Bank Fraud and Mounting Household Debts in America: The Unspoken Victims of “Payday Loans”

Despite what the talking heads are saying, the economy isn’t doing so well. With this most recent jobs report, the two main sectors of growth were fast food and retail, accounting for a total of about 32.2% of jobs created in October. In part, due to low-paying jobs, many are using payday loans to get by and unfortunately when it comes time to pay up, many are paying much more than what they borrowed due to extremely high interest rates. While this has been bought up in the mainstream every now and then, rarely has anyone taken a look how payday loans came into existence and the type of havoc they wreak on people, mainly the poor. We need to realize that payday loans only harm us and explore alternatives.

According to the Journal of Economic Perspectives, the practice of getting credit against one’s next payment goes back to the Great Depression; however, “as the spread of direct deposit and electronic funds transfer technologies slowed the growth in the demand for check cashing services” and payday loans were more of a side job to check cashing businesses. Yet, the situation changed in 1978 that would facilitate the rise of payday lenders.

The beginnings of payday loans can be found in the 1978 Supreme Court case Marquette National Bank v. First of Omaha Service Corp which stated that “national banks were entitled to charge interest rates based on the laws of states where they were physically located, rather than the laws of states where their borrowers lived.” This allowed banks to offer credit cards to anyone they deemed qualified. A further empowerment came from the Depository Institutions Deregulation and Monetary Control Act of 1980 which allowed for banks and financial institutions to decide interest rates based on the market. This laid the foundation for payday loans as now one could set up a payday loan company and charge high interest rates, saying they were based on the market which would allow them to make a profit and due to the court case, payday lenders could offer loans to literally anyone they wanted, even those with bad credit.

Payday lenders are able to profit off of the loans they provide by charging interest, which can get out of control. For example, “For a loan of $300, a typical borrower pays on average $775, with $475 going to pay interest and fees over an average borrowing cycle.” It was noted by the Federal Reserve Bank of Cleveland in 1999 that the loans have “annualized interest rates often ranging from 213 percent to 913 percent” or 4.4%-19% a week! Thus, while the interest rates might not seem ridiculous at first glance, they can easily grow out of control.

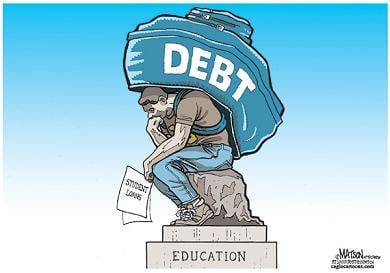

Now, while it’s known that mainly working-class people and the poor are the main users of payday loans, that’s also a rather broad brush. More specificity was attained in 2012, when Pew Research reported that the majority of payday loan borrowers are 25-44 year old white women, though “there are five groups that have higher odds of having used a payday loan: those without a four-year college degree; home renters; African Americans; those earning below $40,000 annually; and those who are separated or divorced.” Furthermore, the Journal of Economic Perspectives found that “three times the percentage of payday loan customers are seriously debt burdened and have been denied credit or not given as much credit as they applied for in the last five years.”

So the victims of payday loans are part of groups and communities that are already having economic troubles, even more so due to the current economic climate. In terms of why people utilized payday loans, it was found that “most borrowers use payday loans to cover ordinary living expenses over the course of months, not unexpected emergencies over the course of weeks,” which really just speaks to the problem of wages and how people aren’t being paid enough.

The situation becomes all the more tragic when one finds that not only are the bottom lines of payday lenders “significantly enhanced by the successful conversion of more and more occasional users into chronic borrowers,” but also that “the federal government has found that one of the country’s biggest payday lenders provides financial incentives to its staff to encourage chronic borrowing by individual patrons,” (emphasis added) as was reported in a 2003 issue of Economic Development Quarterly. So the vulnerable are then put into a cycle of poverty which is extremely difficult to get out of.

There has been an attempt by state governments to regulate payday loans. Some states ban outright, whereas others limit interest rates. The lenders are getting smart and attempting to avoid regulation by “making surface changes to their businesses that don’t alter their core products: high-cost, small-dollar loans for people who aren’t able to pay them back.”

It should be noted that payday lenders are not small chumps in the financial world. For a while major banks were involved in payday lending, such as “Wells Fargo, Bank of America, US Bank, JP Morgan Bank, and National City (PNC Financial Services Group)” and were able to finance 38% of the entire payday lending industry and that is a rather conservative estimate. These banks bowed out of the industry in January 2014 after being warned by federal regulators that they were going to look to see if the loans violated consumer protection laws. But the problem doesn’t end there.

There are also middlemen involved that operate on behalf of the payday companies. It was reported in April 2014 that a lawsuit was being filed against Money Mutual which claimed that “[claimed] the company [was] operating as an unlicensed lender by arranging loans that violate a [Illinois] state law that restricts borrower fees.” Money Mutual is itself not a lender, but rather “a lead generator that sells sensitive customer information, like bank-account numbers and email addresses, to payday lenders, and federal and state officials increasingly are cracking down on these businesses.” Middlemen like Money Mutual can be paid $50-$150 per lead, even if the person doesn’t take out a loan. This can quickly add up. In 2012 Bloomberg News found that “lead generators in financial services take in $100 million a year, with the market growing by more than 16 percent annually.”

Yet, this is just with storefront lenders, all new problems arise when one delves into the world of online payday lending. It has beenreported that many online payday lenders “attempt to skirt the rules and charge exorbitant fees, amongst other affronts to regulations that leave many a consumer seeking payday loan legal help” and that the Pew Research Center “found that about 30 percent of Internet payday loan borrowers claim they have received at least one threat from the lender,” whether it be for arrest or that the debtor’s employer would be contacted.

One of the worst problems with online payday lenders is theft; just take the story of Jeannie Morris of Kansas City. She entered personal information on websites that offered to match her up with payday lenders, however the situation took a turn for the worse when, “without asking her approval, two unrelated online lenders based in Kansas City had plopped $300 each into her bank account.

Together, they began withdrawing $360 a month in interest payments” and after her account was wiped clean, Jeannie was hounded by collection companies. Jeannie is not alone as “many consumers reported that loans they’d never authorized had been dropped into their bank accounts. Then those accounts often evaporated as the lenders snatched out money for interest payments while never applying any of the money to the loan principal.” So now online payday lenders can just lend people money without asking them and then clean out people’s bank accounts, effectively stealing from families.

The situation may seem hopeless, but there are alternatives to payday loans. One way is with credit union loans where members are allowed to borrow up to $500 each month and each loan is “connected to a SALO cash account, which automatically deducts 5 percent of the loan and places it in a savings account to create a ‘rainy day fund’ for the borrower.” Small consumer loans are another option. They are a lot less expensive than payday loans, for example, “a person can borrow $1,000 from a finance company for a year and pay less than a $200-$300 payday loan over the same period. If possible, someone could also get a cash advance on their credit card. In the long term, credit counseling can help a person to create a debt repayment plan and find a way to balance a budget.

Payday lenders are a major problem and prey on the desperate in order to make money. We need to organize and fight for the economic freedom of everyone. Consumer watchdog groups and payday borrowers and victims of payday theft need to come together to end this practice that creates a cycle of debt. To quote the rallying cry of IWW songwriter Joe Hill: “Don’t mourn, organize!”

Originally posted on Occupy.com

Devon Douglas-Bowers is a 22 year old independent writer and researcher and is the Politics/Government Department Chair of the Hampton Institute. He can be contacted at devondb[at]mail[dot]com.