Back to the Future with Empire Oil

A network of oil companies arond Mayfair, but registered in Britain's offshore tax-haven network, provides a snapshot of the new imperialism.

“I want the Britain of the future to be a truly Global Britain, which is a force for good in the world. Steadfast in upholding our values – not least our fierce commitment to protecting the natural environment.” PM Theresa May, January 2018

As Britain heads for an uncertain post-Brexit future, the prospect of a deregulated corporate global free-for-all operating from offshore accounts with damaging environmental impact is the nightmare envisaged by many. But that future may be closer than people realise.

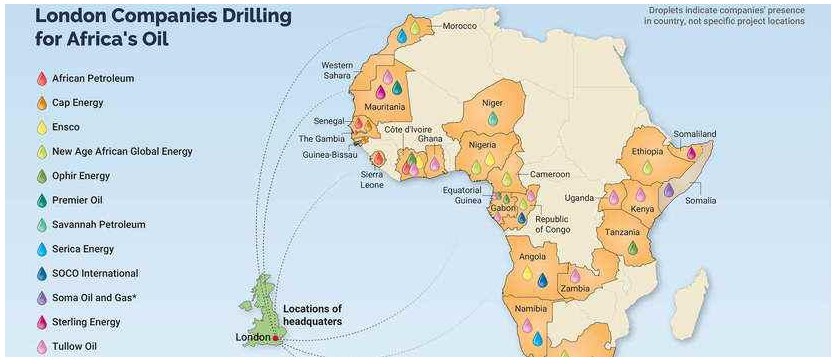

DeSmog UK has identified a hub of a dozen companies based around Mayfair, drilling for oil in Africa, and making use of tax-havens in British overseas territories and crown dependencies such as the British Virgin Islands, the Cayman Islands and Jersey.

This is Empire Oil, a neocolonial snapshot of the future simultaneously revisiting Britain’s Imperial past in countries such as Somaliland, Kenya, Zambia, Tanzania, Nigeria and South Africa – and forging a new path for Global Britain.

At the centre of it is the Alternative Investment Market (AIM), London’s junior stock exchange. AIM operates ‘light touch regulation’, leading it to be described as a ‘casino’. It’s a system where nominee advisors – or ‘nomads’ – can act as both regulators of the system and brokers, potentially creating serious conflicts of interest.

Companies are using London’s reputation as a financial powerhouse to raise funds, while taking advantage of rules that allow them to keep ownership details hidden in offshore accounts

This makes public scrutiny challenging and once again demonstrates the value of independent media. With no corporate-backing, DeSmog UK is free to pursue stories the mainstream press often shy away from.

Source: Desmog.co.uk

Take for example Soma Oil and Gas, which was founded in 2013 by the former leader of the Conservative Party and now company chairman Michael Howard to pursue oil and gas opportunities in Somalia.

Since its creation in 2013, Soma Oil and Gas has changed its registration address five times in central London according to Companies’ House. In 2015, it was the subject of a criminal investigation by the Serious Fraud office (SFO) “in relation to allegations of corruption in Somalia”. In 2016, the SFO closed the case because of “insufficient evidence”. No charges were ever made.

Another company embroiled in controversy is London-based New Age African Global Energy – which was formed in Jersey in 2007 by Steve Lowden, an oil executive who had previously worked with Marathon Oil and Premier Oil.

The company is backed by US hedge-fund Och-Ziff, which had to pay more than $400 million (£295 million) in bribery settlements following an investigation by the US government that found the company had paid more than $100 million (£74 million) in bribes to government officials in Libya, Chad, Niger, Guinea and the Democratic Republic of Congo to secure natural resources deals and investments.

The director of the Securities and Exchange Commission’s enforcement division Andrew J. Ceresney, said:

“Och-Ziff engaged in complicated, far-reaching schemes to get special access and secure significant deals and profits through corruption.”

A lawyer for Och Ziff told a federal judge presiding over the case in New York that “Och-Ziff has taken substantial remedial efforts to improve its compliance program to ensure something like this can never happen again”, Reuters reported.

DeSmog UK’s investigation does not identify illegal activity. However, the companies’ London residence combined with their use of tax havens and international activities raise serious questions about the UK’s commitment to being a global leader on environmental and corporate accountability issues.

The current system is allowing outsourced extraction in far-off lands by companies that are unregulated and untraceable.

The UK is one of 51 countries signed up to the Extractive Industries Transparency Initiative (EITI), a global scheme that compels oil, gas and mining companies to disclose any payments made to governments. But companies registered in crown dependencies and overseas territories such as the Cayman Islands and the British Virgin Islands do not have to make financial disclosures under the EITI.

Pressure is mounting to reform AIM.

Last year, AIM itself called for submissions around proposed changes to its admission rules. AIM’s discussion paper included “consideration of further supervisory powers and sanctions to ensure consistency of standards across the market”.

Responding to AIM, the NGO Rights and Accountability in Development (RAID) called for “urgent action to halt the laundering of assets” and warned that the light regulation system needed to be scrapped in order to stop London attracting “dirty money”.

RAID’s submission, seen by DeSmog UK, stated:

“It is highly doubtful that self-regulation, relying on private firms with vested interests as gatekeepers and designed to be ‘light touch’ will ever eliminate or even significantly reduce the use of AIM to launder assets and dirty money through London.”

AIM subsequently announced a series of minor changes to its listing process, none of which faced the structural reforms campaigners had called for to transform its system. It currently seems inconceivable that such a volatile and profitable forum will reform itself.

Such a move would have to come from government, but that also seems unlikely given wild rhetoric about Britain’s golden future as a global trading nation.

Earlier this month, the government was defeated in the UK parliament when MPs voted through a new amendment to the Sanctions and Anti-Money Laundering Bill which would require 14 British overseas territories to publish registers of beneficial ownership by 2020 or face having them imposed.

Campaigners have seen the vote as a sign the mood may be changing over corporate openness and transparency.

But for now it seems that Empire Oil is London’s dirty secret, and it’s back to the future for Mayfair’s money boys.

Read the full special investigation here.

*

Mike Small is Editor of Bella Caledonia and Deputy Editor of DeSmogUK.