Corporate Welfare: Bankrupting US Cities, Destroying Pensions, Jobs and City Services

To some, it may come as a surprise that the bankrupt City of Detroit and the hard-hit State of Michigan are subsidizing the Big Three automakers, the pharmaceutical industry, energy companies and virtually every large Michigan business. But a massive giveaway—“corporate welfare,” both locally and nationally—is bankrupting municipalities everywhere as shown by reports from Demos (“The Detroit Bankrupcty”, the New York Times (“United States of Subsidies”) and Good Jobs First (“Megadeals”).

While making the political decision to use the bankruptcy court to destroy pensions, jobs, city services and public institutions like the Detroit Institute of Arts, the government has been nothing but generous to Fortune 500 CEOs asking for a handout.

In a city where citizens routinely wait for up to three hours for public transportation and tens of thousands suffer from utility shutoffs in the dead of winter, more than $20 million a year has been awarded to companies including Comerica Bank, Rock Ventures/Garbsman, the Farbman Group, Quicken Loans, the Detroit Medical Center and multibillion-dollar conglomerate DTE Energy.

Wallace C. Turbeville’s report on the bankruptcy for Demos calls these “extensive subsidies” and suggests the emergency manager “reclaim tax subsides and other expenditures to incentivize investment in the downtown area” and treat them similarly to the rest of the city’s debt. Of course Emergency Manager Kevyn Orr, a Democrat, has been placed into his dictatorial position not to penalize his corporate masters but to ensure their interests and lay the basis for their dramatic increase in profit-taking.

Tax boondoggles in the city include a whopping $285 million to billionaire Mike Ilitch for a 45-block entertainment district and $100 million in tax abatements for Compuware, also a billion-dollar company.

Smaller gifts were available as well, including $27 million in tax incentives awarded to the Meridian Health Plan building to be built in the central business district. Owners David, Sherry, Jon, Sean and Michael Cotton are real estate developers whose core business is a series of health care businesses in Michigan, Illinois, Iowa and several other states. The Cottons believe they can boost that number to $35 million in public financing through additional credits, according to Crain’s Detroit Business.

Another recipient of the city’s munificence is Whole Foods Market, a wildly profitable firm paying out $500 million last year in stock dividends, which is receiving $4.2 million, but hopes to get more from so-called brownfield (“blighted” areas requiring “revitalization”) incentives.

Detroit has been saddled with 16 “renaissance zones” that were virtually tax-free for business and forgave millions of dollars in taxes. At the same time, Detroit homeowners have the highest property taxes among the nation’s 50 largest cities, and paid twice the national average in tax.

Last September, a frenzy of downtown Detroit developers spurred the first-ever Novogradac Historic Tax Credit Conference. It brought them together with hundreds of assorted accountants and tax attorneys looking to parlay the Federal Historic Preservation Tax Incentive program into millions of dollars. The possibility of funding 20 percent of rehabilitation costs with federal dollars has whetted the appetites of the gentrifiers/developers who are in the process of evicting hundreds of elderly and disabled Section 8 renters living in downtown buildings.

But it was not just Detroit and federal agencies that contributed to the corporate coffers. The role of the State of Michigan was pivotal to the Detroit bankruptcy on multiple levels. It was Governor Rick Snyder who conspired with law firm Jones Day and Kevyn Orr to declare the city in “financial emergency” and appoint Orr with the prearranged plan to impose bankruptcy, void contracts and loot the city’s assets.

Not as well publicized was the fact that the “tipping point” in Detroit’s cash flow crisis was reached when Michigan’s annual state revenue sharing was cut by $67 million per year. Author of the Demos report, Walter Turbeville, explains the mechanics in “The Detroit Bankruptcy”. It was in two stages, and part of the cut followed declining populations, but “$42.8 millions (64 percent of the total state cuts) were at the discretion of the state legislature.

“By cutting revenue-sharing with the city, the state effectively reduced its own budget challenges on the backs of the taxpayers of Detroit (and other cities). These cuts account for nearly a third of the city’s revenue losses between FY 2011 and FY 2012.” Turbeville, a former Goldman Sachs accountant, concludes, “Thus, the state was an active player in the events leading to the cash flow crisis.”

Put more bluntly, Governor Rick Snyder and the state legislature—with the full support of both Republicans and Democrats—pulled the plug on Detroit, suffering in the aftershock of the Great Recession of 2008.

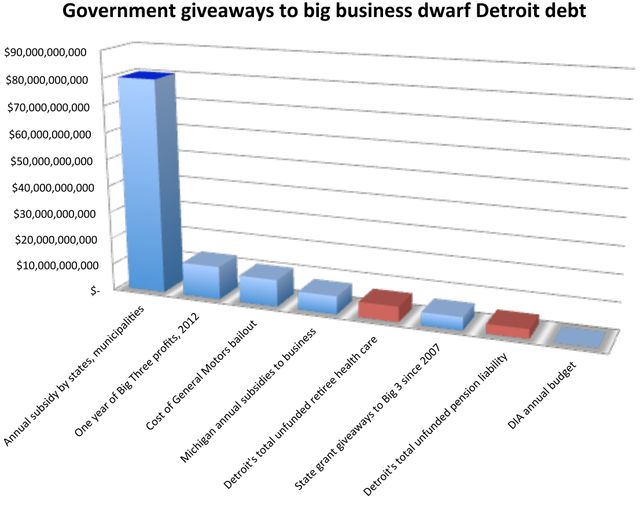

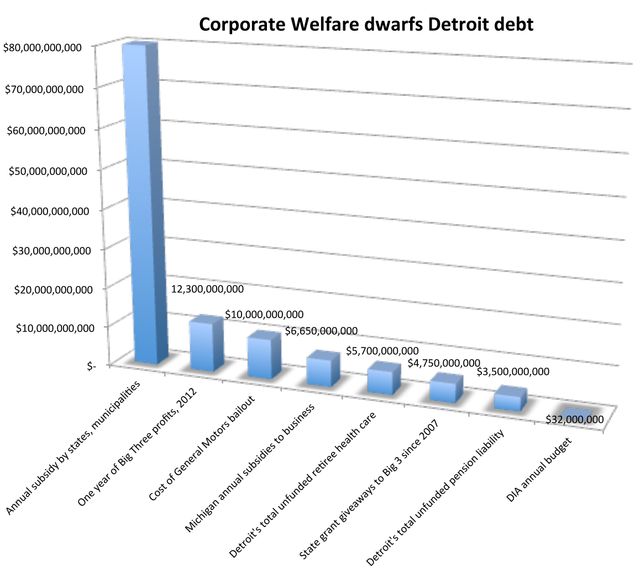

Yet while depriving Detroit, as well as other Michigan municipalities, of desperately needed revenues, the State of Michigan was spending—as it has done annually—a staggering $6.65 billion on business incentives.

Michigan: More megadeals than any other state

According to the Good Jobs First report, Michigan—possibly the hardest hit state of the “Rust Belt”—has offered more large government-funded subsidies to corporations than any other in the nation. It identifies 29 megadeals involving awards higher than $75 million.

The New York Times series “United States of Subsidies” by Louise Story points out that 30 cents out of every dollar in Michigan’s budget goes to this type of “corporate welfare” at the direct expense of support to education, infrastructure and municipalities.

The lion’s share of these gifts went to the Big Three automakers, now expecting to post all-time record profits in 2013, above the already banner year of 2012 at $12.3 billion. General Motors (whose government bailout is now estimated to have cost taxpayers $10 billion) was the top beneficiary receiving $3.3 billion in aid, according to the Center for Automotive Research. The New York Times puts Ford at $1.58 billion and Chrysler at $1.4 billion. Overall national incentives for automakers since 1985 are pegged at an astronomical $13.9 billion. It should be noted that whether Democrats or Republicans were in power, the process escalated.

Among others, Story conducted more than two dozen in-depth interviews with former GM officials and tax consultants to prepare “United States of Subsidies”. She pointed to the role of Argonaut Realty, the automaker’s real estate division, in conducting the shakedown of local governments across the US. GM enlisted their tax managers, charities’ accountants and union representatives alongside plant managers and executives in a combination of threats and negotiations to rein in the biggest tax boondoggles. “For towns, it became a game of survival,” notes Story.

The procedure is classic: cities and states are pitted against each other in a reverse auction. Often even the scenario presented was a fraud, perpetrated by the transnational company seeking higher profits. One example in the GM saga was the company’s demand for tax cuts in Moraine, Ohio. GM told the city that Moraine was competing with Shreveport, Louisiana and Linden, New Jersey to maintain an auto plant. After the Moraine school board caved and accepted the property tax cuts to education funding, it was discovered that the other towns had not been in discussion with GM.

This is a national scourge. As the stakes for jobs has intensified, states are creating more and more incentives. In 2010 alone, 40 new types of tax credits were created or expanded. Oklahoma and West Virginia give up amounts equal to about one-third of their budgets, Maine about one-fifth. Texas awards $19 billion a year and Alaska, West Virginia and Nebraska give up the most per resident, according to the Times.

Because no national database of corporate incentives exists, Story and Good Jobs First had to conduct months-long investigations to uncover the myriad layers of giveaways by thousands of government agencies and officials.

$80 billion annually funneled to big business

The Times uncovered a staggering $80 billion annually donated by states, counties and cities to business. And it cautioned that the actual cost of awards is certainly far higher. The report points to the wide range of corporate entities receiving money, including many among the world’s most profitable firms: Exxon Mobil, Royal Dutch Shell, Boeing, Airbus, Citigroup, Goldman Sachs, Walt Disney, ESPN, Sears, General Electric, Dow Chemical, Amazon, Apple, Intel and Samsung. Sixteen of the Fortune 50 are represented.

Dozens of officials at large corporations who were questioned by Louise Story justified the whipsawing of communities as “owing it to the shareholders to maximize profits,” she reported. Hallmark CEO Donald Hall Jr. said, “this use of incentives is really transferring money from education to businesses.”

It is also no accident how difficult it was assembling these statistics; the government accounting standards board has failed to regulate the accounting of tax-based economic development expenditures. There is furthermore very little oversight once grants are issued. For the most part, no one tracks the “effectiveness” of job retention as a result of giveaways.

A poignant Metro Detroit example is the famed Ford Willow Run plant in Ypsilanti, Michigan, designed by Albert Kahn and used to build bombers in World War II. After the war, it became Kaiser Motors and then was taken over by General Motors, which expanded the facility into a complex. Over the years, the small outlying town of Ypsilanti granted more than $200 million in incentives to the facility.

Doug Winters, the city’s attorney, explained to the Times reporter, “They had put basically a stranglehold on the entire state of Michigan and other places across the country by just grabbing these tax abatements by the billions. They were doing it with a very thinly disguised threat that if you don’t give us these tax abatements, then we’ll have to go somewhere else.”

After the company closed the first plant, the city sued, but was unsuccessful. The judge said that a company’s job assurances “cannot be evidence of a promise.” In 2010 the company closed the remaining factory and Winters sued again. The claim has now been relegated to the corporate books of the defunct “bad GM”.

Referring to General Motors, Winters told Story, “We’re their own private ATM. When they need money, they come begging, but when they don’t want oversight, they say ‘get out of the way’.”

Like payoffs to the Mafia consigliere, there is no respite for states, counties, school districts or municipalities. Ford and GM are now slated to receive federal tax credits for making more fuel-efficient vehicles… worth $50 million, an event celebrated by Michigan Democratic Senators Carl Levin and Debbie Stabenow. Republican Governor of Michigan Rick Snyder recently announced a state grant of $2.5 million for infrastructure improvements for Hyundai’s Superior Township technical center in Metro Detroit. The GM plant in the small enclave of Detroit, Hamtramck, is asking for $1.8 million in order to make critical investments in their operations.

It goes on and on. The substantial New York Times exposé demonstrates the proliferation of this “beggar-thy-neighbor” policy in the false hope of local officials maintaining economically viable communities. As a result, hundreds of school districts are in financial emergency, teachers and staffs are subjected to pay cuts and layoffs, recreation centers are closed and city infrastructure is allowed to rot. Municipalities are systematically being bankrupted as a greater and greater portion of social wealth is diverted to the profits of their resident corporations.

The extent of corporate blackmail nationally demonstrates that the looting of Detroit is just the beginning. Here is a glimpse of the national picture:

*Walmart, the world’s most profitable corporation, receives $1.2 in taxpayer assistance.

*Alcoa receives a 30-year discounted electricity deal worth $5.6 billion.

*Sasol natural gas could receive as much as $21 billion on investment subsidies.

*Boeing’s tax breaks and subsidies are estimated at $3.2 billion.

*Nike’s 30-year single sales factor tax commitment nets it $2.02 billion.

*Intel’s property tax abatement for a computer chip plant means $2 billions in benefits.

*Cheniere Energy of Louisiana will retain $1.69 billion in earnings due to subsidies for the Sabine Pass natural gas liquefaction plant.

*Google’s North Carolina deal received $254,700,000 (for 210 jobs).

*Apple’s North Carolina negotiations yielded $320,700,000 (for 50 jobs).

*Goldman Sachs moved operations from Manhattan to Jersey City, New Jersey and netted $164 million in tax incentives.

What was once considered extortion or bribery has become a normal business model. The blood and sweat of the working class demands nationalization of the ill-gotten gains of the parasitic financial elite and the establishment of a society where jobs, housing, education, pensions, and culture are considered basic rights for all of society.