyprus, the Baltic Republics and Slovenia, but also Belgium, the Netherlands, the United Kingdom, Austria…, countries that had been badly hit by the 2008 financial crisis. |1| Not forgetting Italy, which was caught up by the banking crisis a few years after the others.

In the early 2000s, the creation of the Eurozone generated significant volatile and often speculative financial flows |2| that went from economies of the Centre (Germany, France, the Benelux, Austria…) towards countries of the Periphery (Greece, Ireland, Portugal, Spain, Slovenia, etc.).

Major private banks and other financial institutions in economies of the Centre loaned huge sums to the public and private sectors in the economies of the Periphery for it was more profitable to invest in those countries than on the national markets of the economies of the Centre. A single currency (the euro) boosted those flows since it did away with the danger of the local currency being devaluated in case of crisis in countries of the Periphery.

This resulted in a private credit bubble mostly involving real estate (mortgages), but also consumer credit. The assets of banks in the Periphery increased significantly, albeit in terms of debt.

In Ireland, the crisis broke out in September 2008, when major banks went bankrupt in the wake of Lehman Brothers in the United States. In Spain, Greece and Portugal, the crisis started later, in 2009-2010. |3|

When the private credit bubble burst in 2009-2010 (in the context of international recession resulting from the US subprime crisis and its contamination of banks in the European economies of the Centre), private banks had to be massively bailed out.

These bail-outs led to a huge increase in public debt. Indeed the use of public money to bail out banks and other institutions turned out to be very costly.

It is now clear that banks should not have been bailed out, which meant socializing their losses. Banks should have used bail-in mechanisms: organize an orderly kind of bankruptcy and call upon major private shareholders and creditors to pay for sanitizing the situation. The opportunity should also have been seized to socialize the financial sector, i.e., to expropriate the private banking sector and turn it into a public service. |4|

However, there were strong ties, when not actual connivance, between Eurozone governments |5| and the private banking sector. Governments thus decided to use public money to bail out private bankers.

Since States in the Periphery could not afford the financial cost of bailing-out their banks so as to protect the French and German banks, governments of the Central economies (Germany, France, the Netherlands, Belgium, Luxembourg, Austria, etc.) and the European Commission (sometimes with the help of the IMF) implemented the notorious Memorandums of Understanding (MoUs). Thanks to those MoUs, major private banks and other private financial institutions in Germany, France, countries of the Benelux and Austria (i.e. the private financial sector of the Central economies) could reduce their exposition in economies of the Periphery. Governments and European institutions used this opportunity to reinforce the offensive of capital against labour as well as to reduce the possibility for people to actually use their democratic rights throughout Europe.

The way the Eurozone was constructed and the crisis of the capitalist system are accountable for the crisis that can be observed in countries of the Periphery since 2009-2010.

Steps that led to the 2010 Greek crisis

From 1996, under the auspices of PM Kostas Simitis (PASOK), Greece has committed itself deeper and deeper to the neoliberal model that had first been implemented in 1985 when Andreas Papandreou, after a promising start, shifted away from left-wing positions two years after François Mitterrand. |6|

Between 1996 and 2004, during Kostas Simitis’ two terms as PM, an impressive programme of privatizations was implemented (which recalls Lionel Jospin’s Socialist government in France – 1997-2002 – also carrying out major privatizations which right-wing parties and employers had been dreaming of since the 1980s).

Greece went farther than most EU countries in reducing corporate taxes. Measures were adopted that directly undermined social conquests won between 1974 and 1985, notably in terms of labour conditions and stability. Similarly, the Socialist government favoured a deep-seated deregulation of the financial sector (which also occurred in other EU countries and in the US); this resulted in an increase in its importance in the economy.

Greek banks settled in the Balkans and Turkey, which reinforced a deceptive sense of achievement.

During this period, the rate at which the Greek GDP increased was higher than the average EU rate, GDP per capita was catching up on the average, and the Human Development Index was improving. Growth was significant in some cutting-edge sectors such as optical and electrical equipment and computers. Yet in fact as they further integrated Greece into the EU and the Eurozone, Greek leaders and private corporations increased the country’s dependence and reduced any actual possibility for economic and social development.

How banks developed and how the Greek economy was financialized before it entered the Eurozone

Until 1998, 70% of the Greek banking system was public. Loans handed out by banks amounted to about €80 billion while deposits amounted to €85 billion, which indicated a healthy economy (see below). That situation was to change radically. Between 1998 and 2000, public banks were sold at heavily-discounted prices to private capital and four major banks emerged, covering 65% of the banking market: |7| the National Bank of Greece, Alpha Bank, Eurobank and Piraeus Bank. Among those four banks only the National Bank of Greece was still under indirect public control.

During those same two years under socialist PM Kostas Simitis’ leadership, deregulation was thriving in the banking sector as indeed in other parts of the world. Let us remember that in 1999 Bill Clinton’s Democrat administration repealed the Glass-Steagall Act, which had been voted in by the Roosevelt administration to counter the 1933 US banking crisis. This meant the end of separating deposit banks from business banks and accelerated the deregulation process that led to the 2000-2001 and 2007-2008 crises. In Greece, the government supported private banks (which decreased return on deposits) through an aggressive communication campaign to prompt middle-class households, companies and pension funds to invest on the stock market; so the government did not tax capital gains. This casino-like kind of economy resulted in a stock-market bubble that burst in 2000, with tragic losses for many households, small and medium-sized companies and the pension scheme, which had invested heavily. |8| We also have to keep in mind that the stock-market bubble made it possible for rich investors to launder their dirty money.

Rise in Greek private and public debt from 2000-2001

Private debt increased hugely in the first decade of the new millennium. Lured by the very attractive conditions offered by banks and the whole private commercial sector (mass retail, the automobile and construction industries, etc.), households went massively into debt, as did the non-financial companies. Moreover the shift to the euro |9| had led to a significant increase in the cost of living in a country where buying basic food takes up about half of a family’s budget.

This private debt was the driving force of the Greek economy as it was in Spain, Ireland, Portugal, Slovenia and other countries of the former Eastern bloc that joined the EU. Thanks to a strong euro, Greek banks (and Greek branches of foreign banks) could expand their international activities and cheaply finance their national activities. They took out loans with a vengeance. The graph below (Fig. 1) shows that Greece’s accession to the Eurozone in 2001 boosted an inflow of financial capital, in the form of loans or portfolio investments (Non-FDI in the chart, i.e. inflows which do not correspond to long-term investments) while long-term investments (FDI–Foreign Direct Investment) remained stagnant.

Figure 1 – Flow of financial capital into Greece (1999-2009)

In $ million. Source: IMF |10|

With the vast amounts of liquidity made available by the central banks in 2007-2009, Western European banks (above all the German and French banks, but also the Belgian, Dutch, British, Luxembourg and Irish banks) as well as Swiss and US banks lent extensively to Greece (to the private sector and to the public authorities). One must also take into account that the accession of Greece to the euro bolstered the faith of Western European bankers, who thought that the big European countries would come to their aid in case of a problem. They did not worry about Greece’s ability to repay the capital they loaned and considered that they could take very high risks in Greece. History seems to have proved them right so far: the European Commission and, in particular, the French and German governments have given their unfailing support to the private banks of Western Europe. But in allowing the socialization of the banks’ losses, European governments have placed their own public finances in a critical position.

In the chart below (Fig. 2) we see that the countries of Western Europe first increased their loans to Greece between December 2005 and March 2007 (during this period, the volume of loans grew by 50%, from less than 80 billion to 120 billion dollars). After the subprime crisis started in the United States, loans increased dramatically once again (+33%) between June 2007 and the summer of 2008 (from 120 to 160 billion dollars). Then they stayed at a very high level (about 120 billion dollars). This means that the private banks of Western Europe used the money which was lent in vast quantities and at low cost by the European Central Bank and the US Federal Reserve in order to increase their own loans to countries such as Greece. |11| Over there, where the rates were higher, they could make juicy profits. Private banks are therefore largely responsible for Greece’s excessive debt.

Figure 2 – Evolution of Western European banks’ exposure to Greece

(in billions of dollars)

Source: BIS consolidated statistics, ultimate risk basis (from Costas Lapavitsas et al. The Eurozone Between Austerity and Default)

As shown in the following pie-chart (Fig. 3), Greek debts are overwhelmingly held by European banks, mostly French, German, Italian, Belgian, Dutch, Luxembourg and British.

Figure 3– Foreign holders (almost exclusively foreign banks and other financial companies) of Greek debt securities (end of 2008 |12| )

Source: CPIS in Costas Lapavitsas et al. The Eurozone Between Austerity and Default

A survey conducted by Barclays on Greece’s external debt in the third term of 2009 shows that the distribution was approximately the same (note that the currency used below is the US dollar). |13| The next graph (Fig. 4) is particularly interesting in that it shows that large French insurance groups were highly exposed, as were Luxembourg-based hedge funds. |14|

Figure 4 – Creditors of the Greek debt

Greece’s public debt amounted to about $390 billion by the end of the third term of 2009. Close to three quarters of that debt is held by foreign institutions, the majority of them European.

Source: New York Times

In a book published in 2016, Yanis Varoufakis describes what led German, French and other foreign private banks to make massive loans to Eurozone countries of the European Periphery, with their governments’ support. According to Varoufakis, once they felt sure countries of the Periphery would not leave the Eurozone, French and German bankers started treating all borrowing countries as presenting exactly the same level of risk, or of solvability, which was nonsense. Worse still, since they knew they would get their money back, they soon found out that “it was more lucrative to lend to persons, companies and banks of deficit member States than to German or Austrian customers” since in those countries people “displayed the deep-seated aversion to debt that recent memory of poverty engenders.” Indeed ideal customers (borrowers) are not yet indebted and have some personal property such as “a farmhouse or an apartment in Naples, Athens or Andalusia.”

Varoufakis relies on information gathered during a conversation he had in 2011 with a man called Franz, who worked for a German bank. Franz, he writes, “went to some lengths to impress upon me the suddenness and force with which his bank targeted the European Periphery. Its new business plan was straightforward: to secure a higher share of the Eurozone market than other banks, the French banks in particular, which were also on a lending spree.” Those countries with a significant trade imbalance offered bankers three major advantages: (1) there was room for a lot of lending; (2) exports to deficit countries “were now immune to devaluations of the defunct, weaker currencies”; (3) they could charge much higher interest rates in deficit countries since interest rates indicate the price of money, and money is cheaper in exporting countries such as Germany than in importing countries such as Greece. |15|

A private credit bubble caused by Greek and foreign banks with government complicity

The Greek banks pushed their customers to borrow massively to finance their consumption. As the graph in Fig. 4 shows, household loans increased fivefold between 2001 and 2008; whereas business loans increased two and a half fold. On the other hand, over the same period, Greek banks reduced their loans to public administrations.

Figure 5 – Credit to domestic residents by Greek banks (2001-2008)

Source: Bank of Greece

The big increase in Greek household, business and financial company debt is visible in Fig. 6 where the graph shows how total Greek debt developed between 1997 and 2009 alongside the reduction of public debt from 70 to 42%.

Figure 6 – Greek debt by sector of issuer (% of total)

NB pour la mise en ligne il faut aller prendre le graphique original dans l’étude de Lapavitsas afin que la légende dans le graph soit en anglais

Source: Bank of Greece, QEDS, IMF (from Costas Lapavitsas et al.The Eurozone Between Austerity and Default)

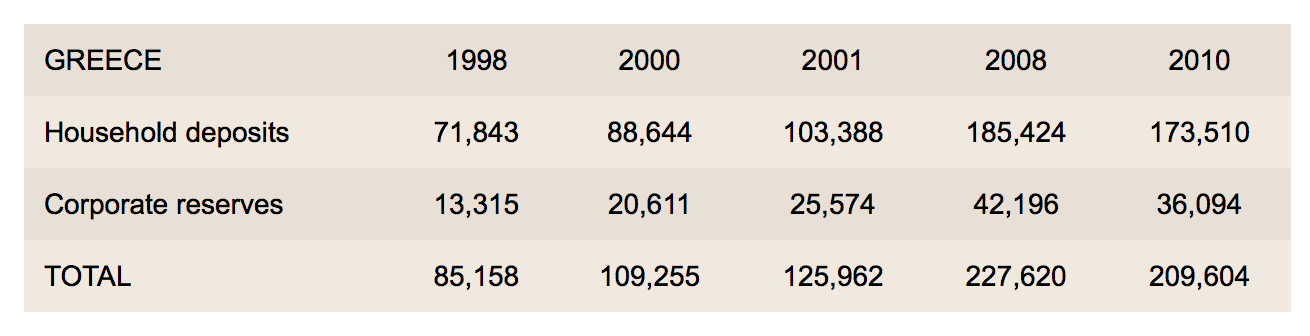

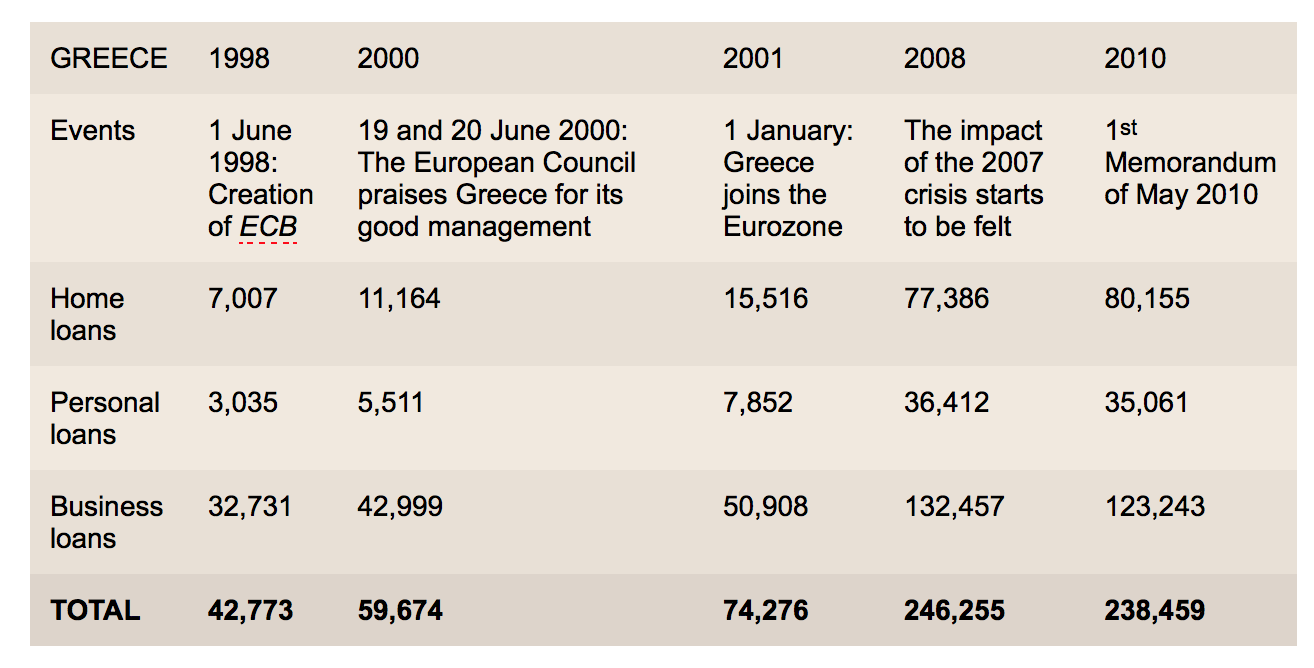

Table 1 clearly shows the big increase in bank lending to households and business.

Table 1. Bank lending tendencies to households and business between 12/1998 and 12/2010 (in millions of euros).

Source : Bank of Greece |16|

Source : Bank of Greece |16|

Table 2 shows that the increase in deposits was much inferior to the increase in credit shown in Table 1.

Table 2. Deposit and repurchase agreement tendencies of households and businesses in Greece between December 1998 and December 2010 (in million of Euros).

Source : Bank of Greece

In 1998, deposits on bank accounts were more than twice the amount of the loans that banks had granted to private-sector activities, an indication of a healthy situation. By 2008 the situation had seriously deteriorated: deposits were far less than the sums on loan. |17| The Greek Banks had taken advantage of the easy money supplied by French, German and other foreign banks.

Greek banks increased their borrowing from foreign banks six-and-a-half fold, from €12.3 billion to €78.6 billion, between 2002 and 2009. If we include other private external sources of financing (investment funds, money-market funds, insurance companies) the respective figures are €19 billion and €112 billion.

And that’s not all: the Greek banks were short-term borrowers on foreign interbank markets (what is more, most of the deposits in Greek banks were short-term and of course, as we have seen, they were also among the financial resources into which banks dipped) in order to finance medium- and long-term loans to their borrowers, especially for property purchase and development, or for durable goods (such as household equipment or cars), making them vulnerable to the tendencies of the financial markets and movements of deposit withdrawals.

However, this deterioration undermining banks’ balance sheets was not at all reflected by their profitability curves. In 2005, according to a study by the Greek Central Bank, banking profits had gone up by 198%, whilst their taxes decreased by 18.8%. The ROE |18| reached the extraordinary ratio of 26% while the European Union average was 17.4%.

This short-term profiteering attracted the attention of French banks, which took over Greek banks in order to facilitate and stimulate their investments in what they considered to be a new Eldorado. |19| In March 2004, Société Générale acquired a majority holding (50.01%) in the Banque Générale de Grèce, which was renamed Geniki Bank. In August 2006 Crédit Agricole S.A. took over Emporiki Bank S.A. In a press release at the time, Georges Pauget, CEO of Crédit Agricole S.A., justified the move by saying “…this acquisition […] gives us access to a growing market in a rapidly expanding region”. |20| René Carron, Chairman of Crédit Agricole S.A., declared: “I’m delighted with the success of the Emporiki offer and would like to express my thanks to the Greek government and other shareholders for showing their confidence and support for this offer. This transaction is a major step in our international strategy and will contribute to our objective to increase our net banking income on non-French operations”.

The announcement by the government, at the beginning of 2005, that construction resulting from building permits issued after 1st October 2006 would no longer be exempt from VAT, created a building boom accompanied by an explosion in the number of mortgage loans that overtook the whole country – even though housing demand was amply satisfied. According to the statistics office, ELSTAT, in 2001, the country had 11 million inhabitants for 5.4 million homes, 1.4 million of which were unoccupied. This contributed to the private-loan speculative bubble. |21| In 2011, there were 6.4 million homes, of which 2.5 million were unoccupied. |22|

The banks weakened during 2008-2009 because of the excessive risks they took and the credit bubble they caused

In September-October 2008, following the failure of Lehman Bros. in the US and the effects on Western European banks (failures in Belgium, Germany, Iceland, Ireland and the UK), mutual confidence between banks evaporated and interbank loans stopped completely – a phenomenon they called a “credit crunch” –, which put the highly dependent Greek banks into very hot water. Their shares plummeted during the second half of 2008 to levels 20% below their early 2007 quotations. At the same time the interest demanded for their borrowings increased by 500 base points – that is, 5%. |23|

The Greek banks only survived thanks to liquidities made available by the Bank of Greece under ECB rules that provide for massive cash-flow to all the Eurozone banks. (The same practice is followed by the Fed, the Bank of England and the Swiss central bank).

In the following graph (Fig. 7) the green line shows how the tendencies of the Greek banks to use this Eurosystem funding evolved. |24|

Figure 7 – Exposure of Greek banks to the government and liabilities to the BoG, in billions of Euros (2007-2010)

Source: Bank of Greece.

Nevertheless, changing the principal sources of funding is not particular to Greece – the same phenomenon has been noted in most Eurozone countries and beyond. Central banks became the favourite money supplier to private banks through 2008-2009.

In October 2008 the Greek banks were in crisis; the Karamanlis Government announced a €28 billion bail-out plan, of which €3.5 billion were used to recapitalize the banks and the remainder served as guarantees for further borrowing from the Central Bank. At the same time depositors were reassured in order to avoid a run on the banks (massive withdrawals that could cause banks to fail). These policies are not exceptional. As much in the US as in Europe, including Switzerland, governments have been providing massive capital and guarantees that have greatly increased public debt without durably improving the health of the banking sector.

Many Belgian, British, Dutch, French, German, Swiss and North American banks received substantial public aid through 2008-2009 and beyond. Between October 2008 and September 2012, total aid granted by the European Commission reached €5,059.9 billion – that is, 40.3% of EU GDP. According to an estimation by Professor James Felkerson, the US Fed granted aid to the tune of $29,614.4 billion to US and non-US banks.

In 2008, the Greek banks, along with their Cypriot, Portuguese and Spanish counter-parts, were not considered to be under threat, because unlike the banks in the US and the most developed European economies, they had not taken massive positions in the structured financial products that shook the US and Northern and Western European banking system to its foundations.

However, the banks in the peripheral Eurozone countries, too, were actually on the verge of defaulting and their governments did not have the resources needed to come to their rescue as effectively as the governments of the central economies and the United States had.

The particularities of the Greek banks

One of the particularities of the Greek banking situation is the combination of weak equity and an increase in credit repayment defaults.

In March 2009, the Greek banks’ equity totalled €28.9 billion – no more than 6.2% of their balance sheet, which totalled €473.1 billion. Loan loss reserves amounted to only €7.2 billion, much less than the amount necessary to cover the actual risk. In fact reserves amounted to only 3% of the €217.1 billion in loans granted, whereas the ratio of “Non-Performing Loans” (NPLs) was 6%. |25|

The insufficiency of assets was caused by paying oversized dividends to private shareholders between 2005 and 2008 (see above).

According to a memo in the European Parliament, bad debt risks had increased to 43.5% in Greece, in September 2015, and 50% in Cyprus.

The amount of dubious debt in the Eurozone on 30 September 2015

The international crisis that badly hit the Greek economy in 2009 fragilized households and small businesses in particular to point where more and more fell into debt repayment arrears.

Bank deposits had become markedly inferior to outstanding loans, private cash-flow from banks and other financial institutions stopped, arrears increased, property prices slumped and capital fled (organized by, or at least with the complicity of, the banks), the Greek banks’ positions became inextricable. This was the consequence of the dangerous adventures that the Greek banks had entered upon with the complicity of the Greek government and under the laissez-faire attitude of the European regulatory authorities.

The reaction of the Greek banks to the crisis, which they had largely provoked themselves, and to the international recession affecting the Greek economy, aggravated the situation. Whereas the Central Bank made liquidities available to Greek banks under the pretext that they would be made available to households and businesses in order to stimulate the economy, the banks used these sums in entirely different ways, as the following graph, in Fig. 8, shows.

Figure 8. Greece, domestic credit growth, 2009 – 2015

Source: Bank of Greece

The Greek banks cut off lending to households and non-financial companies (made up mostly of the self-employed or of small- and average-size companies with no more than ten staff members |26|), who were in need of funds to finance their debt repayments, thus worsening their already dire difficulties. Of course, it must not be forgotten that the austerity policies imposed by the Troika and the Greek government from 2010 had already reduced household and small business incomes, pushing them further towards payment defaults.

The criminal practices of the Greek banks were even worse than those of the Northern and Western European banks. Here are a few noteworthy examples brought to light by Daniel Munevar:

In the case of the now-defunct Hellenic PostBank it is estimated that between 2006 and 2012 it lent around €500 million to prominent businessmen without securing any type of guarantee. |27| Eventually, once they became NPLs, the losses associated with them were directly passed on to the taxpayers. At the time, Alexis Tsipras denounced the bank scandal as a triangle of corruption involving leading companies, banks and political parties that exchange favours. |28| In the case of another defunct bank, the Agricultural Bank of Greece, it is now estimated that between 2000 and 2012 it extended 1,300 loans for a value close to €5 billion. |29| These loans were extended without any type of guarantee and were provided to government supporters in what amounted to a patron/client relationship.3 |30|

As scandalous as the above examples might be, probably the most iconic case of the corruption and excesses that characterized the Greek banking system before the crisis was that of the Marfin Popular Bank (MPB). In 2006, Marfin Investment Group (MIG), a Greek-based investment group led by Andreas Vgenepoulos, bought a minority stake at Laiki Bank in Cyprus. After this transaction was completed, Laiki was transformed into a new entity, MPB. Vgenopolous then took the decision to undertake an IPO of MIG. To ensure the success of the initial offering, Vgenepoulos, who was a member of the boards of both companies, used more than €700 million in loans provided by MPB to support the initial price of the share offering of MIG in 2007. |31| By 2010, it is estimated that MPB had provided €1.8 billion in loans to entities related to MIG in Greece in what amounted to a clear conflict of interest. |32| Even though the BoG conducted an audit in 2009 that identified these problems and raised further questions regarding the management of the bank, the regulators did nothing to address these issues. By the time the Cypriot authorities took over the bank in 2011 it was estimated that MPB had a loan portfolio in Greece of 12 billion euros, most of it of dubious quality. |33| According to the Chairman appointed by the Cypriot authorities, Michael Sarris, the “single most important factor” dissuading investors from helping recapitalize the bank was not sovereign bonds but concern that further losses in the loan portfolio in Greece could materialize. |34|

Dramatizing public indebtedness and the deficit protects the interests of the private Greek and foreign banks who are responsible for the crisis

If we believe the rhetoric prevailing at the international level, the Memorandum of Understanding of 2010 constitutes the only possible response to Greece’s public-finance crisis. According to this deliberately misleading explanation, the Greek State supposedly gave Greeks the benefit of a generous system of social protection |35| in spite of the fact that they were paying no taxes (Christine Lagarde, remember, as Managing Director of the IMF, had stated that Greeks were paying almost no taxes – neglecting to point out that wage earners and retired persons in Greece have their taxes withheld at source3 |36|). For these facile moralizers, it was irresponsible public expenditure that supposedly led to a dramatic increase in public debt and the deficit. According to their narrative, the financial markets eventually became aware of the danger and refused to continue to finance Greece’s irresponsibility. Following that refusal, the narrative goes, the European governments, the ECB, the European Commission and the IMF decided, in a burst of generosity, to join together to come to the aid of the Greek people, even though they did not deserve such generosity, and at the same time defend the permanence of the Eurozone and the European Union.

In reality, as the Preliminary Report of the Truth Committee on the Greek Public Debt showed, the real cause of the crisis was the private banking sector, both domestic and foreign, and not public debt. Private debt was much larger than public debt.

Late in 2009, the Greek banks had to repay €78 billion in short-term debt to foreign banks, and if the other foreign financial entities (such as Money Market Funds |37| and investment funds) who had granted loans are taken into account, the amount to be repaid was in fact a total €112 billion. Remember that starting in September-October 2008, interbank lending had largely dried up. The Greek banks were able to continue to repay their external creditors at least in part thanks to the line of credit extended by the ECB and the Central Bank of Greece (see Figure 7 above – Exposure of Greek banks to the government and liabilities to the BoG, in billions of Euros (2007-2010)

Loans to the Greek banks from the ECB/Greek Central Bank varied between €40 and 55 billion. That represented between 6% and 8% of the line of credit extended by the ECB, whereas the Greek banks accounted for only 2% of assets in the Eurozone.

The directors of the ECB implied in Autumn 2009 that they planned to end that line of credit. |38| This caused a great deal of anxiety on the part of foreign creditors of the Greek banks and the Greek bankers themselves. Should the Greek banks not be able to continue repaying their debts to the foreign banks, a serious crisis could ensue. According to the major private foreign creditors of the Greek banks, the only solution that could avoid a failure of the Greek banks (and the losses that would have caused for the foreign banks) was for the State to recapitalize them and grant them guarantees for an amount well in excess of what was made available beginning in October 2008. That also implied that the ECB would maintain the line of credit it had extended them. George Papandreou, who had just handily won the legislative elections on 4 October 2009, realized that the Greek government alone would not have the resources to save the Greek bankers despite his good will towards (not to say complicity with) them. His opponents in New Democracy, who had just lost the elections, felt the same.

Instead of making those who were responsible, both in Greece and abroad (that is, the private shareholders, the board members of the banks, and the foreign banks and other financial entities who had contributed to generating the speculative bubble) bear the cost of the banking crisis, Papandreou dramatized the public debt and the deficit in order to justify an external intervention aimed at bringing in sufficient capital to face the situation the banks were in. The Papandreou government falsified the statistics on Greece’s debt – not in order to reduce it (as the prevailing narrative claims) but in fact to increase it (see the Box on Falsification). He wanted to spare the foreign (principally French and German) banks heavy losses and protect the private shareholders and top executives of the Greek banks.

He made the choice of resorting to “international aid” under the deceitful pretext of “solidarity” because he was sure he could never convince his electorate to make sacrifices in order to protect the big French and German banks… and Greek bankers.

Falsification of public deficit and public debt

After the Parliamentary Elections of 2009 (4/10/2009), the newly elected government of George Papandreou illegally revised and increased both the public deficit and debt for the period before the Memorandum of 2010. |39|

Hospital liabilities

The public deficit estimation of 2009 was increased through several revisions: the public deficit as a share of GDP increased from 11.9% in the first revision to 15.8% in the last.

One of the most shocking examples of falsification of the public deficit is related to the public hospitals’ liabilities.

In Greece, as in the rest of the EU, suppliers traditionally provide public hospitals with pharmaceuticals and medical equipment. Due to the required invoice validation procedures required by the Court of Audit, these items are paid after the date of delivery. In September 2009, a large number of non-validated hospital liabilities for the years 2005-2008 was identified, even though there was not a proper estimation of their value. On the 2nd of October 2009, within the usual Eurostat procedures, the National Statistical Service of Greece (NSSG) sent to Eurostat the deficit and debt notification tables. Based on the hospital survey traditionally carried out by the NSSG, these included an estimate of the outstanding hospital liabilities of €2.3 billion. On a 21stOctober notification, this amount was increased by €2.5 billion. Thus, total liabilities increased to €4.8 billion. The European authorities initially contested this new amount given the suspicious procedures under which it was compiled:

“In the 21st October notification, an amount of €2.5 billion was added to the government deficit of 2008 on top of the €2.3 billion. This was done according to the Greek authorities under a direct instruction from the Ministry of Finance, in spite of the fact that the real total amount of hospital liabilities is still unknown, that there was no justification to impute this amount only in 2008 and not in previous years as well, and that the NSSG had voiced its dissent on the issue to the GAO [General Account Office] and to the MOF [Ministry of Finance]. This is to be considered as a wrong methodological decision taken by the GAO.” |40|

However, in April 2010, based on the Greek government’s “Technical Report on the Revision of Hospital Liabilities” (3/2/2010), |41| Eurostat not only gave in to Greece’s new government demands about the contested amount of €2.5 billion, but also included an additional €1.8 billion. Thus, the initial amount of €2.3 billion, according to the Notification Table of the 2nd October 2009, was increased to €6.6 billion, despite the fact that the Court of Audit had only validated €1.2 billion out of the total. The remaining €5.4 billion of unproven hospital liabilities increased the public deficit of 2009 and that of previous years.

These statistical practices for the accounting of hospital liabilities clearly contravene European Regulations (see ESA95 par. 3.06, EC No. 2516/2000 Article 2, Commission Reg. EC No. 995/2001) and the European Statistics Code of Practice, especially regarding the principles of independence of statistical measurements, statistical objectivity and reliability.

It is important to highlight that a month and a half after the illegal increase of the public deficit, the Ministry of Finance called the suppliers and asked them to accept a 30% discount on the liabilities for the 2005-2008 period. Thus, a large part of hospital liabilities was never paid to pharmaceutical suppliers by the Greek government, while the discount was never reflected in official statistics. |42|

Public corporations

One of several falsification cases concerns 17 public corporations (DEKO). In 2010 ELSTAT |43| and Eurostat transferred the liabilities of the 17 DEKO from the Non-financial Corporations sector to the General Government sector. This increased public debt in 2009 by €18.2 billion.

This group of corporations had been classified as Non-Financial Corporations after Eurostat had verified and approved their inclusion in this category. It is important to emphasize that there were no changes in the ESA95 classificatory rules between 2000 and 2010.

The reclassification took place without carrying out the required studies; it also took place at night after the ELSTAT Board had left. In this way the president of ELSTAT was able to introduce the changes without questions from the Board members. Thus, the role of the national experts was completely ignored, in total contravention of ESA95 Regulations. Consequently, the institutionally established criteria for the reclassification of an economic unit under the General Government sector was infringed. |44|

Goldman Sachs swaps

Another case of unsubstantiated increase of public debt in 2009 is related to the statistical treatment of swaps with Goldman Sachs. The one-person ELSTAT leadership increased the public debt by €21 billion. This amount was distributed ad hoc over the four financial years from 2006 to 2009. This was a retroactive increase of Greece’s public debt and was done in contradiction of EC Regulations.

In total, it is estimated that as a result of these technically unsupported adjustments, the budget deficit for 2009 was increased by an estimated 6 to 8 percentage points of GDP. Likewise, public debt was increased by a total of €28 billion.

We consider the falsification of statistical data as directly related to the dramatization of the budget and public debt situation. This was done in order to convince public opinion in Greece and Europe to support the bail-out of the Greek economy in 2010 with all its catastrophic conditionalities for the Greek population. The European parliaments voted on the “rescue” of Greece based on falsified statistical data. The banking crisis was underestimated by an overestimation of the public sector’s economic problems.

As for European leaders like Angela Merkel and Nicolas Sarkozy, who had already implemented plans to bail out private banks in their respective countries in 2008, they agreed to launch a programme that was purportedly to “aid Greece” (and which was to be followed by programmes of the same type in Ireland, Portugal and Spain) and under which the private banks in their countries could be paid with public funds. Repayment of the bail-out of bankers, then, would be done on the backs of the Greek people (and the peoples of the peripheral countries who would get caught up in the same system). |45| All this on the pretext of aiding Greece out of solidarity. The “aiding Greece” narrative is nothing but a sordid and deceitful cover-story to hide what was in reality socialisation of the banks’ losses. The Truth Committee on the Greek Public Debt, in its Preliminary Report of June 2015, threw light on the mechanism that was put in place starting in 2010 (see in particular Chapters 2, 3 and 4).

Yanis Varoufakis denounces the swindle in his own words: “But this was not a bail-out. Greece was never bailed out. Nor were the rest of Europe’s swine—or PIIGS as Portugal, Ireland, Italy, Greece and Spain became collectively branded. Greece’s bail-out, then Ireland’s, then Portugal’s, then Spain’s were rescue packages for, primarily, French and German banks.” (…) “The problem here was that Chancellor Merkel and President Sarkozy could not imagine going back, once more, to their parliaments for more money for their banker chums. So they did the next best thing: they went to their parliaments invoking the cherished principle of solidarity with Greece, then Ireland, then Portugal and finally Spain.”4 |46|

Yet an alternative was possible, and necessary. Following their win in the 2009 elections thanks to a campaign during which they denounced the neoliberal policies of New Democracy, the Papandreou government, had it wanted to make good on its campaign promises, would have had to socialize the banking sector by organizing an orderly failure and protecting depositors. Several historical examples demonstrate that organizing such a failure and then starting up financial services again to operate in the interests of the population would have been quite possible. They should have taken the example of what had been done in Iceland since 2008 |47| and in Sweden and Norway in the 1990s. |48| Instead, Papandreou chose to follow the scandalous and catastrophic example of the Irish government, which bailed out the bankers in 2008 and in September 2010 agreed to a European aid plan that had dramatic consequences for Ireland’s people. When in fact what was needed was to go even farther than Iceland and Sweden and completely and permanently socialize the financial sector. The foreign banks and private Greek shareholders should have been made to bear the losses stemming from resolving the banking crisis and those responsible for the banking disaster should have been prosecuted. That would have allowed Greece to avoid the successive Memoranda that have subjected the Greek people to a dramatic humanitarian crisis and to humiliation, without any of it resulting in truly cleaning up the Greek banking system. The chart below shows the evolution of payment defaults on credits and throws light on why the situation of the Greek banks remains highly precarious, whereas their directors have faced no legal consequences and most of them have remained in their positions since the crisis began. In Iceland, remember, several bankers went to prison.

Figure 9 – Greece, evolution of NPLs as% of total loans, 2009 – 2015

Source: IMF

NPLs increased greatly between 2010 and 2015 for three main reasons:

- Banks were not forced to recognize losses (which would have amounted to cancellation of the debts).

- The brutal austerity imposed by the Troika, by radically reducing the income of the majority of the population and causing the failure of hundreds of thousands of small and medium companies, made it impossible for a growing number of households and SMEs to continue repaying their debts.

- The banks’ decision to stop granting new loans or refinancing existing ones only encouraged households and companies to default on repayment.

Why private banks want to purchase public debt

The fable according to which the weakness or crisis of private banks is brought about by too high a level of public debt and the risk of suspension of payment by States does not hold up against the facts.

Since the EU has been in existence, not a single member State has gone into payment default, despite the fact that the list of banking crises gets longer every day.

On the other hand, what the dominant media and governments don’t tell us is that for private banks, lending to a State is highly profitable and free of risk. Added to that is the fact that the more sovereign debt a bank holds, the easier it is for it to comply with the rules set by the regulatory authorities. That point requires a technical explanation.

To adhere to the rules that were in force in 2008-2009, the Greek banks, like all European banks, needed to prove that their equity amounted to 8% of their assets. But, as said earlier, in March 2009 their equity only totalled 6.2% of their assets. To reach the 8% required by the authorities, they began buying sovereign debt.

In calculating that ratio of 8%, the regulatory authorities allow banks to weight the assets they hold according to the risk they represent. Sovereign debt held by banks is considered less risky than debt with private individuals or companies. That being the case, banks have every interest in lending more to public authorities than to private individuals or companies, and especially SMEs, which are considered riskier than major corporations. Of course, they can decide to lend to private individuals and SMEs anyway, but when they do they’ll demand very high interest rates.

That’s why, beginning in late 2008 and 2009, the Greek banks continued to increase their lending to the Greek government while at the same time gradually cutting off new loans to households and SMEs. Between 31 December 2008 and 31 December 2010, the Greek banks increased loans to the Greek public authorities by 15%, which proves that they considered such loans more secure.

The next illustration shows why banks who wanted to prove their robustness had every interest in buying public securities rather than continuing to grant loans to households and private individuals.

The illustration above represents the assets of a bank before and after weighting for risks. The column on the left represents the actual assets held by the bank – that is, the loans it has granted. In the example given, which corresponds to an observed average, for 4 units of equity (the capital), the bank lent 100 units to private individuals, companies, States, etc.

For each of these categories of assets, the bank will apply weighting for risk and rely on that weighting to determine its ratio between equity and the total assets on its books. For example, loans to private individuals are weighted at 75%, which means that out of 28 units lent, only 21 will be counted in the weighted balance sheet. As a general rule, loans to States (sovereign debt securities) are weighted at 0% – in other words, they count for 0 on the weighted balance sheet! In fact, only loans to SMEs and companies that are rated low by the rating agencies are accounted for in their entirety, and even for more than they actually represent (weighting is 150% for companies rated below BB-).

Since the regulatory authorities take a bank’s weighted assets as the basis for determining whether it is keeping to the rules, it is in the bank’s best interests to lend to States rather than companies. This enables it to “deflate” its adjusted balance without affecting the true amount of loans granted, which are how it makes part of its profit.

Thus a bank with equity of only 4% of its assets can declare that the ratio actually comes to 10%, if there are enough public debts on its books. This will earn it praise from the regulatory authorities. |49|

All this explains the trajectory of the blue line in the graph we’ve already used. (See Figure 7 – Exposure of Greek banks to the government and liabilities to the BoG, in billions of Euros (2007-2010) above).

A sharp increase in the amount of credit extended by Greek banks to the government can be seen after September 2008. Previously fluctuating between €30 and 40 billion, it suddenly rose to over €60 billion by March 2010.

Note that before the speculative attacks on Greece began, it was able to borrow at very low interest rates. Mainly banks, but other institutional investors (such as insurance companies and pension funds) too, were falling over each other to lend it money.

This is how it came about that on 13 October 2009 Greece issued three-month Treasury bonds (T-Bills) with a very low yield of 0.35%. On the same day it issued six-month bonds at a rate of 0.59%. Seven days later on 20 October 2009, Greece issued one-year bonds yielding 0.94% |50|. Not until less than six months before the Greek crisis broke out did the foreign banks turn off the credit tap. The credit-rating agencies attributed a good rating to Greece and the banks which were lending to it, left, right and centre. Ten months later, to issue six-month bonds it had to commit to a yield of 4.65%, that is, eight times higher than before. This was a fundamental change of circumstances. In September 2009, the Greek Treasury issued six-year bonds at 3.7%, a yield close to those of Belgium or France, and not very far from Germany’s. |51|

There is one highly significant indication of the banks’ responsibility. In 2009, they demanded a lower yield from Greece than in 2008. In June-July-August 2008, before the shock produced by Lehman Brothers’ bankruptcy, the rate was four times higher than in October 2009. In the fourth quarter of 2009, yields reached their lowest point when loans of less than one year fell to below 1%. |52| Why were banks demanding lower yields when they should have realized that the risks were accumulating and Greece’s situation deteriorating?

The graph below shows that Greek and German interest-rates were very close between 2007 and July 2008. After that date, the rate paid by Greece can be seen to increase during the fourth quarter of 2008, after the government had announced its first plan to rescue Greek banks. (The markets then considered that the risks on public debt were higher, seeing that the authorities were willing to increase public debt to bail out the Greek banks.) From that moment on, German and Greek rates followed completely opposite trajectories. It is extraordinary to see that the rate paid out by Greece fell between March and November 2009, when the real situation of Greek banks and the international economic crisis which hit Greece so hard from 2009 (i.e. later than for the stronger countries of the Eurozone) should have led international and Greek banks to demand risk premiums. It was only after November 2009, when Papandreou decided to dramatize the situation and to falsify the public debt statistics, that the rates rose dramatically.

Figure 10 – Germany and Greece, 10-yr government bond yields (2007-2010)

Source: St Louis Fed.

This may seem irrational, as it is not normal for a private bank to lower interest rates at a time of major international crisis, and to a country like Greece that is getting rapidly indebted. However it is logical from the point of view of a banker seeking to maximize immediate profits and convinced that in case of difficulty, the government will bail out his bank. After Lehman Brothers failed, the governments of the USA and Europe made available enormous amounts of liquidities to bail out the banks and kick-start credit and economic activity. Bankers seized this manna of capital to lend it to EU countries like Greece, Portugal, Spain and Italy, certain that in case of trouble, the European Central Bank (ECB) and the European Commission (EC) would come to their aid. From their point of view, they were right.

There is no denying that banks literally threw capital at countries like Greece (including lowering the interest-rates that they demanded), so determined were they that the money they were getting in massive quantities from the public authorities should be placed as loans to Eurozone States.

To go back to the concrete example mentioned above: when on the 20th October 2009 the Greek government sold three-month T-Bills with a yield of 0.35%, it was trying to raise the sum of €1,500 million. Greek and foreign banks along with other investors proposed €7,040 million, or almost five times that amount. Finally, the government decided to borrow €2,400 million. It is thus no exaggeration to claim that the bankers sought to lend as much as possible to a country like Greece.

Now let us go back over the sequence of increases in loans from Western European bankers to Greece over the period 2005-2009 as presented at the beginning of this study. The banks of Western European countries increased their loans to Greece (both in the public and private sectors) for the first time between December 2005 and March 2007. During this period, the volume of loans increased by 50%, from just below 80 billion to 120 billion dollars. Even though the subprime crisis had broken out in the USA, loans saw another sharp increase (+33%) between June 2007 and the summer of 2008 (from 120 to 160 billion dollars), thereafter remaining at a very high level (of about 120 billion dollars). The debts called in from Greece by foreign and Greek banks as a consequence of such frankly adventurous policies are marked by illegitimacy. The banks should have been forced to assume the risks they had taken.

The rescue of foreign and Greek banks thanks to the 2010 Memorandum

The work of the Truth Committee on Greek Public Debt made evident the true motives of the Troika at the time of the First Memorandum in May 2010. The hearing of Panagiotis Roumeliotis helped to set the record straight. Roumeliotis had been a close advisor to the former PASOK Prime Minister Papandreou, a former Greek negotiator with the IMF and a personal friend of Dominique Strauss-Kahn, former chairman of the IMF, whom he met when he was a student in Paris. A few days before the hearing, I had had a private interview with Roumeliotis where I had informed him that I was in possession of secret IMF documents, including notes of a meeting that had been declassified by the Speaker of Parliament. Because they were very compromising, they had been hidden by the former Speaker of the Greek Parliament when they should have been included in an enquiry by the former government into financial delinquency. The documents proved that the decision by the IMF on 9 May 2010 to lend €30 billion to Greece (32 times the sum normally available to the country) was, as clearly expressed by several executive directors, primarily aimed at getting French and German banks out of trouble. This was clearly denounced by the IMF representatives from Brazil and Switzerland! |53| In reply to these objections the representatives from France, Germany and the Netherlands conveyed to the Board the commitments of their countries’ banks to support Greece and broadly maintain their exposure. This is what the French executive said during the meeting: “There was a meeting earlier in the week between the major French banks and my Minister, Ms. Lagarde. |54| I would like to stress what was released at the end of this meeting, which is a statement in which these French banks commit to maintain their exposure to Greece over the lifetime of the programme”. The German executive director said: “(…) these [German] banks basically want to maintain a certain exposure to the Greek banks, which means that they will not sell Greek bonds and they will maintain credit lines to Greece. When these credit lines expire, they will at least in part be renewed”. The Dutch executive director also made promises: “The Dutch banks, in consultation with our Minister of Finance, have had discussions and have publicly announced they will play their part in supporting the Greek government and the Greek banks”. |55|

It has become clear that these three directors deliberately lied to their colleagues to get the loan granted. |56| The loan was not made with the intention of aiding the Greek economy or the Greek people. The money was used to repay French, German and Dutch banks that between them held more than 70% of Greek debt at the time the decision was made.

Then once they had been paid, the banks stopped lending to Greece and shed their Greek securities on the secondary market Secondary market The market where institutional investors resell and purchase financial assets. Thus the secondary market is the market where already existing financial assets are traded. . The ECB, directed by the Frenchman Trichet, helped by purchasing those securities. The banks did exactly the opposite of what had been promised at the IMF. It must be mentioned that during the same meeting several directors criticized the IMF for changing, in a state of panic, IMF loan conditions. |57| Previously, the IMF could not grant a loan to a country unless the conditions made the debt sustainable. As the IMF directors knew perfectly well that lending €30 billion to Greece would not ease the Greek situation, but on the contrary, probably make it even more unsustainable, the rules were changed. Other criteria were adopted without consultation: henceforth, the IMF lends in order to avoid international banking crises. This proves that the real threat was the failure of the three main French banks (BNP Paribas, Crédit Agricole and Société Générale) and some German banks (Hypo Ral Estate and Commerzbank) which, seeking big profits, had lent too much to both the private sector and the Greek government, without applying normal prudential restraint.

If the IMF and the ECB did not want a reduction of Greek public debt in 2010, it was because the governments of France, Germany, the Netherlands and some other Eurozone countries wanted to give these banks time enough to sell off the Greek securities that they had bought and to generally disengage from Greece. And indeed, the foreign banks did get rid of their securities on Greece between March 2010 and March 2012, the date on which debt reduction finally took place (see below). If the Greek government of the time, under George Papandreou, accepted that the Greek public debt not be reduced at the time of the 2010 Memorandum, it was because it too wanted to give time to the Greek banks to sell off a large portion of their Greek securities which were likely to be devalued later when the French and German banks would have had time to disengage (see below). In any case, Jean-Claude Trichet, the French banker who was president of the ECB at the time, threatened to reduce Greek banks’ access to liquidities if the Greek government asked for debt reduction. That was what Panagiotis Roumeliotis declared at his hearing. |58|

Another criticism of the measures imposed on Greece by the IMF came from the Argentine representative, present at the same meeting in May 2010, who explained that the policies the IMF imposes on Greece cannot work. Pablo Pereira made no bones about what he thought of past and present IMF policies. “Harsh lessons from our own past crises are hard to forget. In 2001, somewhat similar policies were proposed by the Fund in Argentina. The catastrophic consequences are well known. (…) There is an undisputable reality that cannot be contested: a debt that cannot be paid will not be paid without a strong process of sustainable growth. (…) We are also too familiar with the consequences of “structural reforms” or policy adjustments that end up thoroughly curtailing aggregate demand and, thus, prospects of economic recovery. (…) It is very likely that Greece might end up worse off after implementing this programme. The adjustment measures recommended by the Fund will reduce the welfare of its population and Greece’s true repayment capacity.” |59|

On 15 June 2015, Panagiotis Roumeliotis testified before the Committee on this entire affair during the quite exceptional public hearing that lasted eight hours. I questioned him, as did the President of the Hellenic Parliament, and he answered us. Then members of the Committee questioned him and he replied to them. Mr. Roumeliotis’s answers amply confirmed the analysis presented above. Like all other important events in the Hellenic Parliament, the hearing was broadcast live on the parliamentary television channel. Audience ratings shot up.

In my introductory speech to the presentation of the Committee’s work that took place on 17 June I summarized the analysis that we made of the underlying reasons why the First Memorandum was imposed on the Greek people as from May 2010. The speech is available here. It was very well received.

I would change nothing in this declaration.

History repeats itself

In a study conducted in September 2015 two economists, Carmen Reinhart and Christoph Trebesch, analysed the debt crises that Greece has been through since the 1820s and independence, from the perspective of dependence on external financing |60|. The two authors, academics with a favourable attitude towards the capitalist system, emphasize how the debt crises that have repeatedly hit Greece are mainly the result of inflow of private foreign capital followed by cessation of the flow. They claim that the crisis affecting Greece and other peripheral countries is not a public-debt crisis, but rather a crisis of external debt (p. 1). They draw a parallel with the external debt crisis that affected Latin America in the 1980s, pointing out the symmetry of situation between debtor countries and creditor countries once a crisis has broken. While Greece was plunged into economic depression after 2010, Germany went through a period of growth. Similarly, the countries of Latin America went through deep depression between the time when the crisis struck in 1982 and the early 1990s, while the economy of the United States, as creditor of the Latin American countries, gradually improved (p. 2).

They note that the most prosperous period for the Greek economy was between 1950 and 2000, when financing was mainly based on the country’s internal resources and did not depend on foreigners (p. 2).

On the other hand, they show that at each crisis of external debt that Greece has known (they list four major ones), when the capital flow from external private creditors (that is, banks) has dried up, the governments of several European powers have got together to lend public money to Greece and rescue the foreign banks. The coalition of powers dictated policies to Greece that served their own interests and those of a few big private banks with which they colluded. Each time, the aim of the policies was to free up the fiscal (budgetary) resources required to repay the debt. This meant a reduction in social spending and public investments. Thus through a variety of ways and means, Greece and the Greek people have been denied the exercise of their sovereignty. This is how Greece as a country has been kept subordinate and peripheral. My own historical research on Greek debt since the 1820s |61| reaches conclusions that are not very different. Carmen Reinhart and Christoph Trebesch insist on the need for a very significant reduction of Greek debt and they reject solutions that consist of rescheduling debt repayments (p. 17). For my part, in the present study, I conclude that the debt claimed by the Troika (the IMF, ECB and the European Commission) must be cancelled.

Conclusion

The Greek crisis that broke out in 2010 was caused by bankers (foreign and Greek) and not by excessive public spending on the part of a State supposedly too generous in social terms. The crisis was produced when the private foreign banks turned off the credit tap, firstly in the private sector, then in the public sector. The so-called aid plan for Greece was designed to serve the interests of private bankers and the dominant countries of the Eurozone. The debts claimed from Greece since 2010 are odious, as they were accumulated in the pursuit of objectives that clearly go against the interests of the population. The creditors were fully aware of this and exploited the situation. These debts must be cancelled.

This research examines in depth and confirms what the Greek Debt Truth Committee showed in 2015, both in its preliminary report of June 2015 and its September 2015 report on the Third Memorandum.

The next study will examine the development of the banking crisis between 2010 and 2016, the restructuring of Greece’s debt in March-April 2012 and the recapitalization of the banks.

Acknowledgements

The author would like to thank the following for reading through the text and making suggestions: Thanos Contargyris, Alexis Cukier, Marie-Laure Coulmin, Romaric Godin, Pierre Gottiniaux, Fotis Goutziomitros, Michel Husson, Nathan Legrand, Ion Papadopoulos, Anouk Renaud, Patrick Saurin, Adonis Zambelis. He also thanks Daniel Munevar, who assisted him in his research and provided a series of graphs.

The author accepts full and sole responsibility for any errors that may occur in this work.

English translation by Snake Arbusto, Vicki Briault, Mike Krolikowski and Christine Pagnoulle

Footnotes

|1| German banks also had to be bailed out with public money, but considering the size of its economy and the resources the government could call upon, Germany was less shattered than other economies.

|2| These financial flows were volatile and speculative in that they were not intended for investment in the productive system of the targeted countries but mainly for consumer credit, mortgages and financial securities.

|3| In Cyprus the crisis broke out in 2012 and led to a Memorandum of Understanding in March 2013.

|4| See http://www.cadtm.org/What-is-to-be-…

|5| Papandreou in Greece, Zapatero then Rajoy in Spain, the Irish government, as well as (of course) Merkel, Sarkozy (then Hollande), the governments of the Benelux countries…

|6| Christos Laskos & Euclid Tsakalotos, Crucible of Resistance: Greece, the Eurozone & the World Economic Crisis, Pluto Press, London, 2013, pp. 18-21.

|7| We will see farther on that due to connivance with the Eurozone authorities and successive governments, those four banks achieved control over 98% of the Greek banking market from 2014 onward.

|8| Let us remember that at about the same time in the US, speculation in the dotcom field resulted in the bursting of the Internet (or new technology) bubble from March 2000. In just two years (2000-2001), benefits the 4,300 Nasdaq companies had accumulated since 1995 ($145 billion) disappeared into thin air.

|9| Greece entered the Eurozone on 1 January 2002.

|10| Graph taken from C. Lapavitsas, A. Kaltenbrunner, G. Lambrinidis, D. Lindo, J. Meadway, J. Michell, J.P. Painceira, E. Pires, J. Powell, A. Stenfors, N. Teles: The Eurozone Between Austerity and Default, September 2010, http://www.researchonmoneyandfinanc…

|11| The same phenomenon was in evidence at the same time in Portugal, Spain, Ireland and the Central and Eastern European countries.

|12| As presented in the pie-chart, the main holders of Greek debt securities (i.e. the banks in the countries mentioned) are France, Germany, Italy, Belgium, the Netherlands, Luxembourg and the UK, while other holders are put together in “Rest of World”. The chart comes from Lapavitsas, op. cit., p. 10.

|13| From an article in the New York Times (29 April 2010): “Germany Already Carrying a Pile of Greek Debt”, http://www.nytimes.com/2010/04/29/b… accessed on 1 November 2016.

|14| In the case of Greece, Greek pension funds were highly exposed, which meant a drastic reduction of income for retired people and for the social security system when the Troika enforced a 50% haircut on Greek debt securities in 2012 (see below).

|15| Source: Yanis Varoufakis, And the Weak Suffer What They Must? Europe’s Crisis and America’s Economic Future, Nation Books, 2016, pp. 147-8.

|16| This table and the following are from: Patrick Saurin, “La ‘Crise grecque’, une crise provoquée par les banques” (The ‘Greek Crisis’ a Bank-provoked crisis), http://www.cadtm.org/La-Crise-grecq… (in French)

|17| The increase in deposits by households and businesses mainly originated not from their own savings but from money lent to them by the banks. In other words the increase in household and small-business deposits is partly a consequence of their higher level of indebtedness.

|18| ROE, Return on Equity, measures the profitability of the equity of a company. It is a ratio that compares the equity to the result.

|19| See: Patrick Saurin, “La ‘Crise grecque’, une crise provoquée par les banques (The “Greek Crisis” a Bank-provoked crisis)”, http://www.cadtm.org/La-Crise-grecq… (in French). Retrieved 3 November 2016.

|20| http://www.credit-agricole.com/modu… Retrieved 3 November 2016

|21| Source: Les Grecs contre l’austérité – Il était une fois la crise de la dette (Greeks Against Austerity – Once Upon A Time There Was A Debt Crisis), collective work, Le Temps des Cerises, Paris, November 2015 (in French)

|22| See: http://www.statistics.gr/el/statist… (in French).

|23| IMF (2009) “Greece: 2009 Article IV Consultation”. IMF Country Report No. 09/244. Retrieved from https://www.imf.org/external/pubs/f…

|24| The Eurosystem, of which the European System of Central Banks (ESCB) is a part, is directed by ECB rules, regulations and decisions. To achieve the goals of the ESCB, the ECB and the national Central Banks may intervene on the capital markets, by purchasing or selling on the spot or futures markets, by holding or otherwise managing securities and negotiable bonds in European Community or non-European Community currencies and in precious metals, or they may make credit agreements with other market actors based on appropriate guarantees for credit.

It is prohibited for the ECB or national central banks to grant loans, credit or overdrafts to public institutions or bodies of the European Community, whether they be national administrations, regional or local authorities, other public authorities, other bodies or public companies of member States; it is also prohibited for the ECB or the national central banks to buy the instruments of their own debt from these same institutions. Nevertheless, since 2010-2011 through different programmes, the ECB has been massively purchasing certain such instruments from the private banks, which suits the latter very well. Since 2015, in the framework of ‘quantitative easing’ policies the ECB has again increased its purchases of sovereign debt from private banks.

|25| http://www.europarl.europa.eu/RegDa…)574400_EN.pdf

|26| According to Christos Laskos and Euclide Tsakalotos, of the 879,318 companies recorded (all activities included), 844,917 or 96.1% employed between 1 and 4 individuals! Still, according to the same authors, in 2010, 58.7% of the Greek work force were employed in companies with nine or fewer employees, whereas the EU average is 41.1%. Source: Christos Laskos & Euclid Tsakalotos, Crucible of Resistance: Greece, the Eurozone & the World Economic Crisis, Pluto Press, London, 2013, p. 46.

|27| GreekReporter. (2015). “Hellenic Postbank Scandal will Cost Greek State About 500 mln Euros”. Retrieved February 1, 2016, from http://greece.greekreporter.com/201…

|28| DW. (2014). “Greek bankers embroiled in corruption scandal”. Retrieved February 1, 2016, from http://www.dw.com/en/greek-bankers-…

|29| Ekathimerini. (2015). “Minister says ATE bank scandal is biggest of its type”. Retrieved February 1, 2016, from http://www.ekathimerini.com/200923/…

|30| Ibid.

|31| Reuters. (2012). “Special Report: How a Greek bank infected Cyprus”. Retrieved February 1, 2016, from http://uk.reuters.com/article/us-gr…

|32| ThePressProject. (2014). “George Provopoulos: the most powerful man in Greece a few months ago, now a suspect in a bank probe”. Retrieved February 1, 2016, from http://www.thepressproject.gr/detai…

|33| Ibid.

|34| Op. Cit. 17.

|35| On the Greek pension system, see: Michel Husson, “Pourquoi les réformes des retraites ne sont pas soutenables” (“Why the pension reforms are not sustainable”), published 28 November 2016, http://www.cadtm.org/Pourquoi-les-r… (in French)

|36| Le Monde, “Les Grecs se disent ‘humiliés’ par les propos de Christine Lagarde” (Greeks feel ‘humiliated’ by Christine Lagarde’s statements), published 27 May 2012, http://www.lemonde.fr/europe/articl… (in French)

|37| Money Market Funds (MMF) are financial companies in the USA and Europe, subject to little or no control or regulation since they do not hold banking licences.

|38| Ultimately, under the Memorandum of May 2010, the ECB agreed to allow the Greek banks to continue depositing Greek securities (both treasury bills, with a term of less than one year, and sovereign bonds for more than one year) for credit they would then use to repay their private foreign creditors, which thus afforded the latter total protection. It should be stressed that this line of credit played a very important role. The financial press barely mentioned it.

|39| The text of this Box is drawn from the Preliminary Report of the Truth Committee on the Greek Public Debt, June 2015, Chapter 2, http://cadtm.org/Preliminary-Report…

|40| European Commission, 2010. Report On Greek Government Deficit And Debt Statistics. Available at: http://goo.gl/RxJ1eq [Accessed June 12, 2015].

|41| Greek Government, 2010. Technical Report on the Revision of Hospital Liabilities.

|42| Press Release. Ministry of Health and Social Solidarity, 2010.

|43| In March of 2010, the office in charge of official statistics, the National Statistical Service of Greece (NSSG), was renamed ELSTAT (Hellenic Statistics Authority).

|44| Among a plethora of breaches of European Law, the following violations are especially and briefly described: the criterion of the legal form and the type of state involvement; the criterion of 50%, especially the requirement of ESA95 (par. 3.47 and 3.48) about subsidies on products; this violation led to false characterization of revenue as production cost; the ESA95 (par. 6.04) about fixed capital consumption; the Regulations about Capital Injections; the ESA95 definition of government-owned trading businesses (often referred to as public corporations) as not belonging to the General Government sector; the ESA95 requirement of a long period of continuous deficits before and after the reclassification of an economic unit.

|45| According to the dominant narrative, the “bail-out of the Greeks” is financed by the taxpayers of the Eurozone or of one country or another, when in reality it is the Greek taxpayers (and more precisely, the ones at the bottom of the ladder, because proportionally it is they who pay the most taxes) who will pay for it. The taxpayers in the other countries are guarantors of part of the credits that were extended to Greece.

|46| Yanis Varoufakis, And the Weak Suffer What They Must?: Europe’s Crisis and America’s Economic Future, Nation Books, 2016

|47| Renaud Vivien, Eva Joly, “Iceland refuses its accused bankers ‘Out of Court’ settlements”, published 2 March 2016, http://www.cadtm.org/Iceland-refuse…

|48| Mayes, D. (2009). Banking crisis resolution policy – different country experiences. Central Bank of Norway. http://www.norges-bank.no/Upload/77…

|49| For more on this, see: Eric Toussaint, Bancocracy, Resistance Books, IIRE/ CADTM, 2015, chapters 8, 9 and 12. See also: Eric Toussaint, “Banks bluff in a completely legal way”, published in English on 4 July 2013, http://www.cadtm.org/Banks-bluff-in…

|50| Hellenic Republic Public Debt Bulletin, No. 56, December 2009.

|51| On 1 January 2010, before the Greek and the Eurozone crises broke out, Germany had to promise an interest rate of 3.4% on ten-year bonds while by 23 May 2012, the rate for the new issue of ten-year bonds had fallen to 1.4%.

|52| Bank of Greece, Economic Research Department – Secretariat, Statistics Department, Bulletin of Conjunctural Indicators, No. 124, October 2009. Available at www.bankofgreece.gr

|53| After the Committee had made public the most important of these confidential documents, the totality were made entirely public on line: Office memorandum – Subject: Board meeting on Greece’s request for an SBA – May 9, 2010. The verbatim: “Minutes of IMF Executive Board Meeting”, 9 May, 2010; the report and record of decisions: “Board meeting on Greece’s request for an SBA”, Office memorandum, May 10, 2010.

|54| At the time, Christine Lagarde was still Minister in France’s Sarkozy government. She became the CEO of the IMF in 2011 after Dominique Strauss-Kahn resigned.

|55| http://adlib.imf.org/digital_assets… 2010/EBM/353745.PDF p.68

|56| See the Office Memorandum of the IMF direction meeting held on 10 May 2010, at the end of point 4 page 3, “The Dutch, French, and German chairs conveyed to the Board the commitments of their commercial banks to support Greece and broadly maintain their exposures.” http://gesd.free.fr/imfinter2010.pdf

|57| See in the Office Memorandum of the IMF direction meeting held on 10 May 2010, point 7 page 3, that quite clearly states that several IMF executives reproached the direction for having quietly changed the rules. http://gesd.free.fr/imfinter2010.pdf

|58| Moreover Trichet adopted exactly the same attitude towards Ireland six months later in November 2010.

|59| From “Minutes of IMF Executive Board Meeting”, May 9, 2010. See the excellent article by Michel Husson, http://www.cadtm.org/Grece-les-erre…. (Greece: the IMFs ‘Mistakes’) (in French or Spanish.)

|60| Carmen M. Reinhart and Christoph Trebesch, “The Pitfalls of External Dependence: Greece, 1829-2015”, Brookings Papers, 2015.

|61| Eric Toussaint, “Newly Independent Greece Had an Odious Debt Round Her Neck”, published in English 26 April 2016, http://www.cadtm.org/Newly-Independ… and “Greece: Continued Debt Slavery from the End of the 19th Century until the Second World War” published in English 17 May 2016, http://www.cadtm.org/Greece-Continu…