Global Systemic Economic Crisis: Bank Failures, Currency Wars

Just as the Euro crisis pushed Europe to modernize and adapt its economic and financial governance to the challenges of the 21st century, the terrible US dollar crisis will oblige the world to transform the whole of world governance structures, beginning of course with the international monetary system to calm the storm which is on the point of striking currencies.

According to our anticipations, this reorganization which will only start to become a reality with the September G20 unfortunately risks taking place in a hurry since our team envisages the first major fears over the Dollar during the March-June 2013 period.

A phrase by Antonio Gramsci (1) splendidly describes the long, dangerous transition period that we are currently living through: “The old world is dying away, and the new world struggles to come forth: now is the time of monsters”. This period will finally come to an end but the monsters are still restless.

With no surprise, one of the powerful factors which will accelerate the United States’ loss of influence in the world relates to oil. In fact we are witnessing the last days of the petrodollar, the key element of US domination. This is why we have decided to deal with the world oil problem at length in this GEAB. We are also publishing the GEAB Dollar-Index and Euro-Index to follow currency developments more reliably in the current monetary storm. Finally, as usual, we finish with the GlobalEurometre.

In this public announcement for the GEAB N°72, our team has chosen to present a series of converging indices on the crisis which leads it to keep its “global systemic crisis” alert in force for the March-June 2013 period, as well as its anticipation of the risk of “Icelandisation” in the management of the banking crisis.

A flurry of signs of crisis, or why we are keeping the March-June 2013 alert

Since last month (GEAB n°71), the converging line of strong trends and indices announcing a catastrophe during the March-June 2013 period have strengthened further. First of all it’s the “currency wars” which takes on political dimensions and ruins the confidence that countries give each other. We will expand on our analysis below. But it’s also many of the domestic indices which should ring alarm bells about the United States.

In deciding to separate the debates on the budgetary cuts/increase in taxation and on the debt ceiling (2), the Americans have doubled the shock to come: there was only one at the end of February/beginning of March, there is now another in May. This separation reveals the Republicans’ strategy clearly. Of course they will exert a power struggle to the maximum over raising the debt ceiling to reduce spending further, but they will ultimately feel obliged to vote for a rise in order not to be held responsible for the cataclysm which would follow a payment default (3). On the other hand the consequences of the budgetary cuts envisaged for March 1st, though certainly not painless, are far from being as traumatising and the Republicans have really decided to negotiate a sizeable reduction in the public deficit under penalty of leaving the last resort of automatic cuts at work.

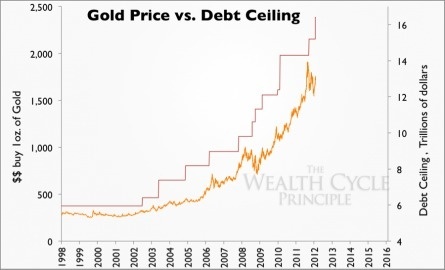

Gold price in Dollars (yellow, left scale) and the US debt ceiling (trillions $, right scale) – Source: wealthcycles.com.

In any event, with these budgetary cuts at the beginning of March, and after a so-called “surprising” and largely ignored drop in US GDP in the 4th quarter of 2012 (4), who could still think that GDP growth in the first quarter of 2013 will be positive (except by making up the numbers)? The fall is all the more inevitable as a few days of economic activity were lost in the North-East because of Nemo (the blizzard) and that there was a severe flu epidemic this year (5). They will be the excuses offered (6) when it’s necessary to justify a fall in GDP in an economy officially supposed to be picking up. Nevertheless an announcement at the end of April of a US relapse into recession (two consecutive quarters of a fall in GDP) will make its own modest impression on the world economy.

Fortunately a “dam” has been built to avoid the waves: Egan Jones, the credit rating agency, less biased than its three big brothers (the one which has already downgraded the US three times to AA-), has been banned from rating the country for 18 months (7); what a happy coincidence! And amongst the three major credit rating agencies, S&P is being prosecuted (8), the only one which dared to downgrade the United States; a second happy coincidence! The others have just to watch their step.

This “dam” although futile especially reveal the fears at the highest level in 2013 and is only one more sign of the shock’s imminence. It’s also from this perspective that the January 1st 2013 decision should be read on the unlimited current account guarantee by Federal Deposit Insurance Corporation (9) (FDIC): by guaranteeing them only up to $250,000, 1,400 billion dollars are no longer guaranteed (10), which could conveniently avoid a FDIC bankruptcy in the event of a problem…

And apparently the insiders of world finance are also preparing themselves: enormous short bets have been placed for expiries through the end of April (11); two Swiss banks are changing their status so that their partners are no longer personally liable for the bank’s losses (12); Eric Schmidt has sold 2.5 billion dollars worth of Google shares (13); etc.

But it’s not only the markets which are preparing for the worst. The US government itself seems to be expecting disorder and a great deal of violence: first of all it is arming its department of internal security (Department of Homeland Security) with 7000 assault rifles) (14), then Obama is signing a law allowing the pure and simple execution of Americans posing a vague “imminent threat” (15), to the great displeasure of a section of US public opinion…

Bank failures: Towards an « Icelandation » of the banking crisis’ management

In the face of this shock, our team estimates that most countries, including the United States, will approach management of the crisis in an “Icelandic style”, i.e. not to bail out the banks and to let them collapse (16). We have already had a glimpse with the liquidation of the Irish bank IBRC which has given many people ideas: “How Ireland liquidated its banking albatross in one night” headlined La Tribune (17) admiringly. This possibility seems to increasingly be the solution in the event of the banks backsliding, for the following reasons: first, it seems much more effective than the 2008-2009 bailout plans judging by Iceland’s recovery; second, countries don’t really have the means to pay for new bailouts anymore; finally, one can’t deny that it must be a big temptation for leaders to get rid in a popular fashion of part of the debts and “toxic assets” which encumber their economy.

These « too big to fail » banks are in fact gorged of public and private Western debt from which they gained their profits and power. In past GEABs our team had already established the link between a bank like Goldman Sachs for example and the Knights-Templar (18), a medieval military order which had grown excessively rich on States’ backs and which King Philip the Fair put an end to, taking their gold for his state coffers. One can see certain current trends following this thread: the efforts of certain States requiring banks to separate investment and deposit banking (19) would in fact ensure that the first’s difficulties don’t overly impact the second; along the same lines, all the lawsuits of which certain very large banks are deservedly currently the object (Barclays, etc… (20)) can also be seen as a means of recovering money from the banks to re-inject it into the states’ coffers or the real economy…

The major countries’ leaders will probably not decide to “blow up” a bank but one thing is certain, that the motivation and the means to save banks in difficulty will have no relationship from now on with those which had been implemented in 2009. If any leniency could be shown for the “too big to fail”, like Bank of America which seems to be ailing (21), at it is certain that those in charge will be accounted for the mistakes to the maximum.

But whatever this period’s management policy, as we had anticipated in the GEAB n°62 (“2013: end of the domination of the US Dollar in the settlement of the world trade”), this new shock will accelerate the loss of US influence and in particular of their ultimate weapon, the Dollar.

Notes

(1) See Wikipedia on this Italian thinker.

(2) Source: The New York Times, 23/01/2013

(3) Two examples of thinking on the consequences of a US payment default: American style, Preparing for the Unthinkable: Could Markets Handle a US Default? (CNBC, 17/01/2013), and Russian style: Could the Russian economy withstand a U.S. default? (RBTH.ru, 04/02/2013).

(4) The kind of reasoning that prevails in US markets, “if the economic news is good, so much better because the economy is improving; if it’s bad, so much better because the Fed will intervene”, shows the extent to which they are disconnected from reality. Which is characteristic of a dysfunctioning power on the edge of the cliff.

(5) Cf. CNBC, Major Flu Outbreak Threatens to Slow Economy Further, 10/01/2013.

(6) Source: ZeroHedge, 07/02/2013

(7) Source: US Securities and Exchange Comission (SEC), 22/01/2013

(8) Source: Wall Street Journal, 04/02/2013

(9) Source: FDIC.gov

(10) Source: BusinessFinance, 19/07/2012

(11) Source: Do Wall Street Insiders Expect Something Really BIG To Happen Very Soon? Activist Post, 07/02/2013

(12) Source: Après plus de 200 ans d’existence, deux banques suisses font leur révolution (After an existence of more than 200 years, two Swiss banks are having their own revolution), Le Monde, 06/02/2012

(13) Source: Forbes, 11/02/2013

(14) Source: The Blaze, 26/01/2013

(15) Source: Le Monde, 06/02/2013

(16) Like Icesave, the Icelandic bank that the authorities let drop; and particularly after a referendum they didn’t take on re-imbursement of the bank’s debts. Source : Wikipedia

(17) Source: La Tribune, 07/02/2013

(18) Source: Wikipedia

(19) Source: Reuters, 02/10/2012

(20) Just to realize the phenomenon’s extent, go « bank + sued » in Google.

(21) Source: The Frightening Truth Behind Bank Of America’s “Earnings”, ZeroHedge (17/01/2013)