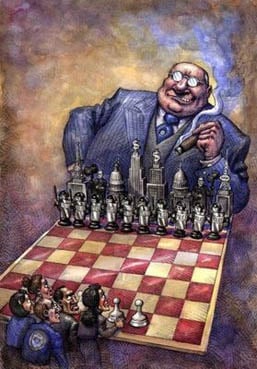

Bank Bailout: Bankster Says Only Gun to Head Will Oblige TARP Repayment

Banks that received billions during the Federal Reserve created implosion of the subprime real estate market say they are not obliged to make good on repaying the money.

From The Wall Street Journal:

Maryland Financial Bank, one of six banks included in the government’s auction this week of stakes it received as part of its crisis-era bailout program, enjoys an unusual luxury: It doesn’t have to make good on the money it still owes taxpayers.

The Journal reports when the TARP program “was hastily assembled in the frantic days of 2008, the government was interested in making sure the capital was widely available to banks of all sizes” and banks that issued noncumulative shares as repayment figured out how to delay and ultimately stiff tax payers.

The Towson, Md., bank, which received $1.7 million in the Troubled Asset Relief Program in 2009, is a beneficiary of a quirk that placed stricter rules on some recipients of financial aid than on others.

Specifically, some of the banks that received TARP money aren’t obligated to make good on dividend payments they have missed. That leaves the banks with a dilemma of either fulfilling their obligations to taxpayers at the expense of their own balance sheets, or keeping the money for themselves. Banks can protect themselves and their shareholders by skipping the payments. Shelling out optional payments to the U.S. government could even be interpreted as a breach of duty to shareholders.

Maryland Financial’s CEO, Robert Chafey, said only physical violence will force him to make good.

“We don’t have a gun to our head to pay this dividend, so why would we pay?” Mr. Chafey said in a February interview, according to the Journal.

Some bailed-out banks don’t have to make good on the money they still owe US taxpayers: http://t.co/5KGGBFijtZ pic.twitter.com/W9mgubilAL

— WSJ Markets (@WSJmarkets) June 20, 2014