Clinton Disaster Fundraising in Haiti: Predatory Humanitarianism?

Interview With Charles Ortel

It is Haiti’s good luck and surely the Clintons‘ misfortune, that Charles Ortel, one of the world’s finest financial analysts, has got the Clinton Foundation in his sights. Mr. Ortel is a graduate of the Harvard Business School with decades of Wall Street experience. He is currently a private investor. He began to release on his website and from his Twitter account (@charlesortel), in early May 2016, a series of detailed reports that are damning to the Clintons and their various supposed charitable initiatives. The Clintons are powerful, and they have squirmed their way out of many tight spots before, but what makes this particular case worthy of our utmost attention is that Ortel is not only outstanding at what he does, but also fearless and dogged in his pursuit of perceived financial malfeasance.

If his analysis of General Electric, which is far more complex than the Clinton charities, successfully pegged GE as being overvalued before its stock plummeted in 2008, then we must hear out his case against the Clinton Foundation. I caught up with him earlier this week, and he graciously agreed to an interview.

Dady Chery: Thank you Charles, for granting us this interview. You have been on the warpath against the Clinton Foundation in this presidential election year in the United States. Do you have anything to disclose about your motivations?

Charles Ortel: I am not active in partisan politics. I fit in neither mainstream political party because I am conservative economically, open-minded socially, and passionate in my belief that America is truly an exceptional place, for all of the many faults evident since its founding, starting in 1492.

As a son of a fiercely smart woman, and the parent of another, I do feel that Hillary Clinton has set a deplorable example by her actions and inactions throughout her life, for women and for all persons who seek to prosper and exist in our great country.

My primary interest, now that I have almost completed an in-depth investigation of the Clinton Foundation is to expose what I see as a mammoth fraud and then prod government authorities in most US states and many foreign countries to punish trustees, executives, major donors, and those in position to exercise significant influence without mercy.

The Clinton Foundation is a textbook case in how disaster relief charities should not be allowed to operate internationally, particularly by powerful, educated lawyers who must know better.

DC: Did the earthquake in Haiti on January 12, 2010 personally affect you or anyone you know?

CO: I have to say that I did not actively follow events in Haiti as they were occurring, and now I feel guilty as it does seem that relief provided under the watch of the Clintons and of George W. Bush’s team likely has compounded vexing problems in an island nation of great promise that seems worse off for all the attention since that dreaded day.

DC: According to your website, the Clinton Foundation’s aim and reach have gone far beyond where they were supposed to go. Please give our readers an overview of this organization.

CO: Originally, on 23 December 1997 when their application for federal tax-exemption was filed with the Internal Revenue Service, the Clinton Foundation was to be a library and research facility based in Little Rock, Arkansas, and to raise an endowment to support these purposes.

When the Clinton Foundation was formed, controversies were escalating that served to crimp the Clintons’ abilities to raise funds to defray massive legal bills, in the many millions of dollars.

Right from the start, the record suggests that fundraising appeals supposedly for the Foundation may have been commingled, inappropriately and illegally, with those for a legal expense trust run by former Senator David Pryor, a close Clinton associate.

By January 2001, Bill Clinton and the Clinton Foundation started becoming involved in numerous “initiatives” far outside the Foundation’s approved tax-exempt purposes that clearly were supposed to be concentrated within the United States from a base inside Arkansas.

DC: It is somewhat of an octopus, with numerous arms, nationally and internationally. How does this work?

CO: Over time, Bill Clinton and the Clinton Foundation raised substantial sums and conducted substantial activities abroad as well as inside the US that were never contemplated in the December 1997 application to the IRS that was approved in January 1998.

So far, no verifiable evidence has been produced by the Clinton Foundation demonstrating that approvals were correctly sought from the IRS to alter, so radically, its approved tax-exempt purposes.

Entities as complicated as the Clinton Foundation are, in theory, regulated by authorities within their home state, by other states within the US, where they solicit funds and/or operate, by the IRS, by federal government agencies, and by foreign governments.

One trouble seems to be that no regulatory agency within the US, so far, seems willing to take on a political dynasty that has proven to be vindictive in the past once it attained elective office, while Hillary Clinton remains poised to grasp the Democrat Party nomination and potentially win the presidency in November 2016.

A second set of issues seems to be that foreign government are unwilling to take regulatory actions abroad until they see US government authorities initiating such actions here.

DC: The Clinton Foundation recently revised its taxes for several years as a result of your discoveries.

CO: I did write a piece in March 2015 for Brietbart, so it is possible the Clinton Foundation was, in part, forced to refile because of my actions.

Unfortunately for them and particularly for their trustees, they did not correctly amend their filings back to 1997 at federal level, they submitted false and materially misleading federal filings, and they failed to submit timely state and foreign filings for 2014 and for prior years.

DC: Charles, it is your view that the Foundation might have broken the law.

CO: Absolutely. I believe that the Foundation, its trustees, key executives, and others in position to exercise significant influence have committed millions of counts of solicitation fraud across state and national boundaries while numerous false and materially misleading submissions circulated in the public domain.

One easy set of abuses to understand is their repeated and ongoing failures to get their financial statements audited properly and consistently in compliance with applicable laws and standards.

Here we are talking about a fraud whose declared scope exceeds $2 billion — but when you count related frauds involving the Global Fund, the Interim Haiti Recovery Commission, UNITAID, American India Foundation and other such criminal activities, you are talking about a global set of frauds bigger than Madoff’s that likely approaches $100 billion, possibly more.

DC: What will happen if it is found in breach of the law? Is this something that could be brushed off and fixed, like revising the taxes again?

CO: I think the Clinton charity fraud conspiracy challenges the notion in the United States and other nations that revere jurisprudence that no one is above the law. For decades, the Clintons — and others in both US political parties, as well as abroad — have operated as if they were entitled, because of their “government service,” to break laws with impunity, and to prey upon the most vulnerable and gullible members of society.

DC: Both Bill and Hillary Clinton began their careers as Yale-educated lawyers. Surely they have covered themselves with regard to their charities and followed federal and state laws.

CO: One must remember that Bill and Hillary often have lied and/or dissembled under oath and that Bill was forced to give up licenses to practice law in Arkansas and before the US Supreme Court in consequence of such conduct.

Cynics have argued that lawyers are, often, paid to lie. I believe that lying lawyers are exceptions rather than the rule and that, in fact, there are many lawyers who literally love the law, and particularly laws in the United States.

DC: How did they get away with not getting audited? Will any heads roll because of this?

CO: From 2001 through 2013, one key person within the IRS who oversaw tax-exempt charities, including Clinton entities, was Lois Lerner who left government service in disgrace following allegations, still being investigated, that she and other compatriots used the IRS to target conservative and Tea Party groups.

Lois Lerner and her allies likely also have the ability to influence regulators not to target charities with which they are politically allied.

At state level, one imagines that the Clintons have numerous friends scattered in regulatory bureaus in many states, even including those such as Arkansas today, where the Governor and Attorney General are Republicans.

DC: You say that the Clintons began their adventures in disaster fundraising well before Haiti’s earthquake.

CO: Bill Clinton became involved with a man who now is a felon named Rajat Gupta, supposedly raising funds to help those in Gujarat, India after an earthquake struck there on January 26, 2001.

I think that this effort, American India Foundation, that Bill has co-chaired ever since formation is another epic fraud that has never been audited or reported properly in any legal jurisdiction.

Moreover, numerous trustees and significant donors in the Gujarat effort have been accused and/or convicted of a variety of frauds. Though Bill Clinton has played a prominent role with his Foundation and with the AIF ever since January 2001, these material defects have never been disclosed in state, federal, and foreign filings for either organization, as required.

There are other significant problems arising from failures to make proper disclosures concerning Bill Clinton’s work with the Tsunami, Katrina, and Gulf Coast disaster relief charities

DC: The Clintons like to say that a pleasure trip in the 1970s brought them to Haiti for the first time. Their political interest in Haiti probably began in 1994 when Bill Clinton reinstated, under his terms, the deposed Haitian President Jean-Bertrand Aristide. This interest grew even more after Aristide was removed from office in February 2004 and a UN stabilizing mission was introduced with the help of Brazil in June of the same year. Finally, of course, there was the 2010 earthquake. How do the Foundation’s activities fit into this timeline?

CO: Press accounts suggest that the Clinton Foundation became involved in Haiti by 2003. At that time, the Clinton Foundationcertainly was not authorized or itself equipped to engage in international activities “fighting HIV/AIDS”, yet it did so starting in 2003.

So far, it is not clear what medicines may have been provided under the auspices of the Clinton Foundation to those afflicted with HIV/AIDS in Haiti and in other countries.

It is clear that Bill Clinton and the Clinton Foundation developed ties to Ranbaxy, an Indian company that supplied genericmedicines. And it subsequently became clear that Ranbaxy sold adulterated medicines to customers in many nations.

DC: Within two months of the earthquake, Clinton got the Haitian parliament to vote an emergency law that allowed his Interim Haiti Recovery Commission (IHRC) to run the country for 18 months. The IHRC raised at least $9.5 billion from the international community. There were fundraisers in New York and other cities. Haitians have searched through the rubble and demanded to know where this money went, because the IHRC did not reconstruct anything. Some Haitian lawyers think that Clinton, in his role as director of the IHRC should answer to Haiti and not benefit from UN immunity in this matter. What do you think, Charles?

CO: Unless the IHRC has somehow acquired a blanket exemption from US state and federal laws — which, if true, should be memorialized somewhere — like other charities that raise money in most US states, it is required to register in advance of soliciting and to file periodic reports.

In the absence of securing federal and state tax exemptions, a US charity is precluded from suggesting to donors that they may deduct their donations on federal and on state tax returns, as laws may allow.

Moreover, to the extent governments have granted money to the IHRC, I imagine that records must exist in the donating country that explain the process by which each donation came to occur, and that “after-action” reports may be found, issued by the more cautious donating governments that have been burned in other instances and countries.

DC: In your experience, when there is fraud involving a charity, how is it done?

CO: Sadly, international charities are perfect fronts for fraud.

The first step is to get in front of a large incoming flow of money, ideally from millions of small donors.

The next step is to hive off as much money as the fraudsters believe they can steal, likely parking this amount in a tax haven nation where the fraudsters purchase required influence.

Sums declared as inflows can then be steered to connected insiders using false invoices, if records are actually used.

All this is possible when there are no competent accountants involved and when trustees are not independent, but instead, either political allies, co-conspirators, or both.

DC: Is there a connection between the Hillary emails and the Foundation’s dealings?

CO: Certainly.

Starting with Hillary’s first campaign to represent New York in the US Senate, Clinton allies were likely solicited for multiple purposes.

As the internet evolved and as speeds increased, communications involving the Foundation certainly occurred.

By November 2008, when Hillary and the Obama Transition Team negotiated their Memorandum of Understanding — itself a misleading and purposefully non-binding subterfuge — email traffic certainly dealt with incoming and outgoing Foundation financial flows and with the dire financial shape of the Foundation that is so evident looking here in Annual Reports for 2007 and 2008 that are intentionally garbled on the Clinton Foundation website.

It is worth noting that major donors to Clinton Foundation entities likely have retained extensive files that the FBI and other government authorities might obtain to flesh out the known record if all missing emails have, in fact, somehow disappeared.

DC: What is the probability that the Foundation and associated organizations will be dissolved?

CO: I believe that the correct course of action is to revoke authorities for all Clinton Foundation entities to operate from their inception — that said, I doubt the federal government will open with this position.

On the other hand, it is quite possible that multiple US states and foreign nations will ultimately force the hand of federal authorities.

DC: Is it even possible for Haitians to recover these funds? What can Haitian activists and politicians do to synergize their efforts with yours?

CO: I think it should be possible to galvanize world support for an investigation into this horrible abuse of power in Haiti by Bill Clinton and others. Getting money back, net of lawyers’ fees, may prove difficult. On the other hand, mobilizing a real rescue effort, with effective oversight may, in the end, be possible.

Those who care about stamping out charity fraud and about helping Haiti as well as other desperately poor nations should join the call to bring the Clinton family and their associates to justice, using peaceful means, by applying the full force of state, federal, and foreign laws to investigate and then punish malefactors.

DC: Is there anything more you wish to say?

CO: Thank you Dady for your tireless work in service of Haiti and of charity — and thank you for contacting me!

DC: Thank you Charles.

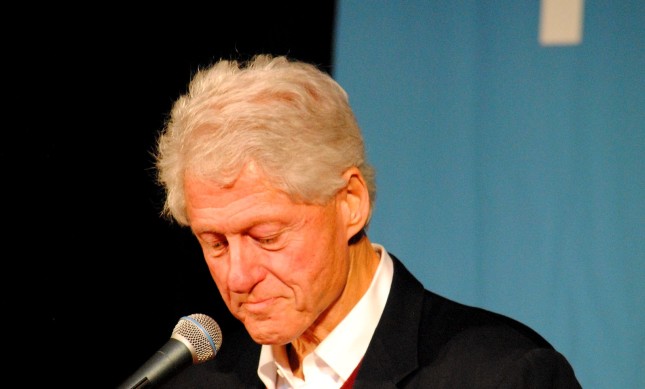

Sources: Dady Chery is the author of We Have Dared to Be Free. Photographs one and fourteen from US Department of State; photograph two by Thierry Ehrmann; three from RIBI Image Library; four, nine and thirteen by Gilbert Mercier; five from US Embassy Canada archive; six from Democracy Chronicles archive; composite seven by Donkey Hotey; photograph eight from United States Mission Genevaarchive; from Fortune Live Media archive; eleven by Colin Crowley; twelve by Marianna S; fifteen and seventeen by Gage Skidmore; and eighteen by Eric Austin.