A Result of Euro-Maidan and US-Supported Regime Change: Ukraine’s Currency Close to Collapsing

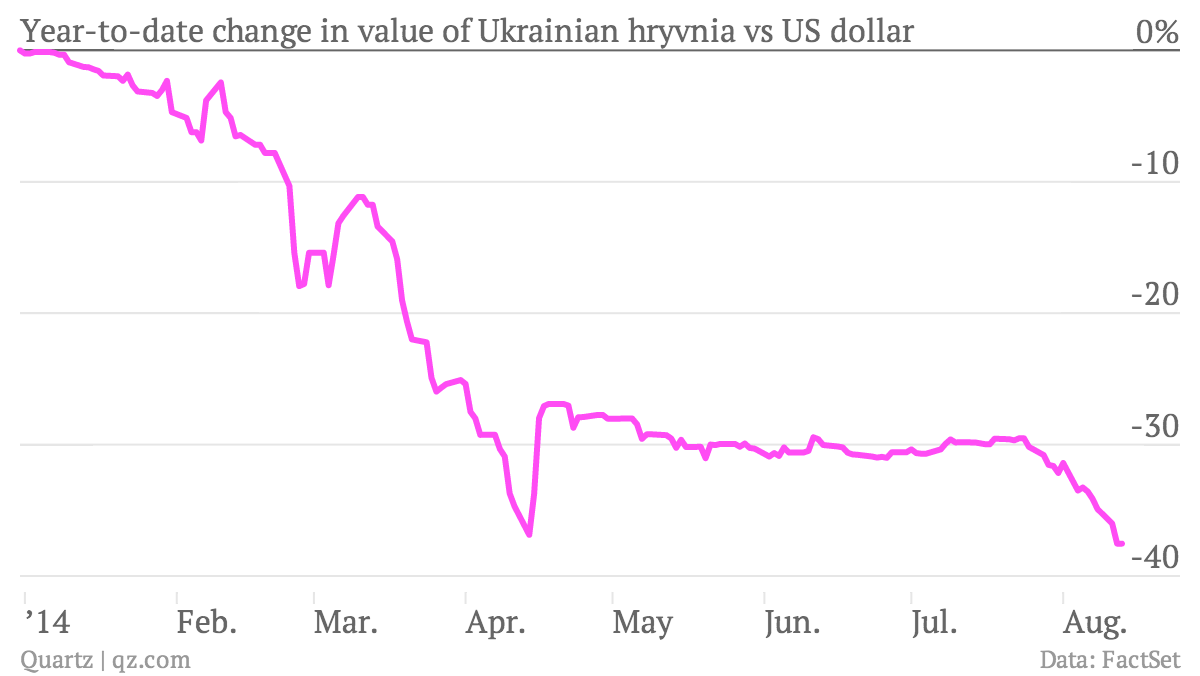

The latest escalation in tensions has taken its toll on Ukraine’s teetering economy. Its currency, the hryvnia, is plumbing new depths this week. Languishing at all-time lows against the dollar, the currency has lost almost 40% of its value against the dollar so far this year:

As the Ukrainian economy goes from bad to worse, the collapse of its currency is a major headache for its economic officials, particularly central bank governor Valeria Gontareva. The currency slide is fueling inflation and making foreign debt burdens heavier, which means that Ukraine might need to ask for more money from the IMF.

Ukraine’s central bank has been dipping into its reserves to prop up the hryvnia in recent days, even as Gontareva decries irrational “panic” (link in Ukrainian). The thing is, Ukraine’s coffers are running dangerously low. The country’s foreign-exchange reserves currently cover only around two months of imports, according to analysts at Ukrsibbank.

A $1.9-billion injection from the IMF and World Bank this month will go out the door, and then some, next month when Ukraine needs to repay more than $2 billion in foreign-currency debts that come due. Fearing further depreciation amid the worsening unrest, locals have recently stepped up trading in their hryvnia for dollars and other safe-haven currencies, depleting reserves even further.

This gives Gontareva little ammunition to fight the forces working against the hryvnia. She has hinted at vague “administrative restrictions” on foreign exchange trading if the hryvnia rout continues, and may be forced to hike interest rates. But until the turmoil in the east subsides—which seems unlikely any time soon—the economy will remain almost totally reliant on foreign financial aid. Ukraine is set to be the worst-performing economy in the world this year, and no other country even comes close.

Edited by Global Research