Historical Roots of the Social Crisis in Brazil. The Role of the IMF

More than a million people across Brazil have joined one of the largest protest movements in the country’s history. Ironically, the social uprising is directed against the economic policies of a self-proclaimed “socialist” alternative to neoliberalism led by the Worker’s Party government of president Dilma Rousseff.

The IMF’s “strong economic medicine” including austerity measures, the privatization of social programs have been implemented under the “progressive” and “populist” banner of the Partido dos Trabalhadores (PT), in consultation with Brazil’s powerful economic elites and in close liaison with the World Bank, the IMF and Wall Street.

While the PT government presents itself as “an alternative” to neoliberalism, committed to poverty alleviation and the redistribution of wealth, its monetary and fiscal policy is in the hands of its Wall Street creditors.

Ironically, the PT government of Dilma Rousseff and her predecessor Luis Ignacio da Silva has been commended by the IMF for:

Ironically, the PT government of Dilma Rousseff and her predecessor Luis Ignacio da Silva has been commended by the IMF for:

“a remarkable social transformation in Brazil underpinned by macroeconomic stability and rising living standards”.

The underlying social realities are otherwise. The World Bank’s “statistics” on poverty are grossly manipulated. Only 11 percent of the population, according to the World Bank are beneath the poverty line. 2.2 percent of the population are living in extreme poverty.

The standard of living in Brazil has collapsed since the accession of the Workers Party in 2003. Millions of people have been marginalized and impoverished including a significant part of the urban middle class.

While the Partido dos Trabalhadores (PT) presents a “progressive” people’s oriented image, officially opposed to “corporate globalization”, the macro-economic agenda has been reinforced. The PT government has consistently manipulated its grassroots, with a view to imposing what the “Washington Consensus” describes as “a strong policy framework”.

The multibillion dollar profit driven infrastructural investments pertaining to The World Cup in 2014 and the Olympic Games in 2016, wrought by corporate corruption, have contributed to a significant increase in Brazil’s external debt, which in turn has reinforced the control of economic policy by its Wall Street creditors.

The protest movement is in large part made up of people who voted for the Partido dos Trabalhadores (PT).

The PT government’s grassroots support has been broken. The base of the Workers Party has gone against the government.

History: Workers Party Betrayal

The Workers Party (Partido dos Trabalhadores) has now been in power for over ten years.

The ongoing social crisis in Brazil is the consequence of the macro-economic agenda launched at the outset of Luis Ignacio da Silva’s accession to the presidency in 2003.

The ongoing social crisis in Brazil is the consequence of the macro-economic agenda launched at the outset of Luis Ignacio da Silva’s accession to the presidency in 2003.

Lula’s election in 2002 embodied the hope of an entire nation. It represented an overwhelming vote against globalization and the neo-liberal model, which has resulted in mass poverty and unemployment throughout Latin America.

The election of Lula in the Fall of 2002 was perceived as a major breaking point, a means to repealing the policy framework of his predecessor Fernando Henrique Cardoso.

While embraced in chorus by progressive movements around the World, Lula’s administration was also being applauded by the main protagonists of the neoliberal model. In the words of the IMF’s Managing Director Horst Kohler:

“I am enthusiastic [with Lula’s administration]; but it is better to say I am deeply impressed by President Lula … the IMF listens to President Lula and the economic team, and that is our philosophy.”

No wonder the IMF is “enthusiastic”. The main institutions of economic and financial management were handed over on a silver platter to Wall Street and Washington.

The IMF and the World Bank have commended the Workers Party government for its commitment to “strong macroeconomic fundamentals.” As far as the IMF is concerned, Brazil “is on track” in conformity with IMF benchmarks. The World Bank has also praised both the Lula and Dilma governments: “Brazil is pursuing a bold social program with fiscal responsibility.”

According to Professor James Petras:

Most Wall Street and Washington policymakers, surprised by Lula’s selection of an orthodox liberal economic team, were perfectly ecstatic when he began to forcefully push through a radical neo-liberal agenda, including privatizing social security, substantially lowering pensions for public sectors employees and reducing the cost and easing the requirements for capitalists firing workers.(Global Research, 2003

According to Marcos Arruda of PACS, a non-governmental research center in Rio de Janeiro:

“Lula’s economic team by pursuing IMF-imposed policies is gutting social payments not just for the retired, but also for the disabled and the poorer families as well.” The pursuance of orthodox economic policies has also pushed up official unemployment to 12 percent while domestic interest rates stand at 26.5 percent, among the highest rates in the world. In Sao Paulo, Brazil’s largest city, unemployment has reached 20 percent. (See Roger Burbach, Global Research, June 2003)

Brazil under the PT government not only endorsed neoliberalism “with a human face”, it also supported the US-led militarization of Latin America and the Caribbean.

Brazil under the PT government not only endorsed neoliberalism “with a human face”, it also supported the US-led militarization of Latin America and the Caribbean.

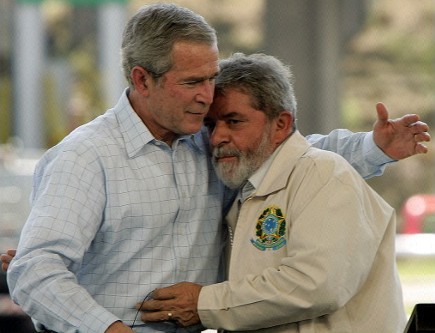

Lula had established a personal relationship with George W. Bush. While he was a staunch critic of the US-led Iraqi war, a supporter of Hugo Chavez, he was also tacitly supportive of US strategic interests in Latin America.

In the wake of the US-France-Canada sponsored coup d’Etat in Haiti in February 2004 against the duly elected government of Jean Bertrand Aristide, President Luis Ignacio da Silva endorsed the military occupation of Haiti and dispatched Brazilian troops to Port au Prince, under the auspices of the UN Stabilization Mission (MINUSTAH).

The article below was first published by Global Research at the outset of the PT government of Luis Ignacio da Silva. It describes how, from the very outset, the presidency of Luis Ignacio da Silva, the leadership of the Worker’s Party betrayed an entire nation.

Meaningful change cannot result from a debate on “an alternative to neoliberalism”, which on the surface appears to be “progressive”, but which tacitly accepts the “globalizers” legitimate right to rule and plunder the developing World.

The social protest movement which has swept Brazil is the result of 10 years of “free market” economic repression under the disguise of a “progressive agenda.”

Michel Chossudovsky, June 21, 2013

Brazil: Neoliberalism with a “Human Face”

by Michel Chossudovsky

Global Research

http://globalresearch.ca/articles/CHO303C.html

April 3, 2003

The inauguration of Luis Ignacio da Silva (Lula) to the presidency of Brazil is historically significant, because millions of Brazilians saw in the Workers Party (Partido dos Trabalhadores), a genuine political and economic alternative to the dominant (neoliberal) “free market” agenda.

Lula’s election embodies the hope of an entire nation. It constitutes an overwhelming vote against globalization and the neo-liberal model, which has resulted in mass poverty and unemployment throughout Latin America.

Meeting in Porto Alegre in late January at the World Social Forum, Lula’s anti-globalization stance was applauded by tens of thousands of delegates from around the World. The debate at the 2003 WSF, held barely two months before the invasion of Iraq, was held under the banner: “Another World is Possible”.

Ironically, while applauding Lula`s victory, nobody — among the prominent critics of “free trade” and corporate driven globalization– who spoke at the 2003 WSF, seemed to have noticed that President Luis Ignacio da Silva`s PT government had already handed over the reigns of macro-economic reform to Wall Street and the IMF.

While embraced in chorus by progressive movements around the World, Lula’s administration was also being applauded by the main protagonists of the neoliberal model In the words of the IMF’s Managing Director Horst Koehler (left)[who later became President of Germany]:

While embraced in chorus by progressive movements around the World, Lula’s administration was also being applauded by the main protagonists of the neoliberal model In the words of the IMF’s Managing Director Horst Koehler (left)[who later became President of Germany]:

I am enthusiastic [with Lula’s administration]; but it is better to say I am deeply impressed by President Lula, indeed, and in particular because I do think he has the credibility which often other leaders lack a bit, and the credibility is that he is serious to work hard to combine growth-oriented policy with social equity. This is the right agenda, the right direction, the right objective for Brazil and, beyond Brazil, in Latin America. So, he has defined the right direction. Second, I think what the government, under the leadership of President Lula, has demonstrated in its first 100 days of government is also impressive and not just airing intention how they work through the process on this huge agenda of reforms. I understand that pension reform, tax reform is high on the agenda, and this is right. The third element is that the IMF listens to President Lula and the economic team, and that is our philosophy, of course, beyond Brazil. (IMF Managing Director Horst Koehler, Press conference, 10 April 2003, http://www.imf.org/external/np/tr/2003/tr030410.htm)

Lula appoints a Wall Street Financier to lead Brazil’s Central Bank

At the very outset of his mandate, Lula reassured foreign investors that “Brazil will not follow neighboring Argentina into default” ( Davos World Economic Forum, January 2003). Now if such is his intent, then why did he appoint to the Central Bank, a man who played a role (as president of Boston Fleet) in the Argentinean debacle and whose bank was allegedly involved in shady money transactions, which contributed to the dramatic collapse of the Argentinean Peso.

By appointing Henrique de Campos Meirelles, the president and CEO of Boston Fleet, to head the country’s Central Bank, President Luis Ignacio da Silva had essentially handed over the conduct of the nation’s finances and monetary policy to Wall Street.

Boston Fleet is the 7th largest bank in the US. After Citigroup, Boston Fleet is Brazil’s second largest creditor institution.

The country is in financial straightjacket. The key finance/banking positions in Lula’s administration are held by Wall Street appointees:

- The Central Bank is under the control of Boston Fleet,

- A former senior executive of Citigroup Mr. Casio Casseb Lima has been put in charge of the State banking giant Banco do Brazil (BB). Cassio Casseb Lima, who worked for Citigroup’s operations in Brazil, was initially recruited to BankBoston in 1976 by Henrique Meirelles. In other words, the head of BB has personal and professional links to Brazil’s two largest commercial creditors: Citigroup and Boston Fleet.

Continuity will be maintained. The new PT team in the Central Bank is a carbon copy of that appointed by (outgoing) President Fernando Henrique Cardoso. The outgoing Central Bank president Arminio Fraga was a former employee of Quantum Fund (New York), which is owned by Wall Street financier George Soros.

In close liaison with Wall Street and the IMF, Lula’s appointee to the Central Bank of Brazil, Henrique de Campos Meirelles, has maintained the policy framework of his predecessor (who was also a Wall Street appointee) : tight monetary policy, generalized austerity measures, high interest rates and a deregulated foreign exchange regime. The latter encourages speculative attacks against the Brazilian Real and capital flight, resulting in a spiraling foreign debt.

Needless to say, the IMF program in Brazil will be geared towards the eventual dismantling of the State banking system in which the new head of Banco do Brazil, a former Citibank official, will no doubt play a crucial role.

No wonder the IMF is “enthusiastic”. The main institutions of economic and financial management are in the hands the country’s creditors. Under these conditions, neoliberalism is “live and kicking”: an “alternative” macro-economic agenda, modeled on the spirit of Porto Alegre is simply not possible.

“Putting the Fox in charge of the Chicken Coop”

Boston Fleet was one among several banks and financial institutions which speculated against the Brazilian Real in 1998-99, leading to the spectacular meltdown of the Sao Paulo stock exchange on “Black Wednesday” 13 January 1999. BankBoston, which later merged with Fleet is estimated to have made a 4.5 billion dollars windfall in Brazil in the course of the Real Plan, starting with an initial investment of $100 million.(Latin Finance, 6 August 1998).

Boston Fleet was one among several banks and financial institutions which speculated against the Brazilian Real in 1998-99, leading to the spectacular meltdown of the Sao Paulo stock exchange on “Black Wednesday” 13 January 1999. BankBoston, which later merged with Fleet is estimated to have made a 4.5 billion dollars windfall in Brazil in the course of the Real Plan, starting with an initial investment of $100 million.(Latin Finance, 6 August 1998).

In other words, Boston Fleet is the “cause” rather than “the solution” to the country’s financial woes. Appointing the former CEO of Boston Fleet to head the nation’s Central Bank is tantamount to “putting the fox to in charge of the chicken coop”.

The new economic team has stated that it is committed to resolving the country’s debt crisis and steering Brazil towards financial stability. Yet the policies they have adopted are likely to have exactly the opposite effects.

Replicating Argentina

It so happens that Lula’s Central Bank president, Henrique Meirelles was a staunch supporter of Argentina’s controversial Finance Minister Domingo Cavallo, who played a key role under the Menem government, in spearheading the country into a deep-seated economic and social crisis.

According to Meirelles in a 1998 interview, who at the time was President and CEO of Bank Boston:

The most fundamental event [in Latin America] was when the stabilization plan was launched in Argentina [under Domingo Cavallo] . It was a different approach, in the sense that it wasn’t a control of prices or a control of the flow of money, but it was a control of the money supply and government finances.(Latin Finance, 6 August 1998).

It is worth noting that the so-called “control of the money supply” referred to by Meirelles, essentially means freezing the supply of credit to local businesses, leading to the collapse of productive activity.

The results, as evidenced by the Argentina debacle, was a string of bankruptcies, leading to mass poverty and unemployment. Under the brunt of Finance Minister Cavallo’s policies, in the course of the 1990s, most State owned national and provincial banks in Argentina, which provided credit to industry and agriculture, were sold off to foreign banks. Citibank and Fleet Bank of Boston were on the receiving end of these ill-fated IMF sponsored reforms.

“Once upon a time, government-owned national and provincial banks supported the nation’s debts. But in the mid- Nineties, the government of Carlos Menem sold these off to Citibank of New York, Fleet Bank of Boston and other foreign operators. Charles Calomiris, a former World Bank adviser, describes these bank privatisations as a ‘really wonderful story’. Wonderful for whom? Argentina has bled out as much as three-quarters of a billion dollars a day in hard currency holdings.” (The Guardian, 12 August 2001)

Domingo Cavallo was the architect of “dollarization”. Acting on behalf of Wall Street, he was responsible for pegging the Peso to the US dollar in a colonial style currency board arrangement, which resulted in a spiraling external debt and the eventual breakdown of the entire monetary system.

The currency board arrangement implemented by Cavallo had been actively promoted by Wall Street, with Citigroup and Fleet Bank in the lead.

Under a currency board, money creation is controlled by external creditors. The Central Bank virtually ceases to exist. The government cannot undertake any form of domestic investment without the approval of its external creditors. The US Federal Reserve takes over the process of money creation. Credit can only be granted to domestic producers by driving up the external (dollar denominated) debt.

Financial Scam

When the Argentina crisis reached its climax in 2001, major creditor banks transferred billions of dollars out of the country. An investigation launched in early 2003 pointed not only to the alleged criminal involvement of former Argentinean finance minister Domingo Cavallo, but also to that of several foreign banks including Citibank and Boston Fleet of which Henrique Mereilles was president and CEO:

“Battling to surmount a deep economic crisis, Argentina [January 2002] targeted capital flight and tax evasion, with police searching US, British and Spanish bank offices and authorities seeking explanations from an ex-president about the origins of his Swiss fortune. Claims that as much as 26 billion dollars left the country illegally late last year prompted the police actions. Later in the day, police went to Citibank, Bank Boston [Fleet] and a subsidiary of Spain’s Santander. (…) The various lawsuits in connection with illegal capital transfers name, among others, former president Fernando de la Rua, who stepped down December 20 [2001]; his economy minister Domingo Cavallo; and Roque Maccarone, who quit as central bank chief…” (AFP, 18 January 2003).

The same banks involved in the Argentinean financial scam, including Boston Fleet under the helm of Henrique Meirelles, were also involved in similar shady money transfers operations in other countries including the Russia Federation:

“[A]s many as 10 U.S. banks might have been used to divert as much as $15 billion from Russia, sources said, citing federal investigators. Fleet Financial Group Inc. and other banks are being investigated because they have accounts that belong to or are linked to Benex International Co.which is at the center of an alleged Russian money-laundering scheme.” (Boston Business Journal, 23 September 1999)

The Brazilian Financial Reforms

Everything indicates that Wall Street’s hidden agenda is to eventually replicate the Argentinean scenario and impose “dollarization” on Brazil. The ground work of this design was established under the Plan Real, at the outset of the presidency of Fernando Henrique Cardoso (1994-2002).

Everything indicates that Wall Street’s hidden agenda is to eventually replicate the Argentinean scenario and impose “dollarization” on Brazil. The ground work of this design was established under the Plan Real, at the outset of the presidency of Fernando Henrique Cardoso (1994-2002).

Henrique Meirelles, who had integrated FHC’s party the PSDB, played a key behind the scens role in setting the stage for the adoption of more fundamental financial reforms:

“In the early 1990s, I [Meirelles] was a member of the board of the American Chamber of Commerce and in charge of an effort to begin lobbying for a change in the Brazilian Constitution. At the same time I was also chairman of the Brazilian Association of International Banks and was in charge of the effort to open up the country to foreign banks and to open the flow of money. I started a broad campaign of approaching key people, including journalists, politicians, professors and advertising professionals. When I started, everyone told me it was hopeless, that the country would never open its markets, that the country should protect its industries. Over a couple of years, I spoke to about 120 representatives. The private sector was fiercely against the opening of the markets, particularly the bankers.(Latin Finance, op cit)

Amending the Constitution

The issue of Constitutional reform was central to Wall Street’s design of economic and financial deregulation.

At the outset of Fernando Collor de Melo’s presidency in 1990, the IMF had demanded an amendment to the 1988 Constitution. There was uproar in the National Congress, with the IMF accused of “gross interference in the internal affairs of the state”.

Several clauses of the 1988 Constitution stood in the way of achieving the IMF’s proposed budget targets, which were under negotiation with the Collor administration. IMF expenditure targets could could not be met without a massive firing of public- sector employees, requiring an amendment to a clause of the 1988 Constitution guaranteeing security of employment to federal civil servants. Also at issue was the financing formula (entrenched in the Constitution) of state and municipal-level programs from federal government sources. This formula limited the ability of the federal government to slash social expenditures and shift revenue towards debt servicing.

Blocked during the short-lived Collor administration, the issue of constitutional reform was reintroduced shortly after the impeachment of President Collor de Melo. In June 1993, Fernando Henrique Cardoso, who at the time was Finance Minister in the interim government of President Itamar Franco, announced budget cuts of 50 per cent in education, health and regional development while pointing to the need for revisions to the 1988 Constitution.

The IMF’s demands regarding Constitutional reform were later embodied in Fernando Henrique Cardoso’s (FHC) presidential platform. The deregulation of the banking sector was a key component of the Constitutional reform process, which at the time had been opposed by the Workers Party in both the House and the Senate.

Meanwhile Henrique Meirelles, who at the time was in charge of BankBoston’s operations in Latin America (with one foot in FHC’s party the PSDB and the other in Wall Street), was lobbying behind the scenes in favour of constitutional reform:

“Eventually we reached an agreement that became part of the Constitutional reform. When the Constitution was first supposed to be reformed, in 1993, it didn’t happen. It didn’t get enough votes. However, after Fernando Henrique Cardoso took office, it was reformed. That particular agreement I had worked on was one of the first points in the Constitution that was actually changed. I [Meirelles] personally was involved in a change which I think at the end of the day meant the beginning of the opening of the Brazilian capital markets. In Brazil, there were restrictions on the flow of capital, on foreign capital acquiring Brazilian banks and on international banks opening branches in Brazil as mandated by the 1988 Constitution, all of which prohibited the development of the capital markets. ” (Latin Finance, 6 August 1998).

The Plan Real

The Plan Real was launched barely a few months before the November 1993 elections while FHC was Finance Minister. The fixed peg of the Real to the US dollar, in many regards, emulated the Argentinean framework, without however instating a currency board arrangement.

Under the Plan Real, price stability was achieved. The stability of the currency was in many regards fictitious. It was sustained by driving up the external debt.

The reforms were conducive to the demise of a large number of domestic banking institutions, which were acquired by a handful of foreign banks under the privatization program launched under the FHC presidency (1994-2002).

A spiraling foreign debt ultimately precipitated a financial crash in January 1999, leading to the collapse of the Real. (for further details see Michel Chossudovsky, The Brazilian Financial Scam, http://www.globalexchange.org/campaigns/brazil/economy/financialScam.html , October 1998. This article was published three months before the January 1999 financial collapse. See also Michel Chossudovsky, Brazil’s IMF Sponsored Economic Disaster, 12.February 1999, http://www.heise.de/tp/english/special/eco/6373/1.html )

Cruel Logic of IMF Rescue Loans

IMF loans are largely intended to finance capital flight. In fact this was the logic of the multibillion dollar loan package granted to Brazil, immediately following the October 1998 elections which led to the reelection of FHC for a second presidential term. The loan was granted barely a few months prior to the January 1999 financial meltdown:

Brazil’s foreign currency reserves have fallen from $78 billion in July 1998 to $48 billion in September. And now the IMF has offered to “lend the money back” to Brazil in the context of a “Korean style” rescue operation which will eventually require the issuing of large amounts of public debt in G-7 countries. The Brazilian authorities have insisted that the country “is not at risk” and what they are seeking is “precautionary funding” (rather than a “bail-out”) to stave of the “contagious effects”of the Asian crisis. Ironically, the amount considered by the IMF (30 billion dollars) is exactly equal to the money “taken out” of the country (during a 3 month period) in the form of capital flight . But the central bank will not be able to use the IMF loan to replenish its hard currency reserves. The bail-out money (including a large part of the $18 billion US contribution to the IMF approved by Congress in October) is intended to enable Brazil to meet current debt servicing obligations, –ie. to reimburse the speculators. The bailout money will never enter Brazil. (See Michel Chossudovsky, The Brazilian Financial Scam, op cit.)

The same logic underlies the $31.4 billion precautionary loan granted by the IMF in September 2002, barely a couple of months prior to the presidential elections. (See IMF Approves US$30.4 Billion Stand-By Credit for Brazil at http://www.imf.org/external/np/sec/pr/2002/pr0240.htm ) This IMF loan constitutes “a social safety net” for institutional speculators and hot money investors.

The IMF pumps billions of dollars into the Central Bank, Forex reserves are replenished on borrowed money. The IMF loan is granted on condition the Central Bank retains a deregulated foreign exchange market coupled with domestic interest rates at very high levels.

The IMF pumps billions of dollars into the Central Bank, Forex reserves are replenished on borrowed money. The IMF loan is granted on condition the Central Bank retains a deregulated foreign exchange market coupled with domestic interest rates at very high levels.

So-called “foreign investors” are able to transfer (in dollars) the proceeds of their “investments” in short term domestic debts (at very high interest rates) out of the country. In other words, the borrowed forex reserves from the IMF are re-appropriated by Brazil’s external creditors.

We must understand the history of successive financial crises in Brazil. With Wall Street creditors in charge, the levels of external debt have continued to climb. The IMF has “come to the rescue” with new multibillion dollar loans, which are always conditional upon the adoption of sweeping austerity measures and the privatization of State assets. The main difference is that this process is now being undertaken under a president, who claims to be opposed to neoliberalism.

It should be noted, however, that the new multibillion dollar IMF “precautionary loan” granted in September 2002, was negotiated by FHC, a few months before the elections. The IMF loan and the conditionalities attached to it set the stage for a spiraling external debt during Lula’s presidential mandate. (See Brazil—Letter of Intent, Memorandum of Economic Policies, and Technical Memorandum of Understanding, at http://www.imf.org/external/np/loi/2002/bra/04/index.htm#mep , Brasília, August 29, 2002.)

Dollarization

With the Central Bank and the Ministry of Finance under the control of the Wall Street establishment, this process will eventually lead Brazil into another financial and foreign exchange crisis. While the underlying logic is similar, based on the same financial manipulations as in 1998-99, in all likelihood it will be far more serious than that of January 1999.

In other words, the macro-economic policies adopted by President Luis Ignacio da Silva could well result, in the foreseeable future, in debt default and the demise of the nation’s currency, leading Brazil down the path of “dollarization”. A currency board arrangement, similar to that of Argentina could be imposed. What this means is that the US dollar would become Brazil’s proxy currency. What this means is that the country looses its economic sovereignty. Its Central Bank is defunct. As in the case of Argentina, monetary policy would be decided by the US Federal Reserve system.

While not officially part of the Free Trade Area of the America’s (FTAA) negotiations, the adoption of the US dollar as the common currency for the Western Hemisphere is being discussed behind closed doors Wall Street intends to extend its control throughout the hemisphere, eventually displacing or taking over remaining domestic banking institutions (including that of Brazil).

The greenback has already been imposed on five Latin American countries including Ecuador, Argentina, Panama, El Salvador and Guatemala. The economic and social consequences of “dollarization” have been devastating. In these countries, Wall Street and the US Federal Reserve system directly control monetary policy.

Brazil’s PT government should draw the lessons of Argentina where the IMF’s economic medicine played a key role in precipitating the country into a deep-seated economic and social crisis.

Unless the present course of monetary policy is reversed, the tendency in Brazil is towards the “Argentina scenario”, with devastating economic and social consequences.

What Prospects under the Lula Presidency?

While the new PT government presents itself as “an alternative” to neoliberalism, committed to poverty alleviation and the redistribution of wealth, its monetary and fiscal policy is in the hands of its Wall Street creditors.

Fome Zero (“zero hunger”), described as a program “to fight misery”, largely conforms to World Bank guidelines on “cost-effective poverty reduction”. The latter require the implementation of so-called “targeted” programs, while drastically slashing social sector budgets. World Bank directives in health and education require curtailing social expenditures with a view to meeting debt servicing obligations.

The IMF and the World Bank have commended President Luis Ignacio da Silva for his commitment to “strong macroeconomic fundamentals.” As far as the IMF is concerned, Brazil “is on track” in conformity with IMF benchmarks. The World Bank has also praised the Lula government: “Brazil is pursuing a bold social program with fiscal responsibility.”

“Another World is possible”?

What kind of “Alternative” is possible, when a government committed to “fighting neoliberalism”, becomes an unbending supporter of “free trade” and “strong economic medicine.”

What kind of “Alternative” is possible, when a government committed to “fighting neoliberalism”, becomes an unbending supporter of “free trade” and “strong economic medicine.”

Beneath the surface and behind the Workers Party’s populist rhetoric, the neoliberal agenda under Lula remains functionally intact.

The grassroots movement which brought Lula to power has been betrayed. And the “progressive” Brazilian intellectuals within Lula’s inner circle bear a heavy burden of responsibility in this process. And what this “left accommodation” does is to ultimately reinforce the clutch of the Wall Street financial establishment on the Brazilian State.

“Another World” cannot be based on empty political slogans. Nor will it result from a shift in “paradigms”, which is not accompanied by real changes in power relations within Brazilian society, within the State system and within the national economy.

Meaningful change cannot result from a debate on “an alternative to neoliberalism”, which on the surface appears to be “progressive”, but which tacitly accepts the “globalizers” legitimate right to rule and plunder the developing World.

The Globalization of Poverty and the New World Order

by Michel Chossudovsky

This book is a skillful combination of lucid explanation and cogently argued critique of the fundamental directions in which our world is moving financially and economically.

In the enlarged second edition, the author reviews the causes and consequences of famine in Sub-Saharan Africa, the dramatic meltdown of financial markets, the demise of State social programs and the devastation resulting from corporate downsizing and trade liberalisation.

“This concise, provocative book reveals the negative effects of imposed economic structural reform, privatization, deregulation and competition. It deserves to be read carefully and widely.”

– Choice, American Library Association (ALA)“The current system, Chossudovsky argues, is one of capital creation through destruction. The author confronts head on the links between civil violence, social and environmental stress, with the modalities of market expansion.”

– Michele Stoddard, Covert Action Quarterly

Click to learn more about The Globalization of Poverty and the New World Order by Michel Chossudovsky