Everything You Know About Money Is Wrong

We Can’t Fix What We Don’t Understand

Bloomberg notes this week that the conventional theory of why money was created is wrong:

There are, broadly speaking, two accounts of the origin and history of money. One is elegant, intuitive and taught in many introductory economics textbooks. The other is true.

The financial economist Charles Goodhart, a former member of the Bank of England’s Monetary Policy Committee, laid out the two views in a 1998 paper, “The Two Concepts of Money: Implications for the Analysis of Optimal Currency Areas.”

The first view, the “M View,” is named after the Austrian 19th century economist and historian Karl Menger, whose 1882 essay “On the Origins of Money” is the canonical statement of an argument that goes back to Aristotle:

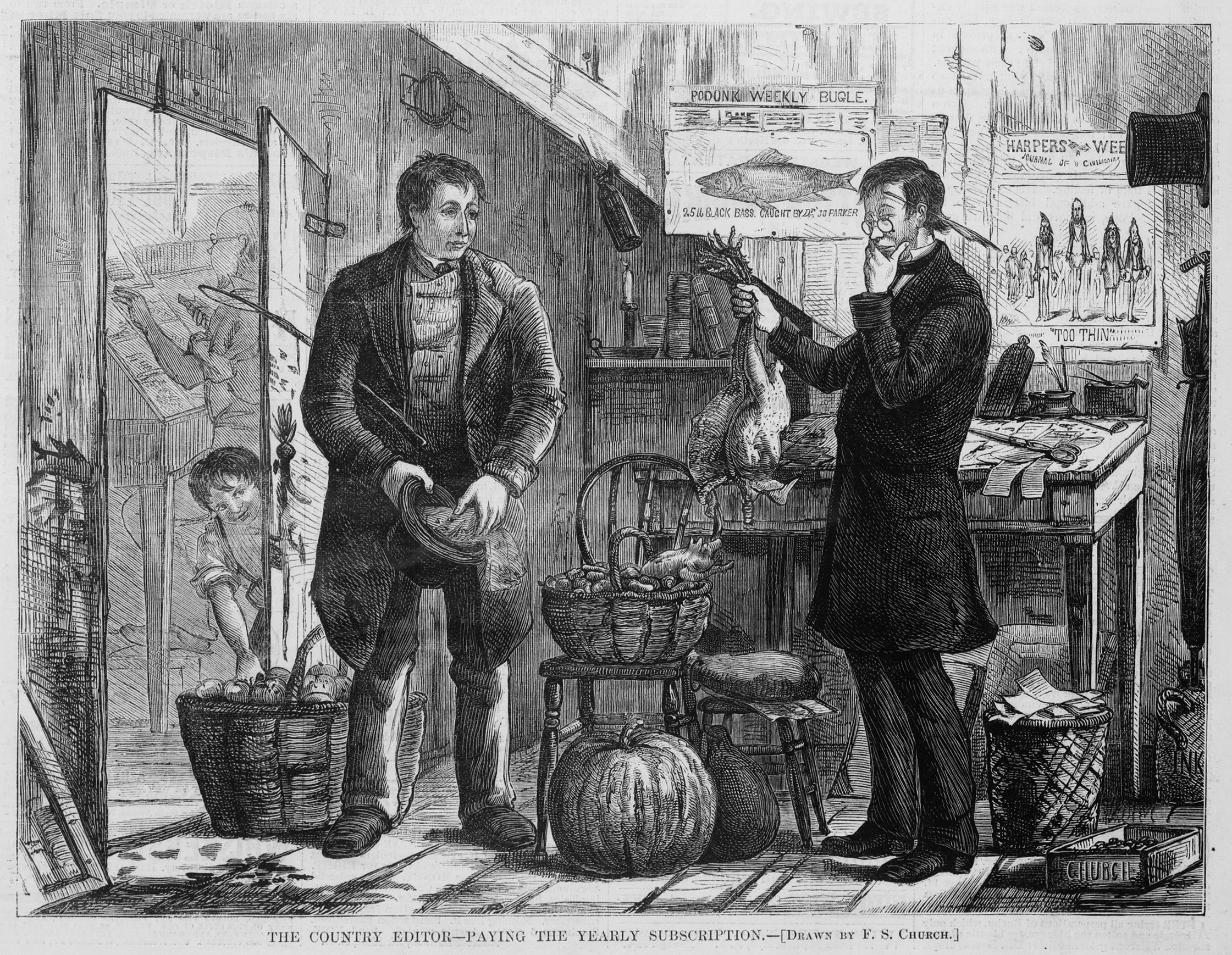

As subsistence farming gives way to more complex economies, individuals want to trade. Simple barter (eight bushels of wheat for one barrel of wine) quickly becomes inefficient, because a buyer’s desires won’t always match up with a seller’s inventory. If a merchant comes through the village with wine and all a farmer has to offer is wheat, but the merchant wants nuts, there’s no trade and both parties walk away unfulfilled. Or the farmer has to incur the costs of finding another merchant who will exchange wheat for nuts and then hope that the first merchant hasn’t moved on to the next village.

But if the merchant and the farmer can exchange some other medium, then the trade can happen. This medium of exchange has to be what Menger calls “saleable,” meaning that it’s easily portable, doesn’t spoil over time and can be divided. Denominated coins work, shells and beads also fit the bill. So do cigarettes in POW camps and jails and Tide laundry detergent for drug dealers. This process, Menger argues, happens without the intervention of the state: “Money has not been generated by law. In its origin it is a social, and not a state institution.” [Menger’s view is the commonly-accepted theory of money.]

Goodhart points out, however, that Menger is just wrong about the actual history of physical money, especially metal coins. Goodhart writes that coins don’t follow Menger’s account at all. Normal people, after all, can’t judge the quality of hunks of metal the same way they can count cigarettes or shells. They can, however, count coins. Coins need to be minted, and governments are the ideal body to do so. Precious metals that become coins are, well, precious, and stores of them need to be protected from theft. Also, a private mint will always have the incentive to say its coins contain more high-value stuff than they actually do. Governments can last a long time and make multi-generational commitments to their currencies that your local blacksmith can’t.

But why oversee money creation in the first place? This brings us to the second theory of money, which Goodhart calls the “C View,” standing for “cartalist” (chartalist is a more common spelling). To simplify radically, it starts with the idea that states minted money to pay soldiers, and then made that money the only acceptable currency for paying taxes. With a standard currency, tax assessment and collection became easier, and the state could make a small profit from seiginorage.

The state-coin connection has far more historical support than Menger’s organic account. As Goodheart points out, strong, state-building rulers (Charlemagne, Edward I of England) tend to be currency innovators, and he could have easily added Franklin D. Roosevelt’s taking the U.S. off the gold standard in 1933 or Abraham Lincoln financing the Civil War with newly issued greenbacks. The inverse is true too: When states collapse, they usually take their currencies with them. When Japan stopped minting coins in 958, the economy reverted to barter within 50 years. When the Roman Empire collapsed in Western Europe, money creation splintered along new political borders.

If money came about independent of states, as according to the M View, one would think it would outlast transient political structures. Historically, however, this tends not to be the case, a strong argument in favor of the C View.

Anthropologist David Graeber – who has extensively studied the history of money and debt – agrees:

There’s a standard story we’re all taught, a ‘once upon a time’ — it’s a fairy tale.

***

Rather than the standard story – first there’s barter, then money, then finally credit comes out of that – if anything its precisely the other way around. Credit and debt comes first, then coinage emerges thousands of years later and then, when you do find “I’ll give you twenty chickens for that cow” type of barter systems, it’s usually when there used to be cash markets, but for some reason – as in Russia, for example, in 1998 – the currency collapses or disappears.

***

Taxes are also key to creating the first markets that operate on cash, since coinage seems to be invented or at least widely popularized to pay soldiers – more or less simultaneously in China, India, and the Mediterranean, where governments find the easiest way to provision the troops is to issue them standard-issue bits of gold or silver and then demand everyone else in the kingdom give them one of those coins back again. Thus we find that the language of debt and the language of morality start to merge.

***

How did this happen? Well, remember I said that the big question in the origins of money is how a sense of obligation – an ‘I owe you one’ – turns into something that can be precisely quantified? Well, the answer seems to be: when there is a potential for violence. If you give someone a pig and they give you a few chickens back you might think they’re a cheapskate, and mock them, but you’re unlikely to come up with a mathematical formula for exactly how cheap you think they are. If someone pokes out your eye in a fight, or kills your brother, that’s when you start saying, “traditional compensation is exactly twenty-seven heifers of the finest quality and if they’re not of the finest quality, this means war!”

Money, in the sense of exact equivalents, seems to emerge from situations like that, but also, war and plunder, the disposal of loot, slavery. In early Medieval Ireland, for example, slave-girls were the highest denomination of currency. And you could specify the exact value of everything in a typical house even though very few of those items were available for sale anywhere because they were used to pay fines or damages if someone broke them.

But once you understand that taxes and money largely begin with war it becomes easier to see what really happened.

Graeber provides an example:

We tend to forget that in, say, the Middle Ages, from France to China, … money was … whatever the king was willing to accept in taxes.

Graeber also notes that the first word for “freedom” in any language is the word for “debt-freedom”, and that much of the language of the great religious movements revolved around forgiveness of debts. And the founders of the Christian and Jewish religions focused on the importance of debt jubilees.

In addition, most Americans don’t realize that our current money system does not serve the public good, but instead continuously sucks the prosperity and vitality out of our economy. As Henry Ford noted:

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

Some claim that public banking is the answer. Others look to gold or Bitcoin as a saner alternative to fiat currencies.

As we noted in 2011, maybe we should get beyond all systems which keep track of exactly to the penny who owes what to whom … in the manner required for warfare and slavery:

Graeber hints at one possibility [for a way out of the money-debt trap]:

[French anthropologist Marcel Mauss] was one of the first anthropologists to ask: well, all right, if not barter, then what? What do people who don’t use money actually do when things change hands? Anthropologists had documented an endless variety of such economic systems, but hadn’t really worked out common principles. What Mauss noticed was that in almost all of them, everyone pretended as if they were just giving one another gifts and then they fervently denied they expected anything back. But in actual fact everyone understood there were implicit rules and recipients would feel compelled to make some sort of return.

What fascinated Mauss was that this seemed to be universally true, even today. If I take a free-market economist out to dinner he’ll feel like he should return the favor and take me out to dinner later. He might even think that he is something of chump if he doesn’t and this even if his theory tells him he just got something for nothing and should be happy about it. Why is that? What is this force that compels me to want to return a gift?

This is an important argument, and it shows there is always a certain morality underlying what we call economic life.

In other words, in communities or webs of human interaction which are small enough that people can remember who gave what, we might be able to set up alternative systems of money and credit so we can largely “opt out” of the status quo systems of money and debt measurement.

I’m not arguing for becoming Luddites and living in mud huts (but that is fine, if you wish to do so). Nor am I suggesting that we all have to become selfless saints who give away all of their possessions without any reasonable expectation of something in return.

I am arguing that it might be possible to empower ourselves – and create our own systems for keeping track on a local or people-centered basis, and create our own vibrant economies using the resources we have – by moving away from the national and global systems dominated by the biggest banks and oligarchs, and towards a system where we “spend” resources and goodwill into our local communities in a way in which trust is built from the ground-up, and the energy of trade and commerce can be re-started. [Trust is – after all – the basis for all prosperous economies.]

Postscript: Mainstream economists will argue that we need a universal, fungible type of money in order to trade on a global basis. But because currencies are now unpegged from anything in the real world and are traded on the currency markets, their values fluctuate wildly in the modern world. In other words, one of the essential characteristics for money – that they represent a universal, fixed yardstick – has disappeared. And fiat currencies have a very short lifespan. So how valuable are they, really, for anyone but forex speculators?

Until we learn what money, credit and debt really are, we will remain victims … getting poorer and poorer.

Postscript: The Bible says that the love of money is the root of all evil. On the other hand, the father of modern economics (Adam Smith), Ronald Reagan, economist Milton Friedman, Wall Street titan Ivan Boesky and students who take economics classes all say that greed is good.

Both are naive.

Money and currency are good to the extent that they help create abundance for ourselves and our communities. They are bad to the extent that they are used to promote warfare and slavery, and that they suck prosperity out of the system.