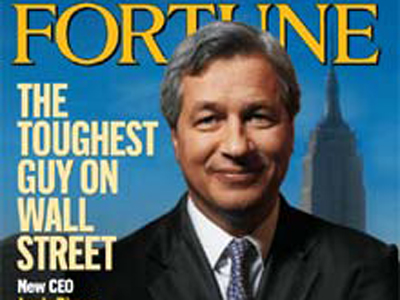

NY Times Calls JPMorgan CEO’s 74 Percent Pay Raise “Laudable”

The New York Times published a commentary last Friday in which the author called a 74 percent pay increase announced last week for JPMorgan Chase CEO Jamie Dimon “laudable.”

Dimon’s pay increase, which brought his 2013 payout to $20 million, followed a year in which his bank agreed to pay over $20 billion in fines to settle charges related to an extraordinary array of crimes, ranging from securities fraud, to forging foreclosure documents, to lying to regulators.

The Times felt compelled to go into print in defense of Dimon after news of his pay increase raised eyebrows in the media and fueled popular outrage over the avarice and criminality of Wall Street.

The author of the Times article, James, B. Stewart, wrote, “[I]n the world of executive compensation, especially when viewed from the rarefied perspective of other chief executives, and more broadly on Wall Street, Mr. Dimon’s pay—and how it was determined—is not only defensible, but laudable.”

Over the past several years, America’s biggest bank has been fined in connection with illegal actions that have had catastrophic social consequences. Less than a month ago, on January 7, the bank agreed to pay $2.05 billion in fines and penalties to settle charges that it was an accomplice in the multi-billion-dollar Ponzi scheme operated by Bernie Madoff, who is currently serving a 150-year prison term. Madoff’s Ponzi scheme was the largest in world history. When it collapsed in 2008, it wiped out the life savings of thousands of retirees and threw a number of charitable organizations into bankruptcy.

The Obama Justice Department, in line with its policy of not prosecuting Wall Street banks or their top executives, offered Dimon a “deferred prosecution” deal in which the bank agreed to the facts presented by the government, but avoided a criminal indictment.

That settlement followed a year in which JPMorgan agreed to pay $13 billion to settle charges that it defrauded investors by selling toxic mortgage-backed securities on false pretences in the run-up to the 2007-2008 collapse of the housing bubble. The same year, the bank paid nearly $1 billion to settle charges arising from its concealment of nearly $6 billion of derivatives losses in the so-called “London Whale” scandal.

The bank was also part of a cash settlement with the top five US mortgage lenders, which had been caught forging and fraudulently processing home foreclosure documents. Untold thousands, or perhaps millions, of families were illegally forced out of their homes as a result.

Also in 2013, JPMorgan paid $4.5 billion to settle charges that it defrauded pension funds and other institutional investors to whom it sold mortgage bonds. The bank paid a separate fine to settle charges that it defrauded credit card customers.

JPMorgan is one of more than a dozen major international banks under investigation for illegally manipulating Libor (the London Interbank Offered Rate), the world’s benchmark interest rate, used to set the rates for $300 trillion worth of financial contracts, including rates on mortgage loans, credit cards, auto loans and derivatives. The rigging of Libor by itself has cost state and local governments, pension funds and retirees, home owners and hundreds of millions of other people untold billions in losses.

These criminal practices—which are epidemic throughout the financial industry—triggered the deepest global economic crisis since the Great Depression, causing millions of people to lose their jobs, their retirement savings, their homes and a large part of their incomes. The number of people who have suffered hunger, homelessness, poverty and disease as a result of the actions of Dimon and his fellow Wall Street crooks, if calculated, would run into the hundreds of millions.

Bailed out and shielded from prosecution by the Obama administration and governments all over the world, those responsible for the crisis, such as Dimon, have been allowed to further enrich themselves by continuing essentially the same practices that precipitated the disaster.

The Times article fails to mention any of the multiple charges against Dimon’s bank, or the long list of settlements into which Dimon has entered with regulators. For the so-called “newspaper of record,” illegal activity is perfectly acceptable so long as the culprits belong to the financial aristocracy.

There is a very different standard when it comes to ordinary people, especially those who expose the crimes of the American government. This is the same newspaper that viciously attacked Julian Assange, smeared Bradley Manning, and sanctimoniously demands that Edward Snowden acknowledge his “guilt” and return to the United States to face a show trial and decades in prison, if not worse.

According to the Times, JPMorgan’s compensation committee was entirely justified in giving Dimon a raise because he succeeded in driving up the company’s share price. As Stewart’s piece notes, “shares gained 37 percent in 2013, and with Mr. Dimon as chief executive, its shares have outpaced both the financials index and the Standard & Poor’s 500-stock index over one-, three- and five-year periods.”

Stewart quotes David Larcker, a business professor at Stanford University, who says, “It’s not like he’s taking home $20 million in cash… His incentives are aligned with shareholders. There’s risk imposed on him. That’s called pay for performance, and it’s a good thing.”

Larcker stressed, the articles notes, that “the board’s duty was to shareholders, not the public at large.”

In an attempt to give his defense of Dimon and his pay increase a fig leaf of objectivity, Stewart purports to present the views of those who are opposed to the raise. But he exudes contempt for what he obviously considers the naïve notion that a corporate swindler should not be rewarded with a multi-million-dollar pay increase. One academic quoted in his piece refers dismissively to a “populist backlash.”

Stewart writes: “Although much of the country may feel that Wall Street executives have largely escaped accountability for the financial crisis, on Wall Street itself, the opposite view prevails, which is that banking executives in general, and Mr. Dimon especially, have been made scapegoats by overzealous regulators.”

When it comes to both criminality and obscene compensation levels, JPMorgan and Dimon are not exceptions; they are the rule among top Wall Street firms and their executives. In his article, Times columnist Stewart points out—not at all critically—that just last week, Morgan Stanley announced that its chief executive, James P. Gorman, will receive an 86 percent increase in his bonus, to $4.9 million, on top of a doubling of his base salary to $1.5 million. In all, his pay for 2013 will significantly exceed the $9.75 million he received in 2012.

Similarly, the article notes that Goldman Sachs CEO Lloyd Blankfein is set to receive a big raise for 2013 from the $21 million he took in the previous year. However, Stewart argues, given the $40.3 million Exxon-Mobil CEO Rex Tillerson was paid in 2012, the $62.2 million CBS Chief Executive Leslie Moonves took in, and Oracle CEO Larry Ellison’s $96.12 million, Dimon’s $20 million “looked modest.”

Defending financial criminals is nothing new for the Times. In 2009, the newspaper vociferously defended Steven Rattner when the private equity firm he co-founded was under investigation for carrying out a kickback scheme involving the New York State retirement pension fund, forcing Rattner to resign as head of Obama’s Auto Task Force. The next year, Rattner settled the charges for $7 million. He is now a regular commentator for the Times.