US Shale Oil and Gas Industry is a Ponzi Scheme Facing Collapse

The mainstream media keeps churning out good news stories about the booming shale oil and gas industry in the United States. Apparently, the fracking industry is going to lead to America becoming the next Saudi Arabia with a hundred years of oil and natural gas. It will provide cheap energy supplies that will boost U.S. Industry and give a major boost to consumers and help the so-called economic recovery.

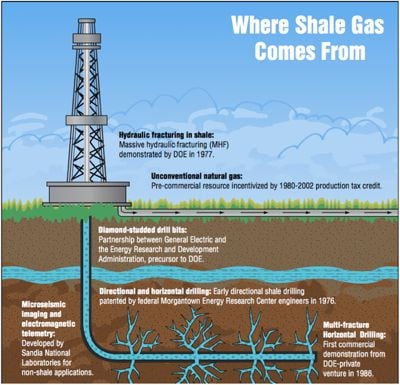

Yet all of the over inflated claims for shale oil and gas are based upon a fantasy. The geological evidence (See the exhaustive studies by University of Texas and by the geologist David Hughes for the Post Carbon Institute in 2014) shows quite clearly that shale gas and tight oil production is likely to peak in the next 5 years.

Tad Patzek, head of the University of Texas at Austin’s department of petroleum and geosystems engineering, has commented that companies are trying to extract shale oil and gas as fast as possible. The danger of this is that, “we’re setting ourselves up for a major fiasco”. He notes that after production peaks in 2020 “there’s going to be a pretty fast decline on the other side” and ”that’s when there’s going to be a rude awakening for the United States.” He notes rather ominously that, “it cannot be good for the US economy.”

Arthur Berman an independent geologist claims that that the U.S. has only 2 years worth of tight oil production left given current levels of consumption. He says that the US has about 10 billion barrels of proven plus proven undeveloped reserves left yet it is consuming 5.5. billion barrels of oil per year. On top of this was the 96% downgrade in shale oil reserves in the Monterey play in California last year by the EIA which was meant to have the largest shale oil reserves in the US.

Arthur Berman an independent geologist claims that that the U.S. has only 2 years worth of tight oil production left given current levels of consumption. He says that the US has about 10 billion barrels of proven plus proven undeveloped reserves left yet it is consuming 5.5. billion barrels of oil per year. On top of this was the 96% downgrade in shale oil reserves in the Monterey play in California last year by the EIA which was meant to have the largest shale oil reserves in the US.

The fracking industry which is going for broke with its drill bay drill attitude is pumping out more oil and gas than ever before. The mainstream are in love with this success story yet conveniently ignore the fact that shale oil and gas industry could not survive without access to cheap credit thanks to the Feds policy of zero per cent interest rates. The smaller energy companies are piling up massive amounts of debt in an effort to continue in existence. Once the ponzi scheme that is the Western financial system collapses then the whole fracking industry will go down the toilet with it.

The mainstream media and bankster politicians keep harping on about the cheap price of shale oil being of great benefit to the consumer. Yet the more important issue for people is not the current price of oil but the dwindling supplies of oil and gas. Since the 1970s oil prices have been volatile showing how this precious energy resource is becoming an increasingly scarce commodity.

What should concern people in the US is the fact that its oil and gas reserves are set to run out in the not too distant future. As Arthur Berman has observed people are just not ready for the fact that they are going to have to make changes in their lifestyles. He says that at talks he gives,”Nobody wants to change the way they live.”

Oil and gas are finite resources which will become increasingly expensive to extract as they become more and more scarce. We shouldn’t have illusions that renewable energy will mean that we can continue our energy extravagant lifestyles. People need to look to the future to a world where they will have to live much energy simpler lifestyles. We should start preparing for this now not when the oil and gas run out.

Notes:

DRILLING DEEPER A Reality Check on U.S. Government Forecasts for a Lasting Tight Oil & Shale Gas Boom By J. David Hughes, Post Carbon Institute, 2014

Natural gas:The fracking fallacy by Mason Inman, Nature, 3/12/2014

Arthur Berman: Why Today’s Shale Era Is The Retirement Party For Oil Production

http://www.peakprosperity.com/podcast/91722/arthur-berman-why-todays-shale-era-retirement-party-oil-production