Black Monday Galore: A Speculator’s Seesaw Paradise

There is something disturbing about the Black Monday collapse of Wall Street, following the rejection of the proposed bailout by the US Congress, and which has not been addressed by the media.

There was prior information on how the Congressional vote would proceed.

There was also an expectation that the market would crumble if the proposed 700 billion dollar bailout were to be rejected by the US Congress.

Speculators including major financial institutions had already positioned themselves.

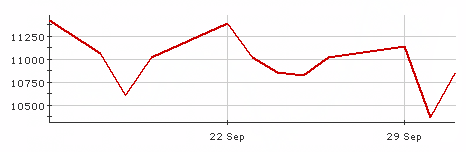

On Black Monday September 29, markets around the world collapsed on news that the US Congress had voted against the bailout. The Dow Jones industrial average fell by 778 points, a decline of almost 7 percent, the largest one day decline since Sept. 17, 2001, when the market opened after September 11, 2001.

In percentage terms, it was the 17th largest one day decline of the DJIA. Those who were involved in speculative trade prior to Congress’ rejection of the legislative process, made billions on Black Monday. And then on Tuesday, they made billions, when the market rebounded, with the Dow jumping up by 485 points, a 4.68% increase, largely compensating for Monday’s decline.

Dow Jones (DJIA)

Those financial actors who had advanced inside information regarding the Congressional decision or had the ability to influence the vote of members of Congress made billions of dollars when the market crumbled.

Ironically, almost twice as much money was “wiped out” from the US stock market on Black Monday September 29 (1.2 trillion dollars) than the value of the Paulson bailout (700 billion dollars). “Even before the opening bell, Monday looked ugly. But by the time that bell sounded again on the New York Stock Exchange, seven and a half frantic hours later, $1.2 trillion had vanished from the U.S. stock market.”

While public opinion celebrates the refusal of US Congress to accept the bailout, the decision of the legislature feeds the speculative onslaught, which in turn favors a greater concentration of wealth and financial power.

What is more profitable to the speculators: the bailout per se or the money they make speculating as to whether the bailout proposal will or will not be adopted by the US Congress and implemented by the US administration?

In a bitter irony, political uncertainty regarding the proposed bailout constitutes ammunition for the speculators.

The banks are “double dippers”; they are the recipients of the bailout. And at the same time they make money speculating on the adoption of the bailout legislation.

Short Term Speculation

What has characterized the stock market in recent years is a seesaw up and down movement, where a temporary meltdown on one day is compensated by an upward rebound on the following business day. Analysts invariably dispel the speculative mechanisms. The rebound is attributable to “regained investor confidence”.

Within a trading day, there is considerable volatility.

There have been numerous “Black Mondays”. Two weeks prior to the 29 Septmber meltdown, on Monday, September 15, 2008, the Dow Jones industrial average (DJIA) declined by 504 points (4.4%). The financial slide had led to an 800 point decline of the Dow Jones in less than a week.

Amply documented, these short term swings in stock markets are the object of a lucrative speculative trade.

Those who had advanced warning of Congress’ decision made a bundle of money on Black Monday. And the following day, Tuesday, when markets rebounded by 4.7% after a 7 percent collapse of the DJI, they made another bundle of money.

Was the Congressional decision in any way connected to the speculative onslaught?

“Black Mondays” are potentially the source of windfall profits. The revenues to be derived by financial institutions, which not only have foreknowledge and inside information but also the ability to manipulate the market are enormous.

Were these up and down swings the result of market manipulation?

Short Selling

In the last two weeks, the U.S. Securities and Exchange Commission established a temporary and partial ban on short-selling. How effective it was remains to be established.

The temporary ban on short selling dampens but does not preclude the speculative drive. Short selling is the act of selling stock which you do not possess and then buying the stock back in the spot market once the price has collapsed.

“The SEC ordered traders, including hedge funds, to stop short selling nearly 800 financial stocks… The emergency measure also required large managers to disclose what stocks they are selling short, or betting on a price drop. The order is set to expire on Thursday at midnight unless SEC commissioners decide to extend it. (Reuters, 30 September 2008)

The news reports suggest that the market rebounded on the presumption that Congress would pass an amended version of the $700 billion bailout. Again what is significant is that there is more money to be made on speculating on whether the bailout will or will not be implemented than on the bailout itself.

The market is in crisis but there is no consistent downward trend. What is happening is a downward movement and then on the following day, the market rebounds and then goes down again and then rebounds.

On each short term movement, institutional speculators including the financial institutions which are the targeted beneficiaries of Paulson’s bailout, make billions of dollars speculating on the short term movement of the stock market, the daily ups and downs.

What is more profitable for the banks: the bailout or speculating on whether the bailout will or will not be adopted?

There is money to be made if you have inside information as to what is happening behind closed doors at the US Congress, on the negotiations between the US Congress, the Treasury, the Fed and Wall Street’s financial institutions.

Similarly, there is money to be made in spreading rumors on negotiations pertaining to the bailout and speculating on the likely short term movement of stock markets which results from the release of false and/or misleading information.

In the weeks ahead, the Paulson bailout will be the object of further speculative transactions on Wall Street.

Will it be adopted? Under what form will it be adopted? Will it be postponed? Will it be thrown out?

Moreover, the lifting of the temporary ban on short selling by the SEC will play a proactive role in exacerbating market instability, while also facilitating the further appropriation of wealth instrumented through speculative trade.

The speculators of the late 1920s belong to a bygone age. Today’s speculative transactions are integrated into the normal functions of giant financial institutions.

At each meltdown and upward rebound, massive speculative gains accrue to major financial speculators. Those who stand to gain are those who have a privileged relationship to the Treasury, Congress and the Federal Reserve as well those involved, behind the scenes, in shaping government economic and financial policy.